Yesterday, BNB broke through $880, setting a new historical high. In this upward cycle driven by treasury strategies and structured finance, BNB Chain has transformed from merely a high-frequency trading network into the main battlefield for the on-chainization of native assets.

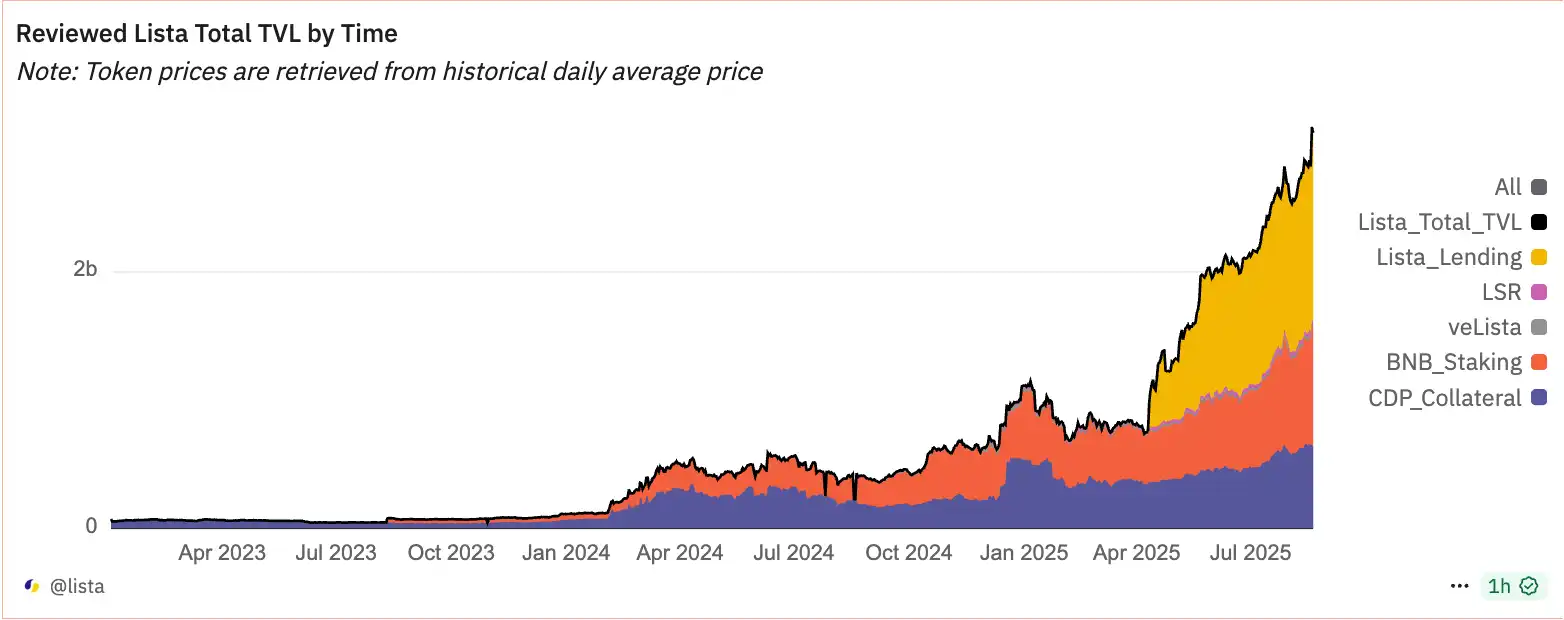

On this battlefield, Lista DAO has quietly taken center stage, becoming the project with the highest TVL on BNB Chain. It not only supports the largest liquid staking market in the BNB ecosystem but also leads multiple core asset pathways, including stablecoins, lending, re-staking, and strategy aggregation, with TVL surpassing $3 billion.

Since Trump returned to the White House, the U.S. has rapidly promoted a series of cryptocurrency-related policies and bills, among which the most representative is the "GENIUS Act." This legislation clarifies the compliance framework for stablecoins and on-chain finance, providing institutional support for the crypto project WLFI led by the Trump family and its dollar-pegged stablecoin USD1.

