Written by:Tim.0x

Translated by: Yangz, Techub News

About a month ago, Crypto Twitter was filled with discussions about "revenue," emphasizing its importance in discussions about other aspects. At that time, I shared a viewpoint that revenue itself is closely related to all businesses/industries, and we should not treat it as a "meta" or "trend" for discussion. In traditional finance, the success of a startup often depends on its product-market fit (PMF) and revenue, and there should be no difference in our industry (the cryptocurrency industry).

Looking at the current hot projects, you will find that successful protocols with substantial revenue share some common patterns. In most cases, they either implement buyback programs or adopt revenue-sharing mechanisms to activate and support the economic system of the protocol. Meanwhile, some other protocols also use these mechanisms but have not succeeded for various reasons.

So far, some project teams (such as OKX) have implemented buyback and burn strategies, causing token prices to "rise with the tide"; other protocols are following suit and viewing this mechanism as a blueprint for development.

What is a buyback?

In simple terms, buyback and burn is a mechanism designed on the protocol through smart contracts, where at a predetermined time, the protocol buys back a certain proportion of circulating tokens from the open market, sometimes sending them to an unrecoverable address, meaning these tokens will never participate in circulation again.

However, not all buybacks are for burning. Sometimes the bought-back tokens are used for distribution to stakers, providing liquidity, or even for user airdrops. The main purpose is to reduce the circulating supply of the token, and as long as there is market demand for the token, the reduction in circulating supply should correspondingly push up the price of the protocol token.

At the same time, there are many criticisms arguing that compared to traditional finance, the cryptocurrency industry does not need such mechanisms. However, due to systemic differences (the concept of circulating supply and other market dynamics), based on the initial design of token economics and the current market conditions, buyback and burn are very important for certain protocols.

Moreover, protocols often push for buyback and burn proposals only after the token price peaks. This is sometimes because there are existing proposals, and sometimes because the protocol is running a mechanism that is not suited for a deflationary model but rather more suitable for inflationary tokens, yet still forcibly implements buyback and burn.

For example, the design metrics of the Pear protocol on Hyperliquid are as follows:

Token Supply: 930 million PEAR tokens

Maximum Supply: 1 billion PEAR tokens

The protocol adopts a revenue-sharing mechanism, where the revenue generated by the protocol is distributed to PEAR stakers. However, in this case, when a large number of tokens are released to the open market after the token generation event (TGE), wealthy individuals can buy a large amount of PEAR and stake it, thus obtaining most of the revenue. In contrast, participants with less capital also have the opportunity/are encouraged to profit from the revenue (as distribution is proportional), but even so, running a buyback and burn strategy remains limited in effectiveness, as the background PEAR tokens are concentrated in the hands of a few.

If the Pear protocol considers integrating buyback and burn, then if the maximum supply was initially set as an inflationary model, the likelihood of the strategy being effective would be higher. Therefore, buyback and burn are effective for specific token designs, while revenue sharing is also effective for certain designs. Of course, this does not mean that these two mechanisms are mutually exclusive within the same protocol.

When did "buyback" start to become a narrative meta?

The trend of buyback and burn originates from two main tracks, including launch platforms and currently the most attention-grabbing products in the market.

Launch Platforms

Undoubtedly, Solana has gained significant attention due to its high trading activity (especially memecoin trading). Seizing this opportunity window, PumpFun ignited the track, paving the way for various launch platforms—these platforms provide opportunities for meme trading through bonding curve mechanisms.

PumpFun set a record for the highest revenue achieved by a cryptocurrency startup in a short time, thus gaining attention and value. However, due to the issuance of PUMP tokens, inefficient distribution, and poor sales profits, its attention waned much faster than expected. During this period, it introduced the PUMP buyback and burn mechanism in an attempt to create FOMO (fear of missing out) around the token.

This marks the first sign of this trend becoming a significant narrative meta.

Next is Raydium Launchlabs, forming the second ring of this model. Raydium buys back RAY tokens daily through trading fees (not 100%) from the secondary market, but only uses the repurchased RAY for other sustainable activities rather than burning.

This is the second sign of this model observed in launch platforms, while bonkfun constitutes the third ring. You will find letsbonk buying back $BONK tokens from the open market and using the revenue generated from platform trading activities for burning.

The repetition of the model fosters a certain belief. Although such operations may not directly produce the expected effects, the continuous promotion by mainstream teams creates a sense of normalcy, thereby supporting the view that "buyback is the best strategy."

Generally speaking, the herd mentality often prevails, even if such behavior may not be rational.

Currently Most Attention-Grabbing Products

Hyperliquid and Kaito are two products worth studying in depth within this trend.

