In today's increasingly crowded DeFi market, retail investors acting as "passive LPs" are gradually becoming silent victims. They seem to join lucrative liquidity pools but are often devoured by high-frequency arbitrage, parameter misconfiguration, and volatility that erodes their principal. Uniswap v3 was once regarded as the technical pinnacle of AMMs, but actual data shows that most LPs are losing money. The problem lies not in the mechanism itself, but in the vast gap between the complexity of the mechanism and the average user.

Gyroscope is attempting to rewrite this script; it is not just another new AMM or another "stablecoin story," but a new market-making system designed specifically for passive LPs, starting from structural design.

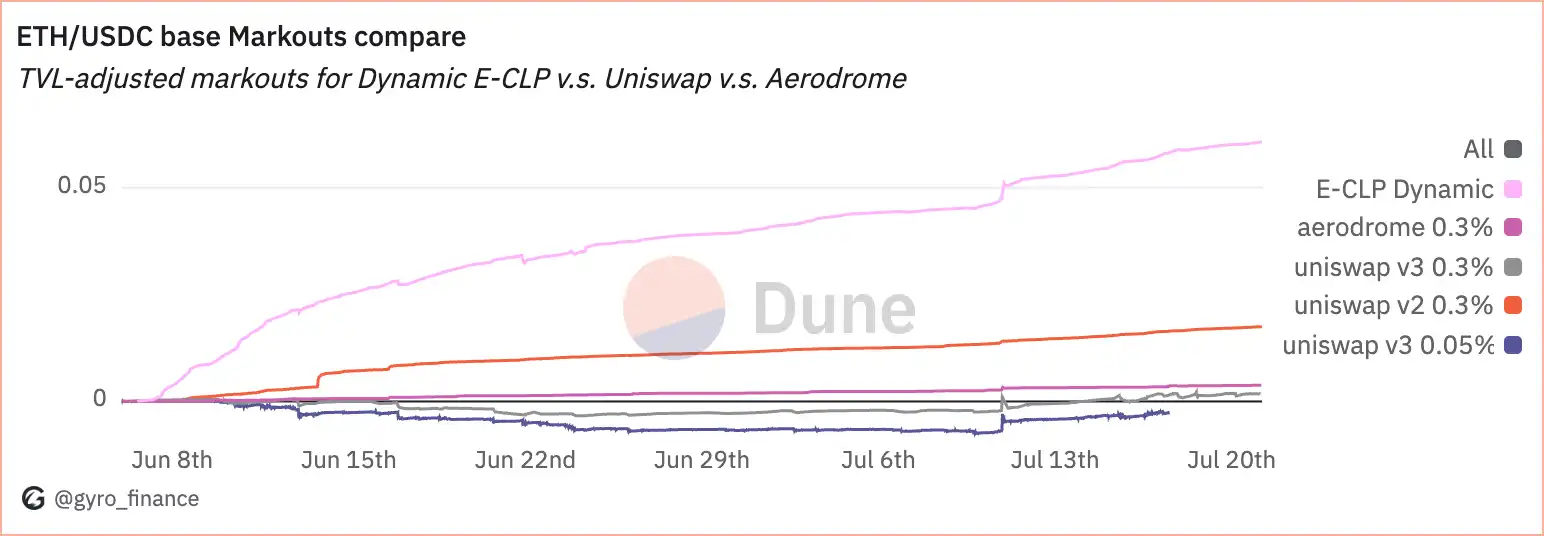

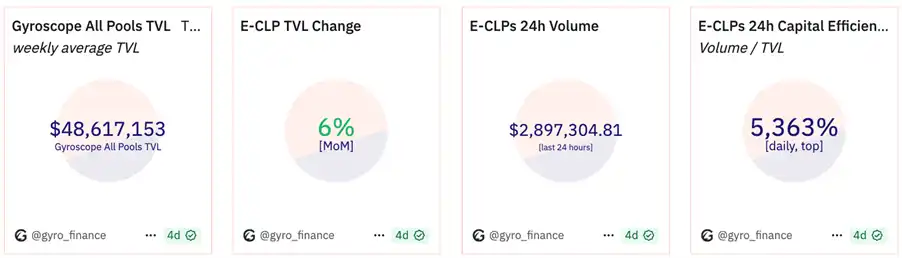

Gyroscope's dynamic liquidity pool E-CLP provides real returns for LPs, outperforming the average LP on Uniswap V3 by 32 times and Aerodrome LP by 15 times. The Dynamic 3-CLP, set to launch next month, will pioneer a three-way liquidity concentration layout, expected to double the performance from the existing base. The recently launched dynamic liquidity pools on the Avalanche chain EURC/USDC; BTC.b/WAVAX and Base chain WETH/cbBTC offer a reward mechanism with an annual interest rate of up to 64%, as detailed in the links at the end of the article.

Recently, BlockBeats invited Gyroscope co-founder Ariah Klages-Mundt for an in-depth interview. We discussed the stability mechanism of GYD, the strategic evolution of the dynamic E-CLP, and ultimately reached the innovative boundaries of the three-asset pool. Along this route, we see a clear main line: replacing strategic blind selection with a structural approach, allowing long-term returns to no longer rely on luck and timing, but rather on a design capability that can be replicated and scaled.

Here is the full content of the interview:

BlockBeats: Please introduce yourself. Why did you initially decide to establish Gyroscope? How has your academic background from Cornell University directly influenced the design of Gyroscope?

Ariah Klages-Mundt: What we are doing at Gyroscope actually started similarly to a research project. My early research predicted many of the issues with stablecoins becoming unpegged, such as what happened to DAI on "Black Thursday," the failure of Fei when it first launched, and the collapse of Terra. Our goal at Gyroscope is to do things differently, creating products that not only yield good returns but are also genuinely practical and structurally sound.

My experience at Cornell had a significant impact on me; the design of Gyroscope is built around the lessons we learned in our research. Both my co-founder and I come from a PhD background, and we began conceptualizing Gyroscope during our doctoral studies. At that time, we observed some trends in the industry and the problems that many people would eventually encounter. So we decided to build a product ourselves, designing from the ground up to see if we could avoid those structural traps.

