Spot conditions show ethereum at $4,399, up 0.2% on the day, within a 24-hour range of $4,357 to $4,486. The market capitalization stands at about $531.3 billion on a circulating supply of roughly 120.7 million, with $31.4 billion in 24-hour volume.

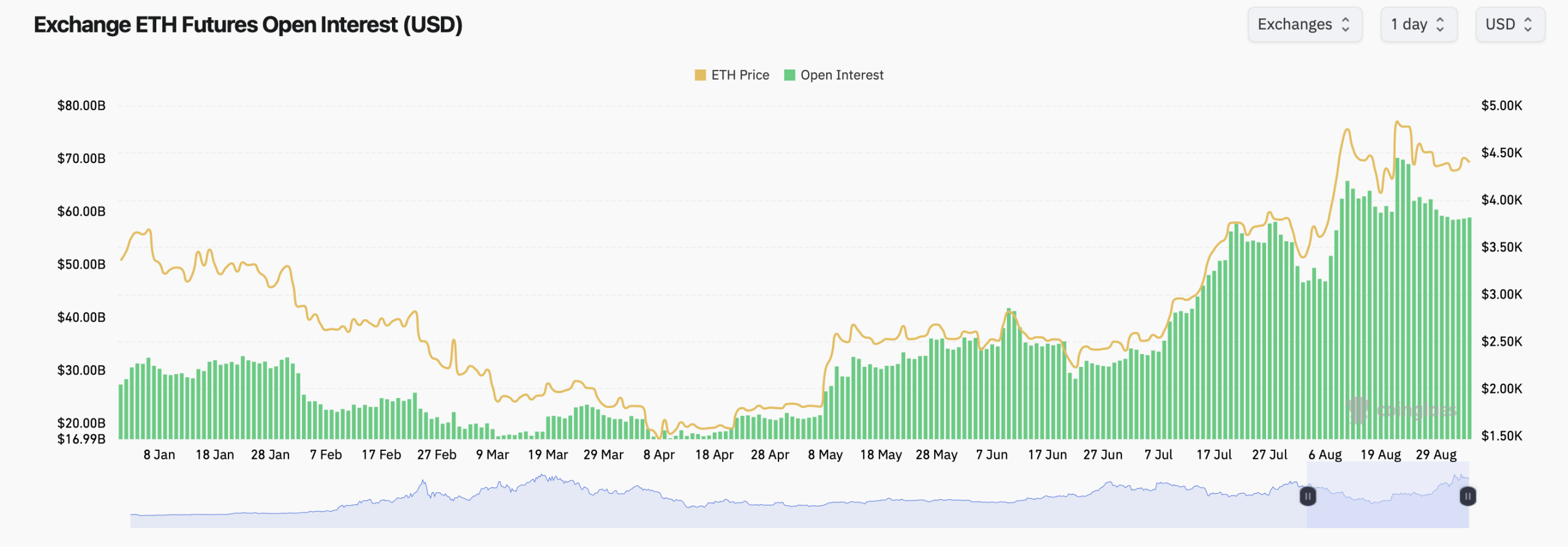

Futures activity remains elevated. Across exchanges, total ethereum futures open interest, according to coinglass.com stats, is 13.38 million ETH, or roughly $58.87 billion. The notional footprint has trended higher since early summer alongside ETH’s recent rising price range.

The dominant centralized exchange (CEX) Binance holds the largest share at $11.50 billion, or 19.54% of the total, followed by CME at $8.38 billion (14.23%). Bitget lists $6.44 billion (10.93%), Bybit $5.30 billion (8.99%), Gate $4.72 billion (8.01%), and OKX $3.84 billion (6.51%).

MEXC shows $2.45 billion (4.16%), WhiteBIT $2.18 billion (3.7%), BingX $1.21 billion (2.06%), and Kucoin $426.5 million (0.72%). Momentum over the last day is mixed across venues.

Aggregate open interest is up about 1.04% on the session. By exchange, 24-hour changes include OKX +2.38%, Bybit +4.13%, Bitget +7.53%, Gate +1.19%, and CME +0.24%; Binance is down 0.60%, MEXC down 0.46%, WhiteBIT up 0.15%, BingX down 14.34%, and Kucoin down 18.65%.

Today’s options ETH metrics, per coinglass.com, point to a call-heavy posture. Options open interest is 64.78% calls versus 35.22% puts, equal to about 2.40 million ETH in calls and 1.30 million ETH in puts.

The recent trading tape is far more balanced. Over the past 24 hours, options volume is 52.17% calls and 47.83% puts, or roughly 162,198 ETH versus 148,715 ETH. Open interest is concentrated in higher-strike calls.

The largest individual positions include Deribit Dec. 26, 2025 $6,000 calls (87,119 ETH), $4,000 calls (74,553 ETH), and $7,000 calls (56,784 ETH). Near-dated interest is visible in the Sept. 26, 2025 $4,000 and $4,500 calls.

Volume leadership over the last day tilts toward protective puts and at-the-money calls. Notable lines include the Oct. 31, 2025 $3,300 put (7,303 ETH) and $3,200 put (7,041 ETH), alongside the Sept. 26, 2025 $4,500 call (6,754 ETH) and $4,000 put (6,691 ETH).

Ethereum‘s max pain levels, based on Deribit, cluster between the low $3,000s and low $4,000s into year-end. The curve dips toward roughly $3,100 around the Sept. 26 expiry, rises toward the low $4,000s by late December, and drifts lower toward the mid-$2,000s by March 2026 before rebounding.

Across expiries, notional concentration is heaviest on Sept. 26 and Dec. 26, with additional interest at year-end 2026 quarters. The mix suggests traders are keying on quarter-end milestones while keeping downside hedges active into the fourth quarter. Spot flows remain active on major venues, with ETH derivatives liquidity deepest on Binance and CME on Thursday.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。