In every cycle of the cryptocurrency market, certain innovative mechanisms always emerge, becoming hotspots that drive industry development. The Launchpad/Launchpool launched by Binance is a prime example. By rigorously screening and reviewing projects, simplifying user participation processes, and providing matching and liquidity support immediately after project launch, Launchpool has grown into an industry benchmark in just a few months.

Several now-leading star projects initially completed their financing and cold starts on the Launchpool platform. Leveraging Binance's global user base and deep liquidity, these projects quickly generated market effects. Historical data has repeatedly validated its value, with the average ROI of projects maintaining a high level over the long term, making it widely regarded as one of the most reliable early investment channels.

In this cycle, Binance launched a new mechanism called "Binance Alpha." The launch of Alpha sparked widespread discussion, with some believing it to be a new value discovery tool in the crypto market, providing users with stable returns and early opportunities. However, some investors complained that Binance Alpha projects often peak immediately upon launch, with users primarily being opportunists who do not bring real incremental value to the projects.

Amidst this controversy and discussion, the Binance Alpha project has also surpassed 100 issues.

Consecutive 15 Weeks at the Top of Crypto Wallet Trading Volume

Binance launched Binance Alpha on December 17, 2024. Initially, it was just an experimental discovery tool within the Binance Web3 wallet, used to identify potential projects. In the early stages, the projects launched on Alpha were mainly Meme and AI tokens. Starting from early 2025, Alpha's scope gradually expanded to non-Meme tokens.

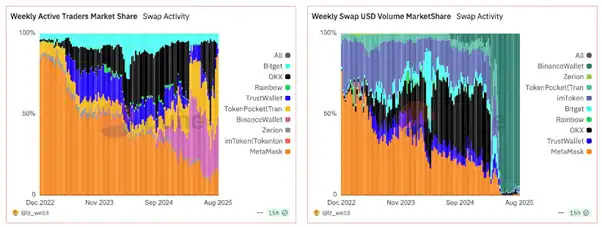

The real turning point occurred in March 2025 when Binance Alpha iterated to 2.0, introducing Alpha points and integrating directly with CEX, allowing users to participate in Alpha token trading directly with funds from their exchange accounts without additional cross-chain operations. Data shows that on March 18, the daily on-chain trading volume of the Binance wallet reached $90.556 million, accounting for 54.1% of the total trading volume in the crypto wallet sector that day, ranking first in the market, with daily trading volume increasing over 24 times compared to early March. The number of active trading users also topped the list with 28,103 users, accounting for 29.5% of the total active traders in the sector.

The latest data shows that the trading volume generated by the Binance wallet accounts for 93.7% of the total trading volume in the crypto wallet sector, maintaining a share of over 90% for 15 consecutive weeks.

47.5% of Alpha Projects Launched on Binance Contracts

Of course, some users attribute the high trading volume of the Binance wallet to the launch of the Alpha points system. The points mechanism incentivizes users to trade frequently, thereby boosting the overall activity of the wallet.

However, attributing the growth in trading volume solely to Alpha points is undoubtedly an oversimplification of the product iteration and ecosystem operation of the Binance wallet. Alpha points are more like a catalyst, while the true support for its high growth comes from a systematic logic formed by product experience optimization, wealth effect release, and project ecosystem support.

The Alpha points rules require users to maintain trading and asset holdings within a certain period to have the opportunity to receive future project airdrops or subscription qualifications. For many users, this is a low-threshold way to participate; simply completing daily trades provides the chance to capture future returns. Undoubtedly, this mechanism can effectively enhance user trading frequency in the short term. However, in the long run, the dividends brought by points may gradually diminish as the number of quality projects becomes scarce. Therefore, points alone cannot be the sole explanation for the long-term growth of the Binance wallet.

This brings us to the strategic positioning of Alpha 2.0, which directly brings early crypto projects into the Binance wallet and trading platform ecosystem.

For project parties, through airdrops or presales, projects can quickly gain initial exposure and accumulate liquidity in the Alpha market. For users, they can discover potential projects at the first opportunity and enjoy early project dividends. For Binance, this is a new mechanism that connects CEX and DEX, allowing users to seamlessly complete decentralized operations within a centralized exchange.

