A. Macroeconomic Liquidity

Improvement in monetary liquidity. The market expects the Federal Reserve to cut interest rates twice this year and four times next year. Once Trump truly gains control of the majority seats at the Federal Reserve, it will be possible to push for more aggressive easing policies in the future and bypass Federal Reserve decisions through technical means. U.S. stock valuations are already high and show signs of being in the early stages of a bubble. The cryptocurrency market is leading the adjustment ahead of the U.S. stock market.

B. Overall Market Trends

Top 300 by market capitalization gainers:

This week, BTC plummeted, and altcoins fell broadly. Every time Trump issues a coin, it marks the peak of market liquidity. Market focus is on ETH.

Top 5 Gainers

Gains

Top 5 Losers

Losses

ULTIMA

90%

KTA

20%

CRO

50%

QUBIC

20%

QTUM

40%

CTC

10%

OKB

40%

SAROS

10%

BIO

30%

NNT

10%

WLFI: A stablecoin DeFi project created by the Trump family. It will issue coins on September 1, unlocking 20%. The early costs were 0.015 and 0.05, with an initial unlock of 20%.

CRO: The platform token for crypto.com and the gas token for the Crono public chain. Trump Media Technology will raise $6.4 billion for the CRO treasury.

HYPE: A leading on-chain contract platform, the next upgrade will significantly reduce the funding rate by 80%, increasing the number of operating nodes from 21 to 24, and raising the proportion of income used for token buybacks from 50% to 99%.

