ETF Momentum Returns With $444 Million Surge for Ether and $219 Million Boost for Bitcoin

The week opened with a bang. After days of turbulence and outflows, crypto ETFs staged a sharp comeback on Monday, Aug. 25, drawing in a combined $663 million across bitcoin and ether products.

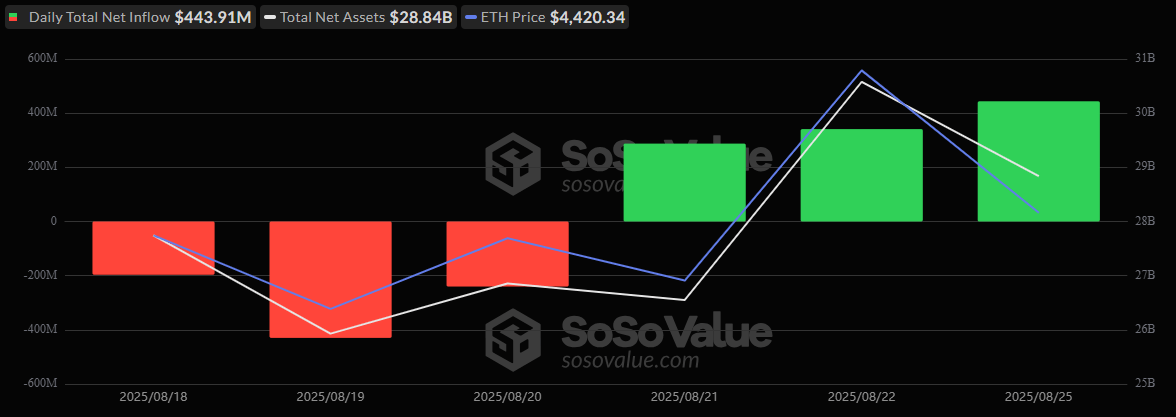

Ether ETFs stole the spotlight, registering a massive $443.91 million inflow. Institutional heavyweight Blackrock’s ETHA led the charge with $314.89 million, backed by Fidelity’s FETH at $87.41 million and Grayscale’s Ether Mini Trust with $53.27 million.

Additional gains came from Bitwise’s ETHW (+$9.69 million), 21shares’ CETH (+$5.62 million), and Invesco’s QETH (+$2.20 million). Only Grayscale’s flagship ETHE bucked the trend, posting a $29.17 million outflow. Even so, the day was decisively positive, with total ether ETF trading volume at $3.75 billion and net assets at $28.84 billion.

Ether ETFs’ momentum looks to be recovering with three days of inflows. Source: Sosovalue

Bitcoin ETFs also bounced back, though on a smaller scale, pulling in $219 million. Flows were broad-based, led by Fidelity’s FBTC (+$65.56 million), Blackrock’s IBIT (+$63.38 million), and Ark 21shares’ ARKB (+$61.21 million).

Support came from Bitwise’s BITB (+$15.18 million), Grayscale’s Bitcoin Mini Trust (+$7.35 million), and VanEck’s HODL (+$6.32 million). No bitcoin ETF saw any outflows, as trading volume remained strong at $4.50 billion, with net assets holding at $143.65 billion.

After a bruising stretch of redemptions, Monday’s surge showed fresh investor conviction returning to crypto ETFs. Whether this marks the start of a new trend or a brief reprieve will be tested in the days ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。