Written by: Oliver, Mars Finance

When a star project with dazzling halos such as "the first Layer 2 based on BitVM" and "invested by Wall Street giant Franklin Templeton" — Bitlayer, officially announces that its token $BTR is about to have its TGE, the market's sentiment is complex and divided. On one hand, there is the anticipation brought by top capital endorsement and grand technological narratives; on the other hand, there is the fatigue and skepticism that permeate the entire market after experiencing the peak and subsequent decline of the inscription craze, along with the chaos of numerous "meme dog L2s."

This raises a sharp question that everyone wants to know the answer to: Is Bitlayer issuing its token now to take advantage of the remaining warmth of the Bitcoin ecosystem for a round of exquisite "harvesting," or does it truly have the capability and capital to sound the horn for a new bull market in this seemingly dormant ecosystem?

To answer this question, we must go beyond the surface noise and delve into its technical core, strategic blueprint, and even the thoughts of its co-founder Kevin He — an entrepreneur who has experienced multiple bull and bear markets and has created ecosystems with a TVL of over ten billion. His insights may provide us with key clues.

Bitlayer's Three Aces — Technology, Economic Model, and Execution Capability

Bitlayer is not a reckless speculative project; its core competitiveness consists of three closely interconnected aces: solid technology, a clear economic model, and reliable execution capability.

Technical Ace: Security Narrative Based on BitVM Its core lies in the pioneering application of the BitVM paradigm, returning to the essence of security. Co-founder Kevin He points out that the essence of BitVM is based on Bitcoin's optimistic Rollup, with its brilliance lying in the community consensus gradually shifting from the arduous attempts to build complex virtual machines on Bitcoin to a feasible path of directly verifying zero-knowledge proofs (ZK Proof). This means challengers only need to verify a deterministic ZK proof on the Bitcoin mainnet to adjudicate fraudulent behavior. This shift significantly reduces the implementation difficulty and brings two fundamental advantages: it can be realized based on existing technologies like Taproot without any upgrades to the Bitcoin protocol; at the same time, through on-chain verification, it firmly anchors the security of Layer 2 on the Bitcoin mainnet, breaking through the traditional dilemma between security and programmability in scaling solutions. As the first team in the industry to clearly develop bridges and Layer 2 based on BitVM, Bitlayer has reached strategic cooperation with mainstream mining pools such as AntPool and F2Pool, securing nearly 40% of Bitcoin's hash power, ensuring that in the event of a fraudulent challenge, the challenged transaction can be prioritized for on-chain packaging — a core advantage that is difficult for other teams to match.

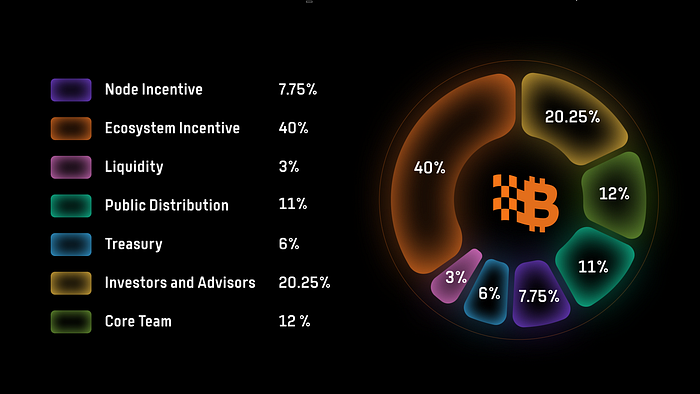

Economic Model Ace: Carefully Designed $BTR Token Economics This not only reflects its strategic intent but also provides a clear path for its transition from "market dream rate" to "price-to-earnings ratio." The total supply of $BTR is fixed at 1 billion tokens, and its distribution strategy clearly focuses on the long-term construction and incentives of the ecosystem.

Massive Ecological Incentives: Up to 40% of the tokens are designated for ecological incentives. This is a huge "war fund," indicating that Bitlayer plans to invest substantial resources to guide and nurture its ecosystem to attract developers and users in the fiercely competitive L2 market.

Clear Token Utility: $BTR is endowed with multiple core functions, including staking to maintain network security, participating in on-chain governance decisions regarding the protocol's future, and a crucial fee switch mechanism. This mechanism can allocate a portion of the protocol's revenue to reward stakers or buy back and burn tokens, directly linking token value to network economic activities.