C. On-Chain Data

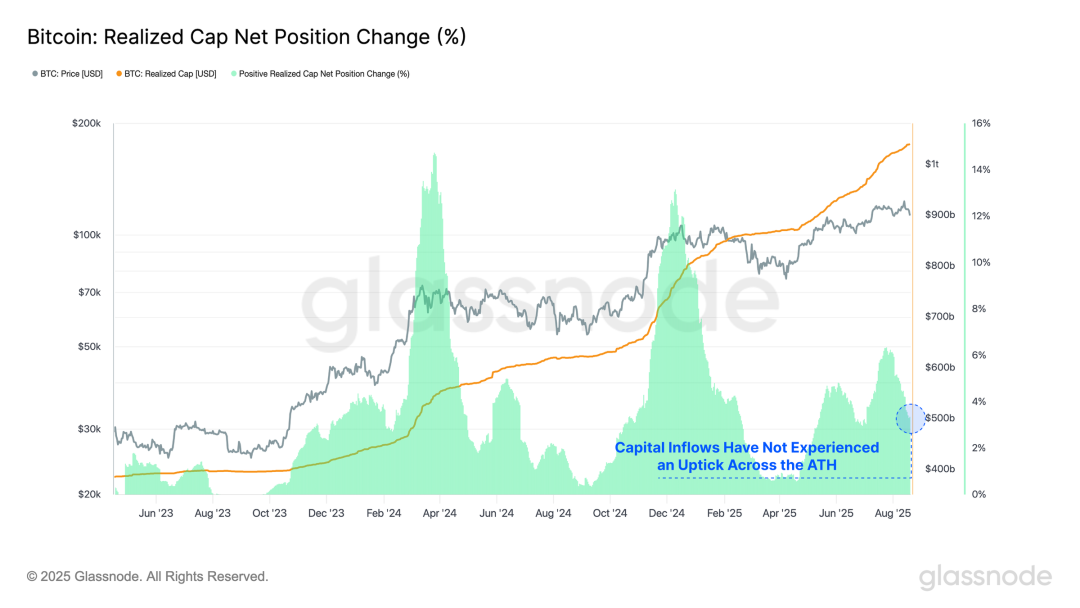

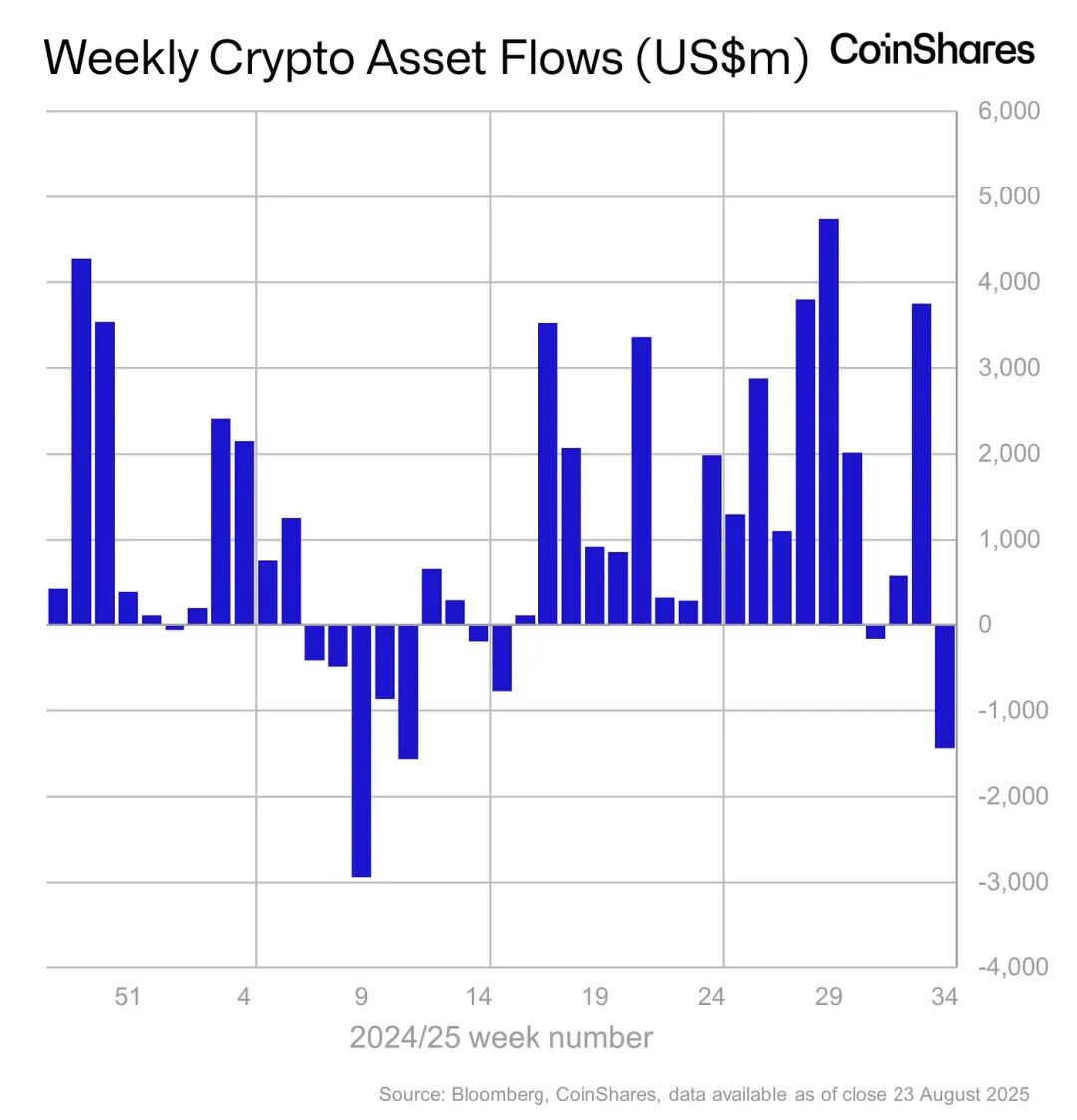

After reaching a local peak, BTC is on a downward trend. After several weeks of significant capital inflow, ETF profit pressure is increasing, indicating that traditional financial demand is cooling.

Institutional funds saw a net outflow of $1.4 billion last week, the highest level since March.

