The main trends that everyone is concerned about have now changed. First, let me clarify that what I share is an objective presentation of current data and does not constitute any investment advice; please refer to it as needed.

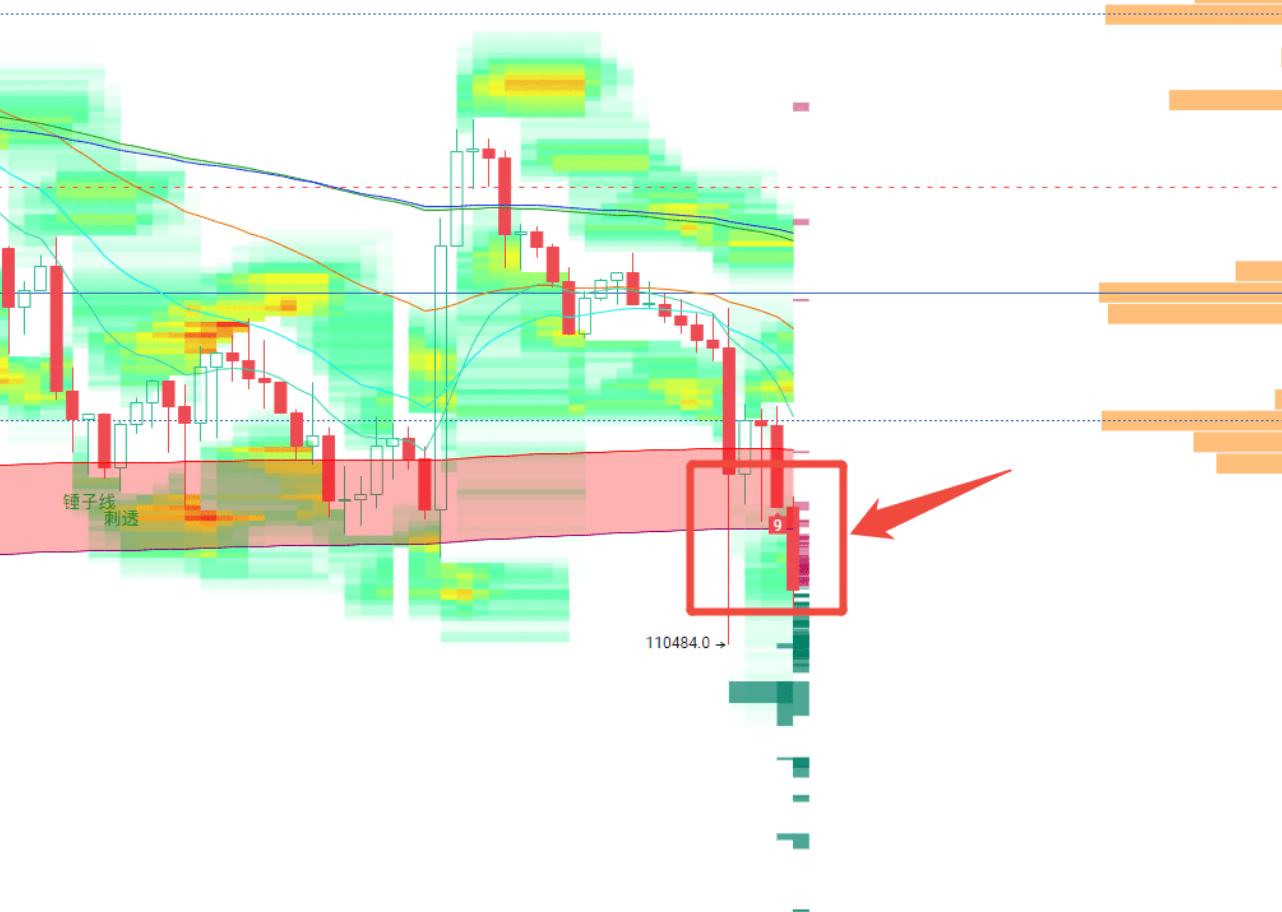

Let's first take a look at Bitcoin's situation. Currently, the main players are engaged in intense competition, with a dense pile of orders stacked up around the current price.

The 3-hour cycle is currently breaking down through the long tunnel area of the Vegas channel.

If the closing confirms a break below this area, we can pay attention to the support level of the 4-hour trend channel.

It would be ideal if a pin bar pattern could form here and stabilize above 11.16k.

