Author: s4mmy, Crypto KOL

Compiled by: Felix, PANews

Note: The author holds some assets mentioned in this article and has partnerships with some of the projects.

As the market fluctuates, you may have a question in mind: Is the market about to peak? The post-traumatic stress disorder (PTSD) from previous cycles is starting to resurface.

However, as the market matures, it is important to consider what new institutional participants prioritize: revenue. Hopefully, there will be a sustainable business model!

Decentralized Artificial Intelligence (“DeAI”) is finally starting to generate real revenue. Computing, data, and agency services are showing signs of product-market fit. Here’s why the next wave of growth may come from fee conversion and corporate demand.

Introduction

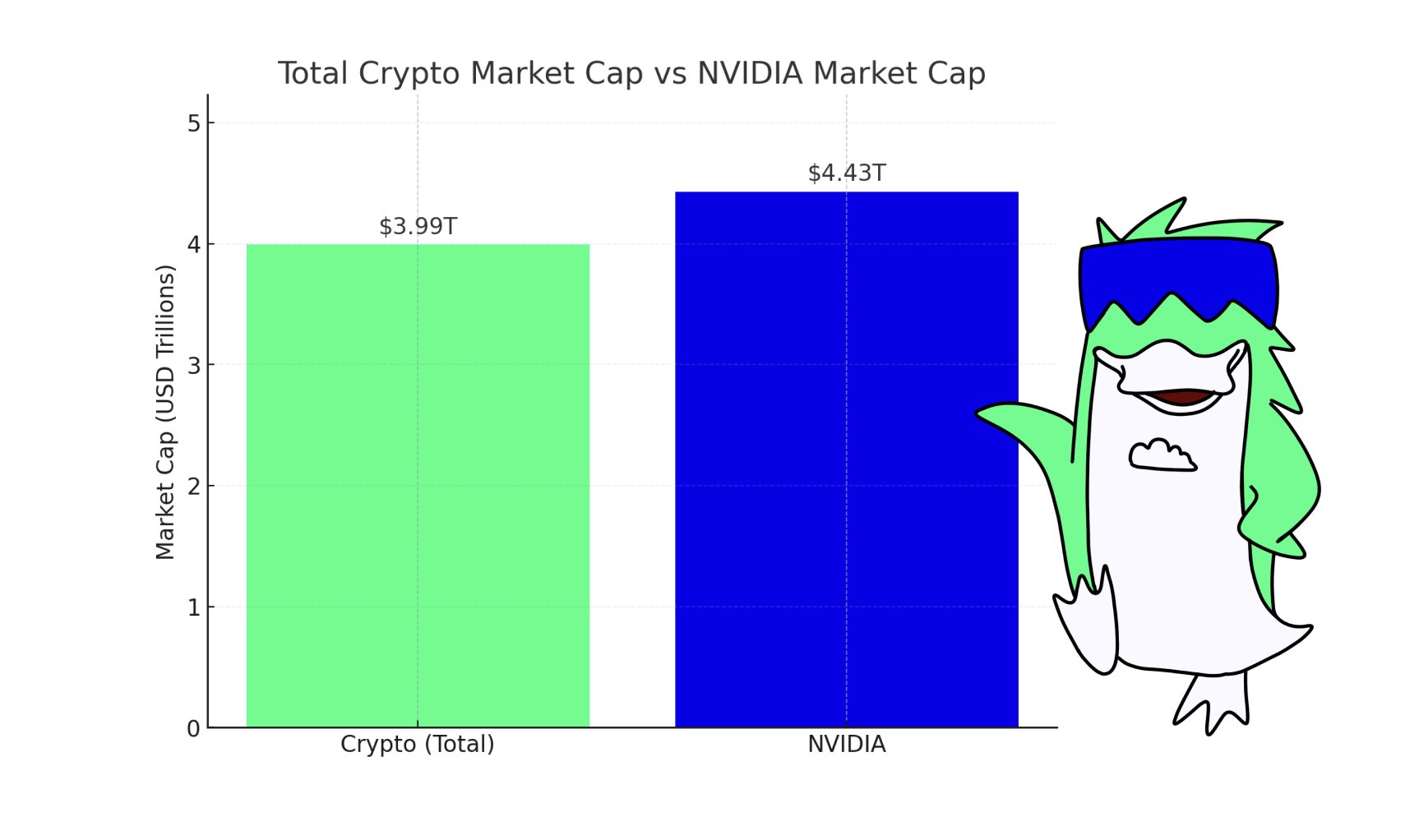

Artificial intelligence is the most disruptive technology of our time. The world's most valuable company (NVIDIA) produces chips for AI, with a market capitalization exceeding the entire cryptocurrency market:

Data Source: CoinMarketCap + Nasdaq

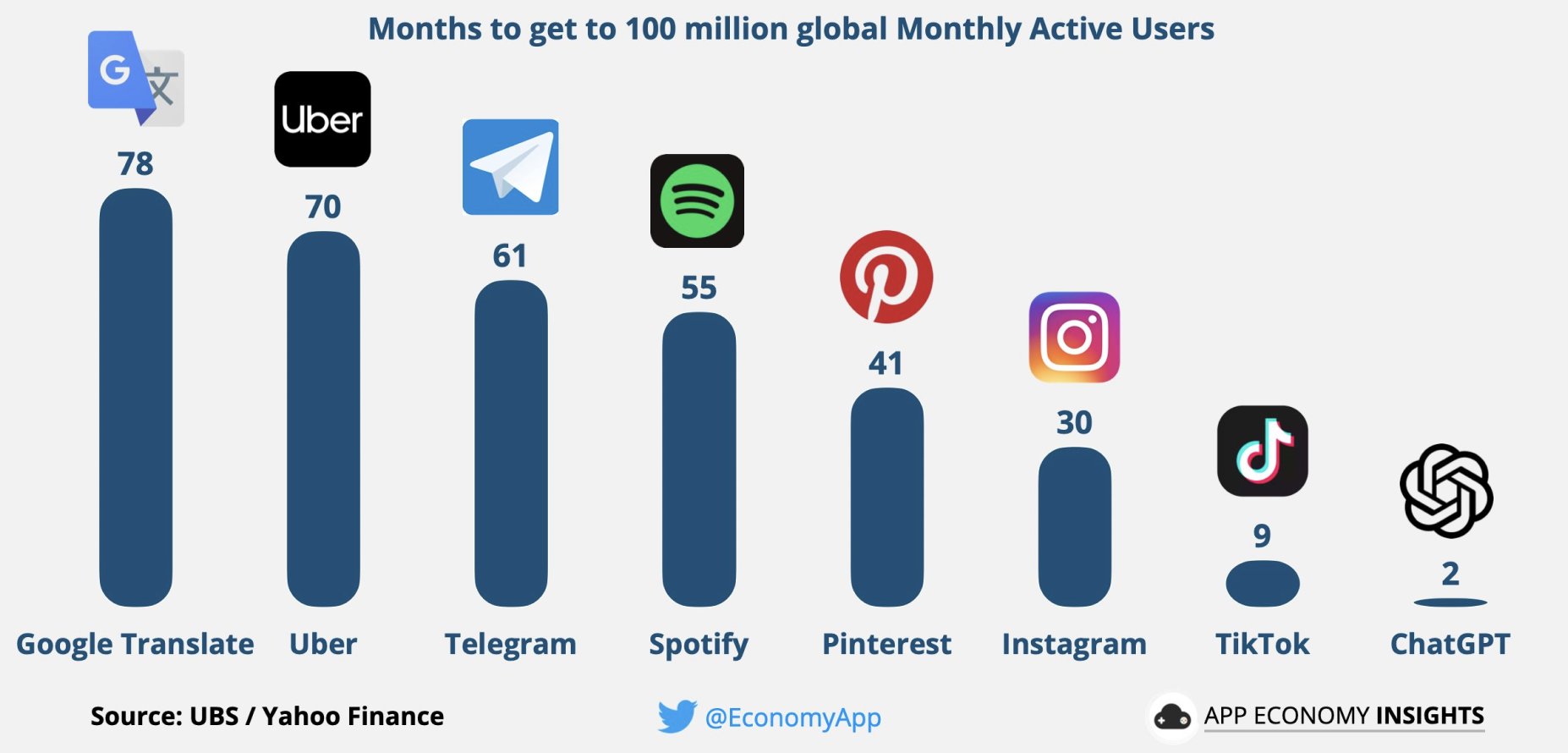

OpenAI became the fastest company to reach 100 million users.

Data Source: UBS/Yahoo Finance

While the adoption rate of crypto protocols is slower than that of centralized protocols, AI (and agents) abstract complexity, making the user interface/user experience more seamless.

What’s the result? Faster adoption rates and the emergence of new, more sustainable business models.

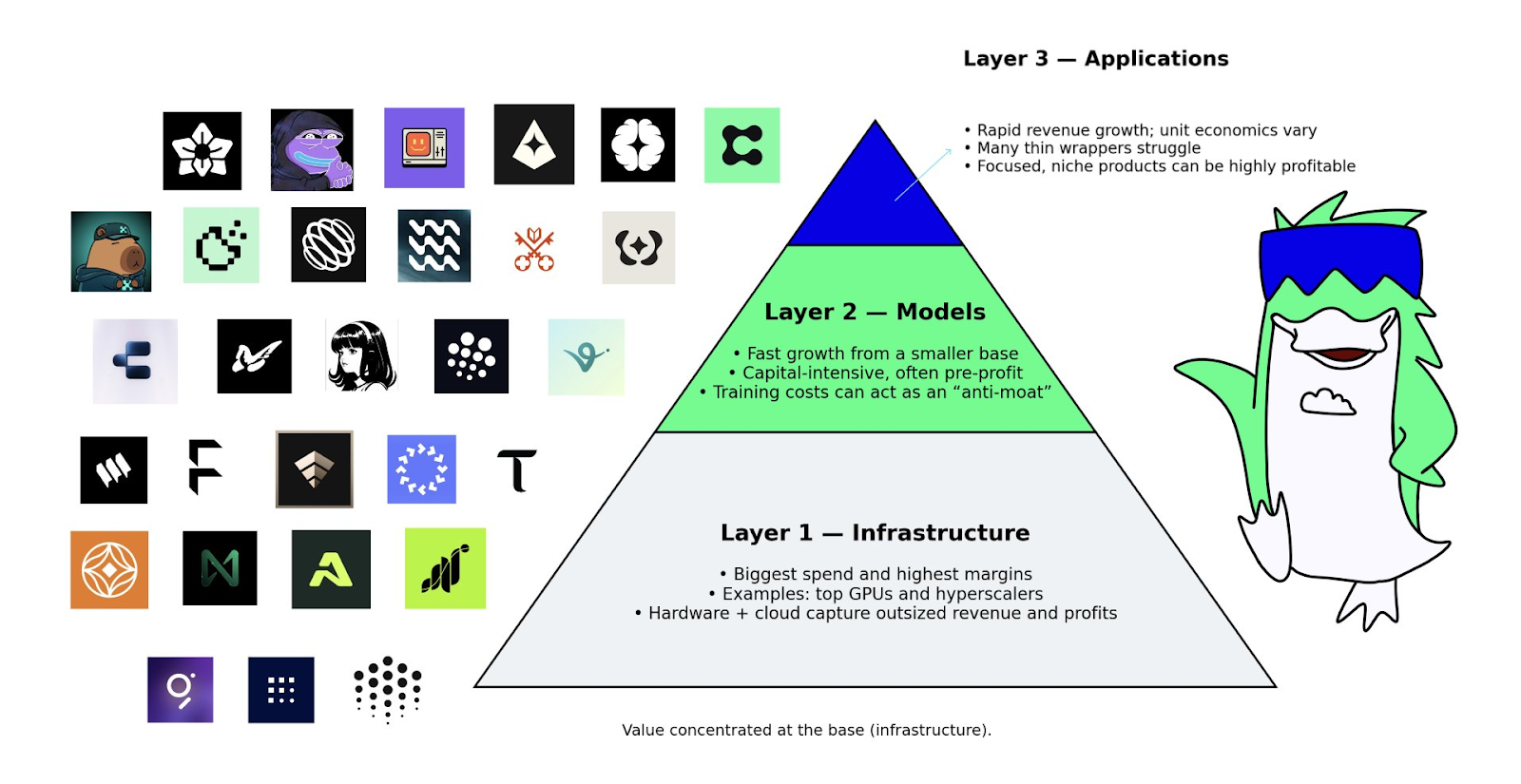

Currently, most economic value is concentrated in infrastructure (chips, cloud, data centers) and foundational models.

But as protocols with real moats emerge, this value may gradually benefit applications.