Bloomberg Data Science PhD Scholarship recipient, Ariah Klages-Mundt

BlockBeats: You describe GYD as an "all-weather" stablecoin. What does this mean? What is the biggest difference for ordinary users compared to stablecoins like USDC or DAI?

Ariah Klages-Mundt: At a high level, Gyroscope's goal is to make liquidity as efficient as possible while keeping user participation as simple and passive as possible.

This concept is first reflected in the design of the stablecoin product, GYD. GYD has many cool features, which you can see in the documentation, but its core value actually comes from its liquidity structure design—it almost always stays close to the pegged price during transactions, making it one of the best performers in the industry. This makes it very suitable for trading, which is key to our vision of integrating GYD into mainstream product strategies.

Our product strategy has actually shifted from being solely a stablecoin to focusing on a broader range of LP tools and dynamic liquidity management.

In terms of dynamic liquidity pools, we have observed that most people who LP in high-volatility trading pairs like BTC-stablecoin end up losing money because they cannot manage their positions efficiently and actively. What we are doing is "reversing the script" by providing a completely passive yet highly effective market-making method through Gyroscope's dynamic liquidity pool mechanism.

We believe that the future of GYD and the entire Gyroscope LP tool system will be closely intertwined and evolve together.

BlockBeats: I want to return to the development history of Gyroscope. For example, what key milestones or turning points have brought the project to where it is today, from the GYD model to the current dynamic CLP?

Ariah Klages-Mundt: We initially designed these liquidity pools to enhance the efficiency of stablecoin clients, with two core goals: to build an on-chain secondary market for stablecoins and to create more effective sources of yield for the underlying assets supporting stablecoins.

During the development of this series of products, we realized a core issue. We found that the business model of stablecoins is very difficult to execute, similar to the sustainability issues faced by many DEX projects.

Most newly issued stablecoins are expanding primarily through token incentives, but this model is fundamentally unsustainable. To attract capital, they have to offer more incentives than they receive, entering a vicious cycle of "the more capital, the higher the subsidies." Even stablecoins like Ethena heavily rely on token incentives to drive growth, often spending more on incentives than they actually earn, making this model clearly difficult to maintain in the long term.

