Original Title: "The State of Crypto Venture Capital in 2025"

Written by: Paul Veradittakit, VeradiVerdict

Translated by: J1N, Techub News

In 2025, record-breaking mergers and acquisitions (M&A) and IPO activities are reshaping and driving the upgrade of the cryptocurrency industry, attracting new capital, institutions, developers, and users, injecting momentum into blockchain innovation and application implementation. This pattern has also appeared in other significant technological transformations: after decades of infrastructure development, explosive growth often follows. Unlike the AI industry, which relies on decades of infrastructure accumulation, the cryptocurrency industry is maturing at a faster pace with a more mature technology stack, showing "compounding" growth. This is why the underlying momentum of this market cycle is fundamentally different from previous cycles: the cryptocurrency industry is moving towards a mature stage based on real value and strategic integration, rather than purely relying on speculative hype.

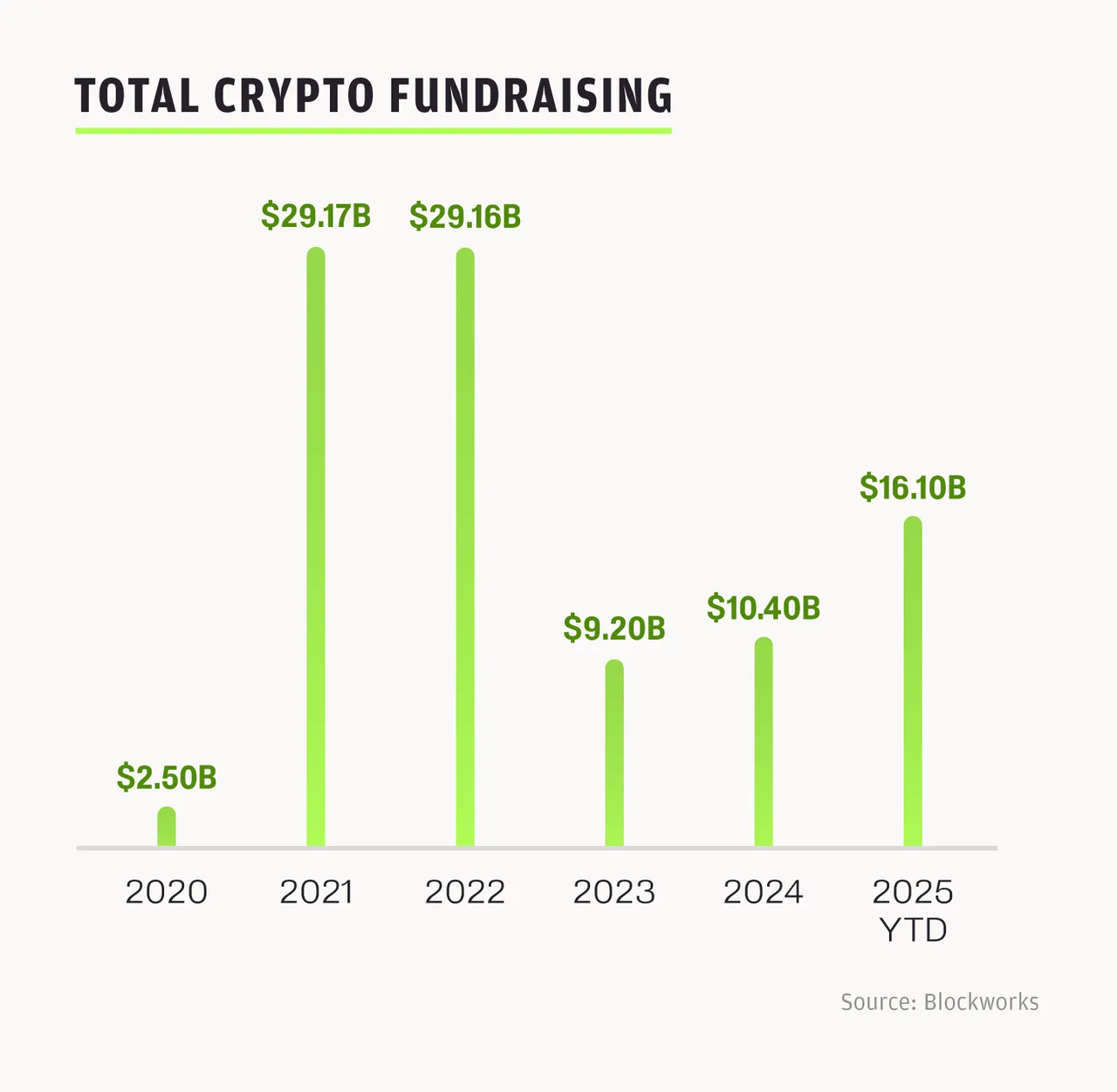

In recent years, the price trends in the cryptocurrency market have shown cyclical fluctuations. Although venture capital (VC) overall has slowed down, the underlying activity in the industry continues to rise against the backdrop of favorable regulations, cryptocurrency-friendly policies, ongoing investments from large companies, and deep intersections between the industry and other fields. After the market peaked in 2022, funding shrank in 2023, gradually warming up in 2024, and entering a full acceleration phase in 2025. In just Q2 of 2025, there were 31 transactions exceeding $50 million, with IPOs, mergers, and debt financing becoming the main drivers of growth. From the beginning of the year to now, the capital attracted by the cryptocurrency market has reached $16.1 billion. However, the trend of capital concentration in cryptocurrency venture capital is similar to that of traditional VC: capital is concentrated in a few funds, meaning larger individual amounts but fewer total transactions. This reflects that many cryptocurrency companies are gradually moving towards a growth phase, and it also means that the current financing environment is more competitive than ever for both founders and investors.

Multiple factors are at play, making this cycle unique: the rebound in token prices, the continuous launch of new products, and increased confidence among founders in the industry, especially with the clarification of regulations around stablecoins and digital assets, which has released more capital. For a long time, regulatory uncertainty has caused developers and Web3 innovators to be cautious; now, with the implementation of cryptocurrency-friendly policies by the Trump administration, bills like the "Genius Act" and "Clarity Act" have laid the groundwork for on-chain adoption. While we cannot determine the far-reaching impact of these bills on the future, it is certain that they have lowered the psychological barriers for investors, promoting the influx of capital and talent into the cryptocurrency field. Additionally, the Federal Reserve is expected to cut interest rates in November, which will bring more capital inflow into risk assets. DATS (Digital Asset Trading System) is locking in more long-term capital, investor risk appetite is increasing, and capital flow is becoming more active.