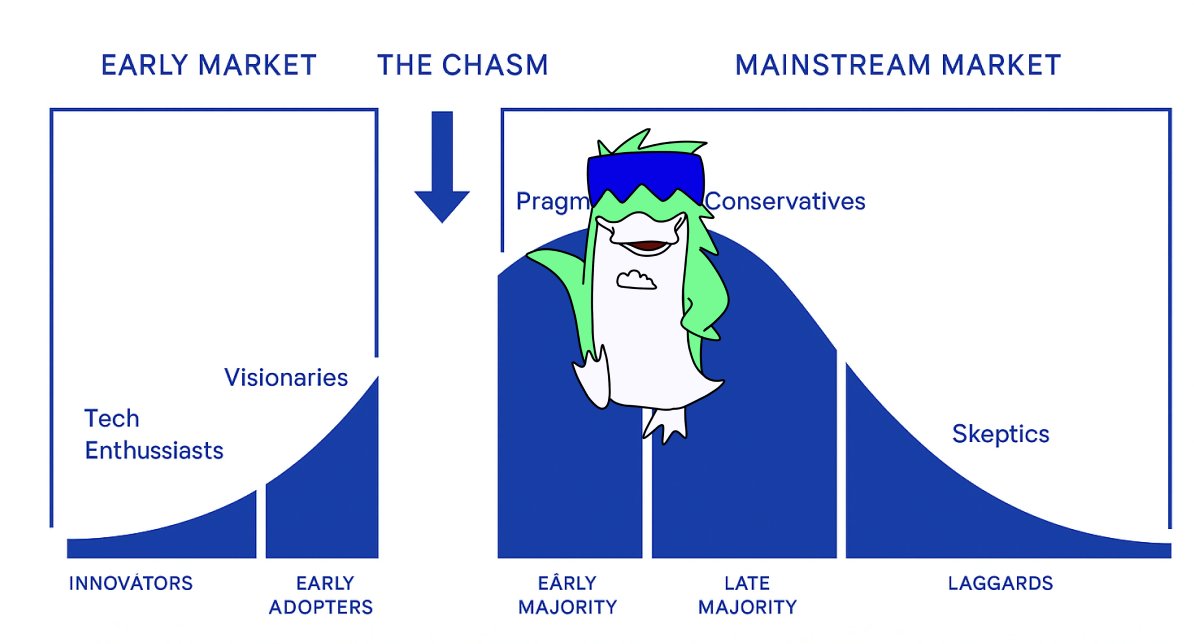

Is the current AI boom (DeAI + CeAI) similar to the internet bubble? It certainly is. History may not repeat itself, but it often has striking similarities.

I personally believe we have crossed the "chasm"; after all, AI is not going away:

There’s no need to worry about limited upside potential; given the nature of AI, as long as new models can bring significant improvements, the upward trend will continue.

Once this trend slows down, capital allocators are likely to stop deploying, as their return on investment will decline. Until then, the frenzy will continue.

Volatility is expected in the short term, along with standout areas. Companies with sustainable business models will ultimately weather the storm like Amazon, Facebook, and Google did in the AI era.

So, how do we identify these sustainable models?

“Revenue is Metadata”

Let’s be clear, revenue is not metadata; it is a fundamental element of a business's survival.

But perhaps in the hype cycle and pure meme-driven speculative frenzy, many crypto projects have forgotten this.

As the market matures and institutions begin to invest, they will inevitably turn to fundamentals; and revenue is clearly the most compelling indicator of growth momentum.

Assuming that the unaudited, self-reported data has not been "beautified."

Traditional finance can use its cash flow discount models and internal/external market segmentation benchmarks to decide which protocols to invest in.

We are already seeing some signs, such as Tether and Hyperliquid surpassing centralized entities on the "per capita revenue" leaderboard.

Why will DeAI protocols be different?

In fact, as crypto infrastructure and ambient coding enable developers to launch blockbuster products on their platforms, we may see "single founders becoming unicorns" become more common.

While current AI protocol revenues may not yet match those of stablecoin protocols, it is important to note that this is related to interest-bearing government bonds. So as interest rates decline, it will affect revenue.

However, if you use AI-generated revenue to support the protocol, then as demand for AI continues to thrive, it is likely to yield good returns on investment.

“If you don’t know where the revenue comes from, then you are the revenue.”

But if you know the revenue comes from the most disruptive technology of our time, then you may have invested in the right place.

Therefore, while everyone is looking forward to the next Circle IPO, I am focusing on the cash flows related to "picks and shovels" in the AI era.

Revenue Engines

Centralized AI companies are achieving $30 million in revenue at a rate 5 times that of traditional SaaS:

This is why Y Combinator states that AI agents will completely surpass the SaaS industry.

Agents will become the new application layer/user interface (UI) of the internet, replacing the UI/UX of DeFi.

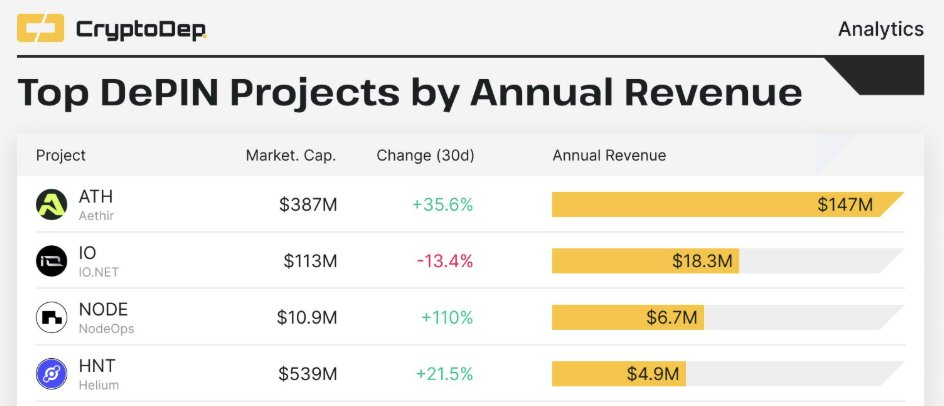

We are already seeing some DePIN projects generating nine-figure annual revenues, but other AI protocols are far from reaching this level… at least for now.

But this situation will change.

Cryptocurrency will empower AI to find product-market fit with the mass market. Validating the vast amounts of data generated by AI is one of many overlapping use cases.