As of the writing, Hyperliquid has accounted for 77% of all perpetual contract trading volume over the past 6 months, with annual fee revenue exceeding $1 billion. Due to Hyperliquid's success, many protocols and individuals consider its token distribution and value accumulation model to be the best and are eager to imitate it. Therefore, any protocol that decides to adopt a buyback and burn mechanism will be seen as a positive signal.

The following image is a typical discussion case.

Hyperliquid uses 93% of its fees to buy back HYPE tokens, with 7% allocated to the HLP treasury. If Hyperliquid can do this, then such operations will be widely recognized as successful and are likely to be replicated.

On the other hand, Kaito has changed the marketing model of Crypto Twitter (CT) by launching a mechanism aimed at incentivizing project attention and establishing reputation standards called InfoFI.

Interestingly, since the launch of the "social token economy" (yapping), it has quickly dominated various information streams. With the buyback and burn model, its token has successfully achieved a shift in attention. Given the high demand for deflationary mechanisms and staked tokens, holding KAITO is considered a wise choice—as long as market attention is maintained, the token price will continue to rise.

This is the ultimate simulation and model worth paying attention to in the context of buyback and burn. Although there is controversy within the industry regarding this, buyback and burn is not the best solution, but it is at least the "least bad" option, far superior to revenue-sharing models.

Why is buyback and burn superior to revenue sharing?

From the perspective of public goods and effective value distribution, the industry has yet to meet expectations. The distribution method of community airdrops clearly reflects this—most of the time, individuals receive returns lower than the value of their contributions during the retrospective distribution process, and complaints are still inevitable during the token generation event (TGE)—this is a typical example of "effective distribution" failure.

While it cannot be definitively concluded whether buyback and burn or revenue sharing achieves optimized distribution better, in fact, the probability of buyback and burn achieving effective value distribution is much higher than that of revenue sharing. This method can compensate for the failures of most projects attempting to create value for early community contributors.

In economic models, stakers and investors are taken into account, and in most cases, they will share the revenue. However, this sharing may not sufficiently incentivize their economic contributions. Moreover, if the same revenue also needs to be shared with equity investors (e.g., SAFE agreements), the distribution pool for stakers and holders will be significantly diluted, ultimately leading to a failure in basic distribution.

This is the core reason why Uniswap as a product rather than a business model would fail (the product itself is successful, but the financial model fails)—its 100% revenue is distributed between liquidity providers and Uniswap Labs (equity investors).

dYdX also faces the same issue: its revenue is not allocated to the treasury but flows to a private company. Although dYdX currently has a buyback and burn mechanism, it remains ineffective due to initial distribution issues.

A noteworthy case (which most CT users are aware of) is: "Clearly, products that do not need tokens still insist on issuing tokens." This is because most protocols adopt the SAFT+token model, where the product team retains most of the revenue—especially in scenarios with fewer network participants (stakers, validators, etc.). The most typical example is PumpFun.

The revenue-sharing mechanism is like the center of a circle, where multiple parties reach out to grab, ultimately leading to vicious competition. Not all those eager for revenue distribution can truly benefit. In contrast, in a buyback and burn mechanism, regardless of how much value/contribution you create for the protocol, buyback and burn can achieve distribution and effect diffusion. Investors benefit from deflation, and holders/stakers also benefit, achieving a win-win situation for all parties.

Key Metrics to Watch

Soon, a large number of projects will implement buyback and burn mechanisms, which may establish a template for blue-chip projects, so standards need to be set to evaluate these projects.

Hitesh emphasized the importance of measuring the annual burn rate in a post rather than overly focusing on revenue, but in my view, these two are complementary. The possibility of maintaining or even increasing the burn rate depends on revenue and, to some extent, on treasury funds (if the protocol chooses to buy back for other reasons).

For older projects (TGE over 6 months), the following metrics should be considered:

Annual Burn Rate

Revenue

Market Cap to Annual Revenue Ratio (P/S)

For new projects (TGE less than 6 months), current valuation, product-market fit (PMF), and token distribution mechanisms should also be evaluated.

Annual Burn Rate

As a metric, the annual burn rate reflects the number of tokens that can be purchased through the buyback program within a specific time frame, and this metric is associated with revenue and market cap to sales ratio (P/S).

It is important to note that due to the differences in buyback frequency among various projects, not all buyback plans are applicable to these metrics.

Take Fluid as an example: the project currently proposes a dynamic buyback model strategy—if the valuation of FLUID reaches $500 million, 100% of the revenue will be used for buybacks; however, if the x*y=k model is adopted, the proportion of revenue allocated for buybacks will decrease as the valuation increases. Additionally, there are various other types of buybacks pending implementation.

