Crypto ETF Momentum Builds: Ether Dominates With 4th Straight Inflow Day

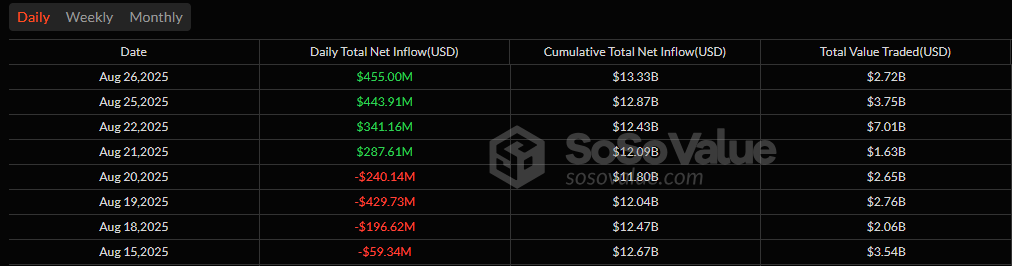

Ether ETFs refuse to slow down. Tuesday, Aug. 26, marked the fourth consecutive day of inflows, with investors pouring $455 million into ether products, cementing their dominance over bitcoin ETFs in August’s rebound phase.

Blackrock’s ETHA once again led the charge with a staggering $323.05 million inflow, followed by Fidelity’s FETH at $85.52 million. Grayscale’s Ether Mini Trust added $41.12 million, while its flagship ETHE chipped in another $5.31 million. Notably, no ether ETF recorded outflows, underscoring the sustained momentum. Total ether ETF trading volume hit $2.72 billion, pushing net assets to $29.89 billion.

Ether streak hits 4th day, as momentum continues to build toward a strong August close. Source: Sosovalue

Bitcoin ETFs also inched forward, though on a smaller scale, drawing in $88.20 million. The flows were widely distributed: Blackrock’s IBIT (+$45.34 million), Fidelity’s FBTC (+$14.52 million), and Grayscale’s Bitcoin Mini Trust (+$11.32 million) anchored the gains.

Bitwise’s BITB (+$9.05 million), Ark 21shares’ ARKB (+$4.05 million), and Vaneck’s HODL (+$3.92 million) rounded out the positive day. Trading activity reached $3.44 billion, with net assets steady at $143.15 billion.

With ether ETFs outpacing bitcoin inflows by more than 5-to-1, the market narrative continues to tilt toward ether in the near term. Investors appear increasingly drawn to ether’s ETF momentum, raising the question: Can Bitcoin catch up before the week is out?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。