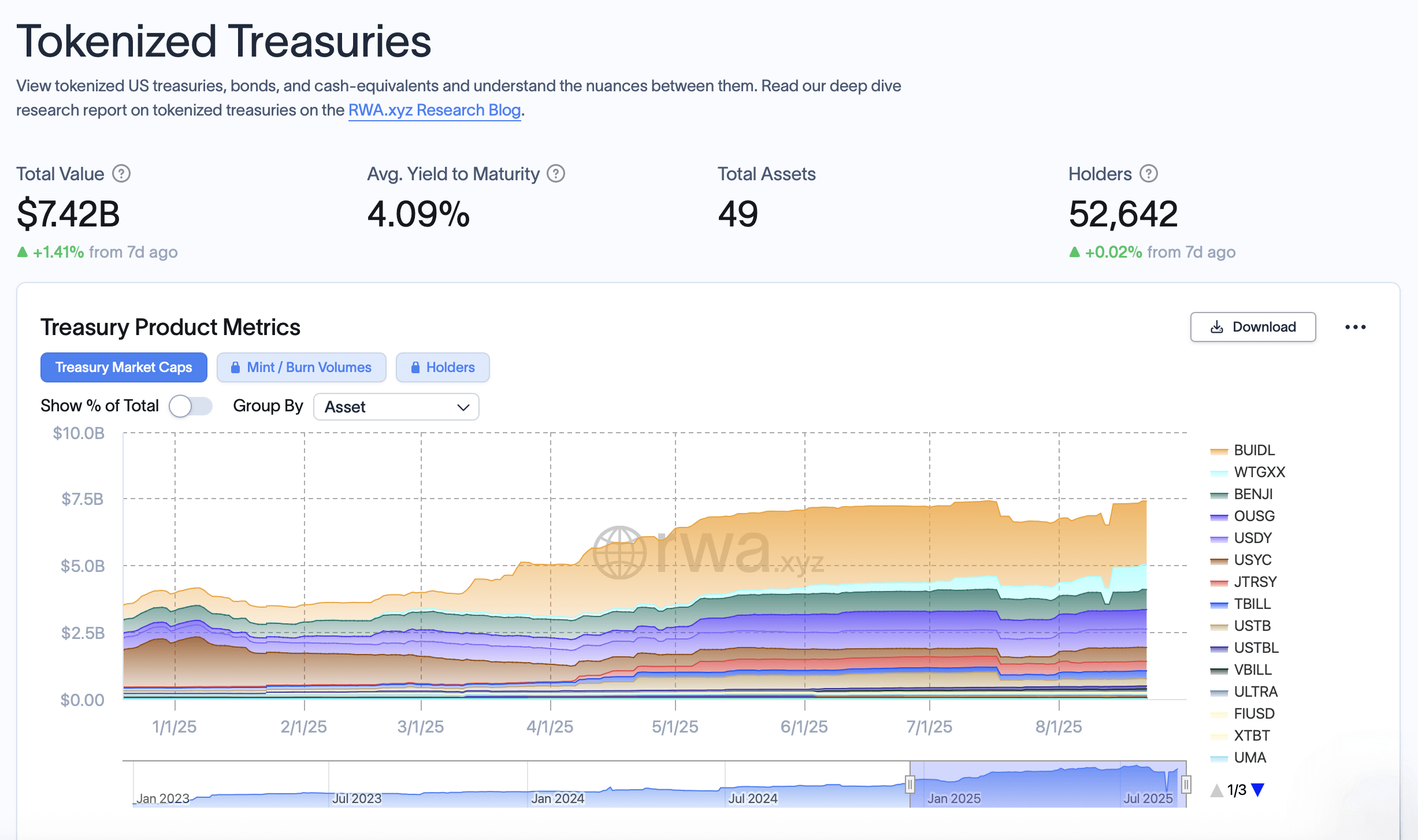

The latest figures from rwa.xyz show growth of 1.41% from a week ago, with tokenized bond products continuing to attract investors seeking onchain exposure to government-backed assets. Currently, the market spans 49 separate assets across multiple issuers and protocols, with an average yield to maturity of 4.09% and more than 52,600 unique holders.

Source: rwa.xyz stats on Aug. 23, 2025.

Blackrock’s USD Institutional Digital Liquidity Fund (BUIDL), issued through Securitize, remains the largest tokenized Treasury product with a market cap of $2.38 billion. Wisdomtree’s Government Money Market Digital Fund (WTGXX) follows with $931 million across Ethereum, Stellar, Solana, Avalanche, and Arbitrum. Franklin Templeton’s Onchain U.S. Government Money Fund (BENJI) ranks third at $748 million, hosted on multiple chains including Ethereum, Stellar, and Polygon.

Rounding out the top five, Ondo’s Short-Term U.S. Government Bond Fund (OUSG) holds $732 million, while Ondo’s U.S. Dollar Yield (USDY) carries $688 million in market value. Circle’s USYC sits close behind at $519 million and is accessible across Ethereum, Solana, and other networks.

The remaining three in the top ten include Janus Henderson’s Anemoy Treasury Fund (JTRSY) at $357 million, Openeden’s TBILL Vault at $290 million, and Superstate’s Short Duration U.S. Government Securities Fund (USTB) at $276 million. Spiko’s U.S. T-Bills Money Market Fund (USTBL) closes the group at $110 million, while the eleventh-place contender, Vaneck’s VBILL, holds $75 million.

By blockchain, Ethereum dominates the sector with $5.3 billion of the total market cap. Stellar accounts for $511 million, BNB Chain $345 million, Solana $304 million, Arbitrum $160 million, Avalanche $139 million, and XRP Ledger $132 million. Collectively, these networks have witnessed a rapid expansion of tokenized bond markets, specifically Ethereum, but also diversifying liquidity across several chains.

Net flows over the past 30 days reveal shifting investor allocations. Wisdomtree’s WTGXX saw the largest inflows at $444 million, followed by Circle’s USYC at $275 million and Openeden’s TBILL Vault at $102 million. On the other hand, Franklin Templeton’s BENJI experienced outflows of $103 million, alongside $51 million leaving Anemoy’s JTRSY and $22 million from Blackrock’s BUIDL.

The return to record TVL levels signals ongoing demand for blockchain-based Treasuries as investors seek digital, liquid, and yield-bearing assets. With institutional players such as Blackrock, Wisdomtree, and Franklin Templeton anchoring the market, tokenized bonds remain one of the fastest-growing segments in real-world asset (RWA) finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。