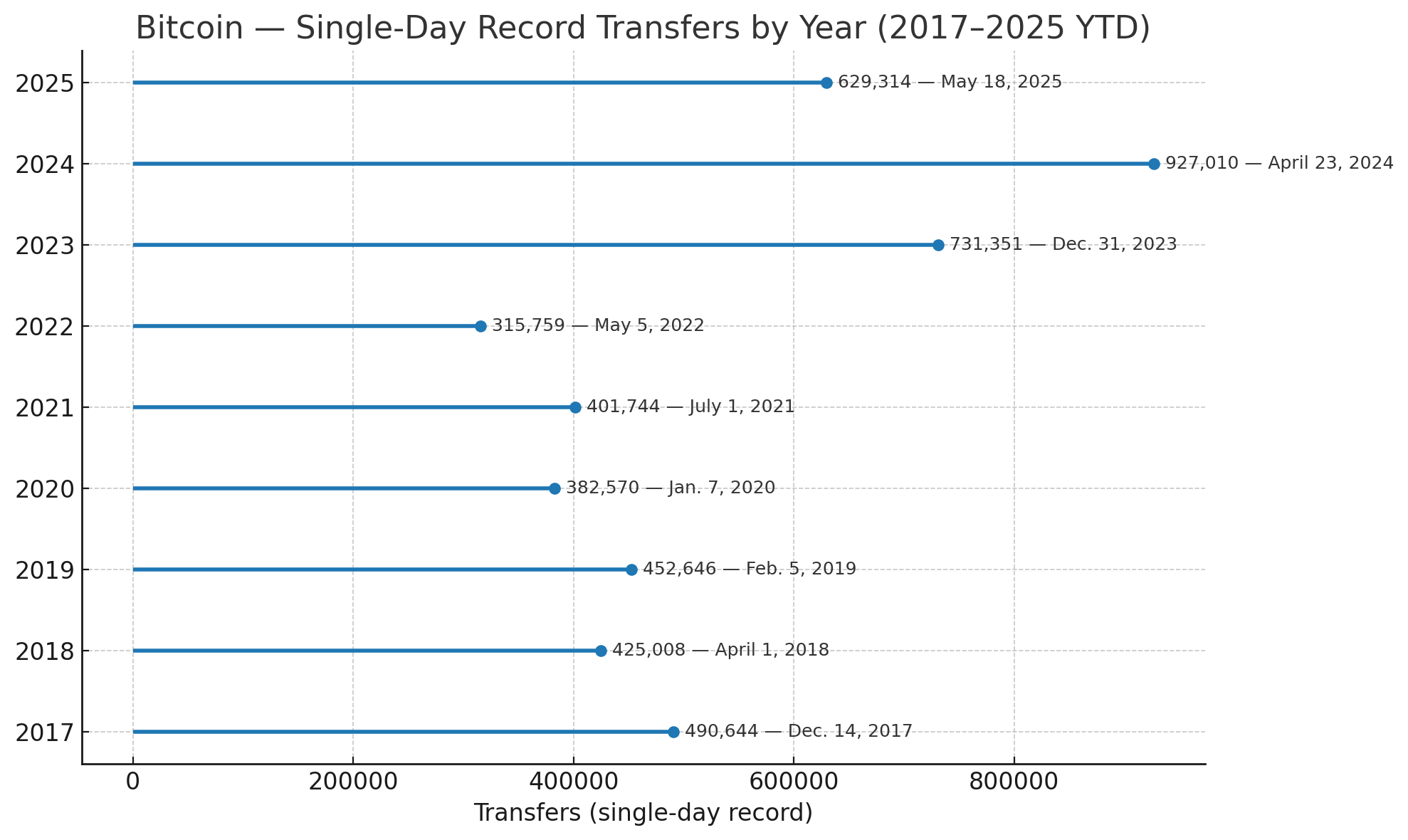

The single busiest day between Jan. 1, 2017, up until now was April 23, 2024, when the Bitcoin network processed 927,010 transfers. By comparison, 2025’s top print to date landed on May 18 at 629,314 transfers, a healthy day by historical standards but well off 2024’s record. The concentration of peak activity last year is notable: the top five days in the data set all sit in 2024, including Aug. 9 (910,083), July 21 (859,629), May 26 (852,655), and July 23 (838,977).