Currently, Bitcoin is showing a weak breakout trend. If a pin bar forms but fails to rebound with volume, it is likely to continue testing support, as one friend has observed. The volume ratio of the recent fast line is quite high, and the performance of the subsequent few K lines will be crucial.

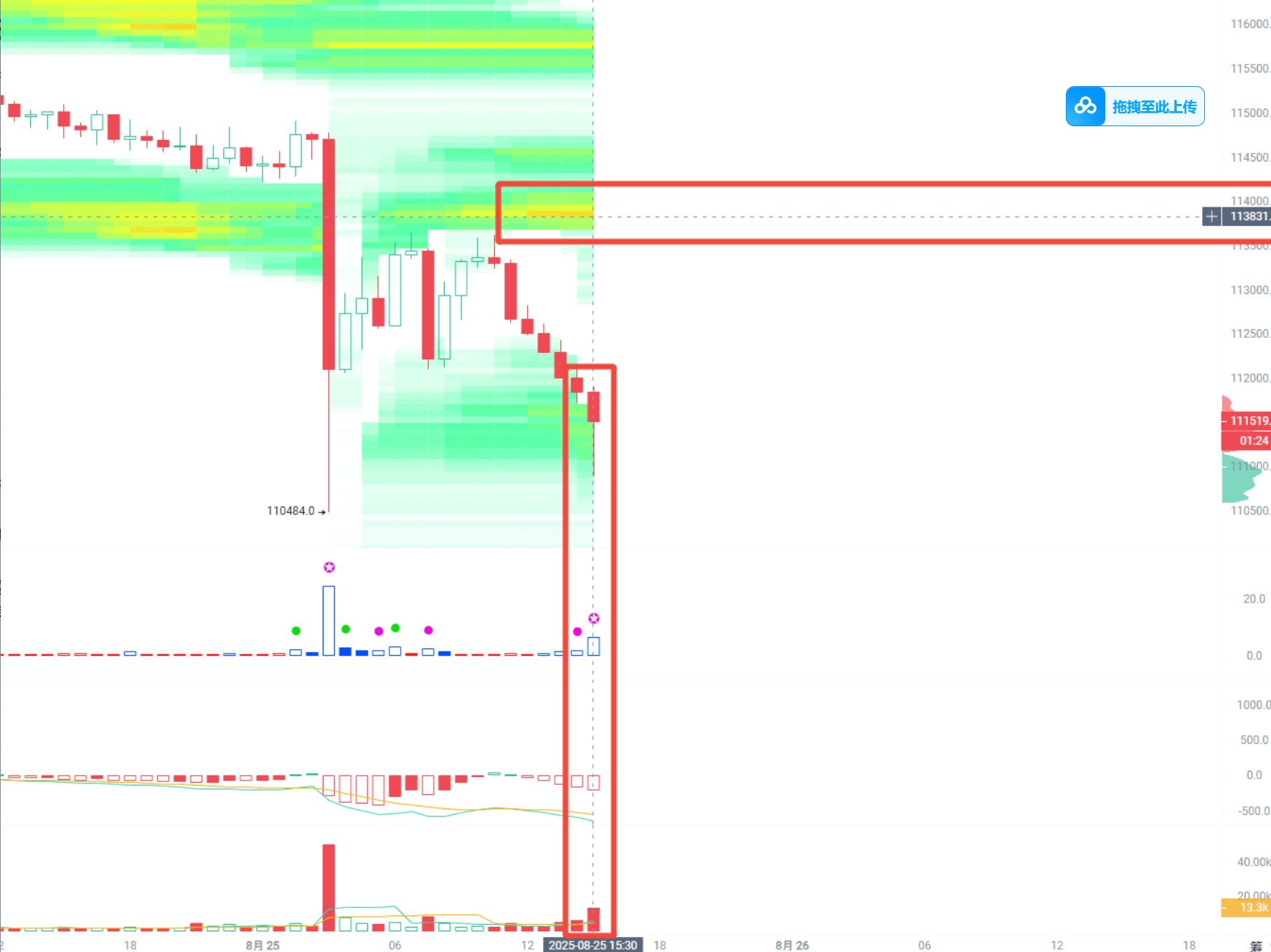

Now let's look at Ethereum; the 45-minute cycle is also breaking down through the Vegas channel.

