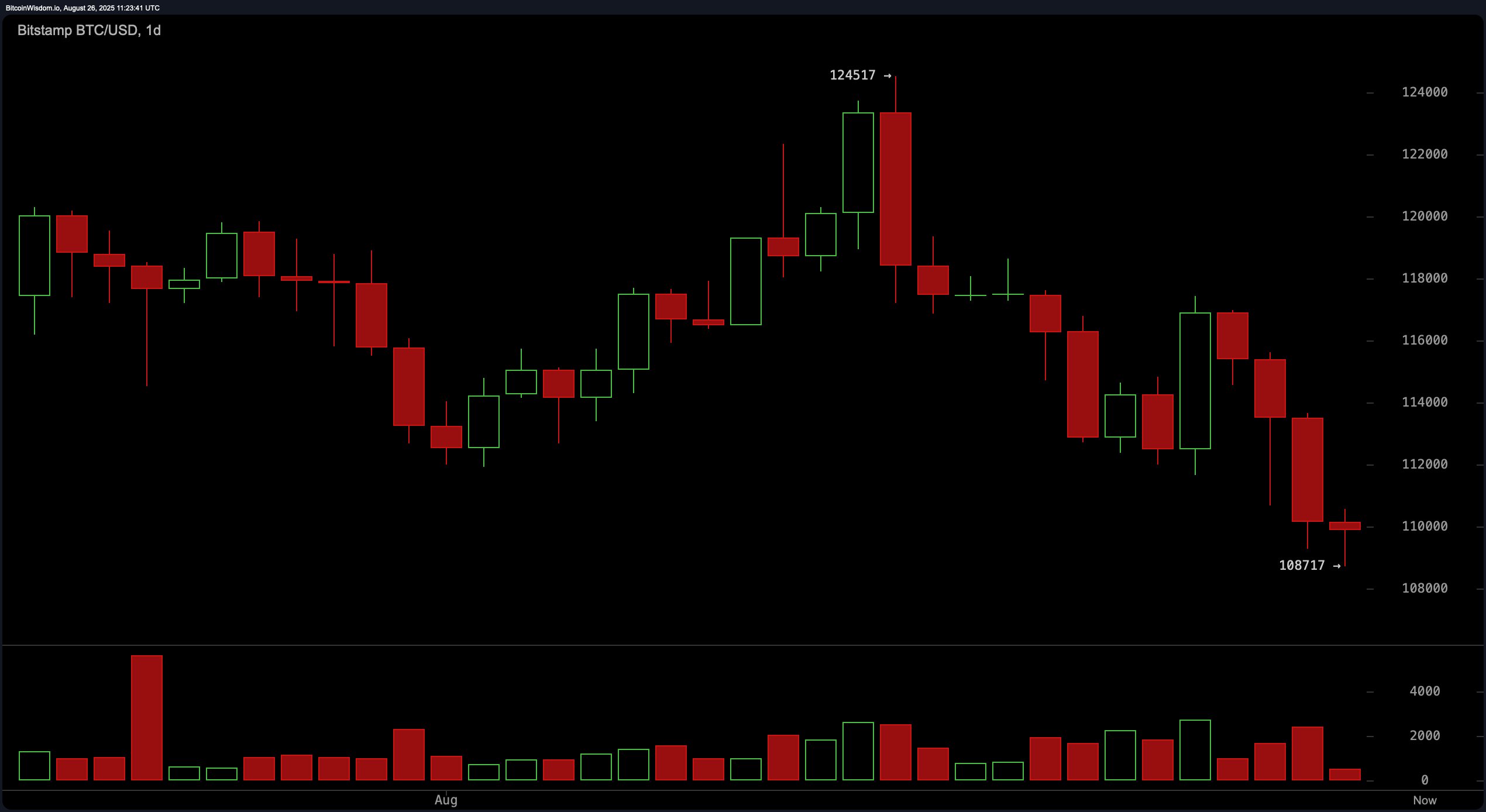

On the daily timeframe, bitcoin remains locked in a defined downtrend, with lower highs and lower lows shaping the price action. A sharp rejection from the recent local top of $124,517 has pulled the price downward by more than 12%, with the latest daily candle closing near $108,717. This pattern is reinforced by bearish engulfing candles and elevated red volume bars, signaling sustained seller dominance. Despite the downward pressure, the emergence of tight-bodied candles may suggest a pause or potential exhaustion phase, though no bullish reversal has been confirmed.

BTC/USD 1-day chart via Bitstamp on Aug. 26, 2025.

The 4-hour bitcoin chart aligns with this bearish outlook, showing an accelerated decline from $117,421 to $108,717. Attempts to rally have been consistently capped, with each bounce forming lower highs and encountering resistance near $112,000 to $113,000. Bearish volume spikes further corroborate the weakness of bullish momentum. A tentative double-bottom structure near $108,700 appears to be forming, but without confirmation, traders are advised to remain cautious. Short entries on intraday bounces remain favorable as long as the resistance ceiling holds.

BTC/USD 4-hour chart via Bitstamp on Aug. 26, 2025.

