The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome all coin friends to follow and like, and refuse any market smoke screens!

Recently, the downward range has become very obvious, leading many new users to feel extremely confused about the future trend, most of whom are contract users obsessed with short-term trends. Today's article will focus on how to do well in contracts and how new users can use contracts to achieve initial accumulation. Contracts are indeed the easiest market to accumulate wealth in today's financial environment. The most painful aspect of contracts is the choice of buying and selling points. Even though it was explained so clearly yesterday, many old users still have doubts about these two points. Regarding the timing of entering and exiting contracts, remember a mantra: as long as the pullback does not break new lows, it is a buying point; as long as the rebound does not create new highs, it is a selling point. For new users, there is not much operation to teach you, and you do not need to understand too much. When Lao Cui faced contract operations, it was simply hard work and data analysis; what everyone calls market sense is actually just data analysis.

During the time of practicing market sense, every day after the market closed, I would go through all the stocks with a transaction amount greater than 100 million, focusing on three points: time, news, and trading volume. Time is used to judge which camp the big players belong to, such as European, Asian, and American trading times, with American trading time being the most intuitive to feel the big players' thoughts. Basically, if buying starts at the beginning of American trading, it is highly likely that the market will close up today. The news corresponds more to trends, but grasping the news requires time accumulation to make correct judgments, such as the upcoming interest rate cuts and the current tapering by the Federal Reserve. These two are contradictory; most market rescue measures are synchronized with expanding the balance sheet and cutting interest rates, but this time it is the tapering phase that has led to interest rate cuts. Why is this so? You need a clear review and must understand the main reasons behind it. If both positive and negative news are released simultaneously, as long as you can understand the implications behind it, you can make correct judgments; the news is the embodiment of trends.

The purpose of tapering is to respond to the return of manufacturing and to reduce debt, while cutting interest rates is to stimulate economic inflow into the stock market. If you can understand these two, you can clearly feel that the impact of this tapering is not significant. Tapering is more about reducing one's own debt, so it will not affect the operation of the stock market and the cryptocurrency market. However, every time tapering occurs, a certain degree of financial crisis will erupt, and you need to pay attention to this. From the news perspective, it can currently be confirmed that the trend is still in a bullish phase. Trading volume is the data that must be looked at every day; you must be clear about the current turnover rate and whether the ratio of trading volume is proportional, thus judging whether the circulation is normal through trading volume. Trading volume best reflects the thoughts of the big players; is there a giant manipulating the trend? For example, previously with Grayscale, almost every time the accumulation opportunity would be about a month before the market started, and now BlackRock and other giants are shifting their focus from Bitcoin to Ethereum.

All actions of the big players will have a time lag in feedback; it is not that once the big players accumulate, they will see profits. This is the focus of yesterday's article; you can review it. When Trump was accumulating Ethereum, the price was at 3400, and Lao Cui's entry price was at 3300. A joke I often make with other analysts is that I self-deprecatingly say I bought at Trump's bottom, only to see it drop to around 1400. At that time, Lao Cui only had one thought: Trump was still accumulating. I saw Trump still choosing to hold and buy around 2000, which is why I heavily invested between 1500-1700. This also led to the opportunity for profits to almost double this time. All measures are merely guessing the movements of the giants; the entire process lasted more than half a year in a loss state, and only in the past two months did I see profits. After finding the trend and understanding the big players, more time is spent testing one's patience and whether there is enough confidence.