Execution Capability Ace: Experienced Team and Top Capital A grand vision ultimately requires a capable team to realize it. Kevin He's resume itself is a powerful credential: he once led a team to achieve a daily trading volume of four million transactions and a TVL exceeding ten billion dollars for the HECO ecosystem. This mature team of nearly sixty people, led by him, along with endorsements from top capital such as Framework Ventures, ABCDE Capital, and Franklin Templeton, forms a solid foundation for Bitlayer to turn its blueprint into reality.

The Battlefield Beneath the Grand Narrative — The Real Temperature of the Bitcoin Ecosystem

Bitlayer's ambitious goals need to be tested on a real battlefield. This battlefield — the Bitcoin ecosystem — is currently in a "sage time" after a carnival, but it is far from silent. It presents a complex, multi-layered picture where ice and fire coexist.

As Kevin He has observed, there is a significant temperature difference in the perception of the ecosystem's status between Eastern and Western markets. The Chinese community, having had overly high expectations for the early inscription craze, generally feels pessimistic after the tide receded; meanwhile, the European and American markets remain relatively active. He believes that judging BTC's ecosystem temperature cannot simply apply Ethereum's standards. The uniqueness of the BTC ecosystem lies in its massive financial activities, such as lending and derivatives trading, which have long existed off-chain. The real opportunity lies in safely and efficiently migrating these trillions of dollars of off-chain activities on-chain. This is the vast ocean of BTCFi, and the current bottleneck is insufficient infrastructure.

Although the craze for inscriptions and runes has cooled, it has left behind two valuable legacies as a successful "stress test": it validated demand with real money, proving the market's immense desire to issue and trade assets on Bitcoin; at the same time, it exposed bottlenecks, making everyone realize that Layer 2 is a necessity for ecosystem development.

Therefore, during this market calm period, the true builders have not paused; an intense "infrastructure race" is quietly unfolding on multiple fronts.

At the protocol layer, innovation continues to deepen. The RGB protocol, which has been awaited for two years, has finally launched on the mainnet, representing a direction for native smart contract exploration. The BRC 2.0 upgrade attempts to graft EVM compatibility onto the massive BRC-20 assets. Additionally, native protocols like SAT 20, which have persisted in development for two years, have finally launched on the mainnet SatoshiNet.

At the application and infrastructure layer, competition is equally fierce. Various Layer 2 solutions are accelerating delivery. In addition to Bitlayer, the Bitcoin bridge Fiamma, built on BitVM 2, has also launched on the mainnet, joining the competition for trust-minimized cross-chain solutions. Meanwhile, native L2s like Spark, which focus on payments and settlements, are also making continuous progress.

At the asset and market level, the ecosystem has not completely frozen. The established Bitcoin NFT series "NodeMonkes" has recently shown strong signs of recovery. In the rune domain, although the leading $DOG has performed mediocrely, several runes have excelled over a longer time frame, and $DOG's successful listing on mainstream exchanges like Kraken marks a gradual recognition of rune assets.

In summary, the current Bitcoin ecosystem is not silent; rather, it has entered a phase of sifting through the false to retain the true and honing internal skills. Bitlayer is entering this era of competing builders with its unique technological route and strong capital.

Harvesting or Dawn? The Answer Lies in the Details of Execution

Now, we can more clearly answer the initial question. Is Bitlayer here to "harvest"? This risk is real. BitVM is a cutting-edge and extremely complex technology, facing significant technical execution risks. At the same time, in the context where competitors like Merlin Chain have aggressively airdropped to seize massive TVL, market competition is exceptionally fierce.

However, the possibility of Bitlayer becoming a "new hope" is becoming increasingly clear. This hope is no longer based on a vague dream but is built on a series of solid pillars:

- A clear roadmap: It has a clear plan from market validation to secure implementation and building a high-frequency trading environment.

- A pragmatic business model: It chooses to start from the essential needs of institutions and users rather than creating demand out of thin air.

- Reliable leadership: It is led by a seasoned leader, providing assurance for the project's execution capability.

- A security philosophy that aligns with the spirit of Bitcoin: Its extreme pursuit of trust minimization is most likely to win the ultimate trust of the Bitcoin core community and long-term holders.

The issuance of $BTR is not the end of the story but the starting gun. That massive 40% ecological incentive fund will fuel Bitlayer's realization of its three-phase roadmap. The final answer lies not in the price of the token at the moment of TGE but in whether Bitlayer can steadily deliver on its technical promises and effectively utilize this "war fund" to cultivate a truly prosperous ecosystem that can migrate Bitcoin's off-chain value on-chain.

For us observers, Bitlayer's journey will be the best sample to measure whether the Bitcoin ecosystem can successfully leap from "digital gold" to "programmable financial infrastructure."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。