So, as we built a series of products for Gyroscope, we had to rethink what the best business model for this protocol really is.

We actually have many valuable components, such as AMM modules that can generate yield and a very innovative stablecoin. We now believe that the most promising path is to grow around "these inherently profitable liquidity pools." They not only solve the actual problems of LPs (like difficulty in managing positions) but also bring considerable returns, possessing independent product value. This is why we are now focusing on them as the main business model of Gyroscope.

At the same time, stablecoins can also complement the value of these liquidity pools very well. As I mentioned at the beginning of the interview, GYD has very strong liquidity near the peg point, and once you adjust your position, it is more flexible than any stablecoin on the market. Therefore, it has a significant advantage as a trading asset and can complement dynamic liquidity pools.

We believe that the best way to achieve "sustainable growth" for stablecoins is to find a clear market positioning for them, such as being a high-liquidity trading asset, and integrate them into a product system with strong profitability. This path can achieve growth without relying on long-term token incentives, but rather through the product's own earning capacity. GYD can leverage these dynamic liquidity pools for expansion and provide insights for another stablecoin we may launch in the future.

Of course, at this stage, we are primarily focused on building dynamic liquidity pools, which is still an exploratory process. We are expanding various profitable liquidity pools, currently including trading pairs with assets like USDC, USDT, and GYD. The core of this stage is to strengthen and grow the product itself.

Next, we are also considering retaining GYD for the long term and continuing to expand its growth potential. We believe that combining DEX and stablecoin clients into a single business model will bring many benefits.

There are two aspects worth emphasizing:

First, as I just mentioned, GYD as a trading asset can be used to build a set of self-profitable structured products around it. These products utilize the characteristics of GYD, allowing for expansion without relying on incentive subsidies.

Second, if you have your own stablecoin product, it becomes easier to integrate it into other products within your ecosystem. For example, our current dynamic liquidity pools with USDC, USDT, etc., have very high yields, and many users want to further amplify these returns. The simplest way might be to connect them to GYD's leverage mechanism.

In this way, users can use GYD to leverage higher returns, and GYD itself can benefit from this, creating a positive synergy within the entire product system.

BlockBeats: There are already many liquidity products on the market. What role do you think Gyroscope plays in the entire DeFi ecosystem? What is your positioning?

Ariah Klages-Mundt: We have noticed a clear gap in the market, especially in serving "passive LPs." Gyroscope's positioning is to make the operations of passive LPs very simple—if you are a passive LP, choosing us should be a "no-brainer" decision: better performance and easier to use.

In the long run, I believe the liquidity product market will gradually differentiate into two main directions: one is simple and efficient solutions designed specifically for passive LPs, which is one end of the market; the other is highly customizable tools aimed at professional market makers, who often need extremely flexible architectures, like the complex configurations of Uniswap v3 and v4. But for passive LPs, they actually do not want to face this complexity; they just want to access high returns through a simple product entry.

And this is precisely the demand that the current market has not fully met. Although there are some passive liquidity solutions, they do not perform well and essentially fall into the same traps as the traditional LP model of Uniswap.

