CME’s Fedwatch tool, along with bets placed on Polymarket and Kalshi, point to easing next month. Data from the Fedwatch tool on cmegroup.com shows a 75% probability of 25 basis points (bps), or quarter-point, cut as of Aug. 23, 2025. The odds still leave a 25% chance the Fed holds the federal funds rate steady.

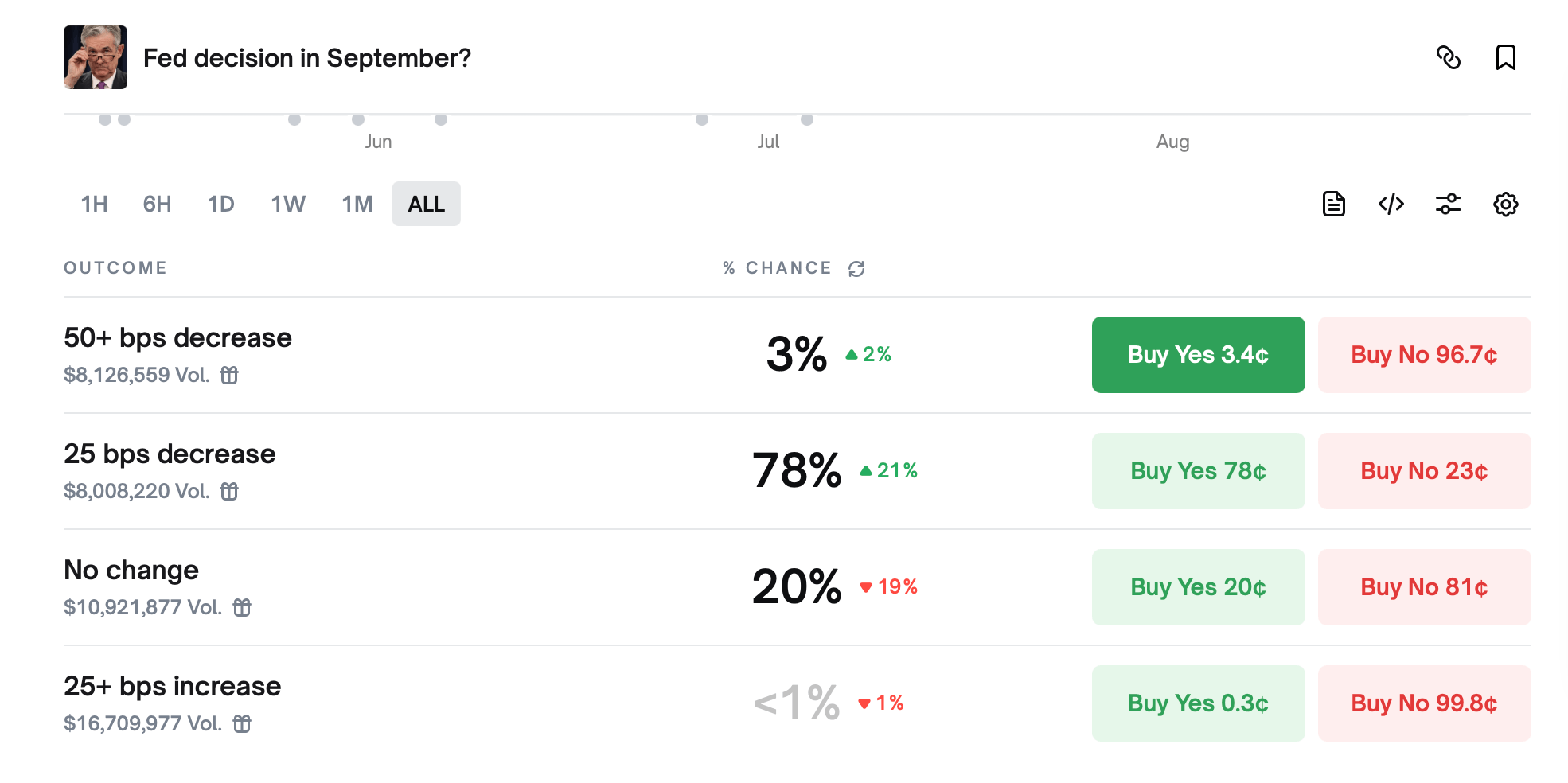

Prediction markets on Polymarket are leaning hard toward a September rate cut from the Federal Reserve, with traders nearly unified on the size of the move. Odds of a 25 basis point trim after the September 2025 meeting now stand at 78%, a jump of 21% in recent sessions.

Source Image: Polymarket Fed bet on Aug. 23, 2025, the day after Powell’s Jackson Hole talk.