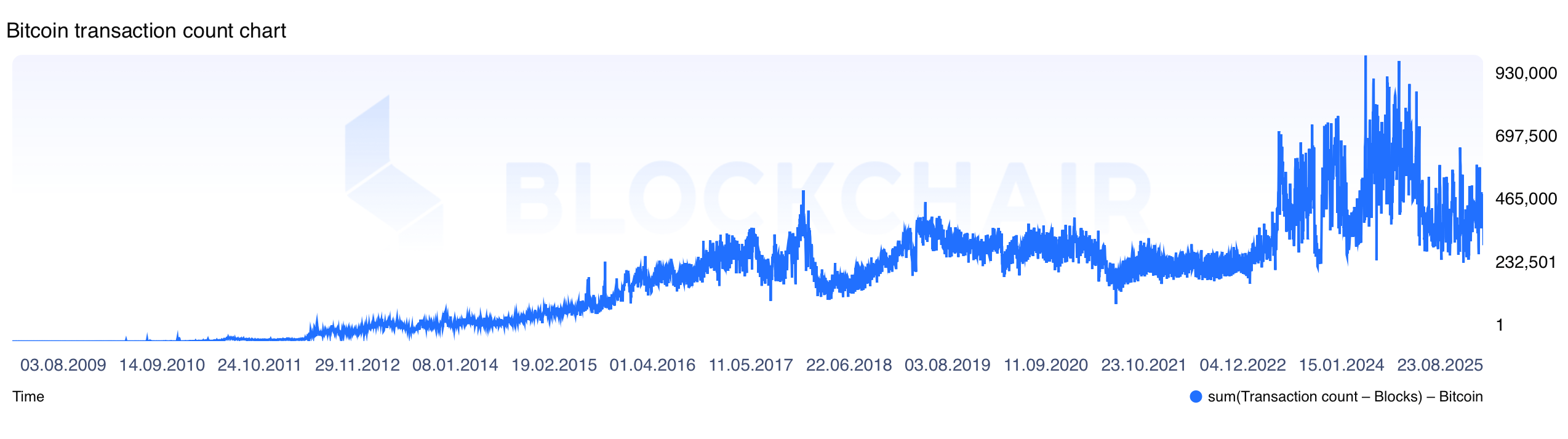

Bitcoin transfers per day according to Blockchair.com data.

According to averages, the step-down is a lot clearer. The 2025 year-to-date mean sits at 395,077 transfers per day, compared with 525,269 per day in 2024. That’s a decline of 24.8% or about 130,000 fewer transfers a day on average. Looking at the same Jan. 1–Aug. 23 window a year earlier, the 2024 average was 518,881, leaving 2025 lower by 23.9% on a like-for-like basis.

Even with the dramatic pullback, 2025 is not a quiet year by longer-run measures. The nine-year average across 2017–2025 is 331,060 transfers per day, and 2025’s 395,077 sits 19.3% above that baseline. In other words, the slowdown is relative to an unusually active 2024 rather than to the broader period since 2017.

Yearly single-day highs trace a long arc of expansion punctuated by bursts: 490,644 (Dec. 14, 2017), 425,008 (April 1, 2018), 452,646 (Feb. 5, 2019), 382,570 (Jan. 7, 2020), 401,744 (July 1, 2021), 315,759 (May 5, 2022), 731,351 (Dec. 31, 2023), 927,010 (April 23, 2024), and 629,314 (May 18, 2025). That 927,010 record is about 2.35 times the 2025 year-to-date average.

Annual bitcoin transaction per day averages tell the same story in smoother form. The series runs 285,105 (2017), 223,002 (2018), 328,174 (2019), 307,523 (2020), 267,935 (2021), 255,086 (2022), 420,318 (2023), 525,269 (2024), and 395,077 year to date (2025). The high watermark is 2024; the weakest annual average belonged to 2018. The latest reading places 2025 roughly 6% below 2023 and 24.8% below 2024.