In this context, USD1 has gradually become the core settlement asset of the BNB ecosystem, while Lista DAO has grown into the largest on-chain liquidity hub for USD1 in just a few months, with the scale in its treasury exceeding $100 million.

Why does the strategic gap in BNBFi need a Lista DAO?

The biggest contradiction in BNB Chain lies in its asset density and abundant liquidity, yet it lacks a composable on-chain yield structure. Ethereum has built a complete "staking—stablecoin—leverage—strategy—structured asset" system with collaborative ecosystems like Lido, Maker, and Pendle, while the BNB ecosystem remains at the stage of "assets being integrated upon launch."

For a long time, BNB assets have mainly been trapped in Binance CEX, with no standardized liquid staking protocol on-chain, and lacking lending and stablecoin infrastructure that supports leverage and yield nesting. The proportion of lending in on-chain TVL is less than 35%, far below Ethereum's over 50%.

In this context, the systemic concept of "BNBFi" has begun to take shape. It is not a single project but rather Binance's overall financial strategy for the on-chainization of native assets. Lista DAO is entering with a "trinity" product structure, becoming the first piece of the puzzle that transforms BNBFi from concept to reality. The emergence of USD1 has provided BNB Chain with a prototype of a "structural stablecoin" for the first time; it is not merely a pegged asset circulating on-chain but an engine that can deeply participate in strategy deployment, compound yields, and liquidity aggregation.

How to construct the lifecycle of BNB on-chain assets?

With the goal of "all in BNBFi," Lista DAO has built a complete asset lifecycle framework for BNBFi through the combination of three types of assets: lisUSD, slisBNB, and slisBNBx. Starting with the native BNB, it enters the collateral or staking path, mints the stablecoin lisUSD, participates in various strategy deployments, builds leverage or compound yields through Lending, and connects to CEX new listing paths via slisBNBx, ultimately achieving yield reinvestment and liquidity circulation.

In the future, with the introduction of more assets and market expansion, Lista Lending and its derivative products will become the key supporting layer of the structured financial ecosystem on BNB Chain—connecting the entire chain's closed-loop system from asset generation, liquidity deployment, to strategy aggregation and yield extraction.

Lista Lending: Reconstructing DeFi Capital Efficiency

Lista Lending went live in April this year, adopting a peer-to-peer architecture similar to Morpho, featuring modularity, risk isolation, and market freedom of creation. Each market can independently set parameters, enabling permissionless strategy deployment and fund distribution.

This mechanism enhances the capital utilization rate on BNB Chain while completing the closed loop of Lista products: funds can enter the collateral system through slisBNB, lend out lisUSD to participate in strategy deployment, and assets circulate and appreciate among various modules. Currently, the TVL of Lista Lending has exceeded $1.5 billion, and as shown in the chart, it has become the backbone of Lista DAO's TVL growth since Lending went live.

slisBNB and slisBNBx: Connecting Staking and New Listing Yields

slisBNB is Lista's native liquid staking token, and as a core product, it brings multiple yields, including validator node rewards and re-staking yields. slisBNBx serves as a collateral certificate token used to participate in Launchpool and other on-chain new listings. Users can stake BNB/slisBNB to obtain lisUSD while minting slisBNBx to participate in new listings, connecting multiple yield pathways.

USD1: Starting Point for Stablecoin Strategy and Yield Hub

In May 2025, Lista DAO completed the deep integration of the USD1 stablecoin launched by the Trump family project World Liberty Finance, incorporating it into treasury collateral assets, CDP minting logic, liquidity deployment paths, and even the Launchpool new listing mechanism, achieving almost "full-path coverage" from user entry to strategy exit. Currently, USD1 has become the starting point for internal strategies and the core liquidity asset of Lista, and leveraging this wave of political and financial integration, Lista DAO has become the circulation hub for USD1 across the network, reflecting its capability for deep integration of external assets.