In terms of investment structure, about one-third of the funds are flowing into "bottom-up" innovative opportunities, such as perpetual contracts, token issuance platforms, prediction markets, and new DeFi protocols; the remaining two-thirds are directed towards "top-down" strategic layouts, such as DATS, real-world asset (RWA) tokenization, ETFs, and IPOs. Among these, "public company stocks" have become the mainstream investment target in this cycle, providing ordinary investors with a more convenient entry into cryptocurrency assets, marking a sign of market health and maturity. This balance shows that the market is maturing, focusing on underlying innovation while accelerating integration with traditional finance.

The window for U.S. cryptocurrency legislation before the 2026 midterm elections is crucial. In this context, the DeFi Education Fund has submitted a response to the Senate Banking Committee's request for comments on "Digital Asset Market Structure" and released a discussion draft of the "2025 Responsible Financial Innovation Act." The recently held "2025 Wyoming Blockchain Summit" focused on digital asset regulation, calling for the U.S. to establish a clear cryptocurrency market framework as soon as possible and to create a balanced market structure. With government officials actively participating and promoting forward-looking policies, the first quarter of 2026 is expected to usher in an unprecedented regulatory foundation.

The Recovery of Token Issuance and IPO Market

In 2025, the number of token listings has decreased, and fewer new tokens can sustain price increases, causing downstream drag on trading volume. Projects relying on token issuance will find it harder to secure financing if they lack market appeal.

In contrast, the IPO window has reopened, with 95 companies listed on U.S. exchanges in 2025, raising $15.6 billion as of mid-June, a 30% year-on-year increase. Cryptocurrency-related IPOs, including Circle and BitGo, are leading the trend, with investors showing a preference for cryptocurrency stocks over tokens. Circle went public on June 5 at an issue price of $31 per share, rising to $233 by mid-July, yielding over 5 times returns, with a market capitalization of $44.98 billion. Recently, Figure and Bullish also went public, with Bullish raising $1.15 billion through partial stablecoin financing, becoming the first of its kind. BitGo plans to IPO and raised $10 million during the 2023 bear market, highlighting investor interest. Cryptocurrency companies are now optimizing revenue and growth rather than speculative token issuance.

