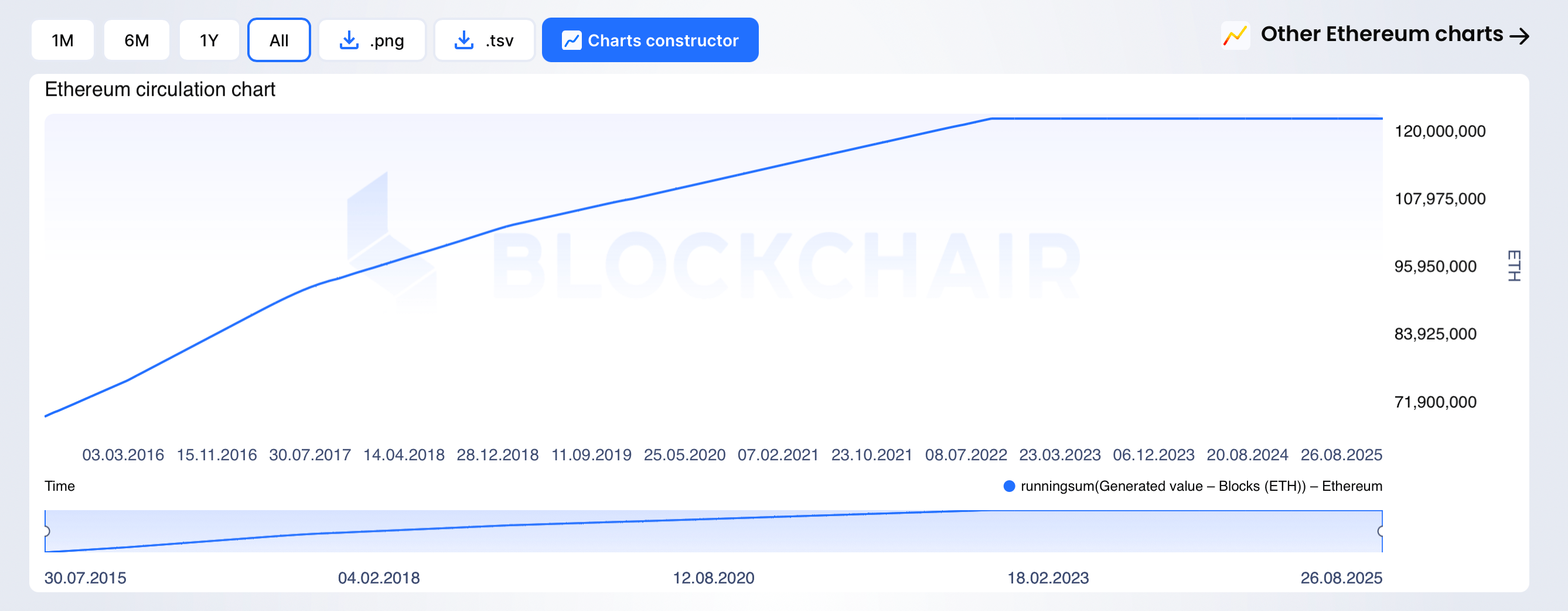

Blockchair’s supply trajectory data indicates Ethereum’s circulating amount has flattened since the 2022 transition to proof-of-stake (PoS) and sits in the low-120 million range today. A snapshot from Ultrasound Money places the current supply around 121,009,974 ETH, with a seven-day net change of +17,877.70 ETH.

Source: Blockchair.com

Over the same week, records show about 18,652.30 ETH was issued and 774.60 ETH was burned, which pencils out to an annualized growth rate of +0.771% a year. That puts issuance near 973,000 ETH/year against a burn pace around 40,000 ETH/year on the same seven-day lens, signaling net issuance at recent activity levels.

Source: Ultrasound.money

Cumulative burn since EIP-1559 crossed the 4,612,246 ETH threshold after four years and 22 days, with a recent burn tempo of about 2.16 ETH per minute and an “issuance offset” reading of 1.17x. Burn leaders over the full period include standard ETH transfers (~376,607 ETH), Opensea (~230,051 ETH), Uniswap V2 (~227,221 ETH), Tether’s USDT (~210,560 ETH), and Uniswap Universal Router (~153,580 ETH).

Alongside these leaders, there’s Uniswap V3 (~124,694 ETH) and Metamask Swap Router (~89,981 ETH), followed by Circle’s USDC (~78,893 ETH) and several other sizable contracts. On the usage side, Ethereum’s daily transaction count chart shows a multiyear climb with recent prints near the upper end of historical ranges, while the ERC-20 transfer series trends higher with spikes that brush the multimillion level.