AI Revenue Protocols

We are already seeing early signs through some products that create real value, which ultimately found product-market fit.

Consumers are willing to pay for this service, whether through subscriptions or backend profit-sharing transaction fee models.

1. Fine-tuned Models: Caesar + Surf

a) Caesar launched its token on day one and integrated it into the model:

Source: GMGN

The alpha product initially required 100,000 tokens, but now the beta version only requires 10,000 tokens. No staking is needed; just deposit into a wallet, thanks to Dynamic's support.

The feedback for the product has been extremely positive, with many users transitioning from traditional centralized models to subscriptions due to enhanced cryptocurrency (and other specific industry) outputs.

As the protocol integrates the Caesar API to enhance the services provided to enterprise clients, revenue is expected to increase. Creating a high-quality product will naturally lead to revenue.

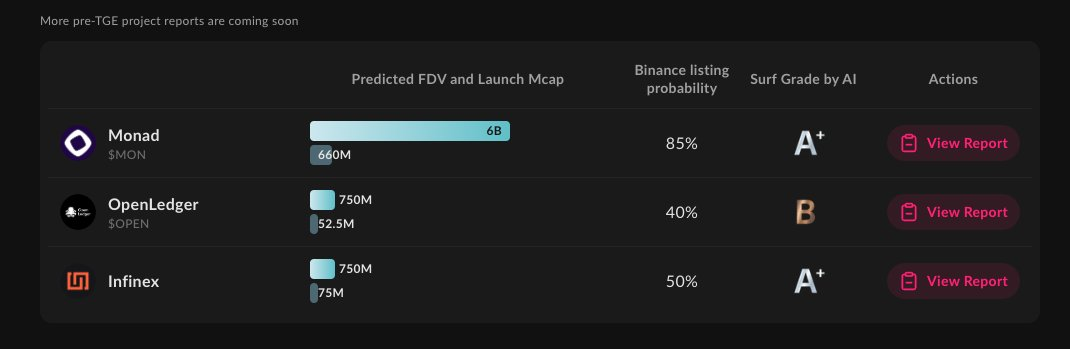

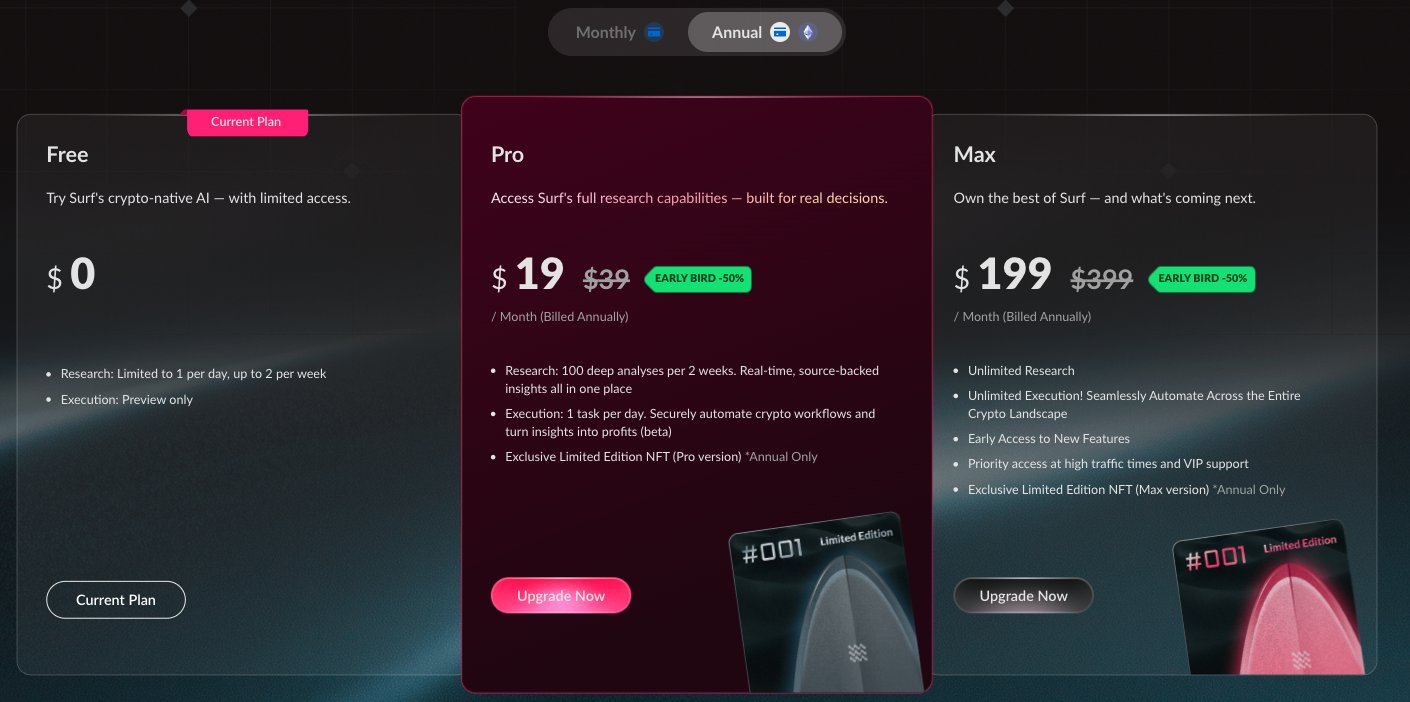

b) SURF provides enhanced cryptocurrency and blockchain-related reports, including pre-TGE cryptocurrency special research:

This helps stand out in niche markets, which general models find hard to reach.