The surge in cryptocurrency IPOs and other "top-down" areas has attracted traditional investors through stable, revenue-driven business models, rather than the volatile cryptocurrency market. This is just the beginning of the IPO wave, with more companies expected to join in the coming months.

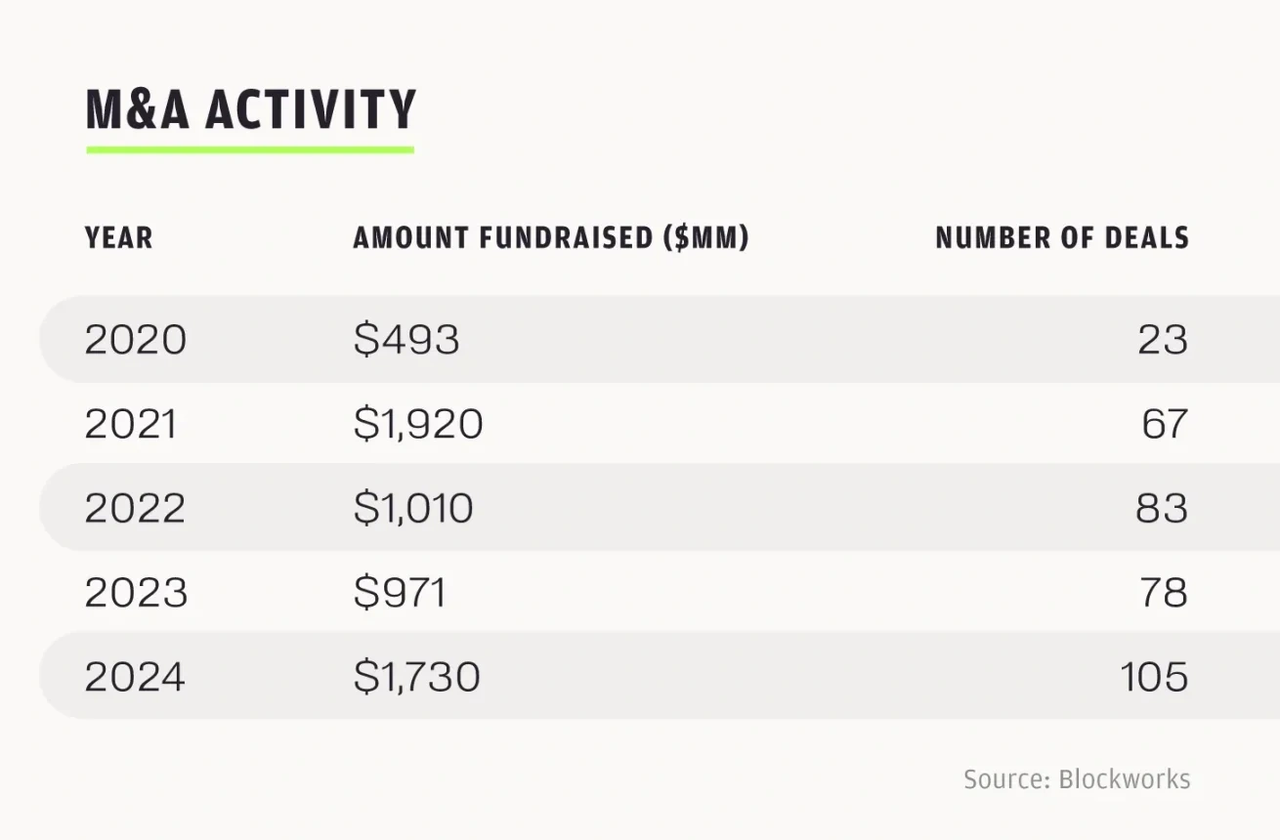

Mergers and Acquisitions and Industry Maturation

2024 was a record year for mergers and acquisitions in the cryptocurrency industry, with over 100 transactions totaling $1.73 billion; the number of mergers and acquisitions in 2025 is expected to exceed that of 2024. As of July, 76 transactions have been completed this year, totaling $6.23 billion, which is 3.6 times last year's total. If the current trend continues, the total for the year is expected to reach 130 transactions.