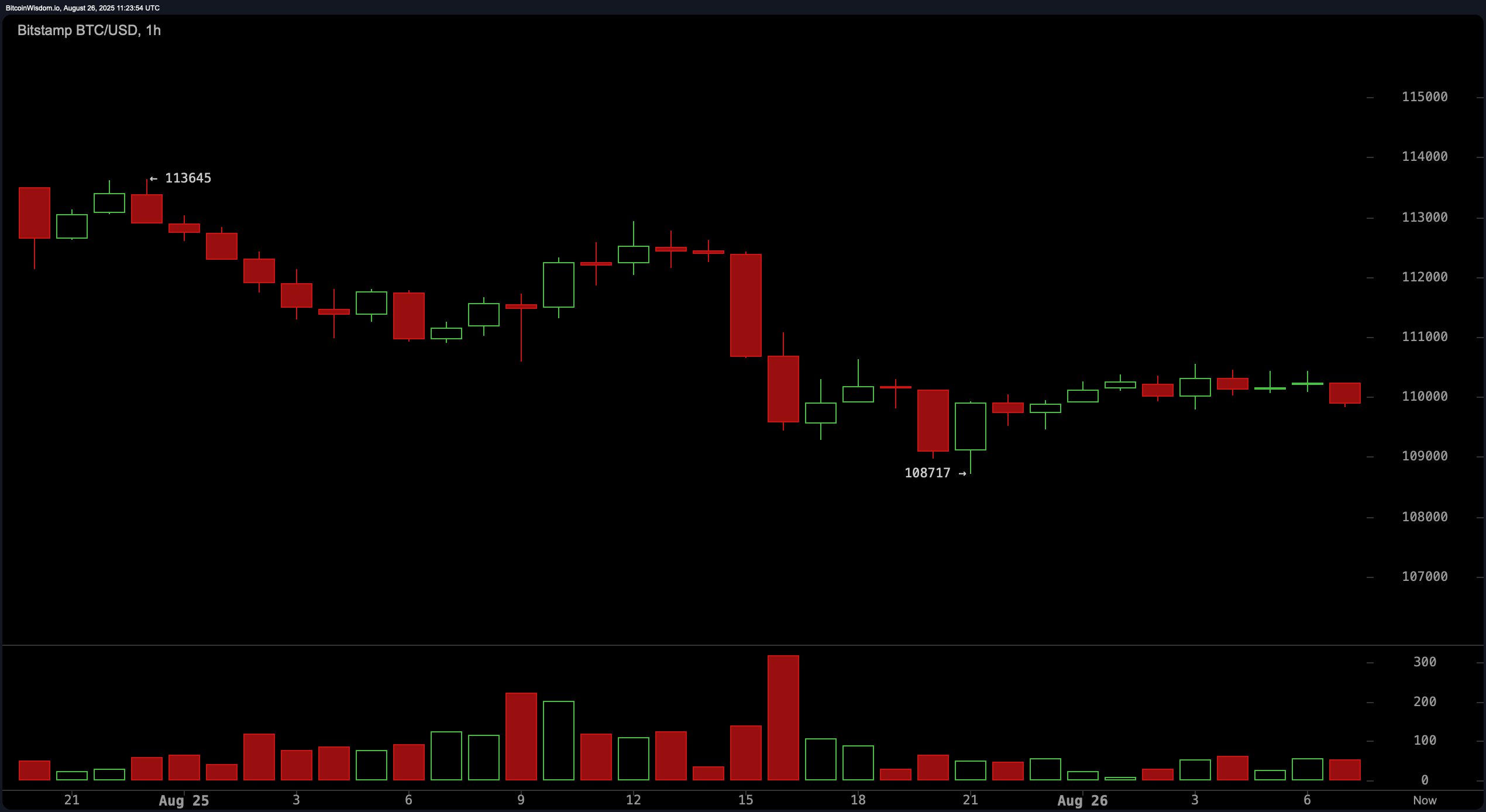

On the 1-hour bitcoin timeframe, the trend transitions from outright bearishness to short-term consolidation. Following the recent decline, bitcoin has stabilized in a narrow range between $109,000 and $110,500. Diminishing candle size and decreasing volume indicate a contraction in volatility. Although buyers have defended the $108,700 support level for now, upward moves have lacked follow-through, suggesting weak conviction. Scalp trades may be considered on well-defined setups, but traders should maintain tight risk controls due to prevailing choppiness.

BTC/USD 1-hour chart via Bitstamp on Aug. 26, 2025.

Oscillator readings provide a mixed but largely neutral picture. The relative strength index (RSI) is positioned at 38, while the stochastic oscillator is at 11, and the commodity channel index (CCI) is deeply negative at −180 — all signaling indecision. The average directional index (ADX) sits at 17, highlighting the absence of a strong directional trend in the short term. Momentum, however, shows a sell signal at −7,562, while the moving average convergence divergence (MACD) level is also bearish at −1,184, reinforcing short-term downside risk.

Moving average (MA) data confirms prevailing bearish sentiment, particularly in the short to medium term. The exponential moving averages (EMAs) and simple moving averages (SMAs) across 10-, 20-, 30-, and 50-period intervals all signal a bearish trend, with prices below each respective benchmark. Notably, the 100-period EMAs and SMAs also remain bearish. Only the 200-period exponential moving average and simple moving average reflect buy signals, suggesting that long-term trend support remains intact — though this support is distant from current price levels, limiting its immediate relevance.

Bull Verdict:

While bitcoin’s price remains pressured by near-term bearish momentum, the successful defense of the $108,700 support zone may offer a foundation for reversal. A sustained move above $113,000, coupled with improving volume and oscillator confirmation, would be required to shift the structure toward a bullish recovery.

Bear Verdict:

Technical indicators across multiple timeframes continue to favor the downside, with persistent rejection at key resistance levels and weak momentum confirming bearish control. Unless bitcoin decisively reclaims the $113,000 threshold, sellers are likely to remain in command, with further declines toward $106,000 a plausible next leg.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。