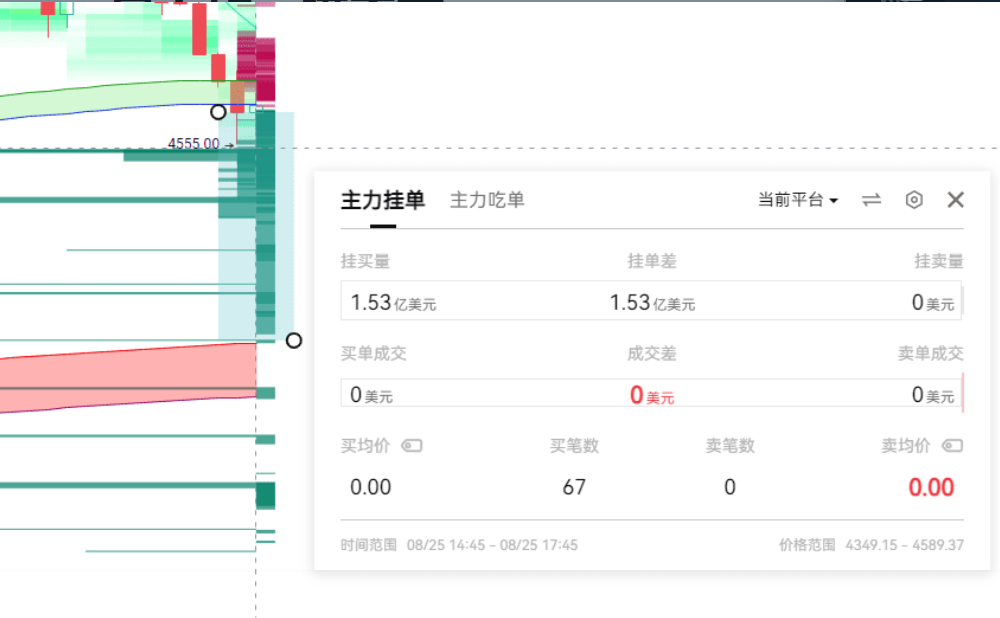

A large number of orders are also piled up around the current price.

These pending orders are not only dense but also amount to even more than Bitcoin, yet the main players' willingness to enter at lower prices is relatively stronger, frequently placing and canceling orders.

Resistance levels are sequentially in the range of 4800-4830, followed by 4900, with further pressure at the 5000 mark. On the support side, 4600 is a key position, followed by the range of 4480-4500, and further support is in the range of 4285-4300. Additionally, it is important to note that the 5000 mark is a recent target for the main players; however, this does not mean that Ethereum will necessarily reach this position, but it indicates that there are currently large whales betting at this level.

Although Ethereum has recently reached new highs, the total market capitalization of cryptocurrencies has not increased in tandem, indicating that the altcoin season may still need to wait. This concludes the data sharing on Ethereum and Bitcoin.

