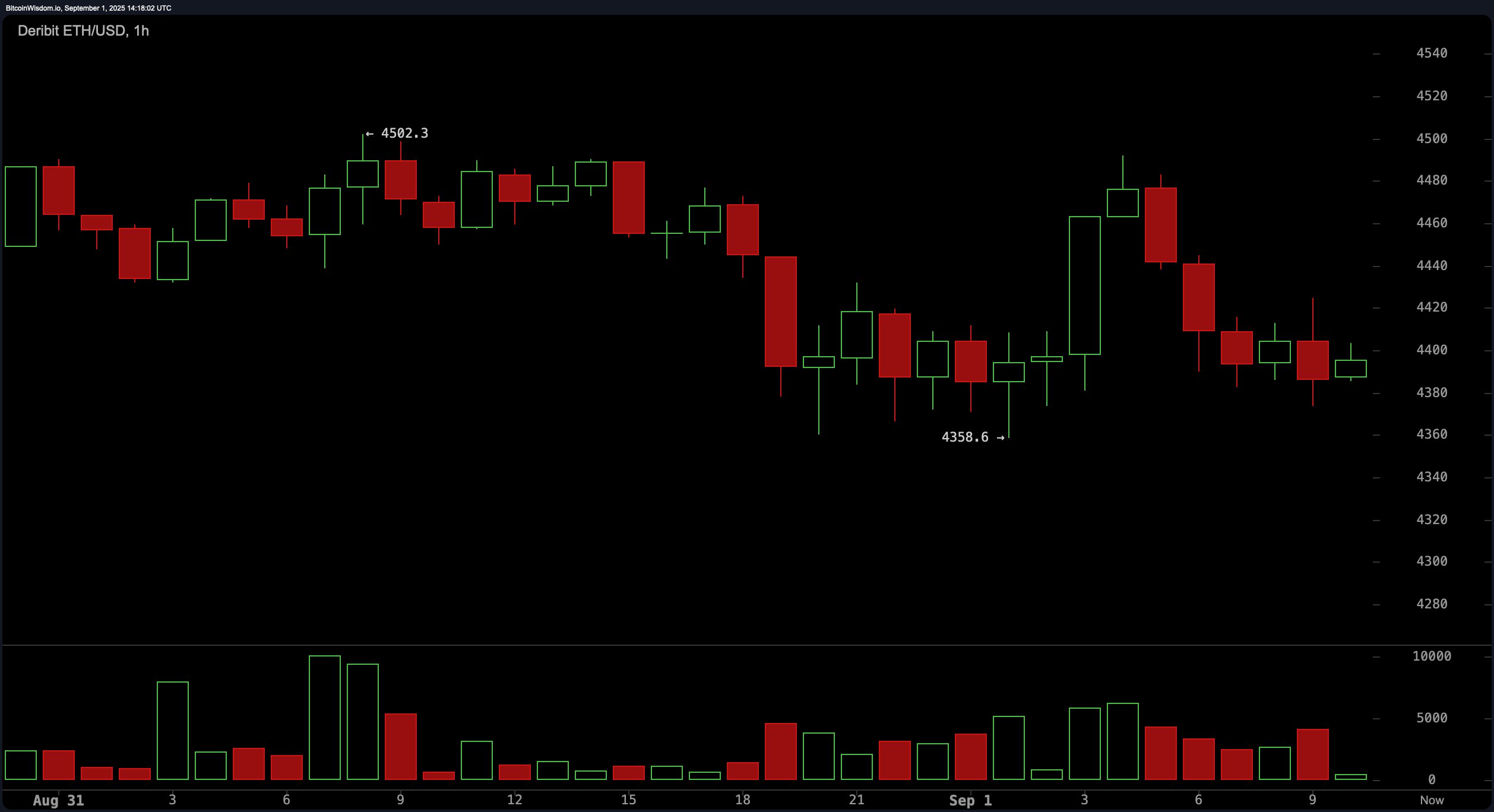

The 1-hour ether chart presents a bearish outlook for ethereum, shaped by a failed recovery attempt from a local support level near $4,358.6. Price action has stalled around $4,400 after rejection from $4,502.3, while declining volume supports the case for weak bullish conviction. The microstructure points to a bearish flag or descending triangle, with a breakdown below $4,350 likely to initiate a move toward $4,300 or even $4,250. A bullish setup only materializes if ethereum breaks above the $4,420–$4,430 zone with strong volume.

ETH/USD via Deribit 1-hour chart on Sept. 1, 2025.