The distribution of quiet days points to how varied onchain transfer activity can be. The five lowest days in the entire data set include June 27, 2021 (121,538), Jan. 8, 2017 (131,875), Jan. 4, 2018 (135,129), March 25, 2018 (135,274), and Aug. 4, 2018 (138,535). Range also expanded and contracted by year: amplitude (highest minus lowest day) measured 358,769 in 2017, narrowed to 166,984 in 2020, then widened to 543,835 in 2023 and 663,028 in 2024 before easing to 373,242 in 2025 through Aug. 23.

Coverage in the 2017-2025 range is quite comprehensive: 365 daily entries in 2017, 2018, 2019, 2021, 2022, and 2023; 366 in 2020 and 2024; and 203 entries for 2025 through Aug. 23. That breadth makes the comparisons across the nine-year window straightforward and reduces the chance of seasonal gaps affecting the view.

If 2024 was the year of throughput records, 2025 is somewhat a year of normalization in terms of financial transfers compared to OP_RETURN transfers. The Bitcoin network is still moving sizable volumes of transactions daily. It’s simply doing so at a pace that is below last year’s high-octane stretch, and closer to the trend one might expect when extraordinary bursts give way to steadier traffic.

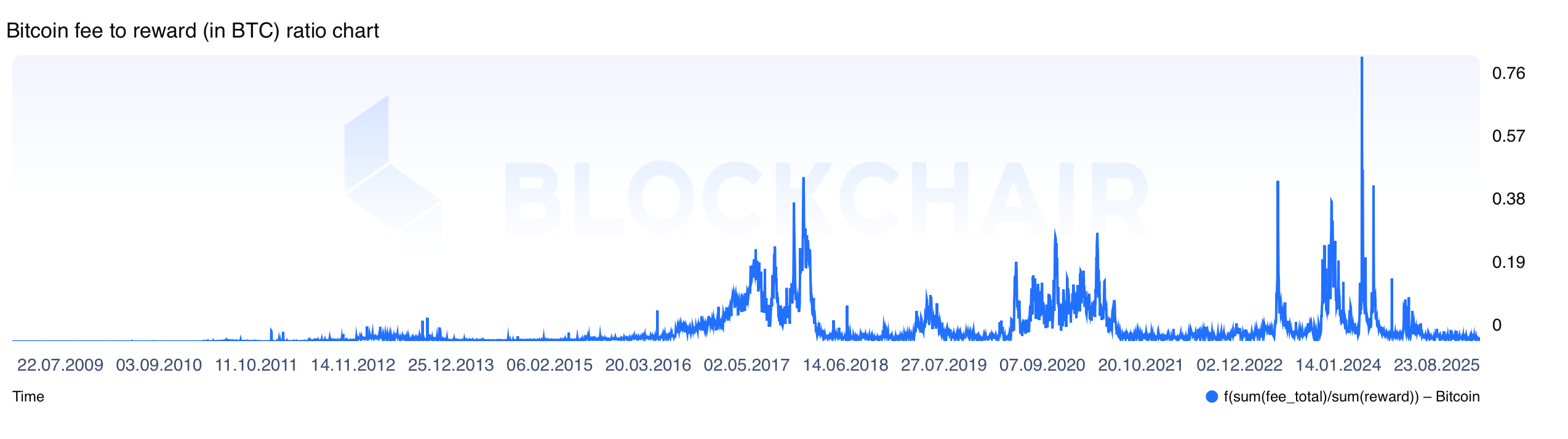

The fee-to-reward ratio adds another but more troublesome layer, and it is striking in 2025. Measured as daily fees divided by daily block rewards, the ratio averages just 1.21% this year through Aug. 23—the lowest level in the nine-year span between 2017 through 2025. By contrast, 2024’s full-year average was 5.60%, and 2023’s was 5.87%; in 2020–2021, the series hovered near 6%. In 2022, it dipped to 1.62% before rebounding in 2023. The 2025 mean sits 77.88% below the 2017–2024 average of 5.49%.

