Good afternoon, friends~

We periodically invite senior industry leaders to our AICoin live broadcast room to discuss industry insights and explore investment opportunities, and today is no exception!

Here is a recap of the Q&A from this live broadcast:

The theme of this session is "Quantitative Strategies for Profit, Mastering Smart Trading" — When it comes to quantification, many friends might think it "sounds complicated," but today's guest will present the key points in a very down-to-earth manner.

Today, we are particularly honored to have a heavyweight guest: he is one of the earliest "loyal users" of AICoin and a quantitative strategy influencer that many in the dynamic square follow! His quantitative strategy is centered around one word: "stability." Many friends have started their journey into quantitative trading by following him.

Alright, let's officially begin our interview!

The first question is to trace back to the source: you have witnessed the growth of AICoin and the entire crypto market as a professional trader. I am particularly curious about how you first got involved with the crypto market? What prompted you to embark on the path of quantitative trading, often referred to as the "lazy person's path to wealth"?

Teacher Blank: "The term 'lazy person's path to wealth' is quite interesting, but in fact, quantification is about 'working smarter.' I first got in touch with Bitcoin because of 'mining' — at that time, I thought the concept was very geeky, fresh, and fun. But what really made me settle down to do quantitative trading was the losses I suffered from emotional trading: I used to stay up late staring at the market until my eyes hurt, and when I saw the market rise, I couldn't help but FOMO in, only to see it drop right after I bought; when I couldn't hold on any longer and had to cut losses, I would end up selling at the lowest point… I fell into every one of these traps.

Later, I realized that in the crypto market, which fluctuates 24/7, if you want to survive and make money, relying on 'feelings' doesn't work; you must rely on systems and discipline. Quantification is the best tool to turn trading logic into 'hard rules' and enforce discipline.

At that time, AICoin launched an arbitrage trading tool, and I became one of the first users — I experienced for the first time that I could earn 'stable money' without manual operation: watching the interest in my account slowly increase daily, 3-5 times higher than bank interest rates. Although it wasn't much at first, my mindset was particularly relaxed. Since then, I have been deeply using the strategy tools released by AICoin, gradually summarizing my experiences, and that's how I became a quantitative trader."

It turns out that behind every "stable" word, there is a story of "instability"!

Speaking of volatility, the market has been "jumping up and down" recently, with both long and short positions being hit as a norm. In your opinion, what opportunities are easily overlooked by ordinary people in such a volatile market? What macro signals do you look at every day?

Teacher Blank: "Volatility is indeed a risk, but for quantitative strategies, it is also a source of profit. In this market, we need to break out of the mindset of 'only looking at rises and falls' and pay more attention to 'volatility' — the more it oscillates, the more some strategies can 'generate' returns.

For example, grid trading and arbitrage are particularly suitable for the current environment: grid trading is like 'picking sesame seeds' in oscillation; every time the market jumps back and forth, it earns a price difference. Many friends using grids have made steady profits during this recent oscillation and rise, so calling it a 'bull market expert' is not an exaggeration. I usually open grid trading for platform tokens, which are equivalent to 'credit certificates' of exchanges. As long as the platform doesn't have major issues, there is basically no significant risk, and it is likely to rise with Bitcoin, which is much more stable than ordinary altcoins. However, I must remind you: I only recommend choosing platform tokens from the top three exchanges; those who understand the reasoning know it.

As for the signals I must look at every day, I mainly focus on two levels:

First, the macro level: the Federal Reserve's interest rate decisions, CPI data, etc., are still key to determining the overall direction — they are like the 'money bags' of the market. Whether the Federal Reserve is injecting or withdrawing money directly affects the overall market liquidity.

Second, the on-chain level: for example, the inflow and outflow of Bitcoin ETF funds, the stablecoin reserves of exchanges. These data are the most direct 'microscope' for observing market sentiment, and you can easily find them in AICoin's data module. Everyone can take a look and try to find patterns."

From macro to on-chain, it's all practical insights!

Based on your previous judgments, which "weapons" in your current "strategy arsenal" are the most handy and advantageous? Can you reveal one or two strategy directions that you are currently focusing on or practicing?

Teacher Blank: "My strategy library has always emphasized 'adaptability to the market' and does not stick to one method. If I had to mention two directions, the first is the integration of 'AI + Quantification' — this is what I have spent the most effort exploring this year.

It's no longer just about setting fixed parameters and ignoring them; instead, we let AI large models help 'watch the market': it will determine whether the current market is oscillating, rising, or falling, and then automatically switch to more suitable parameters for sub-strategies (like grids), essentially allowing the strategy to 'learn' to adapt to the market. If you don't have your own trading system yet, you can try the 'AI-assisted + manual monitoring + quantitative execution' approach; you might be surprised.

The second is multi-strategy combination rotation. As the old saying goes, 'Don't put all your eggs in one basket.' I don't bet on one strategy but run multiple strategies that are not too 'tied together' — for example, running trend strategies, reversal Martingale strategies, and arbitrage strategies simultaneously. This way, even if one strategy temporarily has no returns, another might be making money, ensuring that the capital curve remains as smooth as possible, which is also the core of 'seeking victory in stability.'