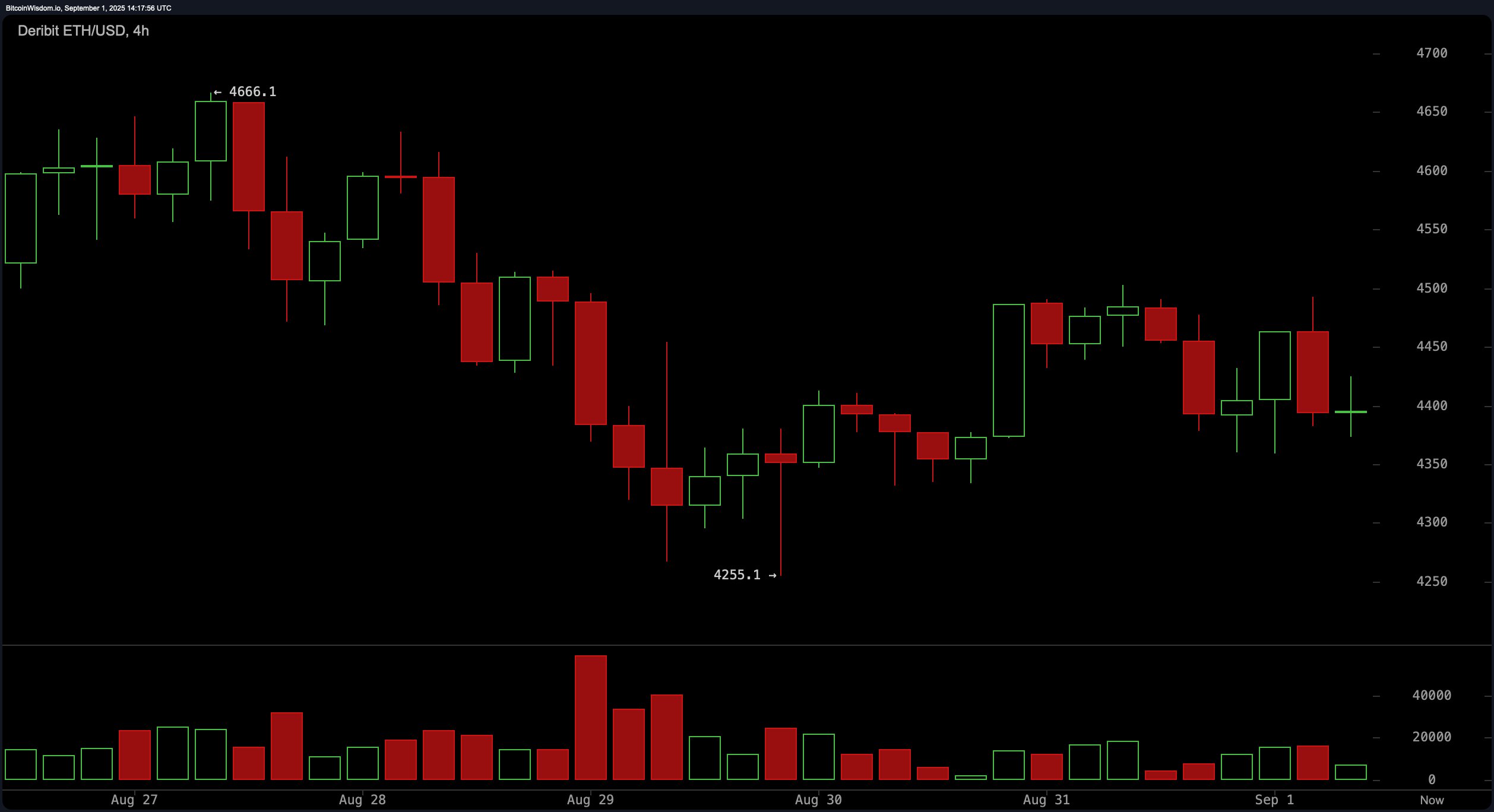

The 4-hour ethereum chart reinforces short-term bearish sentiment. A clear double top around $4,666.1 has led to a drop to $4,255.1, followed by a lower high near $4,500. Notably, red candles are accompanied by higher volume, underscoring the dominance of selling pressure. Key support rests at $4,250, while resistance holds firm at $4,500. Traders may consider short entries if $4,400 fails again, with stops placed above $4,500 and potential downside targets near $4,300.

ETH/USD via Deribit 4-hour chart on Sept. 1, 2025.