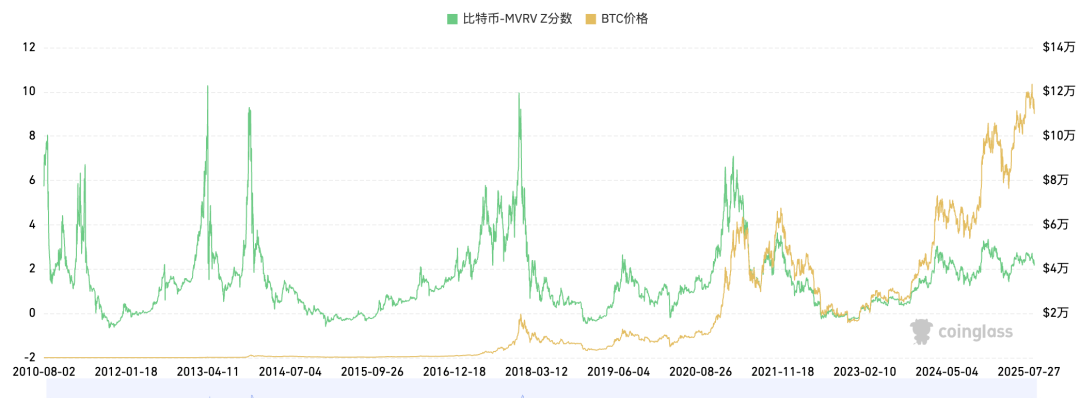

The long-term trend indicator MVRV-ZScore, based on the total market cost, reflects the overall profitability of the market. When the indicator is above 6, it indicates a top range; when below 2, it indicates a bottom range. MVRV has fallen below the critical level of 1, indicating that holders are generally in a loss state. The current indicator is 2.5, close to the middle range.

D. Futures Market

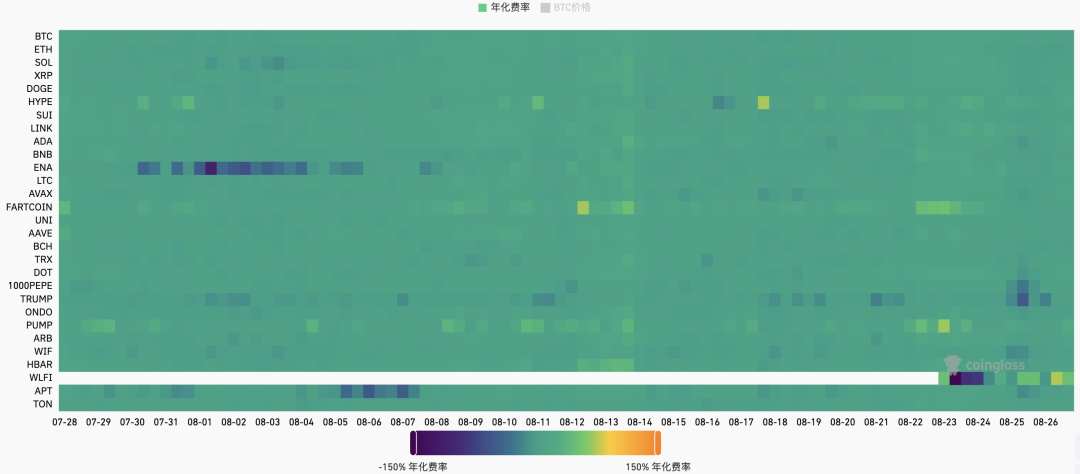

Futures funding rate: This week the rate is 0.01%, which is normal. A rate of 0.05-0.1% indicates a lot of long leverage, marking a short-term market top; a rate of -0.1-0% indicates a lot of short leverage, marking a short-term market bottom.

Futures open interest: This week, BTC open interest has decreased, indicating a withdrawal of major market funds.

Futures long-short ratio: 1.8, indicating a greedy market sentiment. Retail sentiment often serves as a contrarian indicator; below 0.7 indicates fear, while above 2.0 indicates greed. The long-short ratio data is highly volatile, reducing its reference significance.

E. Spot Market

BTC experienced a significant drop this week. The BTC dominance rate fell from a peak of 66% to 58%, marking the first significant and sustained drop since the rebound after the U.S. election, indicating a potential shift towards altcoins. The establishment of numerous altcoin treasury funds has diverted funds from BTC buyers, increasing the financing costs for entities like MicroStrategy.

