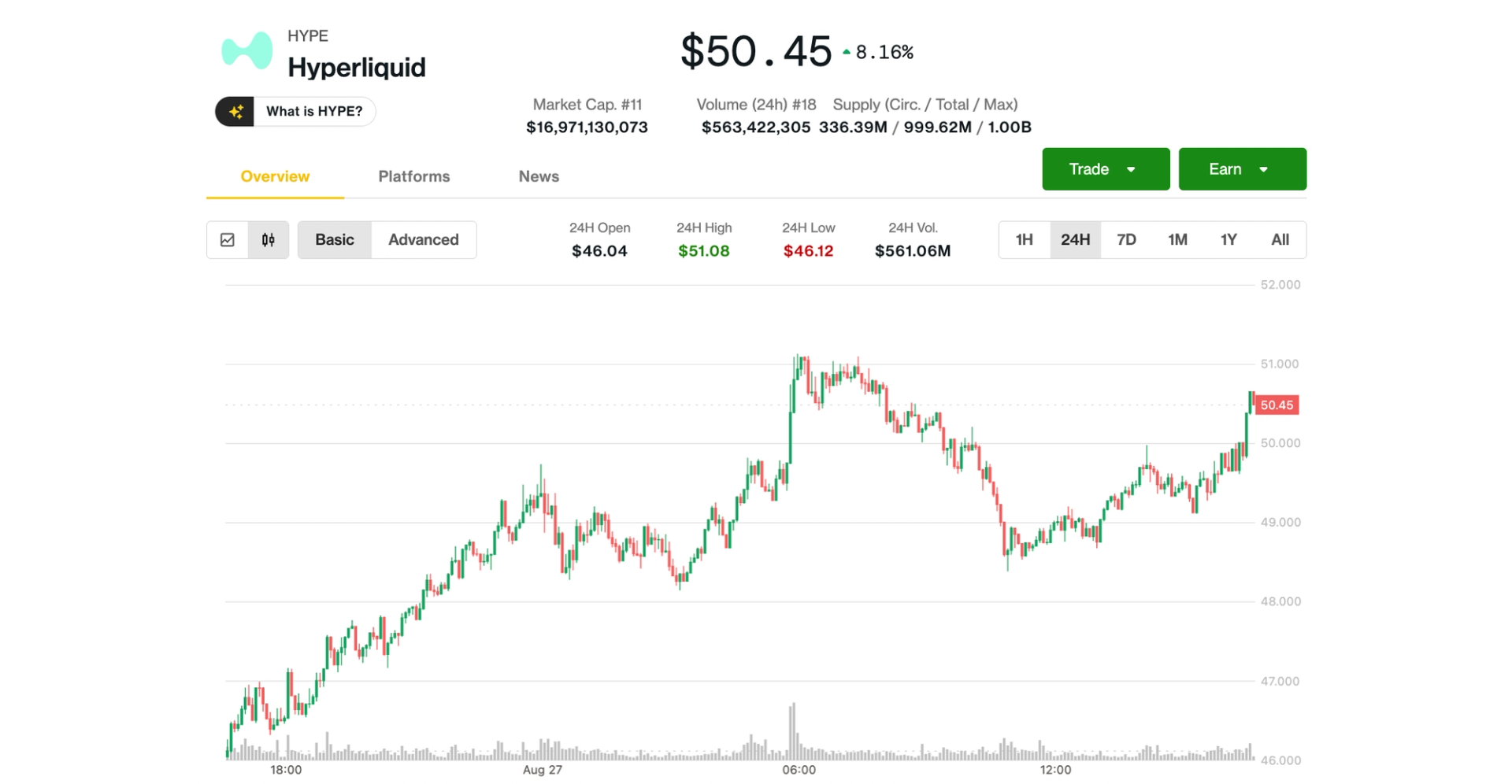

The native token of Hyperliquid (HYPE) surged to a fresh all-time high early Wednesday, continuing its meteoric climb this year as the decentralized exchange best known for on-chain perpetual trading has attracted record activity.

The token broke through the $50 mark for the first time, gaining about 8% in the past 24 hours. HYPE is now up 430% since its April nadir and up roughly 15x since it began trading in late November at around $3.

The rally has been fueled by record trading activity across the exchange and its automated buyback mechanism, which steadily absorbs tokens from the market and reduces circulating supply.