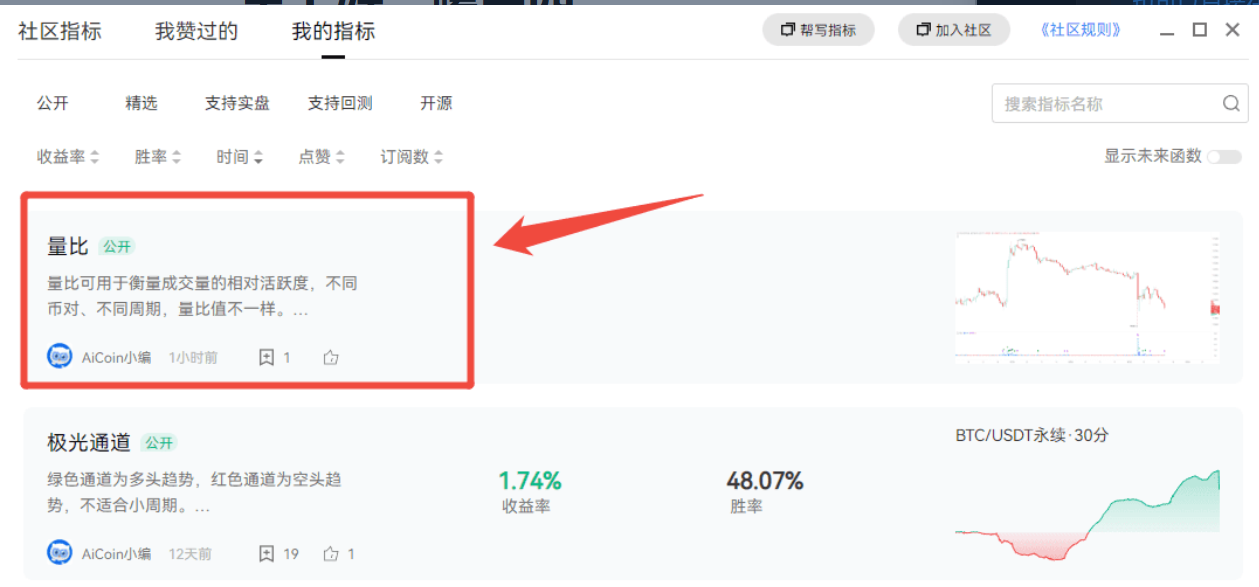

Additionally, I would like to recommend a practical volume ratio indicator, which is mainly used for early warning and is particularly suitable for short cycle analyses such as 15 minutes, 30 minutes, and 45 minutes. You can view it through this link: https://www.aicoin.com/indicator-detail/5dYbA45P6vQkXw1W, or you can directly search for "Volume Ratio" in the community indicators to find it (image).

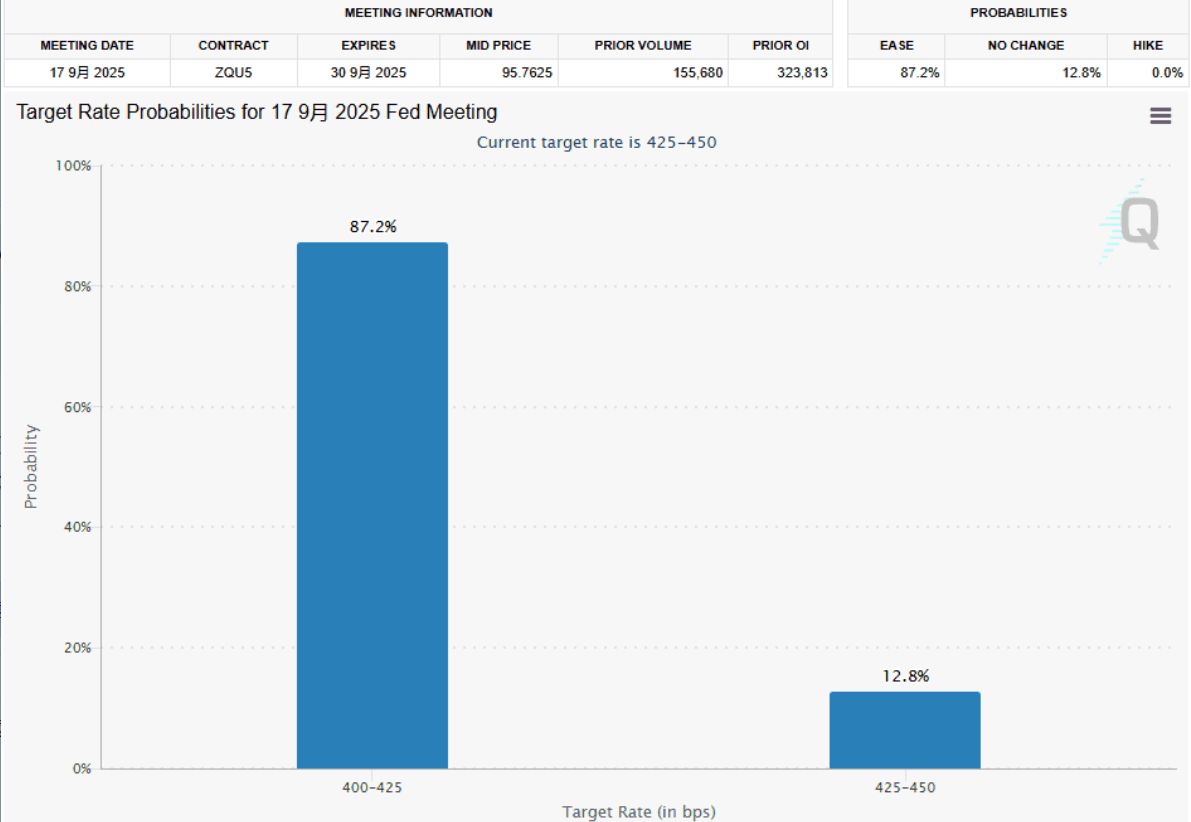

Now, let's return to the theme of this live broadcast. Last Friday's upward trend, as everyone knows, was influenced by comments from old Powell. The market's betting probability for a rate cut by the Federal Reserve in September has now exceeded 87%.

It is worth noting that the Federal Reserve's rate cut is related to the direction of the entire financial market.