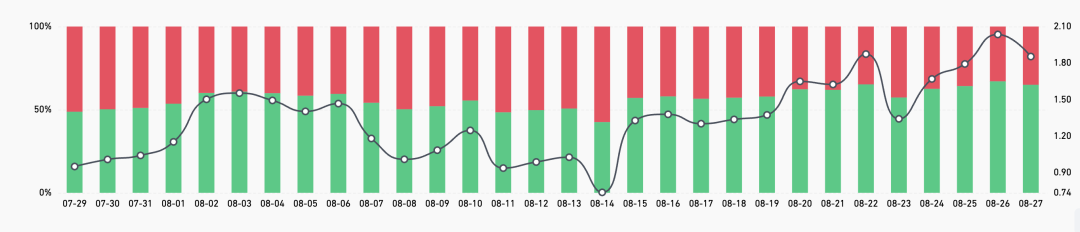

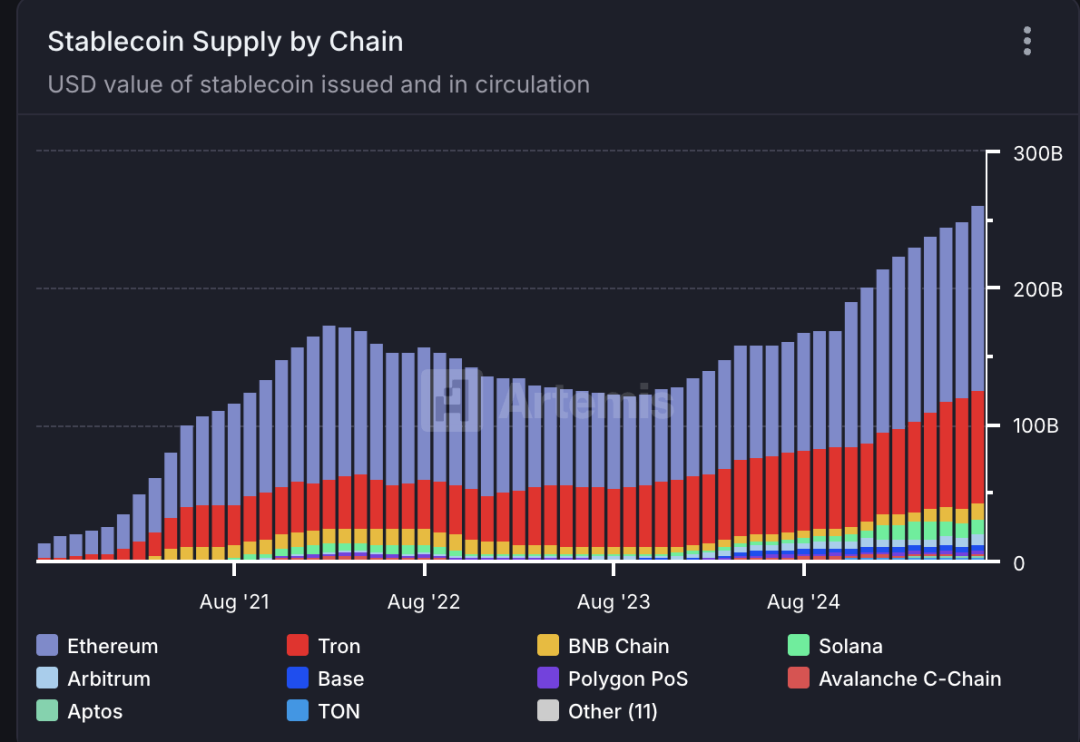

F. Stablecoin Market Global Mainstream Stablecoin Market Capitalization

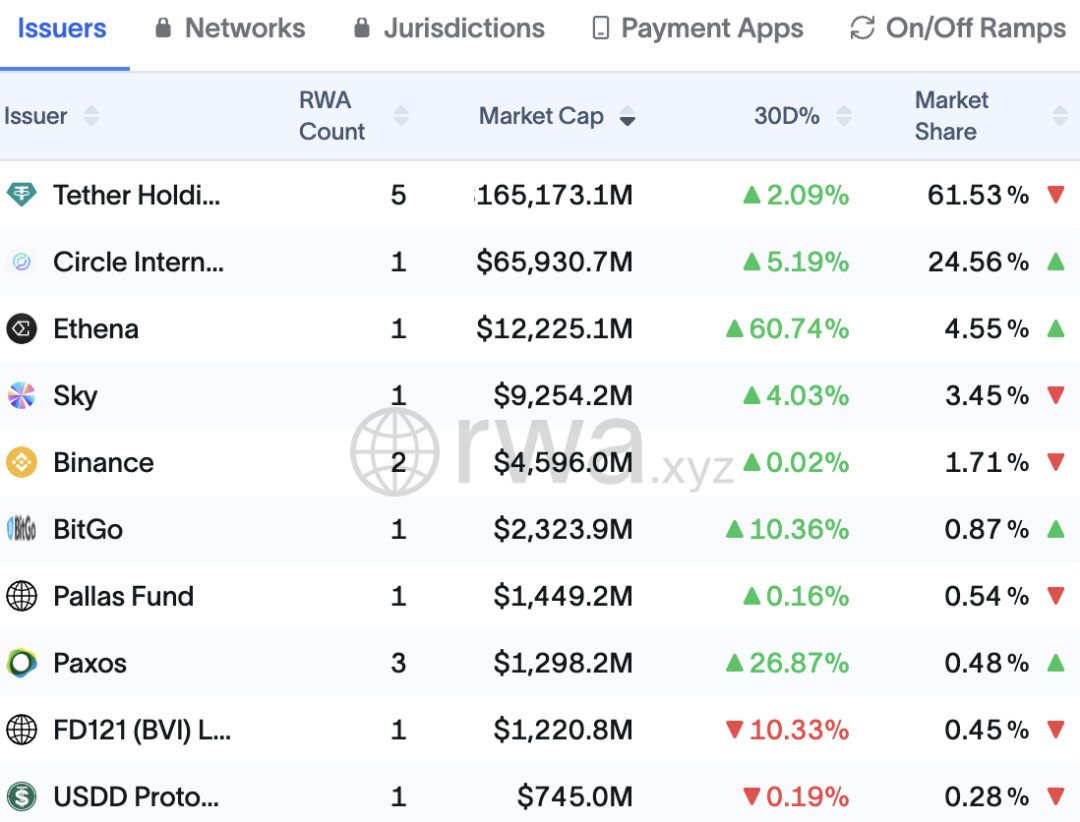

Total global stablecoin supply: $277.8B, a week-on-week increase of 0.1%. In terms of market share, USDT accounts for 62%, and USDC accounts for 25%.

The new stablecoin USD1 grew by 10% this week. The Trump family's DeFi project WLFI will issue coins on September 1, with its stablecoin USD1 having a supply of $3.5 million at its launch in early March this year, and its market capitalization has now exceeded $2.7 billion, ranking 7th among stablecoins. USD1 is pegged to the value of the U.S. dollar at a 1:1 ratio, with asset reserves consisting of cash, U.S. Treasury bonds, and equivalents. The asset custodian is BitGo, and the accounting firm Crowe LLP issues a reserve verification report monthly, which is generally regarded as having high transparency and credibility. USD1 is almost entirely issued on the BNB chain, accounting for over 90% of its total circulation.

