According to the Financial Times, Democrats have launched fierce criticism against the Trump family's actions in the cryptocurrency space, triggering a chain reaction in Washington and Wall Street. Senior Democratic senators Elizabeth Warren and Maxine Waters pointed out in a joint letter earlier that the Trump family's financial holdings in World Liberty Financial (hereinafter referred to as WLFI) constitute "unprecedented conflicts of interest." They warned that this could drive the Trump administration to instruct regulatory agencies like the Securities and Exchange Commission (SEC) to adopt positions favorable to cryptocurrency interests, directly benefiting the president's family.

The Political Powder Keg Behind the Letter

As early as April 2025, these two Democratic senators had sent inquiries to the SEC, asking the agency to explain whether it was subject to political interference, particularly regarding the Trump family's holdings in WLFI. The letter emphasized that the Trump family holds 60% of WLFI's shares, while an affiliated company enjoys 75% of the profit-sharing. This structure is seen as a "clear motive" that could lead the White House to favor its own interests in cryptocurrency regulation. For example, they pointed out that the SEC suddenly halted enforcement actions against cryptocurrency figure Justin Sun in early 2025, which was viewed as a signal of the Trump administration's friendliness towards cryptocurrency.

WLFI tokens plummeted 16% on their first day of trading, quickly falling from the initial price, reflecting not only market doubts about the Trump family's project but also amplifying the Democrats' attack points. Critics argue that the cryptocurrency deregulation policies promoted by the Trump administration—such as the stablecoin regulatory bill passed by Congress—directly pave the way for projects like WLFI. Warren stated in a statement that this legislation "will make it easier for the president and his family to line their pockets." This accusation strikes at the core of American political ethics: how a sitting president's family can profit in a sensitive regulatory industry without triggering conflicts of interest.

The Rise and Fall of the WLFI Project and Market Feedback

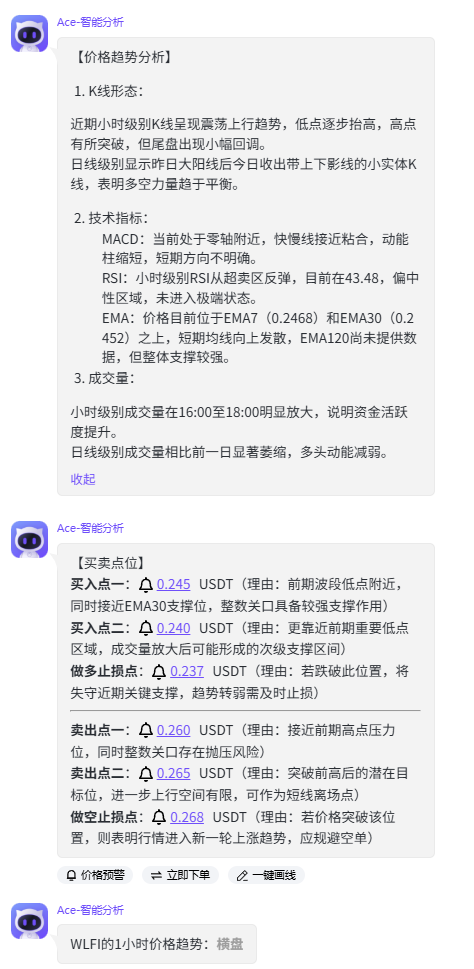

WLFI, as a flagship cryptocurrency project backed by the Trump family, aimed to create a decentralized financial platform, promising users a "freedom finance" experience. However, its launch process was fraught with controversy. In July 2025, WLFI tokens were announced as tradable, immediately triggering a backlash from Democrats. Warren and Waters questioned whether the SEC's decision was influenced by the Trump family, especially regarding the "sudden shift" in cryptocurrency enforcement. By September 2, WLFI tokens faced a sharp decline on their first day of trading, with prices dropping 16% and trading volumes sluggish. This was interpreted by the market as investors avoiding political risk—after all, a project closely associated with the White House could collapse at any moment due to policy changes.

The Tug of War Between Democrats and Republicans

The Democratic camp, led by Warren and Waters, continues to apply pressure. In April 2025, they jointly demanded that the SEC provide transparency, questioning whether the Trump family's cryptocurrency holdings influenced executive decision-making. By September 2, this topic was repeatedly mentioned in the House Financial Services Committee. Waters, as a senior member of the committee, publicly criticized a court ruling that allowed Trump to close the Consumer Financial Protection Bureau, which was seen as an extension of cryptocurrency deregulation. She stated in a statement that this "reckless" ruling opened the door for the Trump family's business empire.

Republicans, on the other hand, generally adopt a defensive stance. Trump supporters argue that the family's involvement in cryptocurrency is a legitimate business activity unrelated to government policy. They point out that WLFI aims to promote financial innovation, aligning with the recovery of the U.S. economy. Some Republican lawmakers even praised Trump's "pro-crypto" stance, believing it helps counter China's lead in the blockchain field. However, this defense is seen by Democrats as mere window dressing. Warren condemned the "financial entanglement" between WLFI and the Trump administration in a Senate resolution in May, calling for a comprehensive investigation.

Far-Reaching Impacts on Regulation and the Market

The Trump family's involvement in cryptocurrency goes beyond personal controversy; it touches the core of the U.S. regulatory framework. The SEC, as the main regulatory body for cryptocurrency, faces questions about its independence. Warren and Waters' letter demands that the SEC clarify whether it is subject to political interference, especially in handling enforcement related to WLFI. If favoritism is confirmed, it could lead to a larger scandal, potentially prompting Congress to push for new ethical legislation to restrict the business activities of family members of sitting officials.

For the cryptocurrency market, this event is a double-edged sword. On one hand, the Trump administration's pro-crypto policies have spurred industry growth, such as the passage of the stablecoin bill aimed at injecting legitimacy into cryptocurrency. On the other hand, the political shadow causes investors to hesitate. The WLFI token's first-day crash is a case in point: despite the White House's backing, the market still voted with its feet. Analysis shows that similar projects may face increased scrutiny, especially under the Democrats' push, as the SEC may resume strict enforcement of cryptocurrency regulations.

This article is for informational sharing only and does not constitute investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。