Unlike traditional stablecoins, where anchoring ends the process, USD1 within the Lista DAO system becomes an embeddable, composable, and compoundable strategy component—this is fundamentally what distinguishes it from purely settlement-based stablecoins like USDT and FDUSD. As of August, the circulation of USD1 on the Lista DAO platform has surpassed $200 million, reflecting its high acceptance in the stablecoin market and validating Lista DAO's capacity as a "liquidity backbone."

Specifically, USD1 has two strategic roles within the Lista system:

As a highly adaptable entry asset, users can deposit USD1 into the Vault to unlock BNB for participation in Launchpool, or they can collateralize it in the CDP module to mint lisUSD and participate in stablecoin mining on PancakeSwap;

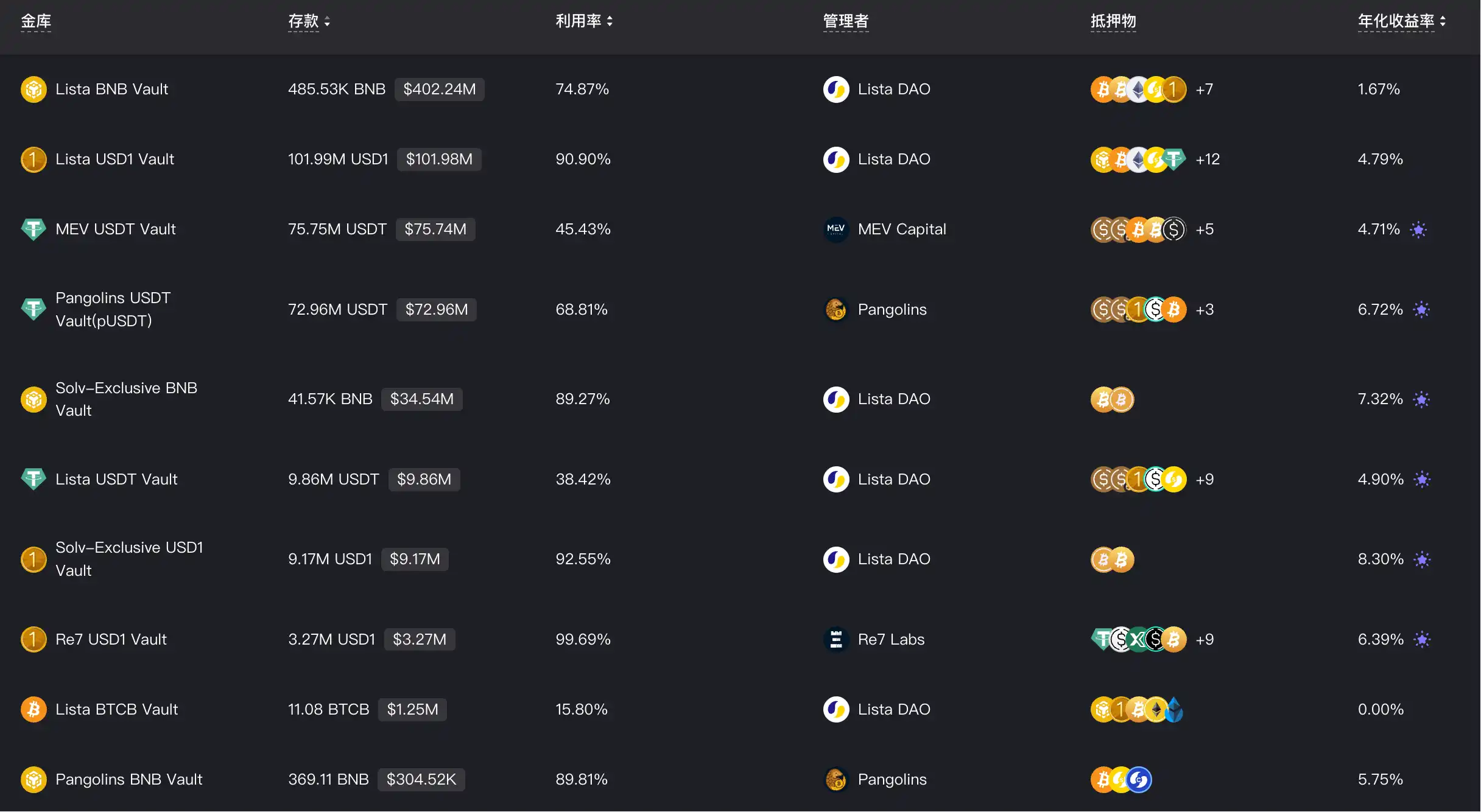

As a cross-module yield medium, USD1 is minted by users collateralizing assets like slisBNB, slisBNBx, or LP Tokens, and can then be used to access Lending and strategy Vaults, thereby achieving compound yields and completing the full chain closed loop from asset collateralization—stablecoin generation—strategy deployment—yield extraction. Currently, the platform has launched over ten vaults, including BNB, USD1, and USDT, with those related to USD1 ranking high in terms of deposit amounts, utilization rates, and yields.

While other protocols remain at the stage of "asset access equals integration," Lista DAO has internalized USD1 as part of the platform's yield structure, enhancing USD1's DeFi usability and making it the most penetrating intermediary asset within the BNBFi structure. In other words, USD1 is not an "asset accessing Lista," but rather transformed by Lista DAO into a "liquidity backbone" and "structured yield engine." This deep binding has also become one of Lista's greatest competitive advantages over other BNB Chain protocols.

From lisUSD to USD1, Lista DAO is gradually constructing a stablecoin layer oriented towards strategy adaptability and guided by yield-driven liquidity, making it no longer just a collection of DeFi protocols but more like a "BNBFi central bank" with open financial hub capabilities.

The Strategic Structural Role of Lista DAO: The Total Entry Point for BNBFi Funds

