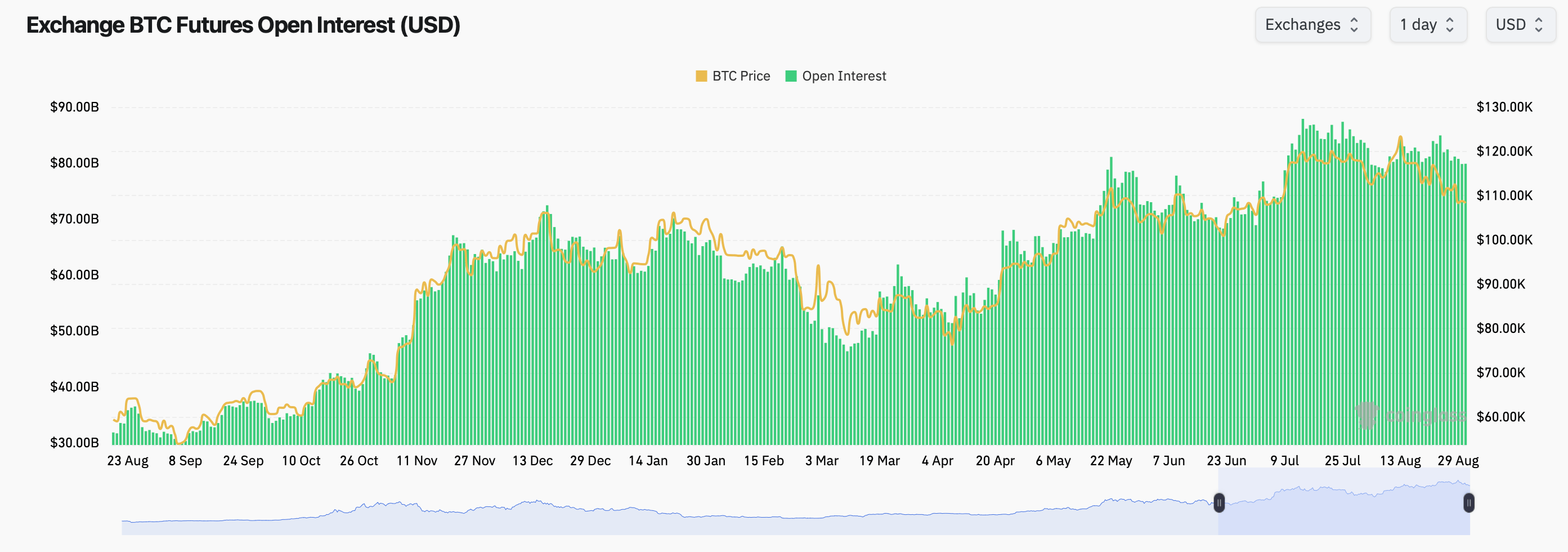

Futures remain thick. Aggregate bitcoin futures open interest on major venues hovers in the mid-$80 billion area, according to coinglass.com, near the upper end of the past year’s band. CME Group remains the largest venue by notional size with 141.78K BTC in open interest, or about $15.36 billion.

Bitcoin futures open interest on Aug. 31, 2025, via coinglass.com.

The digital asset exchange Binance follows with 131.14K BTC ($14.21 billion). Bybit shows 91.28K BTC ($9.89 billion), Gate shows 77.07K BTC ($8.35 billion), Bitget shows 56.77K BTC ($6.14 billion), and OKX shows 38.23K BTC ($4.14 billion).

Rounding out the top 10 are MEXC with 34.30K BTC ($3.71 billion), WhiteBIT with 21.56K BTC ($2.34 billion), Kucoin with 7.63K BTC ($825.37 million), and BingX with 6.20K BTC ($672.01 million).

Price-aligned futures activity tracks the steady spot tape. Exchange-wide open interest presses to yearly highs since July, even as spot stays boxed inside a narrow band this weekend, signaling that significant capital remains committed to directional and basis trades into September.