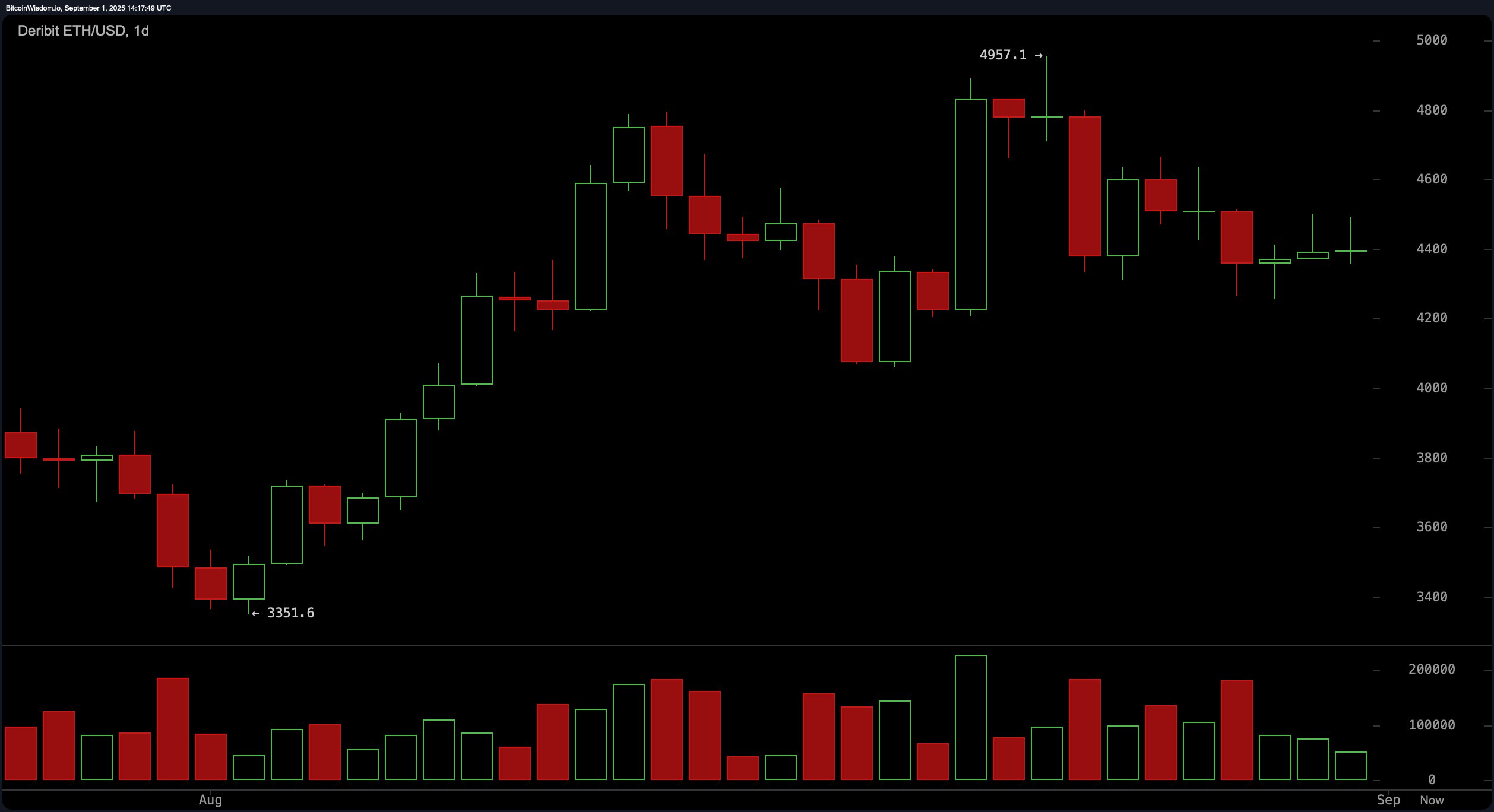

On the daily chart, ethereum shows signs of medium-term consolidation after an uptrend from early August lows around $3,351.6 to highs near $4,957.1. However, recent candles reflect lower highs and closes, trapped in a $4,400–$4,600 range. Decreasing volume suggests exhaustion or indecision. Critical support lies at $4,200, tested multiple times, while a close above $4,700 on strong volume could confirm a bullish continuation.

ETH/USD via Deribit 1-day chart on Sept. 1, 2025.

Momentum oscillators offer mixed signals. The relative strength index (RSI) sits at 53.0, indicating neutrality. The Stochastic oscillator and commodity channel index (CCI) echo this sentiment at 36.5 and −32.4, respectively. Meanwhile, the momentum indicator signals bearish divergence at −429.8, and the moving average convergence divergence (MACD) level of 123.3 suggests continued selling pressure. The Awesome oscillator and average directional index (ADX) remain neutral, adding to the non-committal tone across momentum-based tools.

Ether’s moving averages (MAs) reveal a divergence in short- and long-term sentiment. The 10-period exponential moving average (EMA) at $4,441.5 and simple moving average (SMA) at $4,508.3 both issue bearish signals. However, support builds as the 20, 30, 50, 100, and 200-period moving averages trend upward, indicating long-term bullish structure. Particularly, the 200-period SMA at $2,688.2 and EMA at $3,120.8 reflect a strong foundational uptrend, despite short-term corrections.

In summary, while ethereum maintains a stable spot price at $4,392, the market is currently leaning bearish in the short term, with potential for further downside if key supports break. Medium- to long-term indicators remain constructive, but confirmation of a bullish breakout would require a daily close above $4,700 with stronger volume.

Bull Verdict:

Despite short-term volatility and a bearish tone in lower timeframes, ethereum’s strong support above key moving averages and long-term trend structure favors a bullish continuation—provided the price can close above $4,700 on significant volume. This would likely reestablish upward momentum and open the path to retest August highs near $4,957.

Bear Verdict:

Short-term charts signal increasing downside risk, with momentum weakening and volume favoring sellers. A breakdown below $4,350 could trigger a deeper correction toward $4,250 or lower, especially if macro resistance near $4,500 continues to reject bullish attempts. The current structure favors caution for long positions in the near term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。