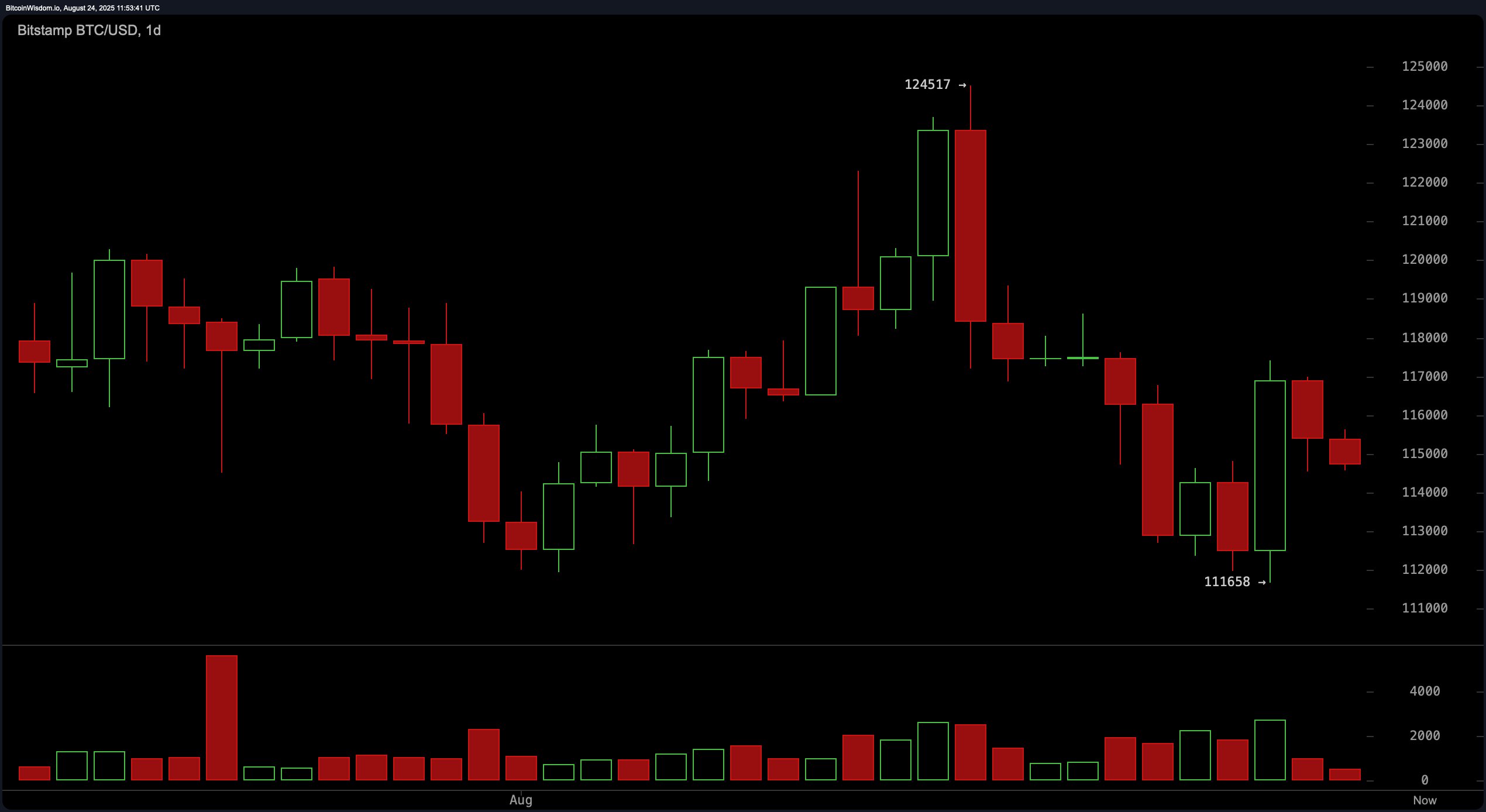

On Aug. 24, leveraging the daily chart, bitcoin is displaying a bearish tone with clear signs of distribution. A double top formation near $124,000, followed by a breakdown below the $117,000 support, signals a shift in momentum. The most recent bounce off $111,658 failed to reclaim prior highs, indicating waning bullish strength. Volume analysis confirms this weakness, with heavy selling pressure on red candles and a lack of conviction on rebounds. For traders, the key reversal zone remains above $117,000, while a break below $111,658 could catalyze further downside.

BTC/USD 1-day chart via Bitstamp on Aug. 24, 2025.