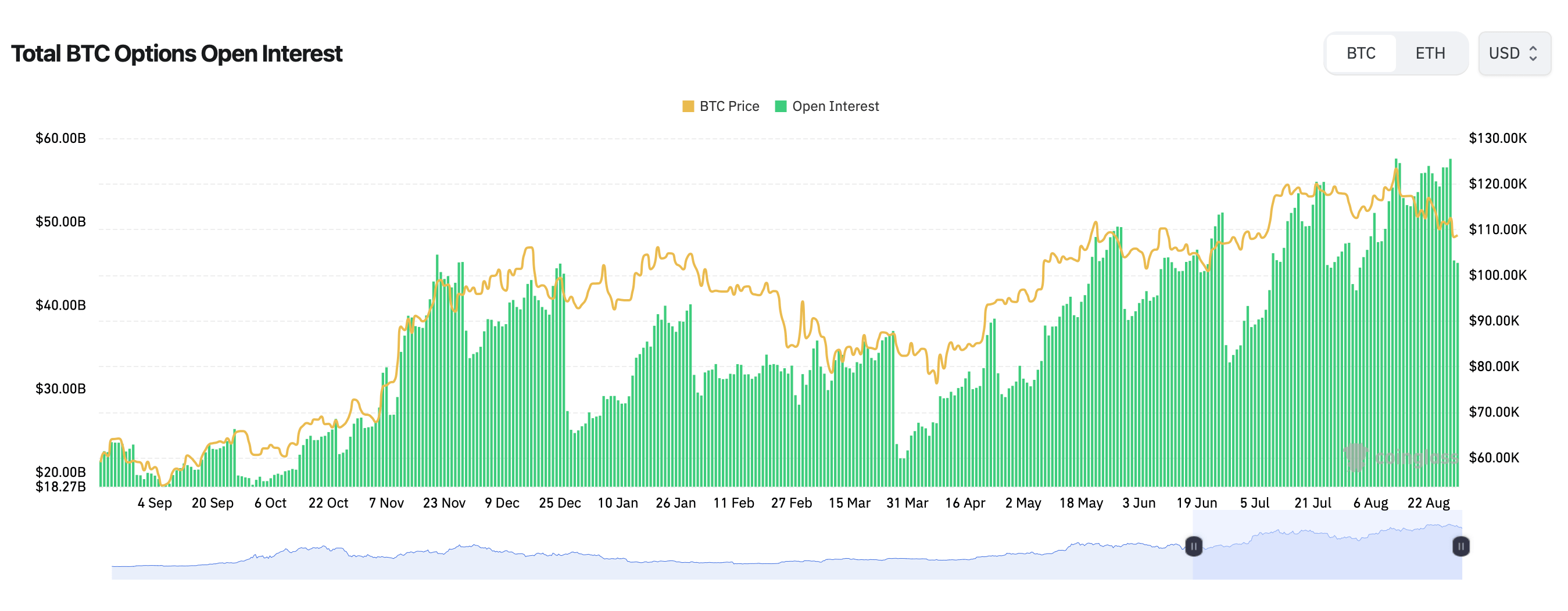

Options positioning remains sizable as well. Total bitcoin options open interest sits north of $50 billion, near record territory, while daily options turnover continues to print in the multi-billion-dollar range. On Deribit — the dominant options venue — open interest skews toward calls, with calls at 223,887 BTC (59.80%) versus puts at 150,495.83 BTC (40.20%). Over the past 24 hours, calls account for 60.68% of volume (6,197.04 BTC) against 39.32% for puts (4,015.26 BTC).

Bitcoin options open interest on Aug. 31, 2025, via coinglass.com.

Strike concentration shows a clear mix of topside exposure and downside protection. Among the largest open-interest lines are the BTC-26SEP25-$95,000 put and a cluster of higher-strike calls around $140,000 to $200,000 into September and December bitcoin expiries. That distribution indicates traders are hedging against drawdowns while keeping upside optionality into year-end.

Max-pain levels — where option buyers collectively feel the least rewarded at expiration — cluster near $110,000 for the near-term monthly cycle. The curve then lifts toward roughly $116,000 into late October, dips toward the $100,000 area for late December, and rises again into mid-2026 expiries.

Taken together, the derivatives stack shows heavy participation on both sides of the tape while spot stays calm. With futures open interest concentrated at CME and Binance and options tilted slightly to calls, positioning remains built for movement even as price action idles inside a $1,200 Sunday corridor.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。