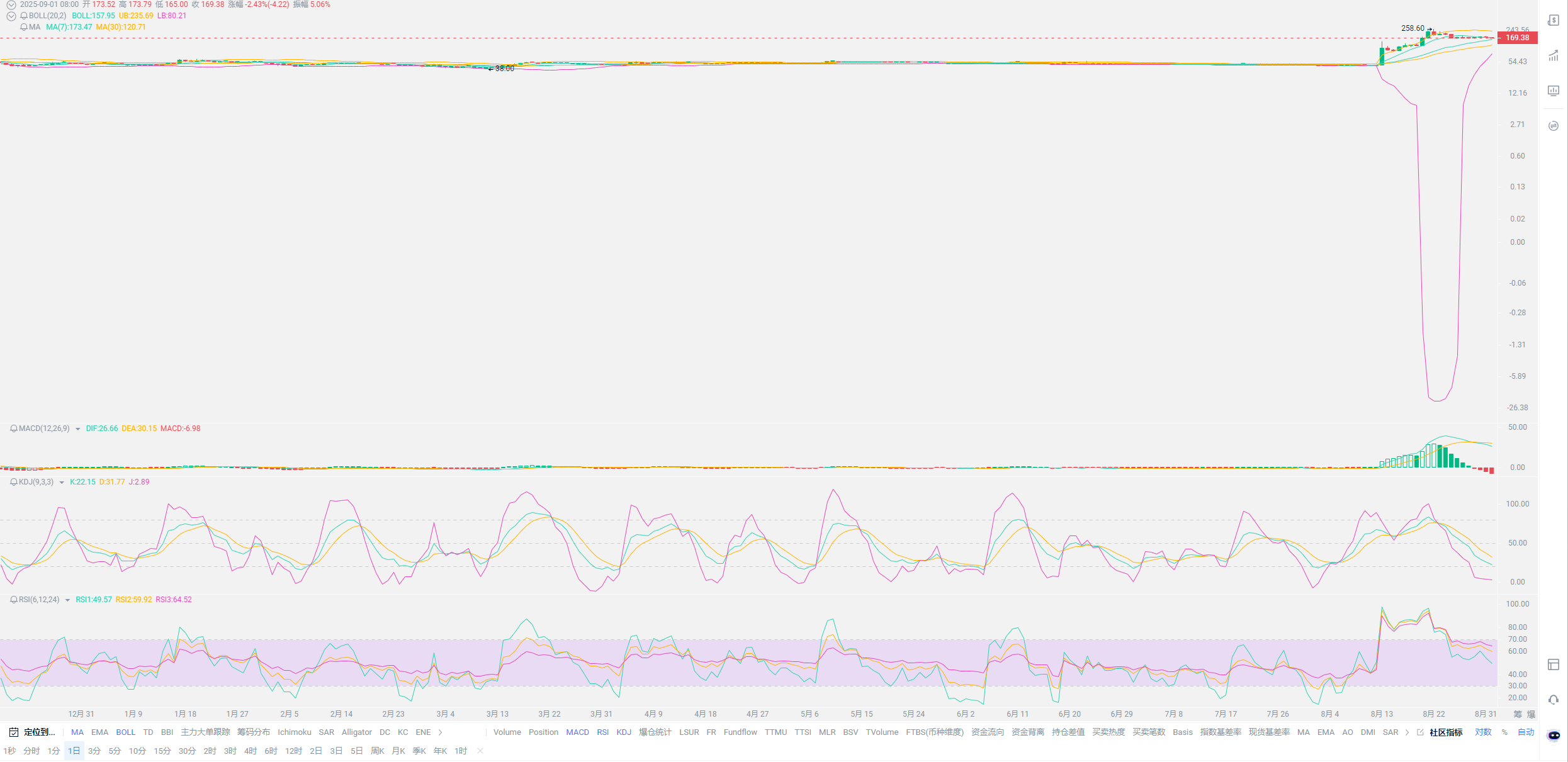

Of course, contract users cannot apply this formula; perhaps choosing to accumulate at 3400, if the price reaches 3500 in the short term, one must choose to exit. At that time, the price was not suitable for contract users to enter. According to the theory of waves, new lows are constantly being created, and what you should do is short. If we consider contract profits, throughout this round of trends, Lao Cui could achieve three times the principal, largely relying on contracts to hedge against spot losses. Regarding the choice of cryptocurrencies, if you want to do contracts now, you can almost give up Bitcoin, and the focus will naturally be on Ethereum. Bitcoin is no longer suitable for contract users to speculate; the required capital volume is too large, and buying one Bitcoin with a hundred times leverage requires thousands of US dollars in principal, which has deviated from the original intention of contracts. According to the logic above, the timing for the end of this pullback is likely as long as it does not break the 4000 mark, you can choose to buy at low positions. Of course, the current stage is still in a fluctuation; only by shaking off retail investors can the next bull market be initiated.

The purpose of the current fluctuations has been given to everyone. How long will the fluctuations last? The duration of the continuation is about controlling the timing of entry. Spot users do not need to consider these issues, while contract users must consider the cost of the first position. I mentioned this yesterday but did not elaborate. The main reason is still due to platform limitations. Next week's data is very important; the current data is worth paying attention to, as at least data falsification is not so blatant now. Therefore, this data release will play a decisive role in the interest rate cut in September. In terms of the cryptocurrency market, it is very likely to become a turning point for the bull market. Regarding domestic economic issues, Lao Cui generally does not refer to domestic data; the domestic A market is not a financial market, so regarding these issues, you do not need to take Lao Cui's advice. If there is a good opportunity, Lao Cui will also notify everyone. Just to mention, the domestic real estate market is not included in the CPI statistics, and I believe everyone can understand.