The outlook for a rate cut of any size by September is even firmer at 80%, while the probability of a cut sometime in 2025 has swelled to 93%. Breaking it down, only 3% of bets price in a larger 50 basis point move, and less than 1% wager on an increase—showing traders see virtually no chance of the Fed tightening.

Meanwhile, the odds of “no change” have tumbled to 20%, down 19 points as expectations shift toward easing. Millions of dollars are stacked behind the 25 basis point option, while bets on a pause or a surprise hike are thinning quickly. Kalshi’s markets tell the same story, showing a decisive lean toward a September cut that mirrors Polymarket’s momentum.

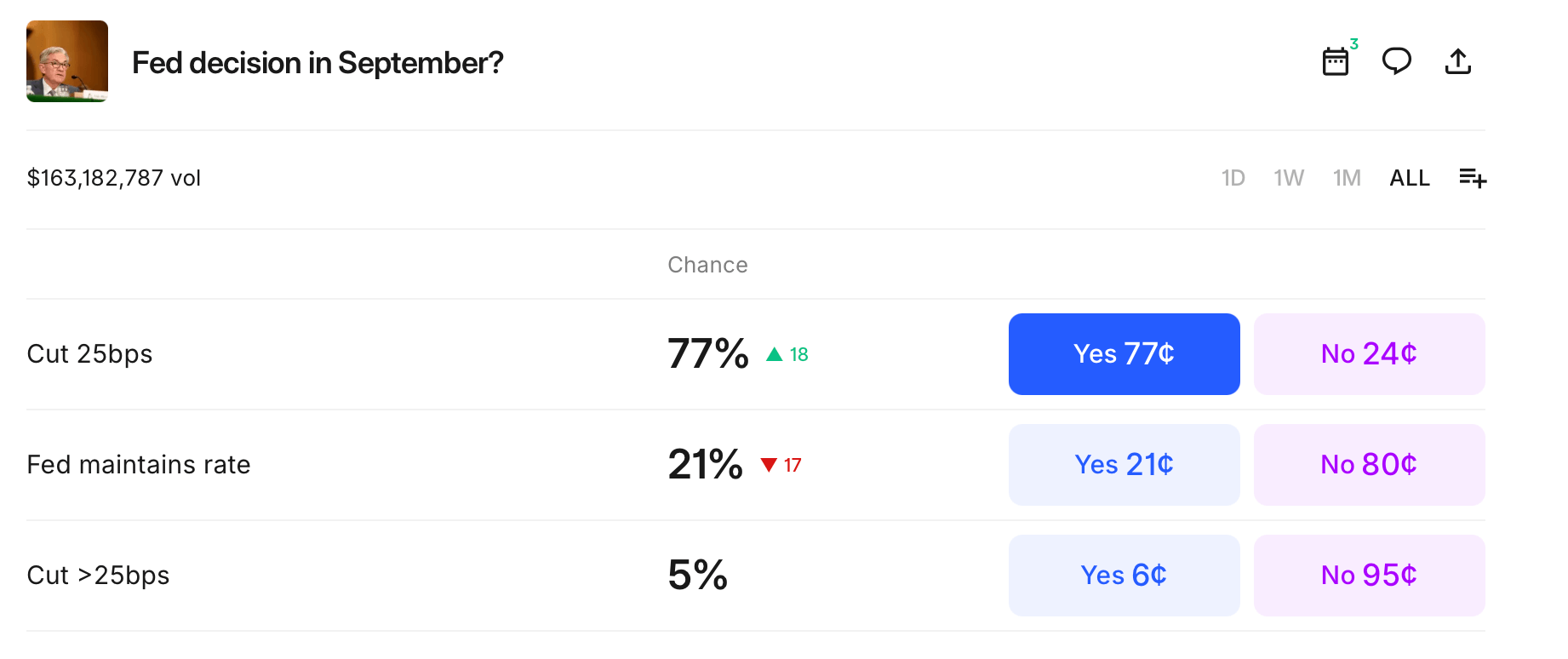

Source Image: Kalshi Fed bet on Aug. 23, 2025.

On Kalshi, traders are pricing a 77% chance the Fed trims rates by 25 basis points, up 18 points in recent activity. The probability of the central bank holding steady has slid to 21%, a 17-point drop, as sentiment swings in favor of easing.

There’s still a thin 5% priced in for something more aggressive than a quarter-point, but conviction is squarely behind the smallest possible move. With over $163 million in wagers shaping these odds, Kalshi reflects strong agreement that the Fed will favor a cautious 25 basis point cut over standing pat or attempting a bolder policy shift.

In short, CME futures, Polymarket, and Kalshi are aligned: September looks like the kickoff for Fed easing, with Powell’s team expected to deliver a measured quarter-point cut instead of a dramatic swing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。