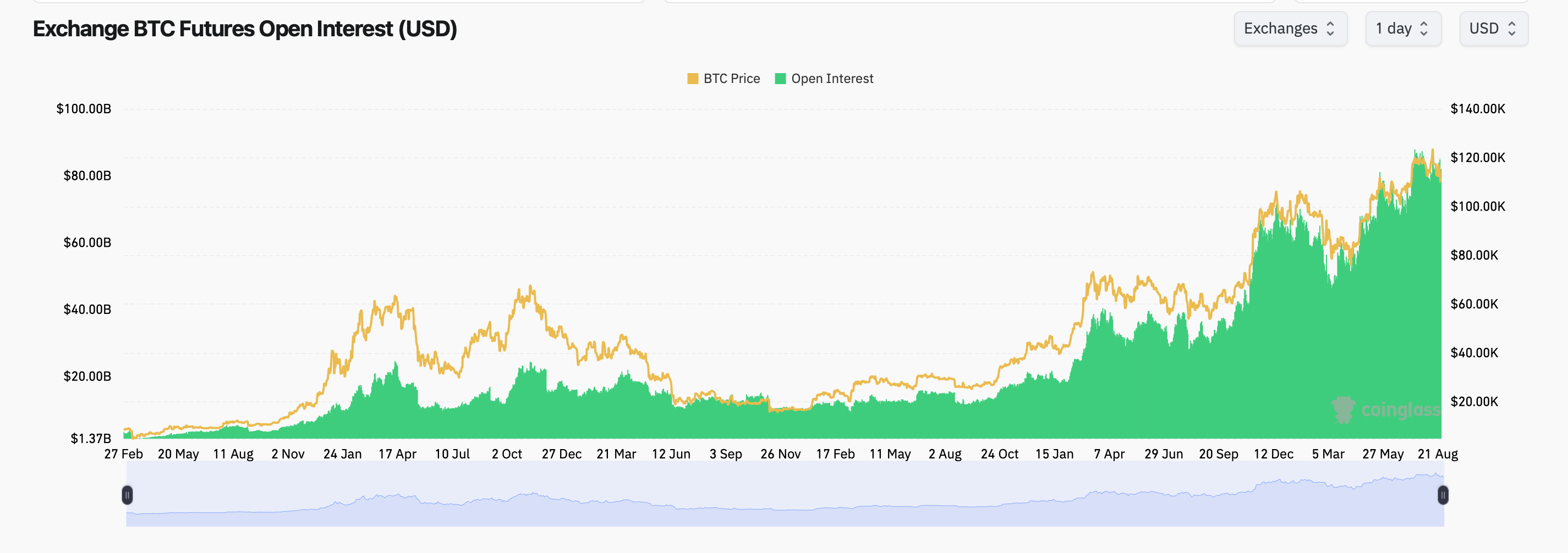

Bitcoin futures open interest now totals $81.54 billion, led by CME at $15.62 billion (141,750 BTC) and Binance at $14.33 billion (129,990 BTC). Bybit ranks third at $9.68 billion, while OKX follows with $4.03 billion. Over 24 hours, most venues saw declines: Binance slipped 5.18%, Gate fell 6.11%, and CME dropped 2.24%. Kucoin was the outlier, up 1.29%.

Options open interest stands at $54.22 billion, with Deribit accounting for the lion’s share. The call-to-put ratio favors bulls — 59.53% of OI is in calls (269,511 BTC) compared to 40.47% in puts (183,230 BTC). Volume echoed the same theme: 57.78% of 24-hour activity came from calls, totaling 29,749 BTC.

The largest bets are clustered in high-strike calls expiring in Q4. The Dec. 26 $140,000 call leads with 10,228 BTC in OI, followed by the Sep. 26 $140,000 call (9,787 BTC) and the Dec. 26 $200,000 call (8,501 BTC). The most notable bearish position is the Sep. 26 $95,000 put with 8,152 BTC in open interest.

Short-dated upside bets were the most active over the past day. The Aug. 29 $116,000 call posted 2,951 BTC in volume, trailed by the Sep. 12 $115,000 call at 1,719 BTC. Other hot strikes included the Dec. 26 $125,000 and $160,000 calls.

With futures open interest hovering near multi-month highs and options activity increasingly tilted toward aggressive calls, traders appear to be loading up in anticipation of further price expansion — all while bitcoin floats just around the $110,000 mark.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。