Original Author: Nicky, Foresight News

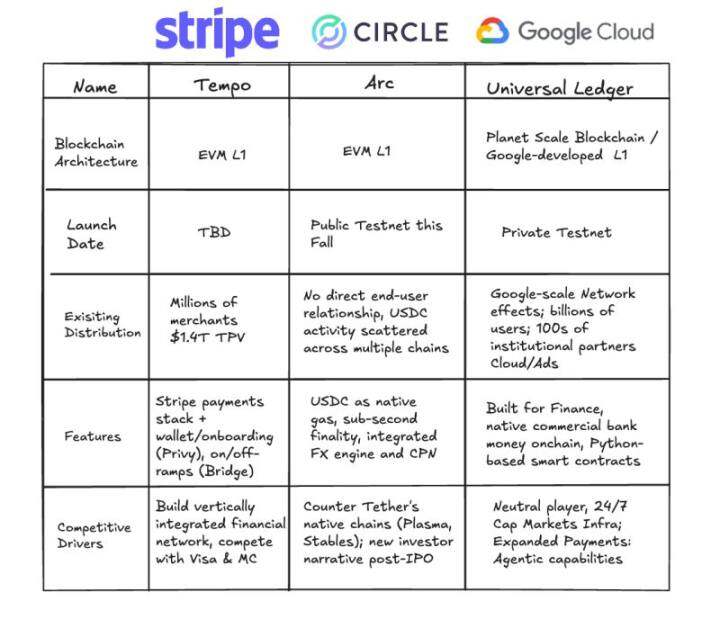

Recently, Rich Widmann, the head of Google’s Web 3 strategy, announced via social media that Google Cloud has officially launched its blockchain network, Google Cloud Universal Ledger (GCUL), defining it as a "Layer 1 blockchain." Discussions have emerged regarding its technological positioning: is GCUL a true Layer 1 public chain, or is it closer to a traditional consortium chain?

Official Positioning and Core Features

According to official descriptions, GCUL is designed as a "high-performance, trust-neutral distributed ledger platform that supports Python smart contracts," currently in the private testnet phase, primarily serving financial institutions. Google Cloud emphasizes that GCUL aims to simplify the management of commercial bank currency accounts and facilitate multi-currency and multi-asset transfers and settlements through distributed ledger technology, while also supporting programmable payments and digital asset management.

In an official article titled "Beyond Stablecoins: The Evolution of Digital Currency," Google further elaborated on GCUL's positioning: it does not aim to "reinvent money," but rather to address the fragmentation, high costs, and inefficiencies of the traditional financial system by upgrading infrastructure. GCUL is packaged as a service provided through an API interface, emphasizing its ease of use, flexibility, and security, particularly in terms of compliance (such as KYC verification) and private deployment advantages.

Notably, early testing of GCUL has already begun in collaboration with the Chicago Mercantile Exchange (CME Group). The two parties announced a pilot program for distributed ledger technology in March 2025, exploring solutions for wholesale payments and asset tokenization.

CME CEO Terry Duffy stated that GCUL is expected to enhance the efficiency of collateral management and margin settlement under the "24/7 trading trend"; Google Cloud's General Manager of Financial Services, Rohit Bhat, emphasized that this collaboration is a "typical case of traditional financial institutions achieving business transformation through modern infrastructure."

Layer 1 vs. Consortium Chain: Definitions and Discrepancies

In the blockchain field, Layer 1 typically refers to underlying public blockchains, such as Ethereum and Solana, characterized by decentralization, permissionless access, and public transparency. Any user can freely participate in network validation, transactions, or deploying smart contracts, and on-chain data is visible to everyone.

In contrast, a consortium blockchain is a permissioned distributed ledger maintained by specific organizations or institutions, with controlled node access and customizable data access permissions. Typical applications include Hyperledger Fabric and AntChain. The advantages of consortium chains lie in compliance and control, but they sacrifice openness and censorship resistance.

Which Model Does GCUL Align With More?

Based on the information currently disclosed, GCUL exhibits clear characteristics of a consortium chain:

- Private and Permissioned: GCUL explicitly operates on a "private and permissioned network," with node access and account permissions controlled by a governing body.

- Target Users: Focused on financial institutions (such as CME Group), rather than allowing public participation.

- Compliance First: The design includes traditional financial compliance requirements such as KYC verification and transaction fees that comply with outsourcing regulations.

- Technical Architecture: Although it supports smart contracts (based on Python), its underlying infrastructure is maintained in a centralized manner by Google Cloud, differing from the "decentralized" concept of Layer 1.

However, Google Cloud officials still insist on calling it "Layer 1," emphasizing "trust neutrality" and "infrastructure neutrality" — meaning any financial institution can use it, rather than being limited to specific interest groups. This phrasing attempts to blur the boundaries between public chains and consortium chains in the narrative.

Third-Party Perspectives: Doubts and Observations

Industry practitioners have expressed differing views on GCUL's positioning:

- Liu Feng, a partner at BODL Ventures, believes that GCUL aligns more with "consortium chain" characteristics, fundamentally differing from decentralized, permissionless public chains.

- Omar, a partner at Dragonfly, stated that Google's previous descriptions of GCUL were somewhat vague, and now the team clearly leans towards packaging it as "Layer 1," but the actual technical details have not been fully disclosed.

- Mert, CEO of Helius, pointed out that GCUL is still a "private and permissioned" system, differing from the open model of public chains.

Despite the doubts, some believe that GCUL may represent a form of "incremental innovation." For example, the pilot collaboration between Google and CME Group shows that institutions have a demand for the application of distributed ledger technology in scenarios such as settlement and collateral management. If GCUL can integrate Google's technological capabilities and financial compliance experience, it may find a practical path between traditional finance and blockchain.

Disclaimer: This article is based on publicly available information analysis; the specific technical architecture and operational model of GCUL will need to be confirmed by subsequent disclosures from Google.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。