Read more: Hyperliquid Now Dominates DeFi Derivatives, Processing $30B a Day

Trading boom

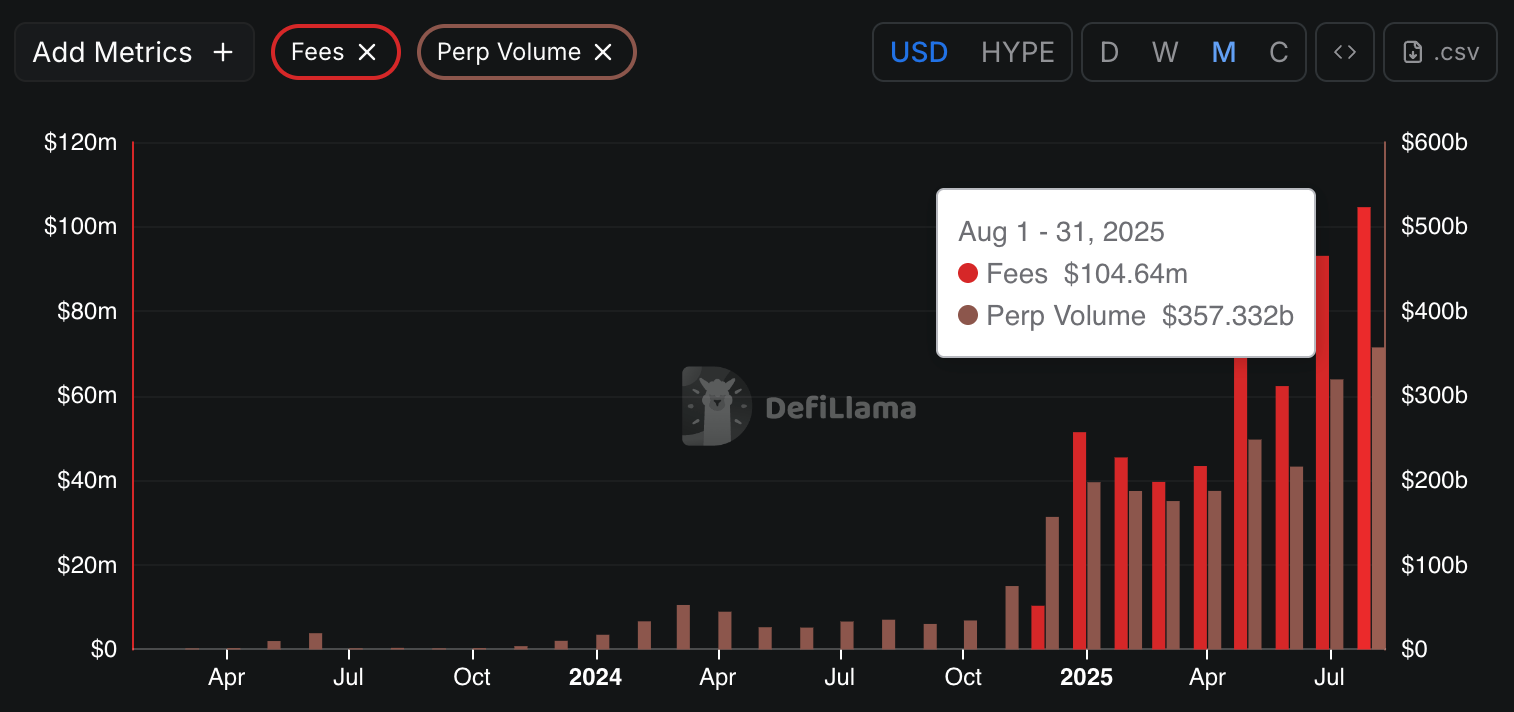

The decentralized exchange recorded more than $357 billion in derivatives volume in August, according to DefiLlama data, up from $319 billion in July and nearly ten times higher than a year ago. Spot trading volumes also set a record, surpassing $3 billion for the week ending Aug. 24, Blockworks data shows.

These flows translated into a windfall for the protocol. Hyperliquid booked $105 million in trading fees during August, the highest this year, per DefiLlama data.

Much of those earnings are funneled directly into purchasing HYPE on the market through Hyperliquid's Assistance Fund. The facility is an automated on-chain mechanism that buys back tokens on the open market, creating sustained buy pressure for HYPE and effectively reducing the circulating supply.

Since its launch in January, the fund’s holdings ballooned from 3 million tokens to 29.8 million HYPE, now worth over $1.5 billion, fueling the token's rally.

On the news front, digital asset custodian BitGo added support on Tuesday for the HyperEVM network, which underpins the Hyperliquid ecosystem, unlocking institutional access to HYPE and related applications.

Analysts flag risks amid strong fundamentals

In a recent research note, ByteTree analysts Shehriyar Ali and Charlie Morris described Hyperliquid as a "powerhouse" that has become the largest decentralized perpetual futures venue.

"All things considered, HyperLiquid is among the most compelling protocols in DeFi today," they wrote. "Its strong fundamentals, record-breaking fee generation and dominant market share make it impossible to ignore."

Despite the bullish fundamentals, the report also flagged concerns about the token's valuation. HYPE currently trades at a fully diluted valuation (FDV) of over $50 billion, with only about third of supply in circulation with a 16.8 billion market capitalization.

Scheduled token unlocks starting in November could also introduce selling pressure, potentially testing the strength of demand, the report noted.

"Although the token has already seen a sharp run-up in recent months, its robust on-chain activity continues to underpin its valuation," the analysts said.

Read more: XPL Futures on Hyperliquid See $130M Wiped Out Ahead of the Plasma Token's Launch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。