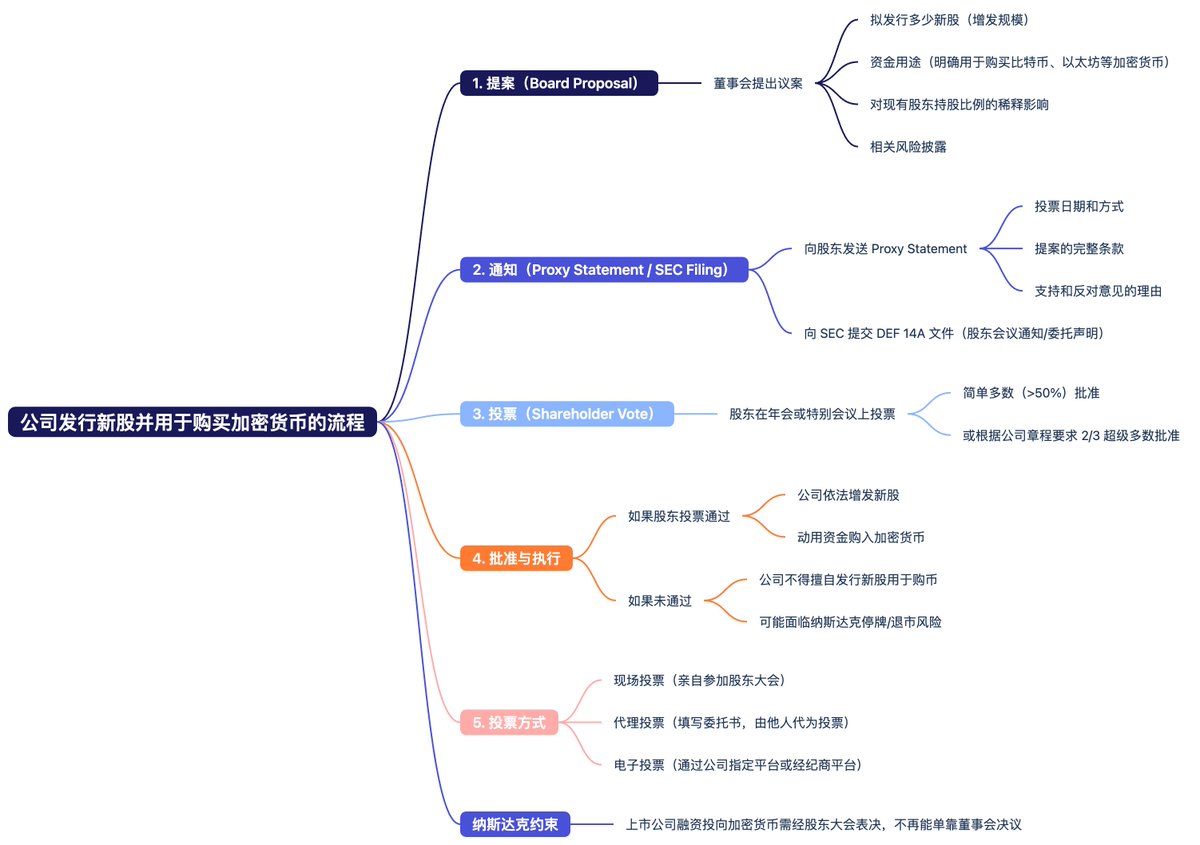

Many friends may not fully understand this, so I will illustrate it with a diagram for clarity. In general, if a publicly listed company wants to purchase cryptocurrency in the future, it will need to obtain majority approval through a vote at a shareholder meeting, rather than relying solely on a board resolution.

Therefore, for companies like $MSTR that buy $BTC weekly, the complexity will increase, and the overall process will lengthen, but it will not reduce the total amount of BTC purchased by MSTR. Overall, it may decrease the frequency of purchases.

For example, instead of buying once a week, it may change to once a month, but the quantity purchased at each time may increase. Additionally, there are usually countermeasures to policies; companies often adopt "shareholder authorization" or "shareholder planned approval" methods to avoid having to hold a meeting every time.

For instance, the board may propose a request for shareholder authorization for the company to issue a certain cap of new shares within a future period (e.g., 12 months) and use the funds to purchase cryptocurrency. If shareholders approve the proposal, the company can operate multiple times within the authorized limit without needing to hold a shareholder meeting each time.

So essentially, while it has become more complex, it will not affect normal purchases. The negative sentiment from this news should be digested over time.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。