The valuation itself is related to the market and its historical valuations. This metric can be used to calculate the percentage of tokens bought back from the circulating supply.

Revenue

Most protocols do not allocate a sufficient proportion of revenue for buybacks, thus having almost no impact on the token—this illustrates that revenue is not a sustainability metric. However, for those protocols that allocate a higher proportion of revenue for buybacks, it is still necessary to focus on examination.

What is the worst-case scenario? If a protocol uses 100% of its revenue for buybacks but experiences a revenue crash, the quantity/proportion of tokens bought back from the secondary market will still have a bottom-line advantage compared to protocols with lower allocation ratios.

Revenue is only a reliable metric when it is not confused with fees. This is particularly unfavorable for protocols that generate revenue solely from protocol fees and have already allocated part of it as incentives—if the net revenue is negative, buyback and burn will be completely ineffective.

Market Cap/Annual Revenue Ratio (P/S Ratio)

As mentioned earlier, this metric is related to the annual burn rate. When the ratio is high, it means the market is willing to pay a higher premium for each unit of revenue from the project; conversely, when the ratio is low, the market values the project's revenue lower, allowing the project to buy back tokens from the secondary market at a lower cost.

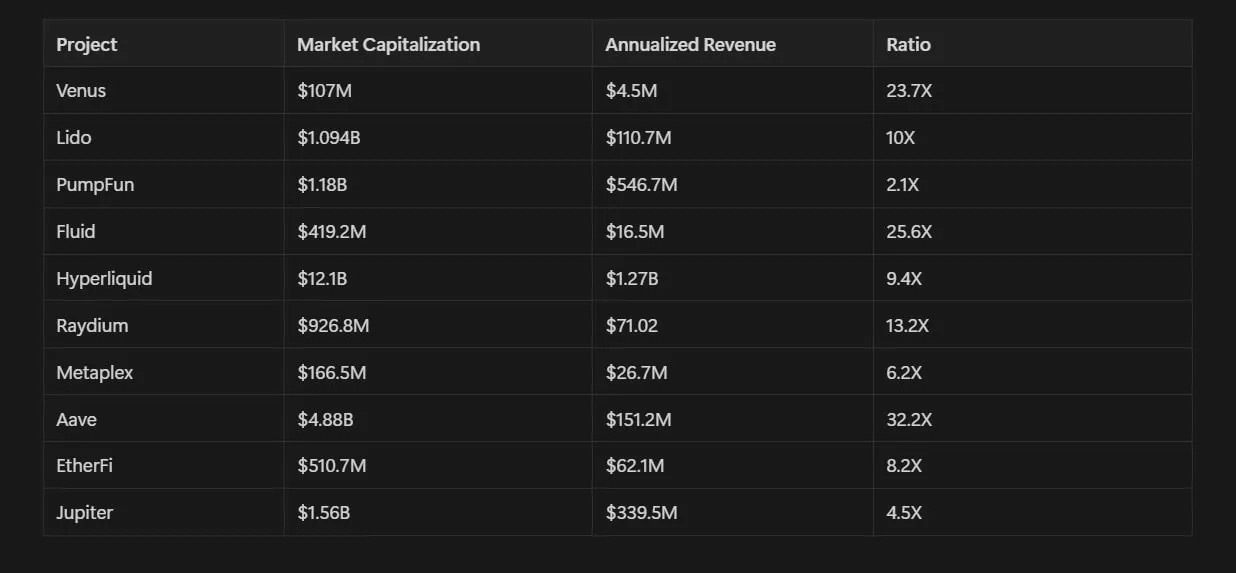

You can take a look at the P/S ratio analysis of the following projects:

PumpFun has a low P/S ratio, allowing for more buybacks, followed closely by Jupiter. Interestingly, Metaplex still has greater buyback potential. However, it is still necessary to consider the burn rate and the proportion of circulating supply being bought back, as these will affect the effectiveness of the buyback plan.

Other noteworthy case studies include the buyback mechanism of Story and the performance of ICM products and buybacks.

Conclusion

Understanding the trend alone is not enough; it is also necessary to study the patterns within the protocols to fully leverage this trend. Taking the IP of the Story protocol as an example, due to its revenue being almost zero, it is impossible to calculate the annual revenue, and its buyback and burn plan may be ineffective. However, thanks to strong market-making capabilities, the price of the IP continues to rise. Understanding these patterns will help you grasp the benefits of this trend. Encouragingly, more reliable metrics may be introduced into our ecosystem in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。