In terms of the chain’s cumulative size, it has grown steadily to roughly 1.3 trillion kilobytes (~1.3 terabytes). Additionally, cost per transaction measured in ETH continues to sit near historical lows relative to early years. Fee conditions this week appear muted. Ultrasound Money’s base fee view shows an average of about 16.3 gwei across the past seven days.

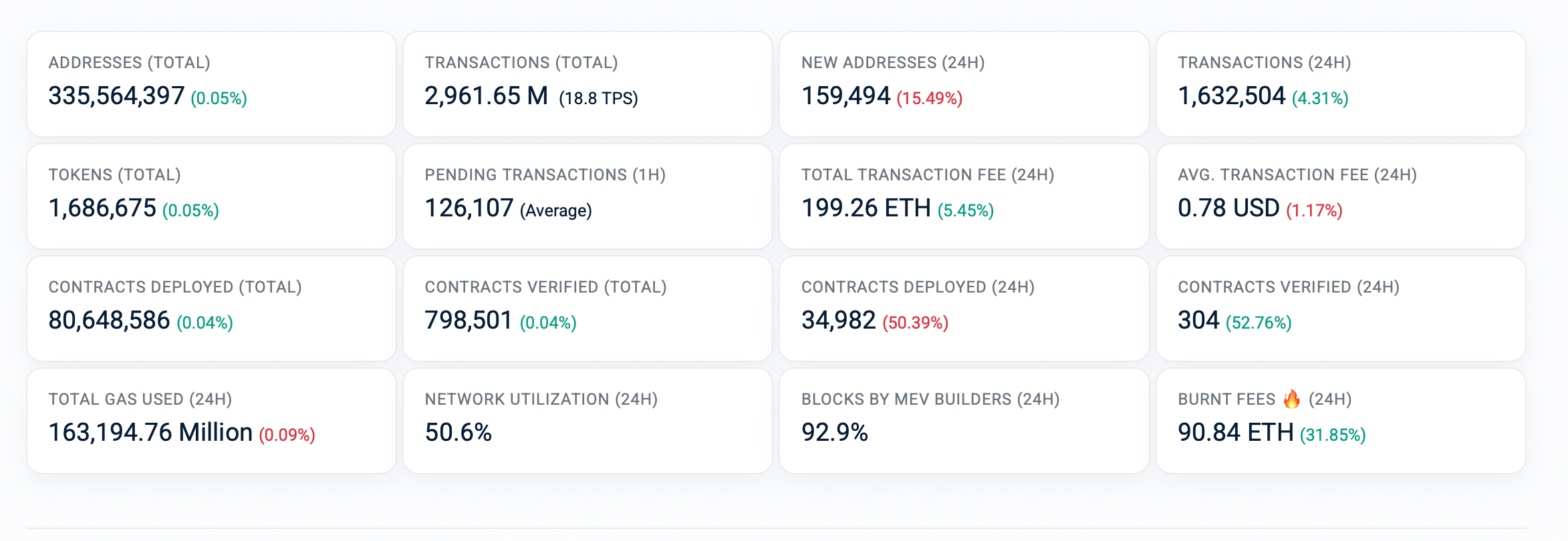

Network statistics mirror that picture of steady, inexpensive throughput. Etherscan data lists 335,564,397 total addresses and 2,961.65 million cumulative transactions, implying an average throughput near 18.8 transactions per second. Over the last 24 hours, Ethereum processed 1,632,504 transactions with total fees of 199.26 ETH and an average fee of $0.78, while burned fees over the same window totaled 90.84 ETH.

Source: Etherscan

The network utilization gauge shows 50.6%, and total gas used for the day is recorded at 163,194.76 million gas units. Contract activity remains a core driver. According to Etherscan, Ethereum counts 80,648,586 total contracts deployed and 798,501 total contracts verified. In the latest 24 hours, 34,982 contracts were deployed (a day-over-day decline on the snapshot), with 304 contracts verified (day-over-day increase). The ecosystem also lists 1,686,675 tokens created onchain.

Block construction is dominated by specialized relays: 92.9% of the last day’s blocks were built by MEV builders, highlighting the prevalence of builder-relay pipelines in Ethereum’s proposer-builder separation era. New address creation remains sizable despite daily variability, with 159,494 new addresses in the last 24 hours (down versus the prior day).

