Author: 0xBrooker

BTC Daily Chart

BTC opened this week at $117,488.59 and closed at $113,478.00, with a low of $110,635.00 and a high of $117,633.80, down 3.41%, with a volatility of 5.95%. The trading volume increased compared to last week.

This week's BTC performance was influenced by a combination of factors, including a sudden shift in market sentiment before and after Powell's dovish remarks, long-term selling pressure, and changes in risk appetite within the crypto market, resulting in a volatile trend.

Ahead of the Jackson Hole global central bank annual meeting, risk assets, including BTC and U.S. stocks, continued to decline. However, at the meeting, the Federal Reserve Chairman unexpectedly released clear "dovish" statements, leading to a significant rebound in the stock and crypto markets.

The market is cautiously returning to expectations of a rate cut in September, but the pace and extent of rate cuts this year remain constrained by economic and employment data. This raises doubts about whether risk assets, which have rebounded significantly and are at high valuations, will continue to rise. The market needs more data to bolster traders' confidence in their positions and enhance the bullish sentiment. Before the September rate cut, the August inflation data is still pending release; if inflation data rises too quickly, the market may revise downward.

Policy, Macro Finance, and Economic Data

Last week's PPI data severely impacted the high-valuation U.S. stock market, raising concerns that rising producer prices will inevitably pass through to consumers, thereby increasing inflation and reducing the likelihood or extent of rate cuts.

The U.S. stock market, which is currently at high valuations, was in a correction state for most of this week, but sector rotation was also occurring, with high-valuation tech stocks continuing to decline while industrial and cyclical stocks saw a rebound. This indicates that the market is only pricing in a downward adjustment of the frequency and extent of rate cuts and has not yet priced in a delay in the September rate cut.

On Friday, Powell's unexpected "dovish" remarks shifted focus from "controlling inflation" to "maintaining employment."

He emphasized that the U.S. economic growth rate has significantly weakened, with a GDP growth rate of 1.2% in the first half of 2025, a substantial decline compared to 2024. The unemployment rate remains stable at 4.2%, but job growth has significantly slowed. The labor market faces downside risks, with reduced immigration leading to a weak labor supply, and declining demand could quickly worsen the employment situation.

He also stated that the core PCE inflation rate of 2.9% has not yet returned to the Fed's target of 2%. Recent tariff policies have raised prices for some goods, causing a one-time impact on CPI in the short term, but long-term inflation expectations remain stable.

In addition to emphasizing the serious employment situation, Powell's mention of "policy framework adjustments" was also seen as a significant positive—abandoning the "average inflation targeting" (FAIT) established since 2020 and returning to a "flexible inflation targeting" approach, emphasizing the need to adjust policies flexibly based on economic data, prioritizing responses to labor market risks.

During his speech on Friday, U.S. stocks and BTC prices surged rapidly, while the dollar index fell, indicating that the market quickly priced in an increased probability of a rate cut in September.

Currently, FedWatch shows a 87.2% probability of a rate cut in September, an increase from earlier pessimistic expectations this week, but still below the previous probability pricing of over 90%.

Before the September rate cut, non-farm employment and August inflation data remain in the spotlight. These data not only determine whether there will be a rate cut in September but also dictate the frequency and extent of rate cuts this year. The market has not yet fully priced in the latter, which will become a trading point in the future.

Crypto Market: Funds Flowing from BTC to ETH

From a technical indicator perspective, driven by reduced risk appetite, BTC retested the "Trump bottom" and the 90-day moving average this week. After Powell's speech at the Jackson Hole meeting on Friday, it rebounded and surged back to the 5-day moving average, but saw a slight pullback over the weekend, supported by the 60-day moving average.

Since last week, as BTC prices broke through and market risk appetite changed, long-term selling pressure has intensified, with this week's selling scale approaching last week's levels, which has created short-term pressure on BTC's price trend.

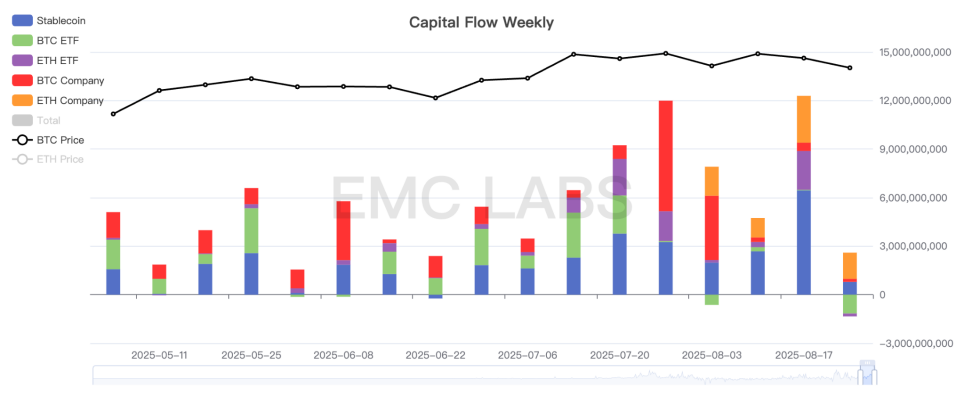

The fundamental reason for BTC's price struggle to break free from selling pressure is the lack of sufficient funds. This week, the total inflow of funds into the crypto market was $1.255 billion, a significant decrease from last week's $12.29 billion. Among them, funds from the BTC Spot ETF channel saw a large outflow of $1.165 billion.

Crypto Market Fund Inflow and Outflow Statistics (Weekly)

With the restart of the rate cut cycle, investor risk appetite has increased, and internal rotation is also occurring in the crypto market. According to eMerge Engine, funds are flowing from BTC to ETH both on and off exchanges, which has driven BTC down 2.41% this week, while ETH rose 6.88%.

The eMerge Engine Altseason Signal has reached 100%. If this continues, BTC prices may remain in a sluggish oscillation or slightly rise, while BTC's market share will continue to decline.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0.625, indicating an upward phase.

EMC Labs was established in April 2023 by crypto asset investors and data scientists. It focuses on blockchain industry research and investments in the crypto secondary market, with industry foresight, insights, and data mining as its core competencies, aiming to participate in the thriving blockchain industry through research and investment, promoting the benefits of blockchain and crypto assets for humanity.

For more information, please visit: https://www.emc.fund

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。