On the winners list, spx6900 (SPX) leads in second with a 12-month gain of 11,693.10% at $1.128619. Cheems token (CHEEMS) follows with 11,377% at $0.051140. virtual protocol (VIRTUAL) rose 3,235.41% to $1.135217, while fartcoin (FARTCOIN) advanced 3,073.15% to $0.785418. Hyperliquid’s hype (HYPE) climbed 1,033.31% to $44.23.

Cryptobubbles.net shows other notable increases include rekt (REKT) up 791.77% to $0.067481, onyxcoin (XCN) up 715.61% to $0.011144, ab (AB) up 634.68% to $0.009153, toshi (TOSHI) up 488.13% to $0.000597, and fluid (FLUID) up 419.98% to $6.21.

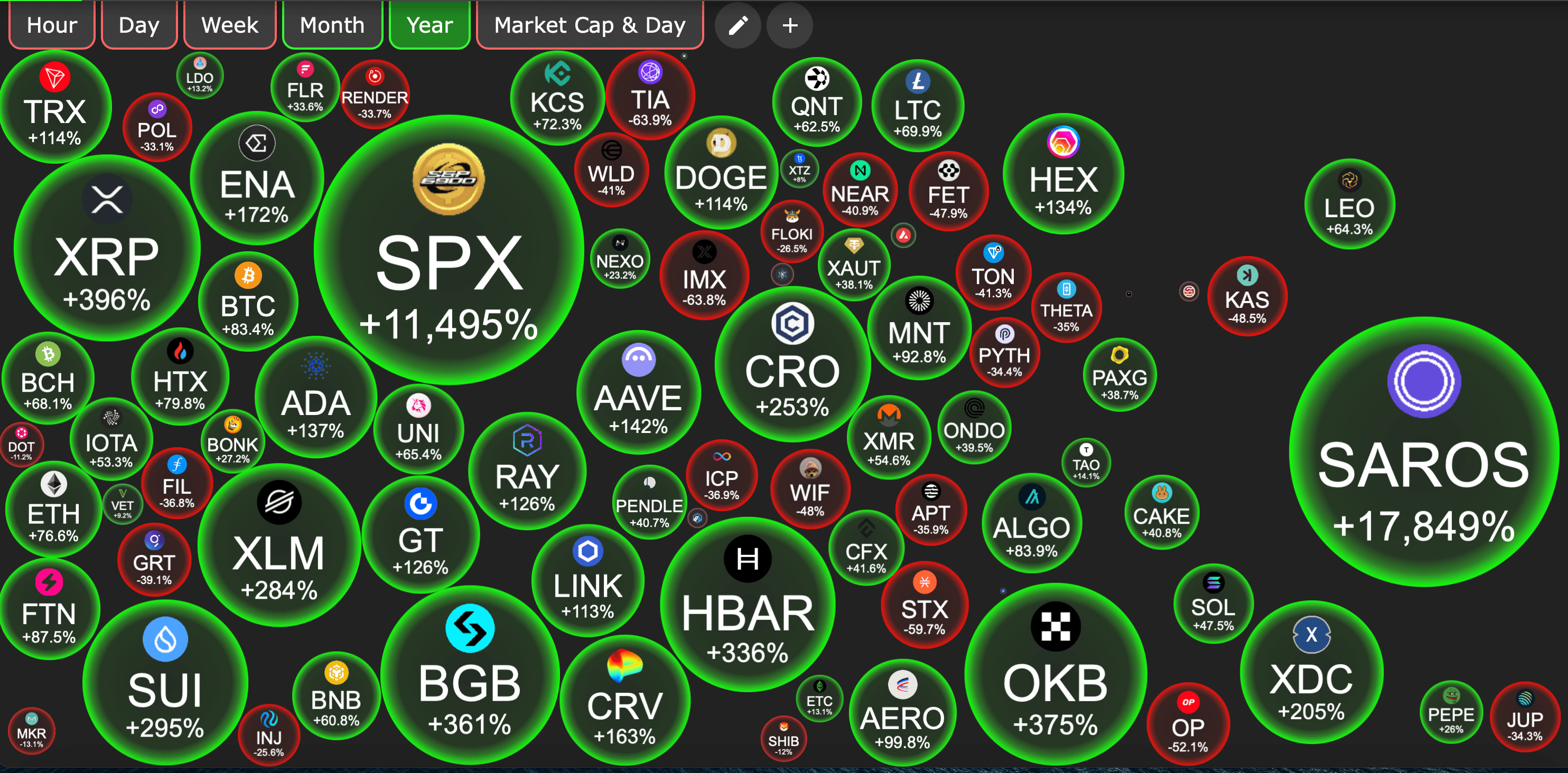

Cryptobubbles.net 12-month data stats from Aug. 31, 2024 to Aug. 31, 2025.

A broader year-view bubble map highlights saros (SAROS) is the top-dog with 17,849% growth, alongside SPX’s massive gains. Among large cap coins, XRP gained 396%, OKB 375%, HBAR 336%, XLM 284%, SUI 295%, BGB 361%, and CRO 253%. Cardano ( ADA) added 137%, aave (AAVE) 142%, chainlink (LINK) 113%, tron ( TRX) 114%, and dogecoin (DOGE) 114%. bitcoin ( BTC) is up 83.4% while ethereum ( ETH) increased 76.6%.

Other notable greens include litecoin ( LTC) at 69.9%, bitcoin cash ( BCH) at 68.1%, solana ( SOL) at 47.5%, monero ( XMR) at 54.6%, uniswap (UNI) at 65.4%, kucoin token (KCS) at 72.3%, curve (CRV) at 163%, raydium (RAY) at 126%, gate (GT) at 126%, aerodrome (AERO) at 99.8%, mantle (MNT) at 92.8%, and the gold-linked tokens XAUT at 38.1% and PAXG at 38.7%.

On the losing side, movement (MOVE) dropped 81.98% to $0.122096, bio protocol (BIO) fell 80.86% to $0.1617, berachain (BERA) declined 76.75% to $2.58, and mantra dao (OM) sank 76.34% to $0.215642. pi network (PI) slid 74.03%, eigenlayer (EIGEN) 70.80%, ronin (RON) 69.32%, thorchain (RUNE) 69.11%, starknet (STRK) 64.64%, and celestia (TIA) 63.90%.

Additional declines on Cryptobubbles’s data include immutable (IMX) at −63.8%, stacks (STX) −59.7%, optimism (OP) −52.1%, wif −48%, kaspa (KAS) −48.5%, near (NEAR) −40.9%, fetch.ai (FET) −47.9%, theta (THETA) −35%, aptos (APT) −35.9%, pyth (PYTH) −34.4%, and maker ( MKR) −13.1%.

The wide gap between outperformers and underperformers illustrates how speculation and shifting narratives dominate digital asset markets these days. Tokens with little historical presence have often captured outsized attention, while others once regarded as foundational struggle to maintain relevance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。