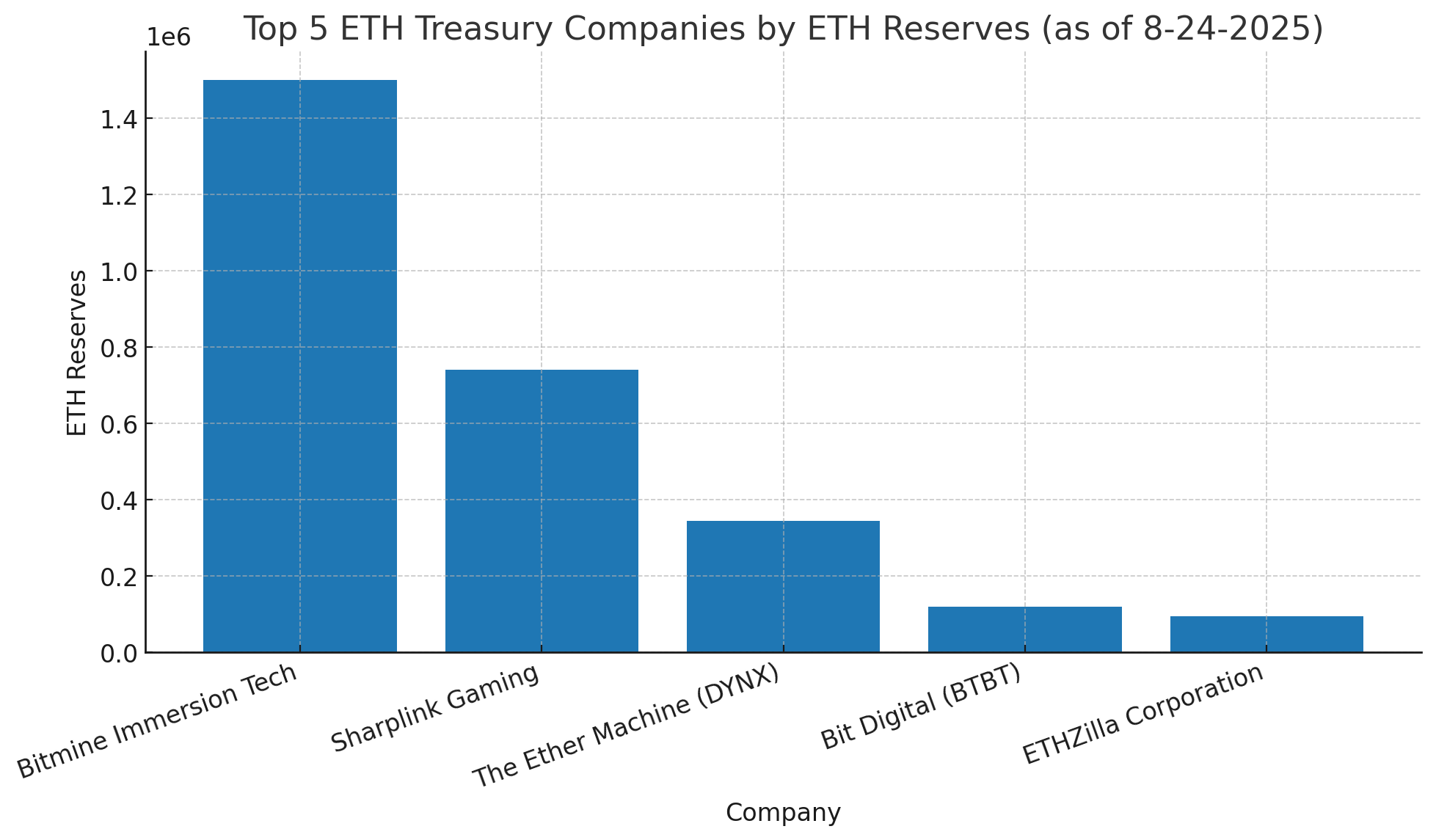

This year’s theme has revolved around institutional adoption of crypto assets. After Strategy, formerly Microstrategy, kicked off the wave of corporate bitcoin buying, a string of publicly traded companies began following suit with ethereum ( ETH) and other alternative crypto assets. For instance, as of Aug. 24, 2025, ten publicly traded companies hold 2,955,200 ETH, with a combined value of about $14.2 billion.

Topping the rankings is Bitmine Immersion Tech, holding an impressive 1.5 million ETH worth $7.29 billion. Over the past six months, NYSE: BMNR has climbed 727%, though in the last five sessions, Bitmine has slipped 12%.

Next up is Sharplink Gaming with 740,800 ETH valued at $3.55 billion. In 183 days, Nasdaq: SBET has gained 270%, but the last five trading days saw SBET drop over 7%.

In third place is The Ether Machine, sitting on 345,400 ETH worth $1.65 billion. Also known as Dynamix Corporation (Nasdaq: DYNX), the company is up more than 10% over six months, though DYNX dipped 0.37% in the past five days.

Source Data: strategicethreserve.xyz

Bit Digital grabs the fourth spot, holding 120,300 ETH valued at $575 million. Nasdaq-listed BTBT has slipped 4% over the past 183 days and is down another 8.4% in the last five.

ETHZilla Corporation isn’t far behind in fifth place, with 94,700 ETH worth $453.2 million. Nasdaq-listed ETHZilla Corporation, with the ticker ETHZ has risen 148% higher over the six-month span, but five-day stats show a 51% decline.

Further down the ranking, BTCS Inc. controls 70,000 ETH worth $335 million, while FG Nexus holds 47,300 ETH valued at $226 million. Gamesquare Holdings, best known for its esports ventures, owns 15,600 ETH, totaling $74 million.