A rate cut means that the Federal Reserve will release liquidity, which will lead to more funds flowing into the market. In the long run, this is undoubtedly good news. However, typically, there will be a wave of speculative increases before a positive event occurs, and once the rate cut is officially implemented, it is likely that profit-taking will occur, which may create short-term bearish conditions.

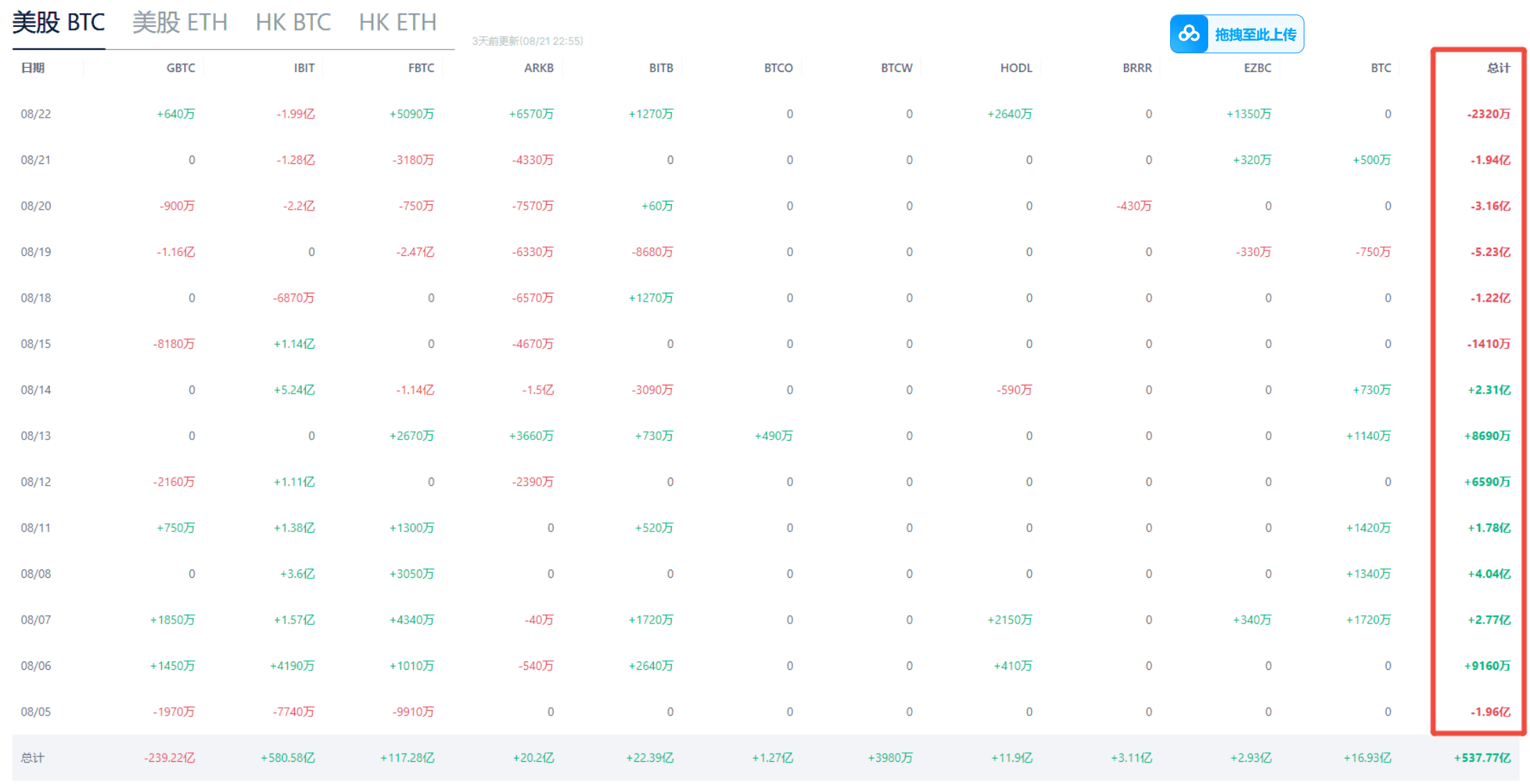

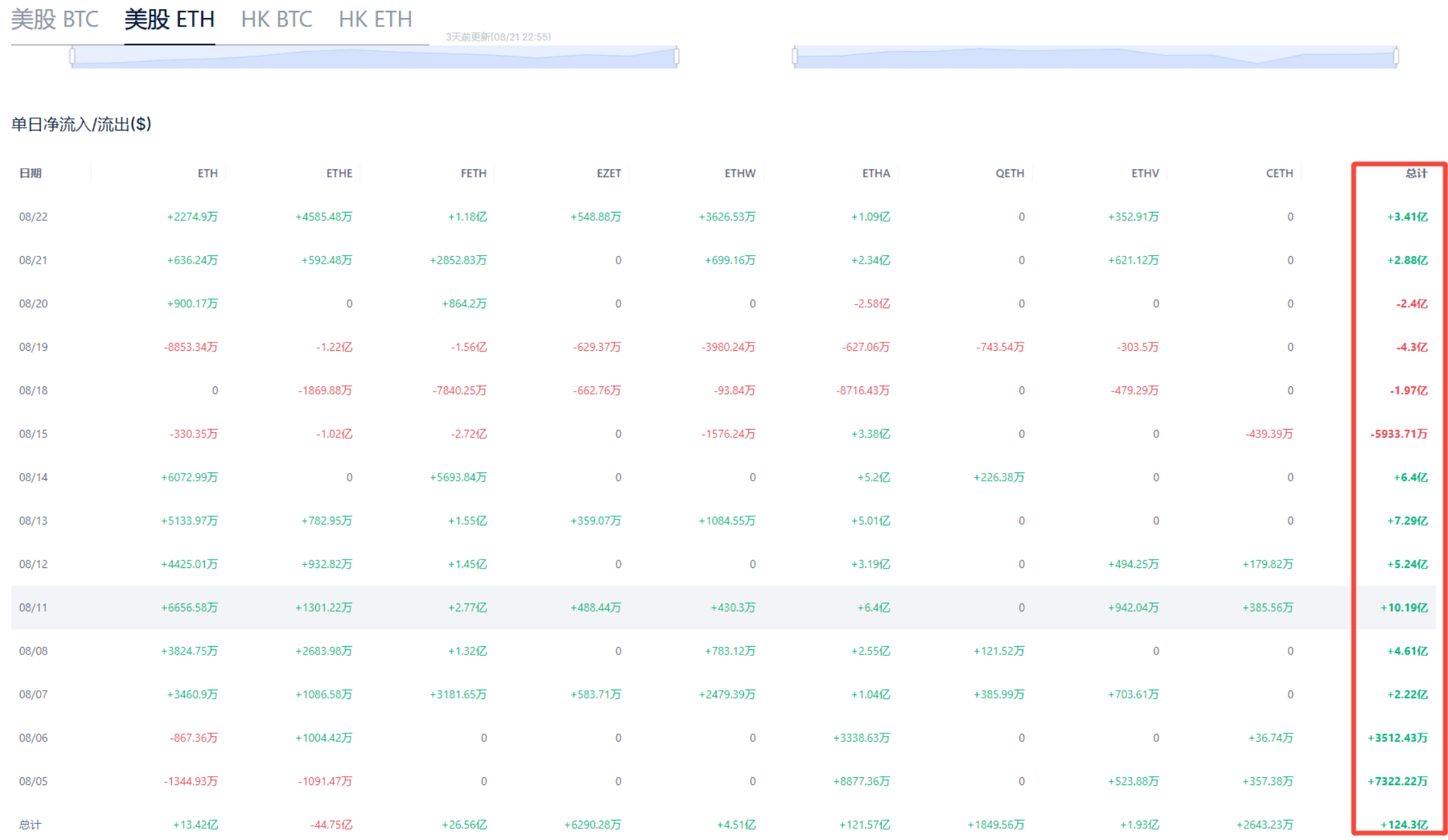

Another important trend is the increase in holdings by U.S. institutions, which can mainly be observed through the data of the U.S. spot ETH ETF.

You can see from these two images that the recent choice of funds is becoming increasingly clear — shifting from BTC to ETH. Major institutions on Wall Street and "smart money" are directing their funds towards ETH, which is also one of the important driving forces behind Ethereum's recent rise.

Therefore, overall, the recent ETH market is supported by both macro liquidity expectations and institutional fund buying, along with the main players betting at the 5000 mark, indicating that there is still room for expectation in the long run. If Ethereum can continue to be strong, to judge whether the altcoin season is approaching, one must pay close attention to changes in total market capitalization. Typically, when the altcoin season arrives, there will be an increase in total market capitalization, a decrease in BTC's market share, and a shift in market sentiment towards greed or FOMO; these are all signals to watch for.

This article only represents the author's personal views and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。