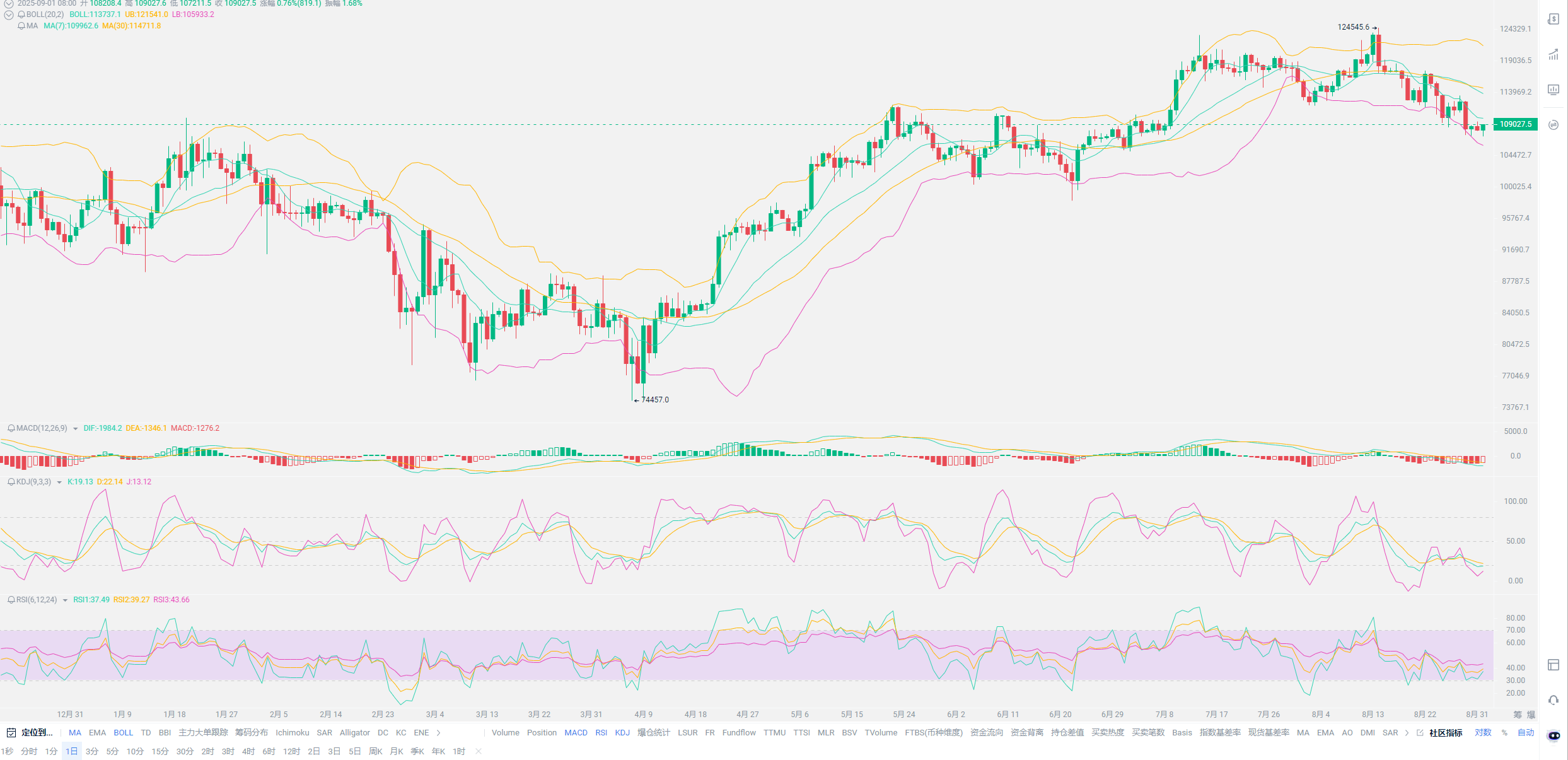

Lao Cui's summary: Today's summary directly provides practical information. The current cryptocurrency market is in a fluctuating trend and is still continuously declining. It seems to show signs of stability, but do not be blinded by a single leaf. Be clear that the core of the fluctuation is to eliminate retail investors; even if the bull market starts, it will first clear out us outsiders. Therefore, if you want to enter the market, you must ensure at least a 20,000 point stop-loss space for Bitcoin and a 1000 point space for Ethereum. On the short-term level, you can refer to the nighttime fluctuations; do not go long above 4400 for Ethereum and above 108,000 for Bitcoin. If it breaks these two positions, that will be your entry position for the day, but it can only be done in a wave form, and the holding time cannot exceed one day. Profits can only be kept between 20-30%, and when reached, it is time to exit. At the same time, if you want to build a trend with contracts, these two points are also the only ones; other cryptocurrencies should not be involved in contracts. The fastest start of this bull market may be SOL first, followed by OKB, which you can still choose to hold. The new highs for these four cryptocurrencies this year will likely be achieved around November, and the trend exit will be between November and December. Since the article is timely, Bitcoin has already broken through the high of 109,000. This article was still written in the morning. If you have specific entry questions, it is best to communicate in real-time, not as an afterthought.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, you can contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and plans the big trend, not focusing on a single piece or position, aiming for the final victory, while the novice fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent troubles.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。