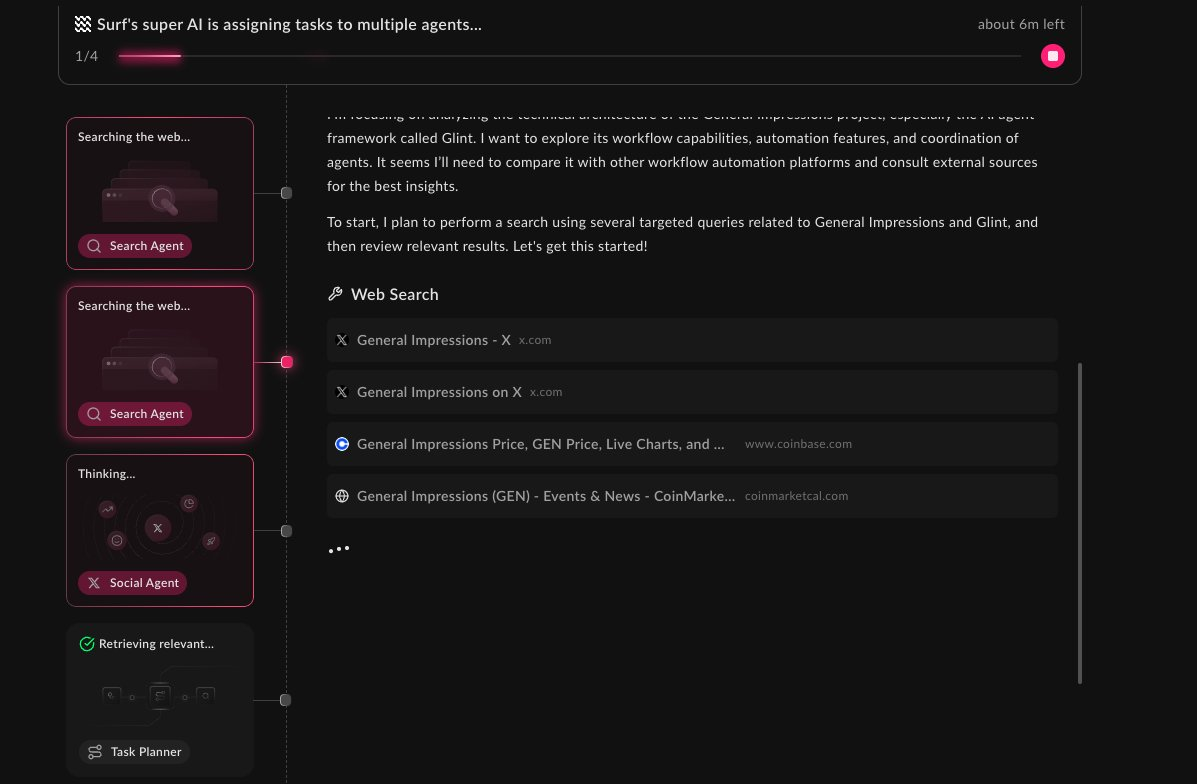

User task requests are assigned to multiple different agents (see below), who execute their respective tasks and then report and consolidate results. This process can be viewed in real-time.

Source: Surf Co Pilot

SURF's parent company Cyber issued a token. Once SURF is launched to a broader audience, it will generate revenue through a subscription model.

2. DePIN: Aethir + Grass

In recent years, the DePIN sector has witnessed significant investment, and several large protocols are now benefiting from it.

Source: CryptoDep

Aethir is a decentralized cloud infrastructure platform that pools underutilized GPUs worldwide to provide on-demand computing power for AI training, inference, and cloud gaming.

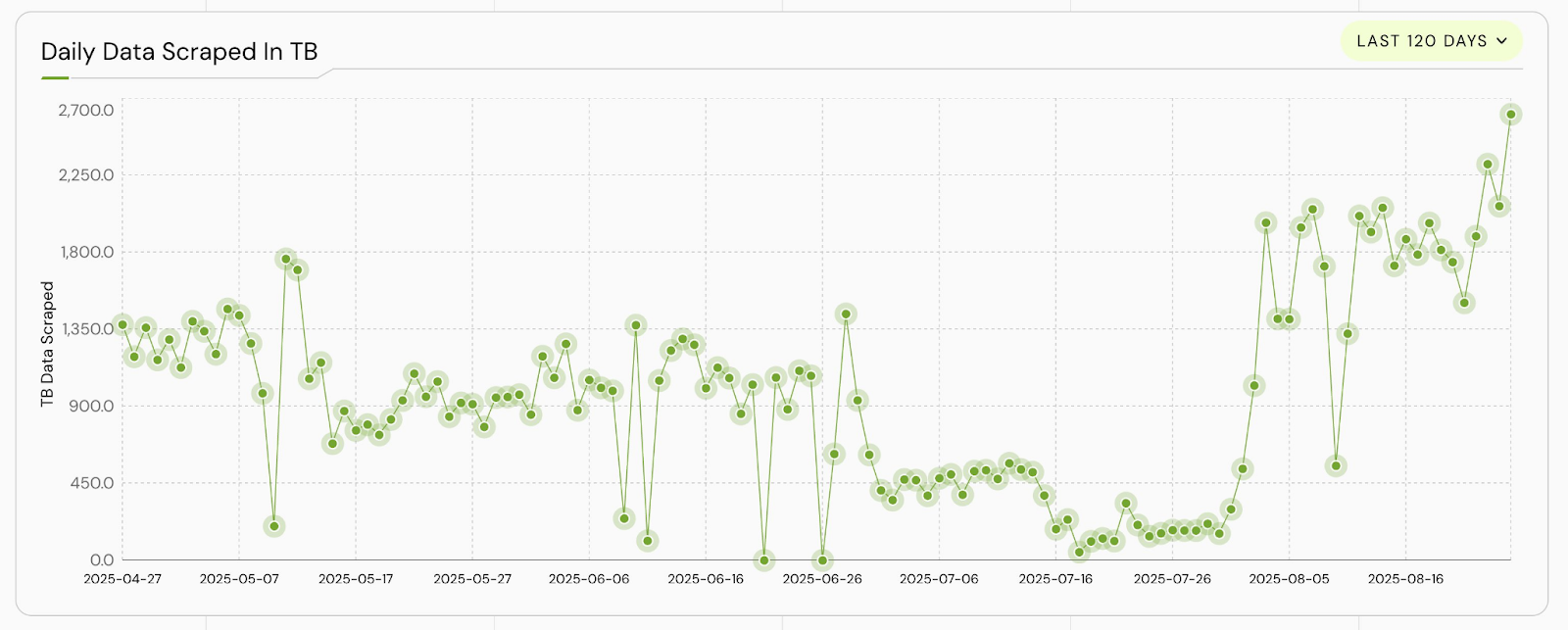

Grass Network rewards users who provide idle internet bandwidth, which is then sold to enterprises. The company generated approximately $33 million in annualized revenue from AI clients last year, with daily data capture reaching up to 2,700 TB.

3. AI Revenue-Backed Capital: USD.AI

USDai is a yield-bearing stablecoin backed by loans of AI hardware and computing resources. The current yield is about 8%; with the continued growth in GPU demand, yields are expected to rise and surpass other stablecoin yield models.