The rise of Lista DAO does not stem from breakthroughs in single-point functions but rather from the simultaneous efforts of institutional, structural, and strategic mechanisms, gradually building an on-chain infrastructure role that is hard to bypass. Especially as BNBFi gradually evolves into the strategic core of Binance's on-chain assets, Lista DAO is no longer just a lending protocol but has become the standard layer in the paths of liquidity release, collateral asset circulation, and yield conversion.

Currently, in the BNBFi ecosystem, whether it is Pendle's PT, YT-slisBNBx, Aster's asBNB, Solv's solvBTC.BNB, or Kernel's strategy-structured assets, their contract paths almost all rely on Lista DAO's slisBNB or slisBNBx.

This means that Lista DAO is not merely an application protocol but the structural master switch for assets in the BNBFi ecosystem. Any funds wishing to enter the strategy layer or re-staking path must first go through Lista DAO for staking or lending to generate original certificates. slisBNB is the generation point for composable assets, slisBNBx is the strategy entry certificate, lisUSD is the universal liquidity unit, and Lista Lending is the system engine for leverage and yield amplification.

The Only Bridge for Strategic Assets on Binance Chain

For a long time, BNB in Binance CEX has been difficult to on-chain, while Lista DAO provides a path that does not require changing asset custody logic. Users can entrust BNB to generate slisBNB and access on-chain yields; or collateralize BNB to generate slisBNBx to participate in Launchpool new listings, or lend out lisUSD for leverage and strategy deployment.

Currently, the only on-chain assets that connect the entire process of Megadrop, Launchpool, and HODLer airdrops are slisBNB and slisBNBx launched by Lista DAO. This is not a product collaboration but a structural path binding.

As of August 2025, the TVL of Lista DAO has surpassed $3 billion, becoming the actual backbone of the restructuring of BNBFi:

slisBNB has become the most mainstream liquid staking asset on BNB Chain, with a TVL of $900 million, accounting for nearly 99% of the network's liquid staking market. The comprehensive annualized yield provided by slisBNB is approximately 11.58%, which includes 10.84% from Launchpool yields and 0.74% from basic liquid staking yields, with a total staking volume of about 1,103,931 BNB.

The current circulating supply of lisUSD is approximately $67.78 million, backed by total collateral assets exceeding $500 million, resulting in an overall collateralization rate of over 1000%.

The TVL of Lista Lending has surpassed $1 billion, making it the second-largest lending protocol on BNB Chain.