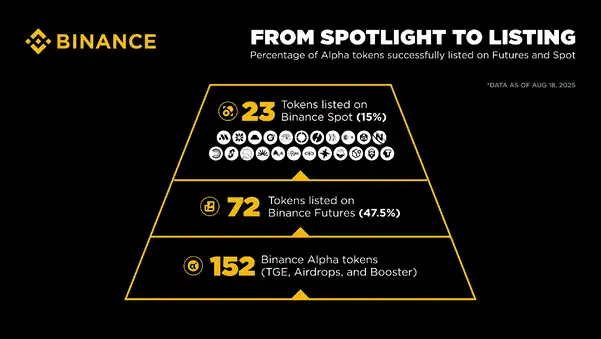

Data shows that Binance Alpha has launched a total of 294 projects to date, of which 114 projects have launched on the contract market, and 36 projects have launched on the main site spot market. If we only count the 152 Alpha projects from TGE, airdrops, and Booster, then 72 projects have launched on the contract market, and 23 projects have launched on the main site spot market, accounting for 47.5% and 15% respectively. The most controversial points airdrop projects total 115, of which 54 have launched on the contract market and 18 on the main site spot market, accounting for 46.9% and 15.7% respectively.

This mechanism of token distribution, trading, and launching on the main site essentially represents a fusion of CEX and DEX, just as Binance Alpha 2.0 allows users to perform DEX operations directly on CEX. Users can enjoy the openness and early dividends of the decentralized market while also obtaining security, compliance, and deep liquidity guarantees within the centralized exchange. For project parties, this is a low-cost, high-efficiency financing and promotion platform. For Binance, this serves as a bridge to unify Web3 users and CEX users within the same ecosystem.

High ROI and Strong Liquidity

If we calculate ROI based on the closing price one hour before a project launches on Alpha and the highest daily closing price after launch, the average ROI of Binance Alpha projects reaches an impressive 227%. Among them, there are projects with ROI exceeding 1000%, such as AIOT, SHELL, and M. More notably, out of all projects, 132 have an ROI exceeding 50%, while only 49 projects have a negative ROI. This means that the vast majority of investors have achieved considerable positive returns within the Alpha ecosystem.

The wealth effect brought by this high ROI has become the strongest driving force for attracting new users and retaining existing users in the Binance wallet. Whether through the points reward mechanism or the high returns of projects, they essentially point to the same fact: users choose to stay because they can genuinely make money here. In stark contrast, while other trading platforms' wallet products have also attempted various incentive programs, they often struggle to generate similar wealth effects due to a lack of sufficient quality projects, ultimately failing to maintain long-term user activity.

Such achievements are not coincidental. Compared to other platforms that often chase short-term trends, Binance Alpha is stricter in project selection, placing greater emphasis on the long-term potential and market value of projects. This allows Alpha to maintain a high ROI while also significantly increasing the overall project success rate compared to its peers.

If high ROI were only demonstrated in data, it would merely be a numbers game. Binance Alpha's industry-leading position also stems from its strong liquidity. Almost all launched projects can achieve tens of millions in trading volume during the opening phase, with depth levels sufficient to support large capital inflows and outflows.

According to CoinMarketCap data, the daily trading volume of Binance Alpha projects reached $4.4 billion. After excluding trading pairs like KOGE and BR, which are commonly viewed as having significant wash trading, the average daily trading volume still stabilizes above $1.5 billion, reaching levels comparable to Bitget, Bybit, and Coinbase.

Image Source: CoinMarketCap

For investors, the significance of Binance Alpha lies in its ability to meet the two core market demands: high ROI and strong liquidity. Supported by these two dimensions, Alpha is not just an investment channel but also an ecological entry point.

As Chari.eth, the founder of TaleX Protocol, stated, "I just need a place to mark our tokens out from thousands of similarly named tokens and allow users to trade conveniently through CEX. Think about it, if you invented Bitcoin back then, wouldn't that be all you needed?" From this perspective, Binance Alpha perfectly meets my requirements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。