ETH Strategy takes ninth place with 12,300 ETH valued at $59 million, and Intchains Group closes out the top ten with 8,800 ETH worth $42.2 million. Altogether, the ten publicly traded firms command 2.45% of the circulating 120,707,592 ETH.

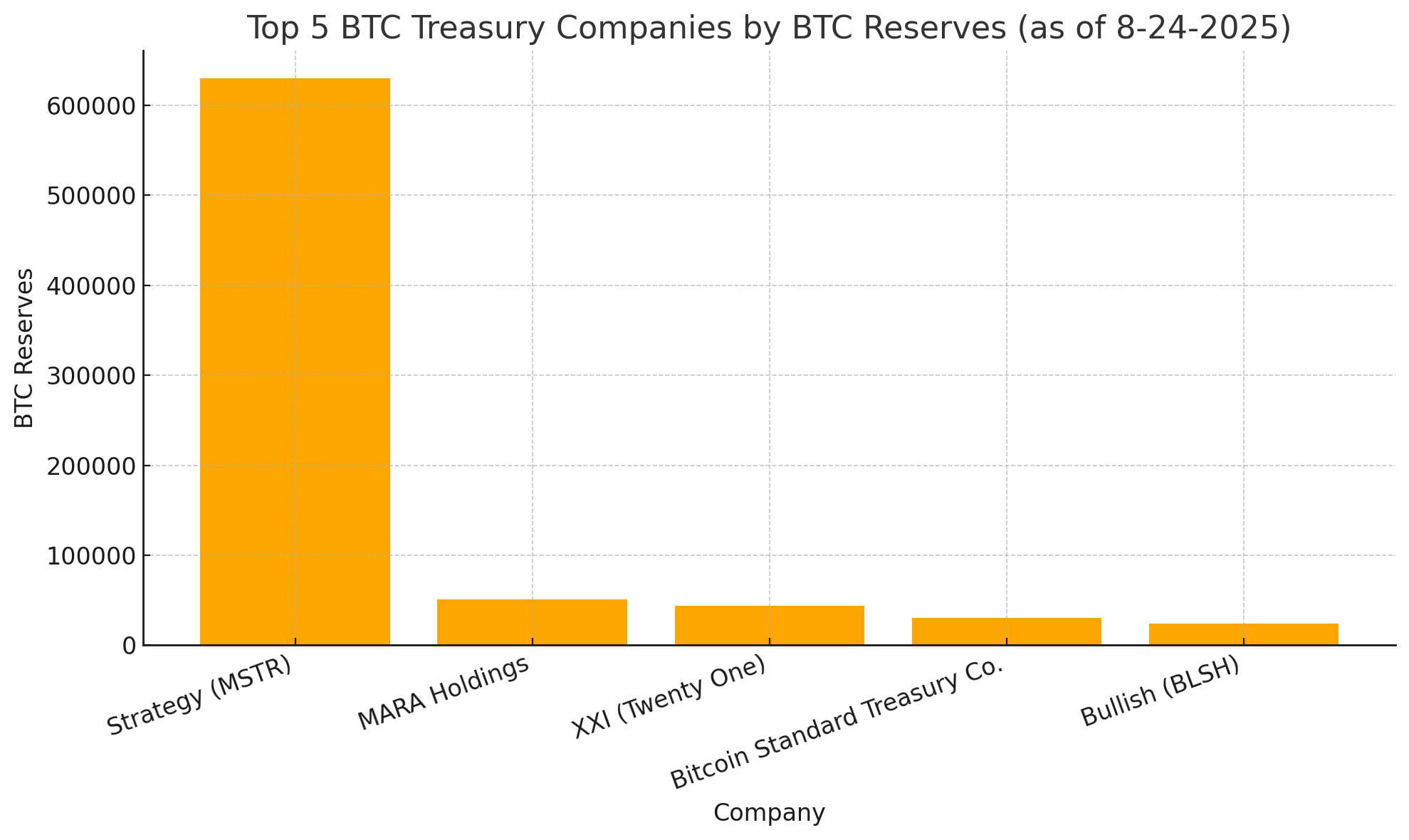

In the bitcoin (BTC) arena, Strategy stands as the largest corporate holder by a wide margin with 629,376 BTC worth $72 billion. Nasdaq-listed MSTR has gained 9% in the past six months but slipped 3.7% over the last week.

Well behind but still significant, MARA Holdings holds 50,639 BTC worth $5.79 billion. Its Nasdaq-listed shares are up 0.09% over six months, after seeing a 3.8% rise in the past five days.

XXI, also known as Twenty One, ranks third with 43,514 BTC valued at $4.97 billion. The company is not yet publicly traded and is preparing for its debut following a business combination with Cantor Equity Partners.

Source Data: bitcointreasuries.net

Bitcoin Standard Treasury Company takes fourth with 30,021 BTC worth $3.43 billion and, like XXI, has not yet entered the market. It is gearing up to list on Nasdaq through a merger with Cantor Equity Partners I (CEPO).

The newly listed NYSE firm Bullish (BLSH) reports 24,000 BTC valued at $2.74 billion today on its balance sheet and has climbed 88% from its debut price. BLSH, however, slid more than 6% in the past week.

In sixth place, Riot Platforms holds 19,239 BTC, while Japan’s Metaplanet has secured 18,888 BTC. Trump Media & Technology Group counts 15,000 BTC on its balance sheet, with Cleanspark holding 12,703 BTC and Coinbase Global closing the top ten at 11,776 BTC.

Altogether, these ten companies control 855,156 BTC—valued at over $97 billion. Both the ether and bitcoin treasury firms highlight crypto’s role as a centerpiece for some of the world’s boldest corporate players.

Statistics collected for this article stemmed from strategicethreserve.xyz and bitcointreasuries.net on Aug. 24, 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。