Holders data points to heavy concentration among the largest wallets and contracts. Ethereum’s rich list shows 390,602,961 holders in total, while the top 10 holders control 61.02% of ETH, the top 20 hold 63.67%, the top 50 hold 68.61%, and the top 100 hold 72.96%. These tallies reflect the outsized share of exchange, staking, protocol, and bridge contracts among the largest addresses.

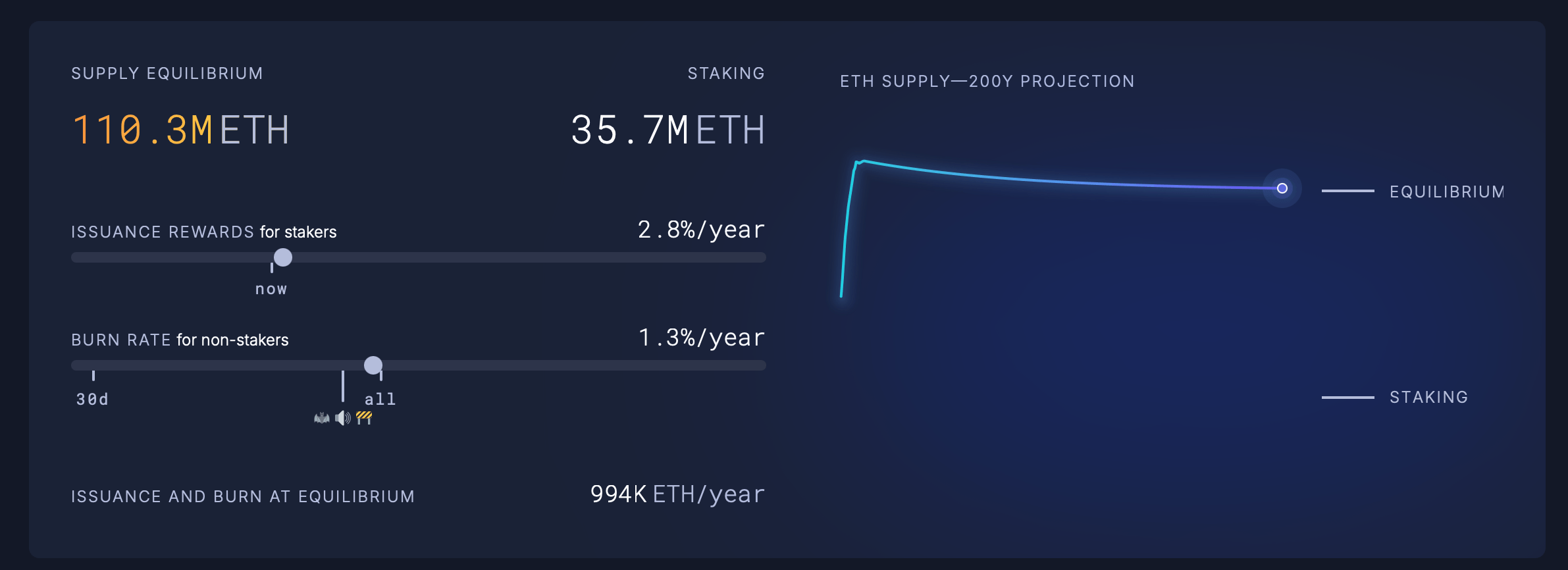

Looking ahead, Ultrasound Money’s long-horizon “Supply Equilibrium” model suggests a steady-state supply near 110.3 million ETH under current dynamics, with staking around 35.7 million ETH. The sliders portray issuance rewards for stakers near 2.8% a year and a burn rate for non-stakers near 1.3% a year, with “issuance and burn at equilibrium” shown around 994,000 ETH a year. The projection curve flattens over time, indicating a tendency toward a slow drift rather than sharp expansion or contraction under present inputs.

Source: Ultrasound.money

Bringing all the strands together, the data depicts an Ethereum network that continues to add data to its ledger, process well over a million transactions per day, and support heavy contract creation and token activity. Fees remain low by recent standards, with base fees hovering in the mid-teens in gwei and average dollar costs under a dollar on the observed day. Despite a long-run burn tally exceeding 4.6 million ETH, the last week registered net issuance as activity and issuance outpaced burn.

Liquidity and governance features of staking, MEV-aware block building, and ERC-20 transfer intensity remain central elements of the system’s current profile. Overall, the metrics describe Ethereum running efficiently with room to absorb more demand, even as incentives tilt toward specialized builders and long-term stakers. Low friction invites continued deployment and token activity, while concentration at the top keeps custody and governance risk in view. If conditions persist, supply looks set to drift gradually, keeping ETH’s monetary profile anchored by usage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。