Bitcoin fee to reward ratio according to Blockchair.com data.

The extremes of the fee series cluster around the last halving period. The all-period record arrived on April 20, 2024, at 75.44% of the block reward, followed by April 23, 2024 (45.51%); April 21, 2024 (44.02%); Dec. 22, 2017 (43.57%); and May 8, 2023 (42.60%). That grouping points to a temporary flare-up that was unusually intense and short-lived.

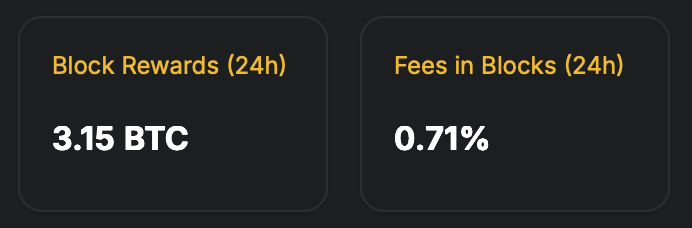

Block rewards and fees in blocks over the last day on Aug. 23, 2025, according to hashrateindex.com.

At the other end, 2025 has logged some of the leanest fee days on record. Among the five lowest in the entire series are Aug. 17, 2025 (0.53%) and June 29, 2025 (0.54%), alongside Jan. 1, 2020 (0.46%); Jan. 25, 2020 (0.55%); and April 17, 2022 (0.52%). This year’s median is 1.14%, and 94.9% of all days in 2025 have printed below 2%. The highest day so far in 2025 is just 3.30% on Feb. 24.

Year-over-year comparisons put the downturn in sharp relief. Against 2024’s full-year average of 5.60%, 2025’s 1.21% implies a drop of about 78%. Comparing the same Jan. 1–Aug. 23 window shows an even larger gap: 7.05% in 2024 versus 1.21% in 2025, a decline of roughly 83% on that like-for-like basis. In practical terms, miners are earning a much smaller slice of their daily revenue from fees this year than they did last year.

Join the two pictures—transactions and fees—and a consistent pattern emerges. The Bitcoin network’s daily transfer counts have stepped down from a cluster of 2024 records, while the fee share has moved from extraordinary to subdued. Neither observation requires conjecture about causes; the timeframe captures the change plainly, both in the counts of transfers and in the ratio that converts network demand into fee revenue for miners.

Context across the nine-year span helps frame expectations. After a low annual average in 2018, transfer activity rose into 2019, eased in 2020–2022, then accelerated in 2023 and peaked in 2024 before cooling this year. Fee share followed its own path: near 6% in 2020–2021, down to 1.62% in 2022, back up to 5.87% in 2023, and then the halving-era spike in April 2024 that quickly faded into 2025’s historically low readings.

It is also worth noting how wide the day-to-day bands can be, even within a single year. The annual low-to-high range stretched from 128,925 in 2022 to 663,028 in 2024, illustrating how bursts and quiet periods coexist inside the same calendar. In 2025 through Aug. 23, the range is 373,242—wider than several prior years, narrower than last year’s blowout.

For readers tracking the network’s cadence, the data is simple. 2024 set the records; 2025 has eased from those heights. Yet 2025 still exceeds the long-run daily average since 2017, which means activity remains solid by historical standards even as it cools from last year’s peak phase.

For miners, the fee picture is even clearer but gloomy. The fee-to-reward ratio in 2025 is low by any recent yardstick, with most days under 2% and only a single day topping 3%. The data’s bottom line is unambiguous: 2025 looks like a normalization year for both network throughput and fee share relative to 2024’s exceptional stretch.

Takeaway for readers: Last year’s records were real and dramatic, and this year’s cooling is equally plain in the numbers. Still, the Bitcoin network continues to move a large volume of transactions each day—above the nine-year average—while the fee-to-reward ratio has reset to low single digits. That combination defines 2025 so far: steady traffic by historical standards and a notably thin fee component for miners.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。