The market momentum in 2025 reflects more of a natural maturation of the industry rather than a concentrated release of demand. Strategic acquisitions, such as Robinhood's acquisition of Bitstamp, demonstrate that leading companies are building integrated platforms. Robinhood's multi-billion dollar bet on the cryptocurrency industry further strengthens market confidence. In Q2 of 2025, Robinhood's cryptocurrency business revenue grew by 98% year-on-year, reaching $160 million, while the company's overall revenue increased by 45% year-on-year to $989 million, with profits of $386 million. As a stock trading platform for retail investors, Robinhood's blockchain layout highlights the trend of the market transitioning towards mainstream, compliant infrastructure.

Similarly, Securitize completed a $400 million financing round led by Mantle in Q2 of 2025 for RWA tokenization; Kalshi completed a $185 million financing round at a $2 billion valuation for building a prediction market. These initiatives indicate that the focus of the cryptocurrency industry has shifted towards collaborating with traditional financial institutions rather than merely chasing speculative opportunities.

The Cross-Industry Integration of Cryptocurrency and Other Fields

Cryptocurrency is no longer isolated but is deeply integrating with cutting-edge technology and global finance. In the AI field, OpenMind's OM1 + FABRIC technology stack fills the "missing layer" in the robotics industry, enabling collaborative robotics through decentralization. Worldcoin's iris-scanning identity system, based on a blockchain identity layer, allows AI agents to autonomously authenticate and transact, solving the security interaction challenges of agents in the cryptocurrency environment. Decentralized AI platforms like Sahara AI (the decentralized version of Scale AI) and Sentient (the decentralized version of Hugging Face) are disrupting traditional AI infrastructure. Cryptocurrency AI applications are still in their early stages but hold great potential, possibly reshaping the market through on-chain agents and trading systems, supporting high-frequency trading of tokenized stocks.

In the payment sector, stablecoins (especially USDC) are gradually integrating into the global payment system, with the "GENIUS Act" further accelerating the adoption of USDC. Circle's revenue in Q1 of 2025 grew by 58.6% year-on-year, reaching $579 million. Analysts predict that the daily trading volume of stablecoins could reach $250 billion in the next three years, and if the growth momentum continues, it may even surpass traditional payment systems like Visa in the next decade. PayPal and Visa are exploring the integration of stablecoins into mainstream payment channels. Robinhood's collaboration with Arbitrum allows users to trade USDC directly on Arbitrum, lowering the barriers for individual investors to use stablecoins. Arbitrum is just the beginning; Layer 2 solutions are accelerating the connection between cryptocurrency and traditional finance.

The intersection of these key industries brings together experts from AI, fintech, consumer technology, and blurs industry boundaries. As a core pillar of decentralized systems, cryptocurrency is occupying a critical position in the global technological architecture.

Looking Ahead

From Q4 2025 to Q1 2026, the market cycle will be structurally stronger. The unprecedented clarity of regulatory policies, anticipated interest rate cuts, and the influx of capital from strategic mergers and IPOs will build a solid market foundation. The current market momentum is driven by real application scenarios rather than mere speculative hype, and the industry is moving towards an accelerated growth phase. Our strategy is to focus investments on A-round companies with the potential to define niche segments.

So far, the U.S. IPO market has welcomed 224 IPOs. The number of IPOs in the first half of 2024 was 94, while in the first half of 2025, it reached 165, an increase of 76%. In just the first half of 2025, there were 185 cryptocurrency-related M&A transactions, expected to exceed the total of 248 for the entire year of 2024. The successful IPOs of well-known companies like Circle, along with traditional financial giants acquiring cryptocurrency companies, highlight the impending strong momentum of the upcoming cycle.

The intersection of the cryptocurrency industry with AI, payments, and infrastructure, coupled with regulatory policy dividends and strong investor interest, will propel us into an era of accelerated growth, further solidifying the core position of the cryptocurrency industry in the global financial and technological systems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。