Data source: Project official website, Coingecko, Defillama

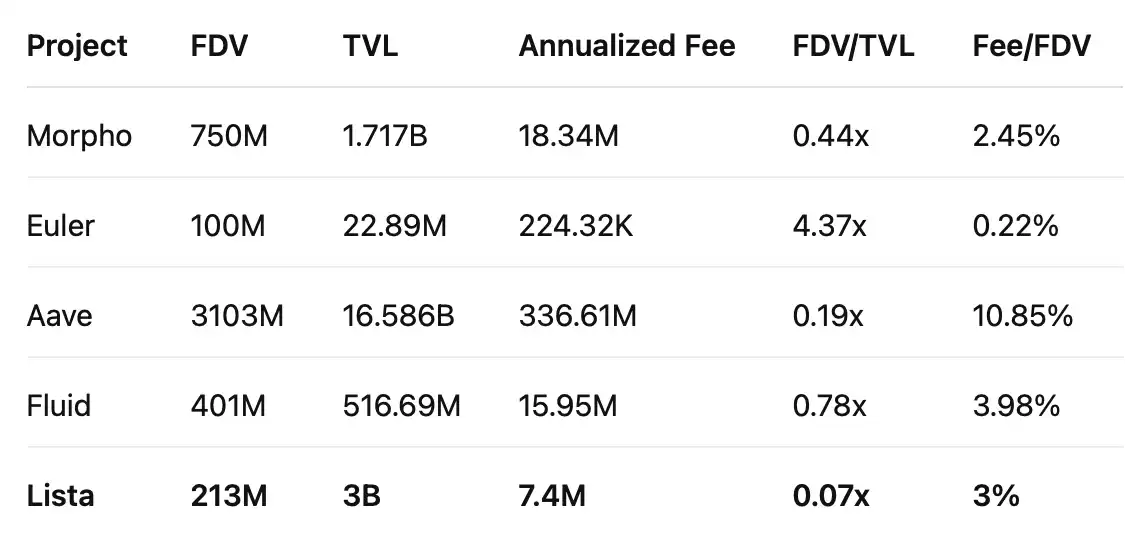

From an on-chain metrics perspective, Lista's current FDV is $213 million, while its TVL has reached $3 billion, resulting in an FDV/TVL ratio of only 0.07x, meaning that for every $1 of protocol valuation, it supports $14.1 of on-chain assets. This multiple remains significantly ahead of comparable projects, highlighting the "value gap" position that Lista occupies.

In contrast, Aave, Morpho, and Fluid have FDV/TVL ratios of 0.19x, 0.44x, and 0.78x, respectively, indicating that the market has partially reflected their protocol maturity or profitability. Despite its massive TVL, Lista has yet to achieve a corresponding market valuation, possibly due to the pace of its token release, the income structure not being fully revealed, or the market still observing its protocol stability and development path.

The success of Lista DAO does not stem from a single breakthrough but from the simultaneous reconstruction of institutional architecture, funding pathways, and yield structures. Whether efficiently integrating USD1 to seize market opportunities or launching the mascot meme Moolah to connect with the community, Lista DAO seems to consistently find the best balance between structure and sentiment.

With the rapid rise in TVL, Lista DAO is also actively optimizing its token economic model. In August 2025, the official announcement confirmed the completion of a 20% total supply burn of LISTA, marking the largest supply-side contraction event since the protocol's launch. This action not only strengthens its long-term value anchoring but also sends a strong governance signal—Lista DAO is transitioning from a high-growth phase to a new cycle of stable self-circulation structure.

The significance of Lista DAO lies in the context of BNB Chain's lack of on-chain financial infrastructure. Its goal is not limited to becoming a "better lending protocol," but rather to serve as the default layer of the "BNB Chain yield structure," acting as the total engine for the release of BNBFi assets. Just as Lido has become the standard for Ethereum's staking pathway, Lista DAO is becoming the structural entry point for the on-chainization of BNB assets. In all future paths built around BNB for leverage, strategy, re-staking, and yield synthesis, Lista DAO will be indispensable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。