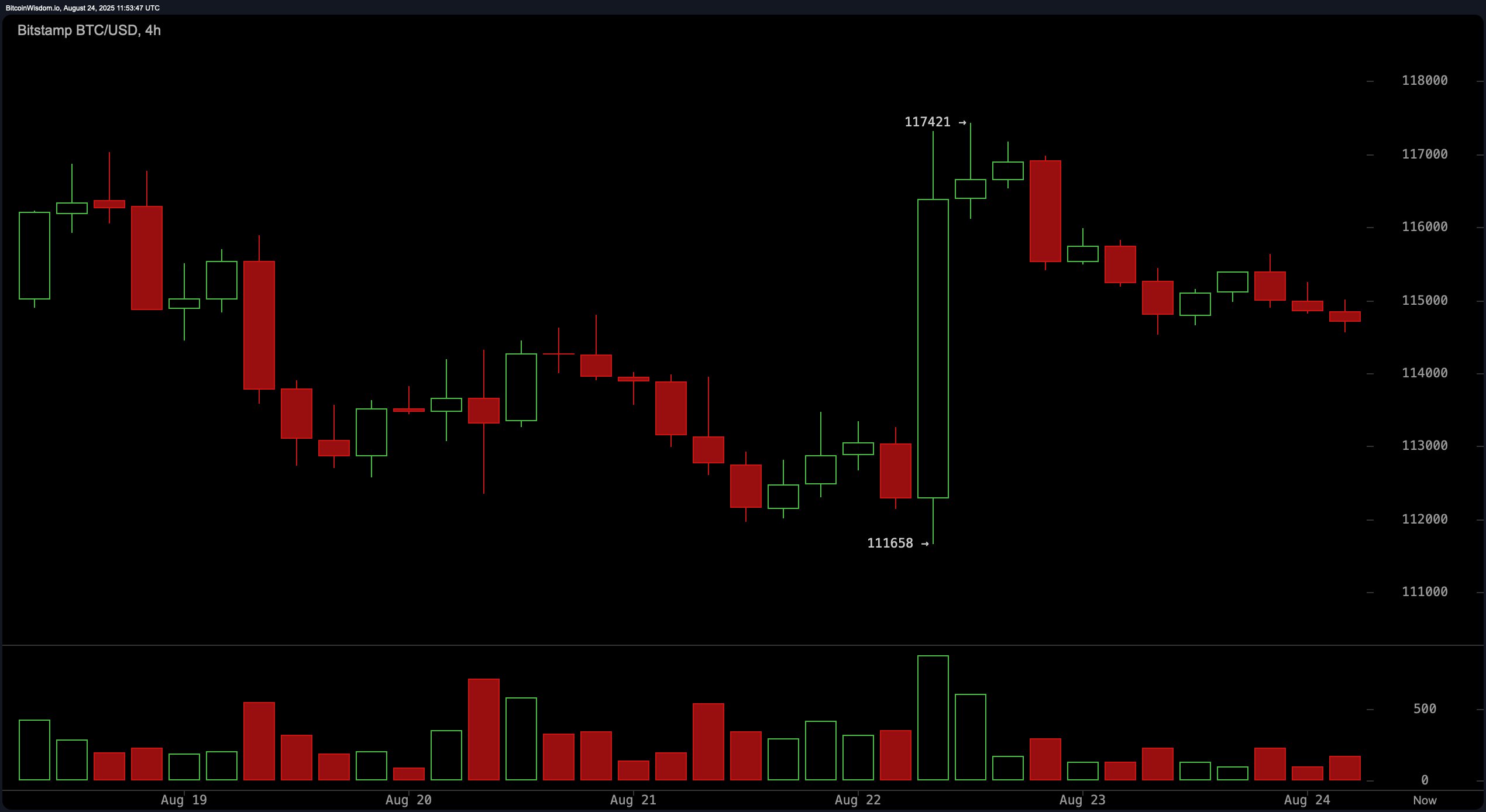

The 4-hour bitcoin chart points to a failed recovery attempt. A sharp wick from $111,658 to $117,421 suggests a short squeeze, yet the lack of sustained follow-through has led to the formation of a bearish flag. Price action has since drifted lower, forming a sequence of lower highs—a classic sign of weakening momentum. The volume spike during the recovery phase points to panic buying, not accumulation. Short entries may be considered if bitcoin breaks below the $114,000–$114,500 support zone, potentially revisiting or undercutting $111,658.

BTC/USD 4-hour chart via Bitstamp on Aug. 24, 2025.