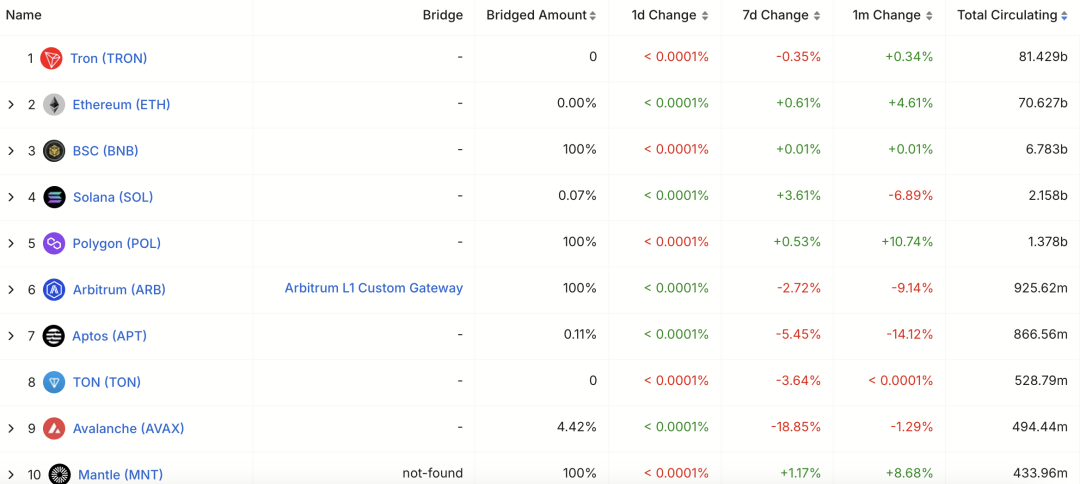

Stablecoins on Various Public Chains

In the past 30 days, USDT has seen significant increases on the Polygon and MNT chains, at 11% and 9% respectively, primarily driven by on-chain DeFi and exchange demand.

The stablecoin public chain Plasma plans to issue coins next month and has initiated multiple deposit financial activities on Binance, reaching a pre-market capitalization of $5 billion.

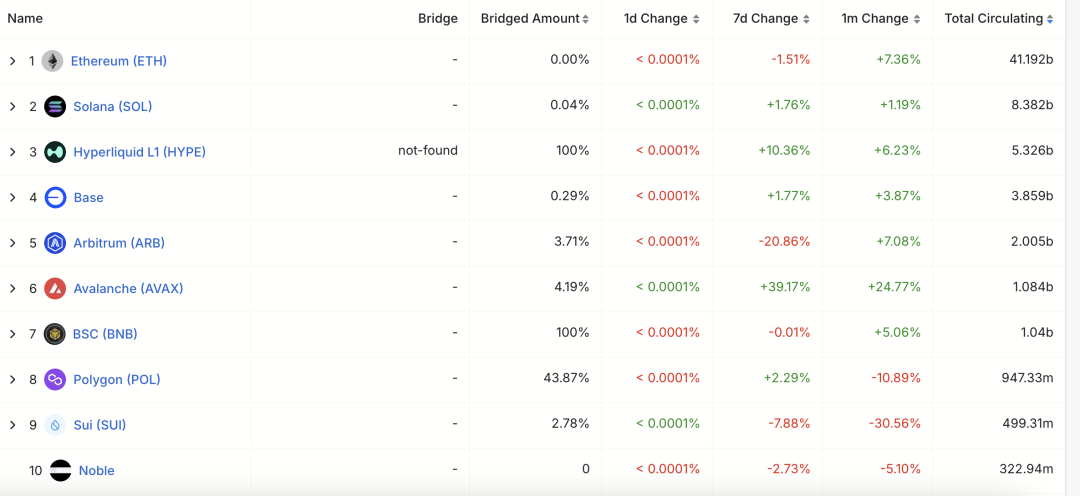

In the past 30 days, USDC has seen significant increases on the AVAX chain and HYPE, at 25% and 6% respectively, primarily driven by on-chain DeFi and exchange demand.

The on-chain contract platform HYPE will significantly reduce the funding rate by 80% in its next upgrade, increasing the number of operating nodes from 21 to 24, and raising the proportion of income used for token buybacks from 50% to 99%. HYPE primarily relies on USDC for inflows and outflows.