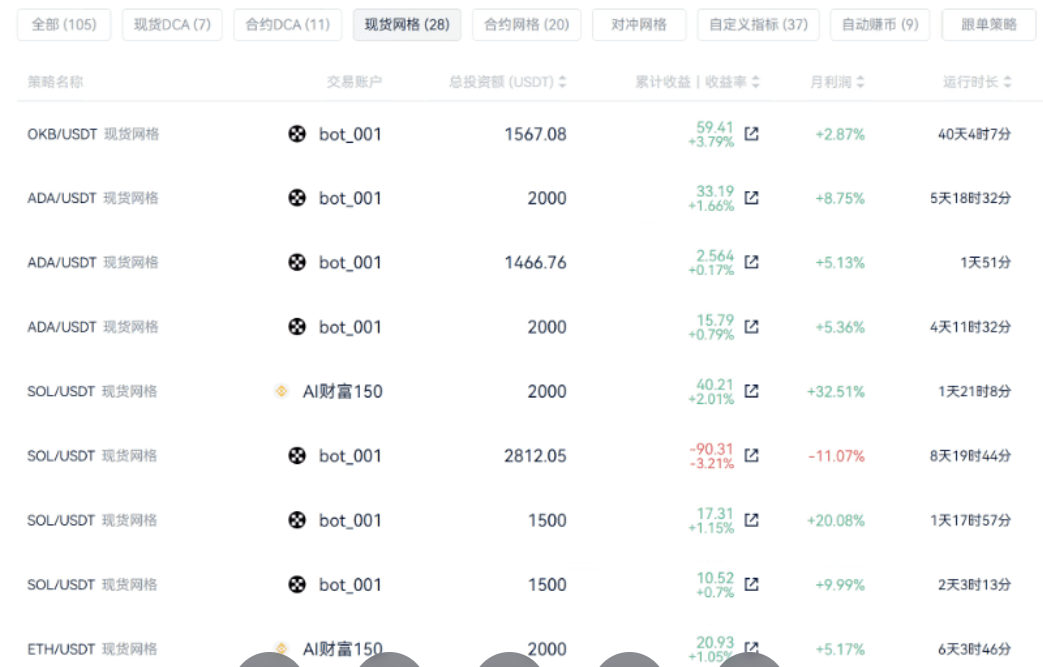

The indicators I posted in the indicator strategy square before were also adapted to the market at that time. Looking back now, the returns are certainly not as good as before, and they need to be adjusted according to the market. Currently, I am running professional arbitrage, grid trading, DCA, and indicator strategies in real-time: arbitrage accounts for 70% of the capital, while grid, DCA, and indicator strategies each account for 10%.

This is the automatic coin-earning function I run with AICoin, fully automated without monitoring. Although the arbitrage profits are not much, they are particularly stable and have been running for over a year;

These are some strategies I usually run, with both gains and losses. There's no need to rush; just wait for time to bring returns; this is a recent comparison of several strategies' returns, and everyone can clearly see the advantages of the combination."

"AI + Quantification" and "Multi-strategy Combination" are definitely the cutting-edge directions of the future!

Speaking of your exclusive strategies, the community has given high praise to your "Small Coin Martingale Strategy." Can you reveal to us the "profit principle" and "applicable scenarios" of this strategy? How does it capture opportunities for profit?

Teacher Blank: "This strategy was written last year, just as the bull market was starting, and everyone was predicting that a bull market would begin in the coming year, so I created this bottom-fishing strategy. Indeed, it is somewhat similar to DCA, suitable for the transition from bear to bull — but I must emphasize: all my sharing is based on my own risk control system and absolutely does not constitute investment advice; everyone must judge based on their own situation.

First, let's talk about the profit principle, which is fundamentally about probability and capital management. Simply put, it's 'buying more as it falls': buying a little more every time the price drops, and slightly increasing the amount bought, which can gradually lower the average holding cost. As long as the market experiences a slight rebound, the previous floating losses can basically be covered, and a bit of profit can be made.

Now, regarding applicable scenarios: it is only suitable for 'high volatility but long-term bullish' quality small coins — for example, those with practical application scenarios, reliable teams, and potential coins ranked outside the top 50 by market cap. Because it requires volatility to trigger orders, it also relies on the property that the coin 'won't keep falling and can rise back in the long term.' Absolutely do not use it on those without substantial value, which could drop to zero at any moment, 'shit coins,' or else your principal could very likely be lost.

In terms of real performance, its goal is not to catch all fluctuations but to seek high win rates and high profit-loss ratios. After its launch, the backtest win rate could reach 90%, but now that everyone's expectations for the bull market are nearing their peak, the adaptability of this strategy has decreased significantly — this is a screenshot of the performance from a month of testing at that time, starting with 300U at 10x leverage, and the returns were relatively stable."

Finally, there are many new friends in the live broadcast room who are just getting interested in quantification. Can you give them one core piece of advice? Also, share one "pitfall avoidance guide" that you think is the most important?

Teacher Blank: "One piece of advice: doing quantification is more like being an 'engineer'; it relies on a rigorous system and ironclad discipline, rather than gambling on luck or taking big risks. Don't think that you can get rich overnight with a 'magical strategy'; quantification is a slow process, and stability is the top priority.

As for the pitfall avoidance guide, everyone must remember: never blindly follow a strategy without fully understanding its risks, and definitely don't invest large amounts of money. First, practice on a simulated account, backtest the strategy yourself, and see how it performed in past markets; then run it with a small amount of real capital to feel its volatility and patterns, and only after understanding it thoroughly should you gradually adjust.

Another small tip: use the right strategy at the right time — for example, run grids during oscillating markets after a rise or fall; try DCA during a market panic after a drop of over 30% (of course, this should be in a bull market phase); and do arbitrage trading in a bull market. Although the profits are small, they are stable.

Remember, the market is always there; those who survive have the right to see tomorrow's opportunities!"

Once again, thank you, Teacher Blank, for your candid sharing today! From trading mindset to practical skills, from past pitfalls to future strategy directions, it was truly full of insights, with no fluff at all!

Our interview segment ends here~

Be sure to tune in every Monday, Wednesday, and Thursday afternoon for the live broadcast, accessible from the left side of the PC group chat - Live Broadcast.

This article only represents the author's personal views and does not represent the platform's stance or views. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。