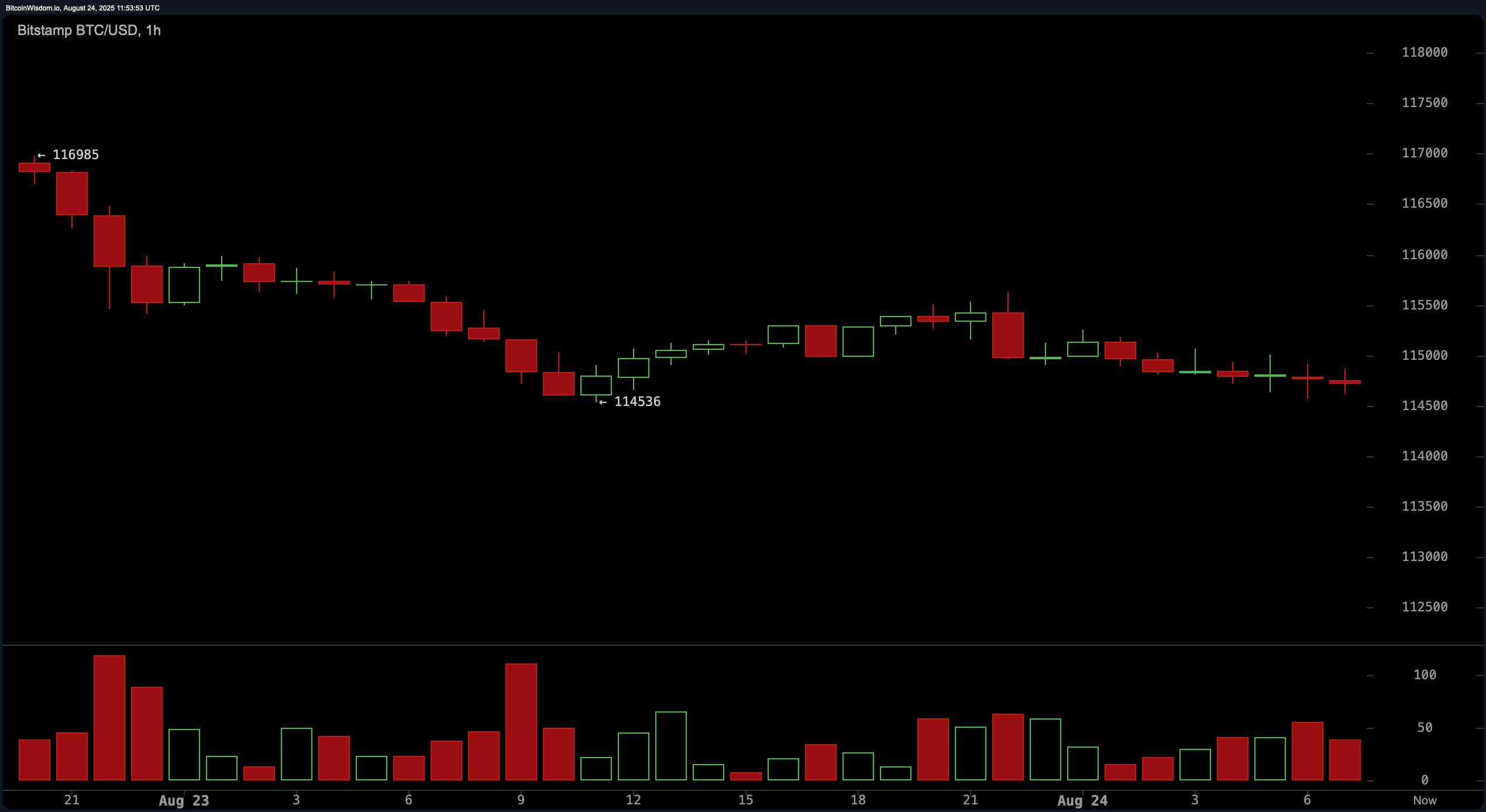

On the hourly chart, bitcoin is locked in a narrow trading band with resistance at $115,000. Price action is marked by tight candles and declining volume, signaling a buildup phase. This sideways movement reflects a market waiting for a decisive catalyst. A breakout above $115,500, accompanied by volume, could prompt a short-term move to $116,500. Conversely, rejection at current levels, especially if selling volume increases, may drag prices back toward $114,000 or lower.

BTC/USD 1-hour chart via Bitstamp on Aug. 24, 2025.

Momentum indicators and oscillators offer a mixed outlook. The relative strength index (RSI) is at 47, reflecting a neutral stance, while the Stochastic oscillator at 31 also signals indecision. The commodity channel index (CCI) stands at −62, and the average directional index (ADX) reads 16—both reinforcing the prevailing lack of a dominant trend. The Awesome oscillator shows a −2,313 print (neutral), while momentum itself is slightly bullish at −3,712. Notably, the moving average convergence divergence (MACD) level at −365 indicates a bearish bias.

Moving averages (MAs) lean heavily bearish across short- to mid-term timeframes. The 10-, 20-, and 30-period exponential and simple moving averages (EMA and SMA) all register bearish signals. These include the 10-period EMA at 115,599 and the 20-period SMA at 116,748. However, longer-term indicators paint a more supportive picture: the 100- and 200-period EMAs and SMAs are positioned well below current price levels, with the 200-period SMA at 100,800, suggesting underlying structural support.

In summary, bitcoin is currently navigating a consolidation phase within a broader corrective structure. Technical conditions remain fragile with potential for downside if $114,000 fails to hold. Upside opportunities depend on a clear break above $115,500 and preferably $117,000, supported by rising volume. For now, traders are advised to monitor volume closely as the market readies for its next move.

Bull Verdict:

If bitcoin can decisively reclaim the $117,000 level with accompanying volume, the technical landscape could shift in favor of the bulls. Until then, upward momentum remains speculative, but long-term moving averages suggest structural support is intact for a renewed rally.

Bear Verdict:

With price action stalling below key resistance and multiple indicators flashing weakness, the bears maintain the upper hand. A breakdown below $114,000, especially with increased volume, could accelerate losses toward the $111,000 zone and potentially as low as $105,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。