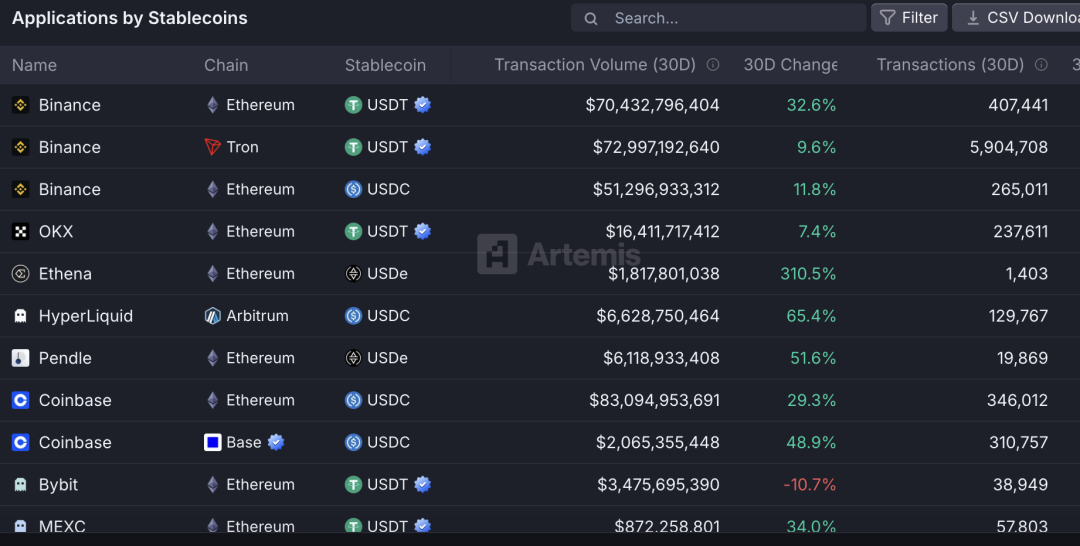

Where Stablecoins Are Mainly Distributed in Applications

In the past 30 days, the most significant stablecoin deposits have been observed in Ethena, primarily due to the high staking yield of USDe, attracting a large number of DeFi players.

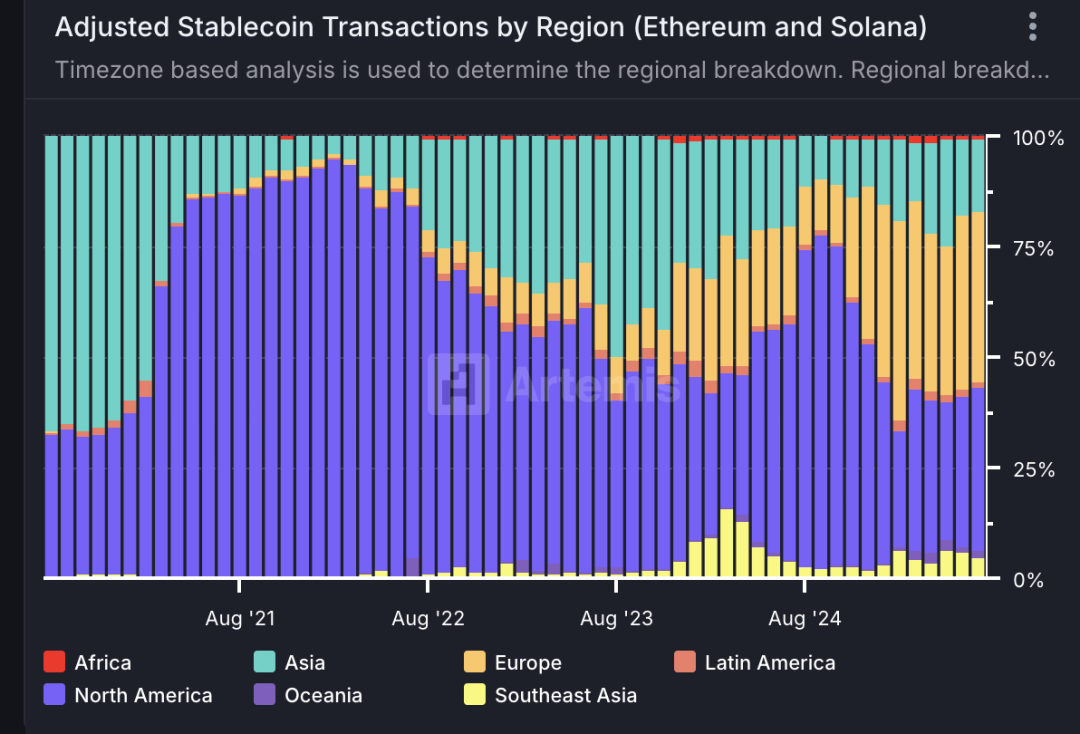

Geographical Distribution of Stablecoin Usage

North America (38%), Europe (37%), and Asia (16%) remain the primary markets, with no significant changes in other regions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。