4. Privacy-Focused AI Tools: Venice

Venice launched earlier this year, aiming to provide a privacy-preserving alternative to centralized AI tools.

Current revenue includes a paid subscription model ($18 per month) and token earnings through VVV staking.

Venice recently released the DIEM token, equivalent to a daily credit of $1 on the Venice API.

Can we see this new token linked to AI-supported revenue?

Arbitrage opportunities are emerging, opening up a whole new market for speculators.

5. Crypto Abstraction Layer: Circuit

foobar collaborates with Circuit AI to improve user experience by abstracting the complexities of DeFi through a familiar and user-friendly interface.

Soon, every DeFi protocol will integrate its own AI agent, or interactions with crypto wallets will be completely replaced by agents.

While it is currently unclear how agents will generate revenue, it is likely through transaction fees or token models.

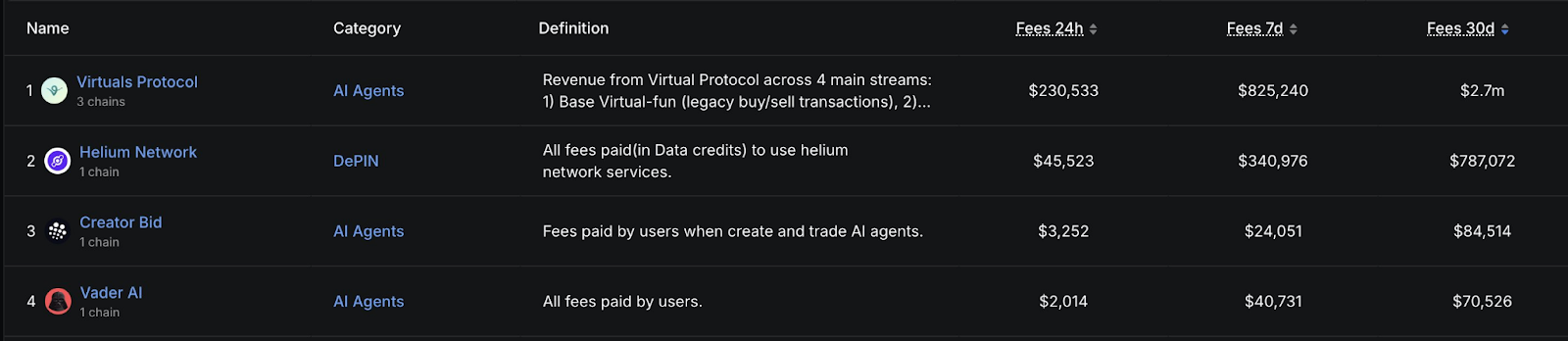

6. Agent Launch Platforms: Virtuals Protocol + Creator.Bid

Virtuals has gradually revived from the Genesis launch platform over the past few months, while Creator Bid has seen a significant price increase with the release of its V2 version and its close ties to the TAO ecosystem.

You might think that the current hype seems to have faded, and these launch platforms are struggling?

Wrong. They are still earning enough fees to sustain operations until a breakthrough application or product is launched through the launch platform.

It is well known that Pump Fun repurchases $10 million worth of tokens weekly, earning millions in fee revenue.

This model also applies to agents, especially as the next wave of AI agent teams launch more powerful products.

Do you think that's why even Sandbox has shut down and turned to launching a token issuance platform?

Aixbt paved the way for Virtuals last December; in my view, this is just a glimpse of future developments.

Pump Fun has attracted significant attention with several popular tokens like Fartcoin, GOAT, and PNUT, with people hoping for more tokens to achieve 1000x returns.

While many are in it for the investment returns, the benefit of tying a meme coin to a product with fundamental value is that it is more sustainable and less reliant on market sentiment.

The premise is that the team is not incompetent and can economically benefit from this revenue through efficient token economics—HYPE is a great example.

7. Agent Applications: OpenServ

Openserv recently launched BRAID—a proprietary inference framework that allows users to launch their own agent applications.

Currently, there have been no decent attempts at an agent application store. There are indeed some AI applications on iOS/Google Play, but there are no truly widely used native crypto applications yet.

Openserv has incubated several teams and attracted a group of skilled team members from companies like NVIDIA and Eliza Labs.

With the launch of this new framework, can we expect to see SERV replicate its infrastructure planning from Q1 2025? It needs to integrate a well-designed fee mechanism to achieve a sustainable revenue model.

