Author: White55, Mars Finance

Institutional Giants' SOL Bet: A $1 Billion Treasury and Opportunities Amidst the Plunge

According to Bloomberg, three top institutions—Galaxy Digital, Jump Crypto, and Multicoin Capital—are advancing a financing plan worth up to $1 billion, specifically for acquiring Solana (SOL) tokens, aiming to establish the world's largest dedicated Solana reserve.

The three giants have hired Wall Street investment bank Cantor Fitzgerald as the lead underwriter and plan to build a centralized digital asset reserve company by acquiring a publicly listed company whose name has not been disclosed. If the deal is completed as scheduled in early September, its scale will exceed that of the current largest Solana reserve pool by more than double.

The SOL Ambition of the Three Giants: Restructuring the Crypto Asset Reserve Landscape

The institutions participating in the treasury formation are long-term supporters of the Solana ecosystem.

- Galaxy Digital led the acquisition of Solana from the FTX estate last year, raising over $600 million;

- Jump Crypto is developing a new Solana validator client called Firedancer, aimed at enhancing network transaction processing capacity;

- Multicoin Capital is an early institutional investor in Solana, with its portfolio deeply tied to the ecosystem's development. This strong binding relationship has led the industry to view this $1 billion plan as a significant endorsement of Solana's long-term value.

Paradigm Shift in Reserve Strategy

This plan marks the expansion of the "corporate crypto reserve" strategy from Bitcoin and Ethereum to public chain ecosystems.

Inspired by Michael Saylor's MicroStrategy Bitcoin reserve strategy, accumulating cryptocurrencies through publicly listed entities has become a new trend for institutions allocating digital assets this year.

Previous strategies focused on Bitcoin and Ethereum have significantly boosted the prices of related assets—digital asset treasury companies (DATs) focusing on Ethereum have accumulated approximately $20 billion in ETH, directly pushing it to break historical highs last week.

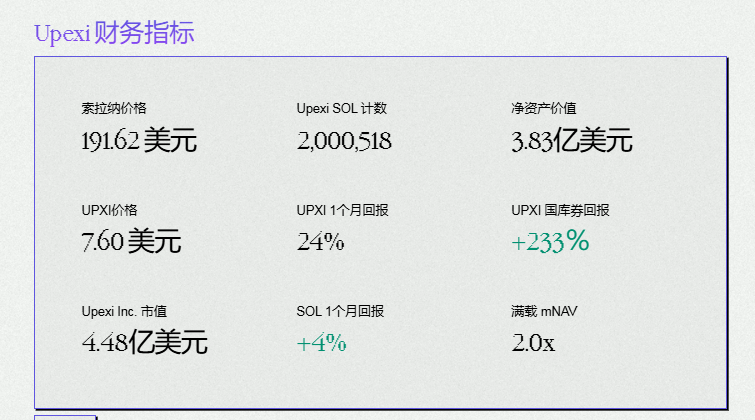

Currently, the largest public holder of Solana is supply chain management company Upexi, holding approximately $380 million worth of SOL (over 2 million tokens).

However, this record is about to be broken: aside from the plans of the three giants, the DeFi Development Company (DDC, formerly Janover), now led by a former Kraken executive, has transformed into a Solana reserve company, with its stock price skyrocketing tenfold in April and has submitted a $1 billion financing application to the SEC to increase its SOL holdings.

Another institution, Sol Strategies, has also clearly identified Solana as a core reserve asset, forming a "MicroStrategy of Solana" camp.

SOL Amidst Market Chill: Divergence Between Technicals and Ecosystem Fundamentals

Price Volatility

While institutions are actively positioning themselves, the market performance of Solana has shown significant volatility.

In the past two days, the price of SOL plummeted from a high of $213 to around $187, a decline of nearly 12%, almost erasing all gains from the previous Powell night, and is retesting the key support range of $170-$180.

Technical charts indicate that the SOL/USD trading pair has formed a descending channel on the hourly chart. If it breaks below the $172 support level, it may further test the $162 or even $150 area. Market sentiment has rapidly shifted from "greed" to "fear," with the crypto fear and greed index dropping from above 70 to 44, marking a new low since June.

Technical Pattern Game

Despite short-term pressure, the medium to long-term technical structure still suggests potential upside. Since April, SOL has formed an "ascending triangle" pattern on the weekly chart, with horizontal resistance at $200 and an ascending trendline support near $176.

If the daily closing price can effectively break above $200 with increased trading volume, it may trigger a bullish trend, targeting $220-$260, and in extreme scenarios, even reaching $362.

Analyst Crypto Jelle pointed out that SOL is "quietly building higher lows," and once it breaks the $200 resistance, "the upward train will be hard to stop."

Ecosystem Resilience Supporting Value

The fundamentals of Solana continue to improve. Data shows that its decentralized exchange (DEX) trading volume consistently leads other public chains, and increased protocol buyback activities indicate enhanced confidence from project teams.

The meme coin platform Pump.fun contributed nearly 90% of Solana's network Launchpad revenue last week, validating its status as the preferred chain for speculative tokens. The upcoming Alpenglow upgrade aims to further enhance network performance, potentially becoming a catalyst for subsequent value discovery.

SOL/ETH Exchange Rate Seeking Bottom: Historical Support at 0.04

Another key signal comes from the SOL/ETH exchange rate. This rate has fallen from a high of 0.089 to around 0.042, approaching the historical support area of 0.04. This position has previously triggered strong rebounds of SOL relative to ETH, and the current level may provide strategic allocation opportunities again.

If the institutional reserve plan materializes, it will tighten the supply of SOL in the spot market, driving its relative performance stronger.

The Double-Edged Sword of Institutional Accumulation: Opportunities and Risks Coexist

Liquidity Siphoning Effect

The establishment of a $1 billion reserve treasury will directly lead to a contraction in market circulation. Based on the current SOL price, this plan equates to locking up approximately 5.3 million SOL (over 1% of total supply). This large-scale lock-up may trigger a liquidity siphoning effect similar to Ethereum DATs—when ETH treasury companies hold 3% of total supply, their price breaks historical highs due to supply tightening.

Systemic Risk Concerns

Galaxy CEO Michael Novogratz warned that the crypto reserve craze may have peaked, and new entrants will face a harsher environment. Any sustained market decline could trigger a chain of forced liquidations, especially when the mortgaged SOL faces liquidation pressure. The Hong Kong Monetary Authority's upcoming implementation of Basel's new crypto capital regulations requires banks to hold a 1250% risk weight for unlicensed blockchain asset exposures, which may suppress traditional financial institutions' willingness to allocate.

Strategic Choices at the Market Crossroads

The $1 billion treasury plan of the three giants stands in dramatic contrast to the plummeting SOL price.

For astute investors, the plunge may open a window for strategic allocation. As institutional treasuries backed by the Solana Foundation begin to absorb spot, as ecosystem DEX trading volumes continue to lead the public chain race, and as the SOL/ETH exchange rate approaches historical support, the market may be transforming "fear" into "opportunity."

However, caution is warranted due to the inherently high volatility of the crypto market—breaking below the $170 support would completely undermine the technical structure, triggering a deeper correction to $150.

In this process of institutional capital restructuring the crypto asset landscape, Solana stands at the critical point of liquidity transformation. The $1 billion treasury is not only a testament to confidence but also a prophecy of market structure: as circulation is continuously locked by institutional treasuries, the recovery of the Solana ecosystem may unfold at a steeper rate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。