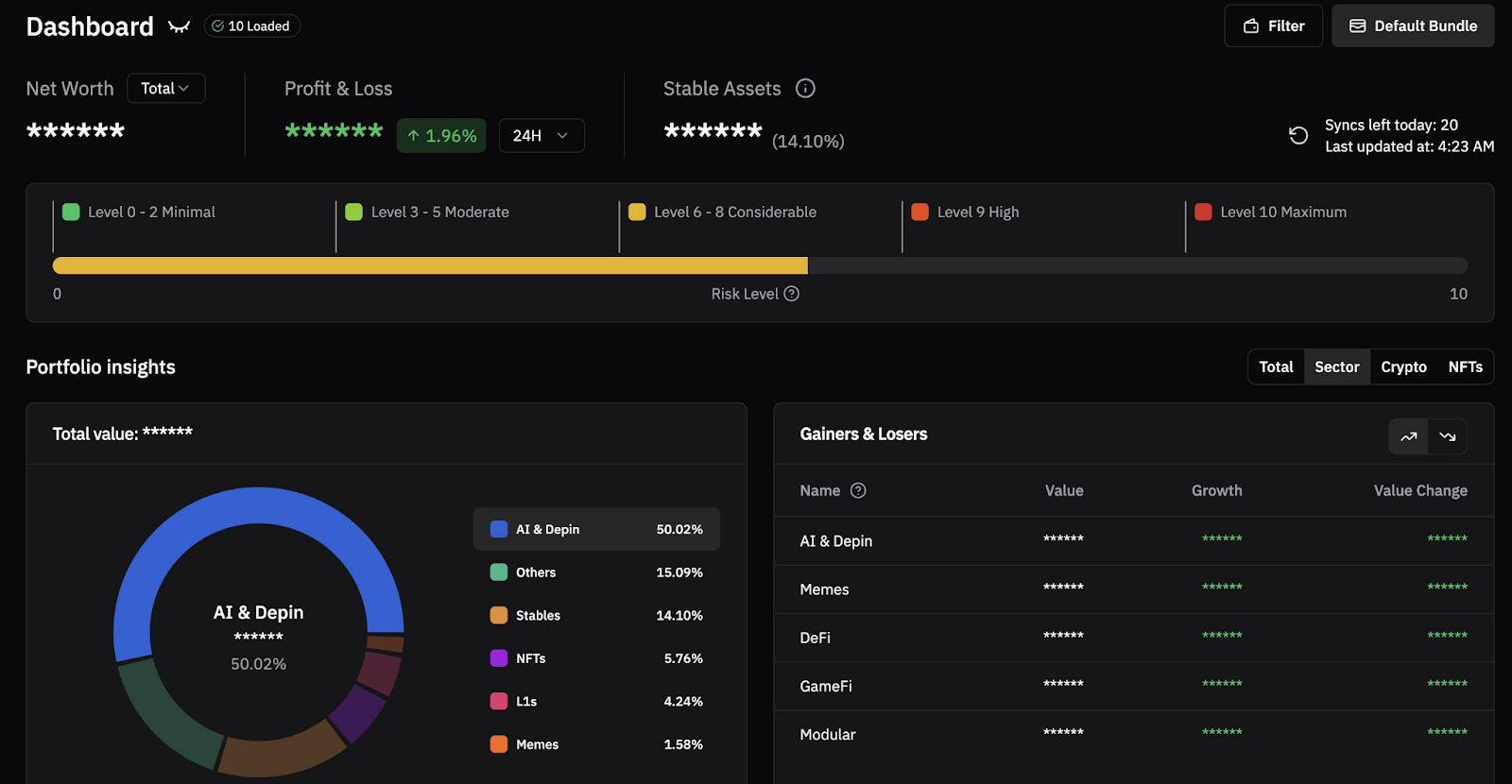

8. Portfolio Management: Cerebro

AI-driven financial literacy and portfolio optimization will be extremely valuable.

The AI portfolio assistant "Alice" provides continuous analysis and alerts to support users' portfolio decisions.

Cerebro users pay a subscription fee ($10 per month) to access more features, making it easier to manage their finances.

This is one of the best services I have personally subscribed to, and I really like its risk status analysis feature—it truly helps in readjusting market exposure when asset prices fluctuate.

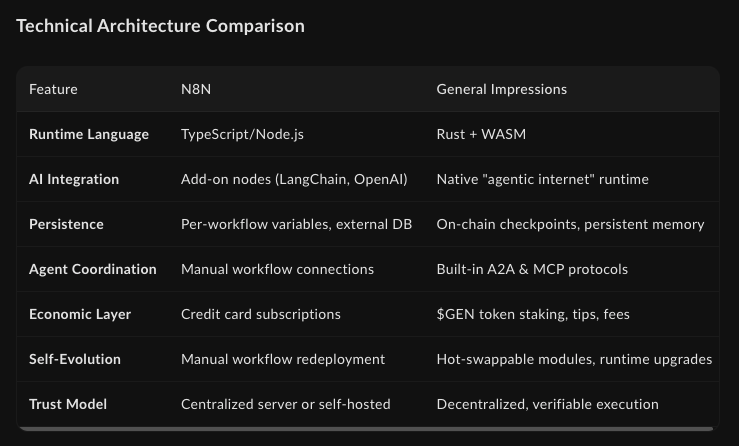

9. Agent Workflow Optimization: General Impressions

Why not apply N8N to the crypto space?

N8N is a leading open-source workflow automation platform that allows users to connect APIs, databases, and services through a visual drag-and-drop interface.

General Impressions offers a Web3 alternative where execution fees or API call fees can be paid using GEN tokens.

SURF Co-pilot made an excellent comparison:

Why DeAI Will Succeed

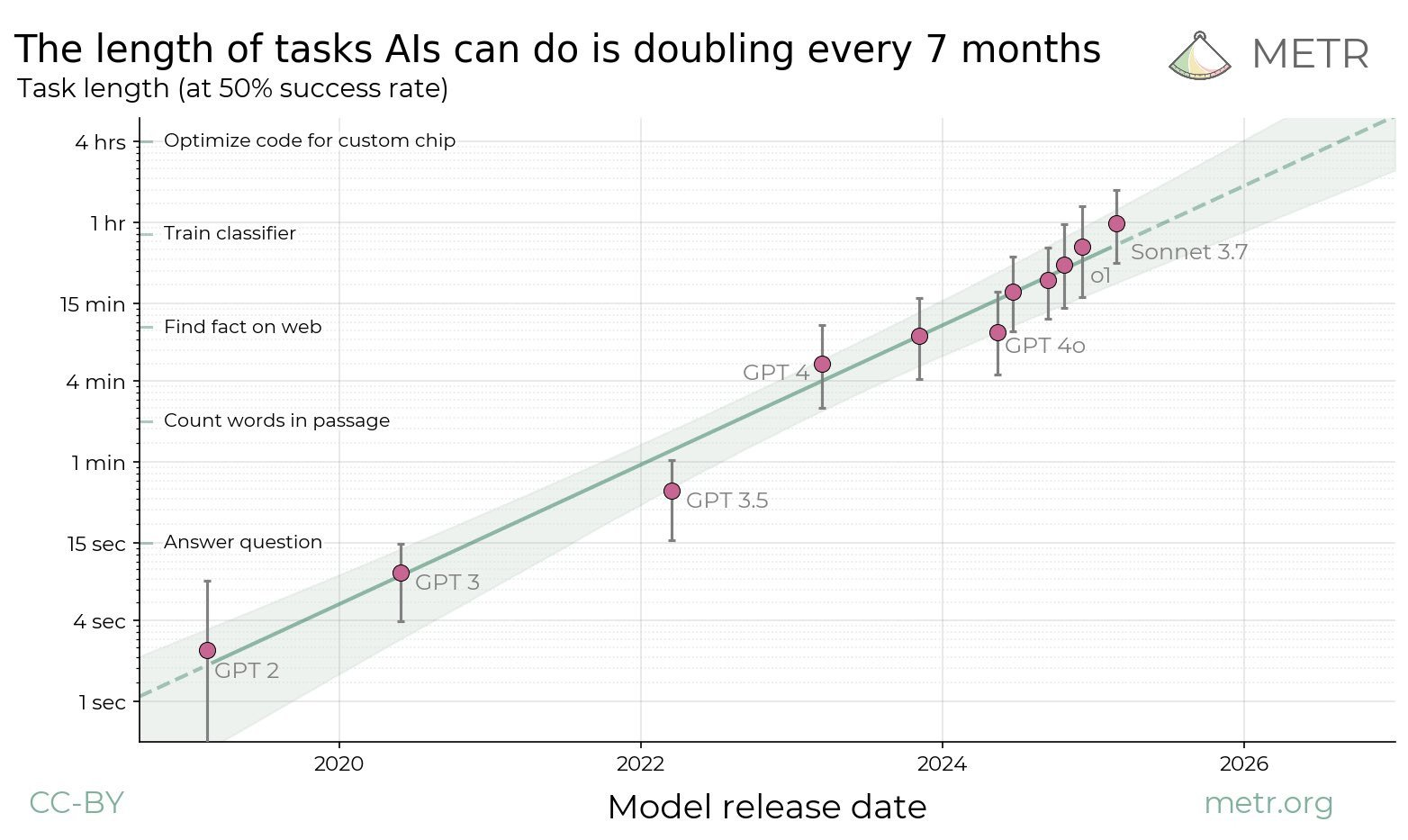

The tasks that AI can accomplish double in duration every 7 months:

No wonder people's jobs are being replaced at an increasingly rapid pace. This saves enormous costs and brings substantial profits to businesses.

AI models have an endless demand for data, computation, and computing power.

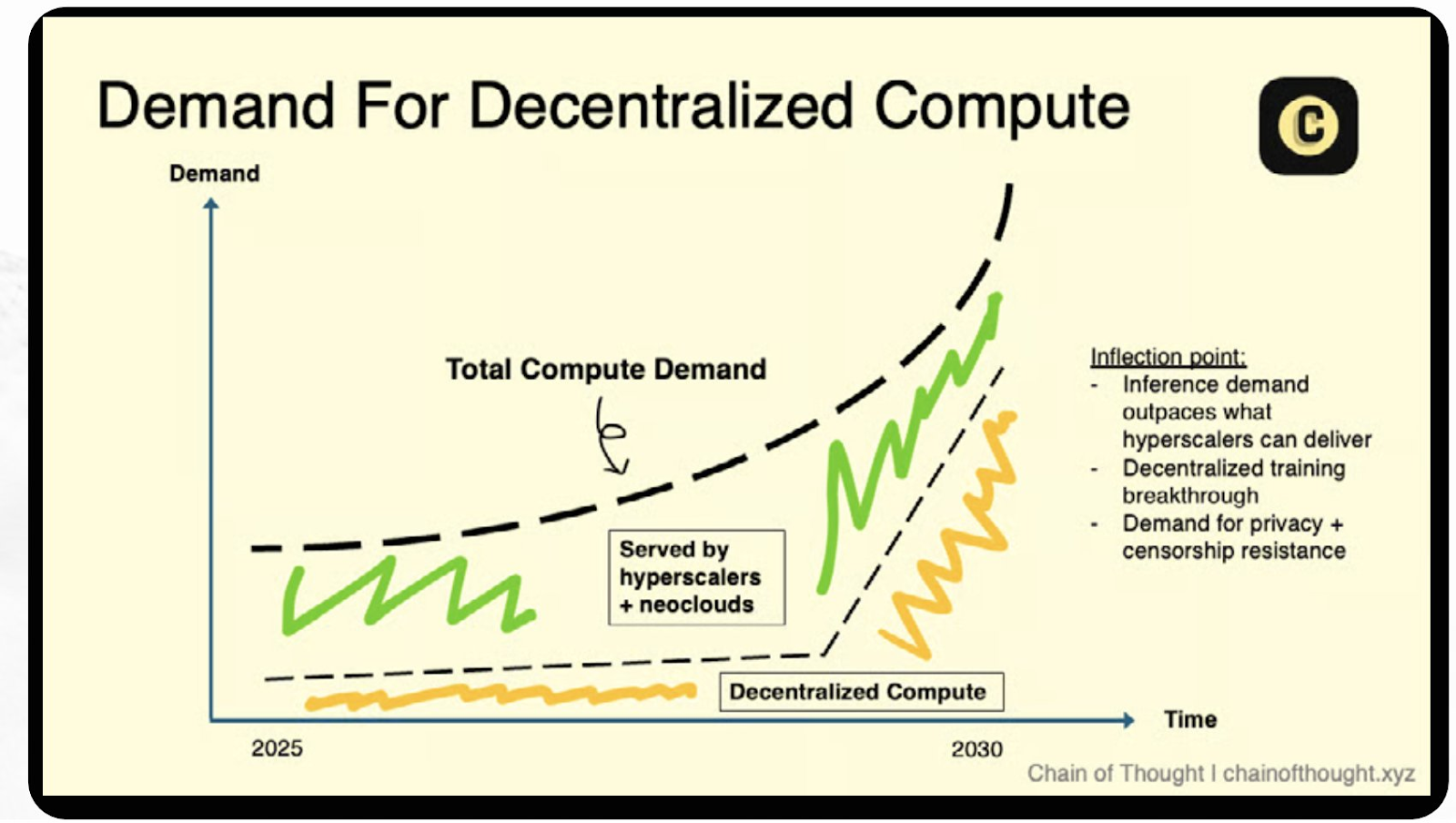

There are still questions about whether centralized computing is sufficient to meet this demand and whether the overall outlook for decentralized computing is optimistic.

Source: Chain of Thought (July 2025)

A significant amount of capital has been invested in infrastructure construction, leading to a surge in power generation. Compared to the broader crypto market, AI protocols are severely undervalued.

At current prices, if TAO's market capitalization reaches Cardano's "current" market capitalization, it would increase 9 times. If the entire crypto market is revalued with increased adoption rates, this number could be much higher.

In my view, the total market capitalization of all AI tokens is only equivalent to 1.9% of the altcoin market, which is simply incredible.

So, what should we focus on?

AI protocols that generate actual revenue through sticky products:

- Consumer-facing (B2C): Are users willing to pay for the services of the protocol?

- Enterprise-facing (B2B): Are other businesses willing to pay for the protocol's API or its AI products?

The key is whether they are willing to become paying customers.

Token pricing based on the roadmap era is a thing of the past; if a project shows no signs of a viable product, there is no need to participate.

Related Reading: The world's most "profitable" company changes hands: A crypto team formed by 11 people generates $100 million per person

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。