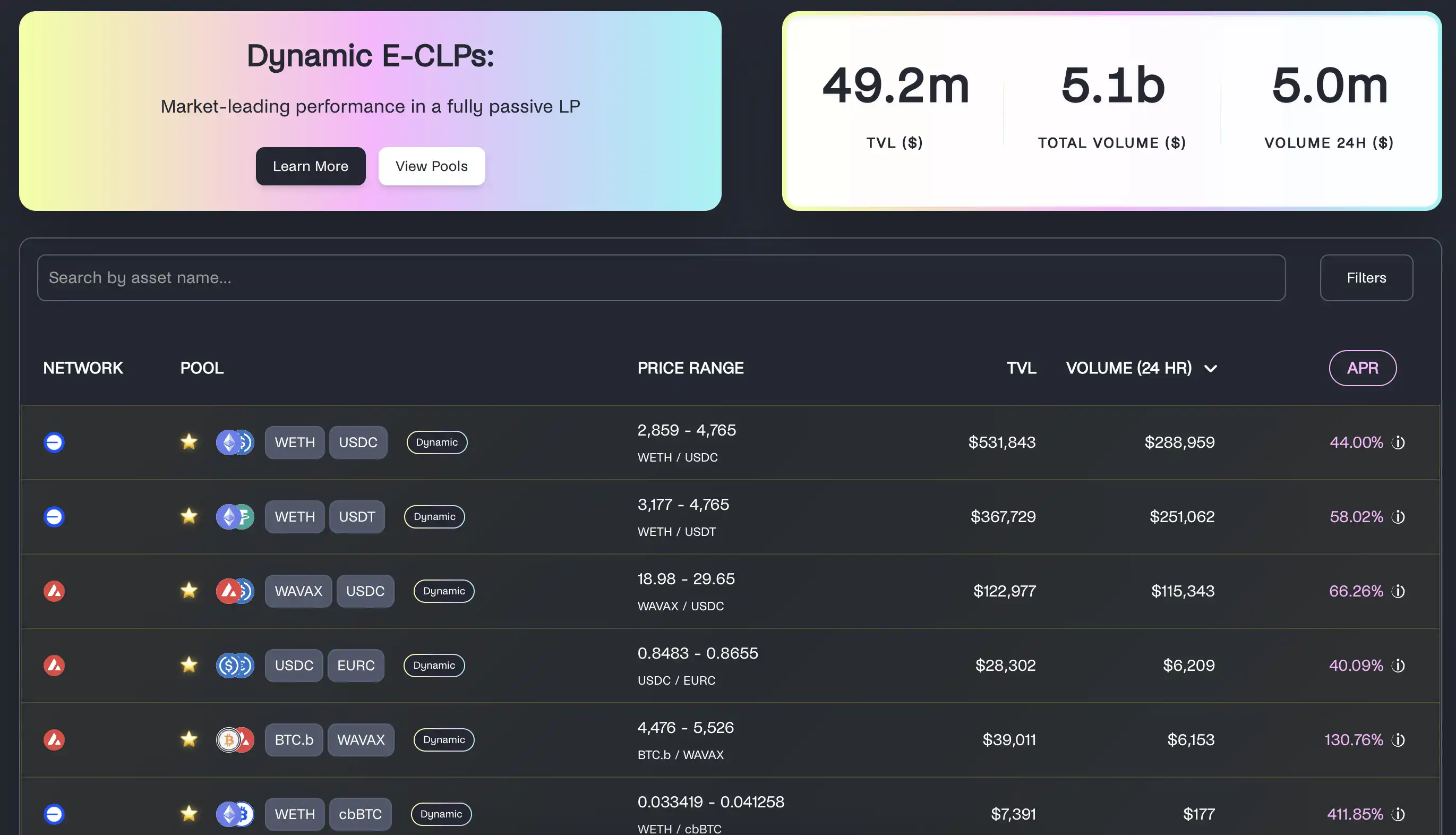

Gyroscope official website liquidity pool page

Highlights of the Dynamic E-CLP mechanism and yield performance

BlockBeats: Dynamic E-CLP is your recent major innovation, now deployed on chains like Base. The actual yield on ETH/USDC is reportedly 32 times that of Uniswap v3. What is the core mechanism innovation behind this?

Ariah Klages-Mundt: It is essentially a concentrated liquidity pool that uses an elliptical curve as the trading curve, which is where the "E" in the name comes from. The core design of this pool allows it to automatically adjust with market fluctuations, aiming to help LPs (liquidity providers) always stay within the effective price range, earning more fee income without the need for frequent manual rebalancing or position adjustments.

In other words, the entire liquidity strategy is directly written into the code, so LPs do not need to operate it themselves; the system will automatically execute this strategy. Since its launch, our dynamic E-CLP has outperformed the average LP on Uniswap V3 by 32 times.

What does this mean? Simply put, most LPs on Uniswap V3 have suffered from manually managing their positions—they either lose earnings because their liquidity runs out of range or choose the wrong strategy and get repeatedly harvested by arbitrageurs, resulting in unsatisfactory outcomes.

The advantage of the dynamic E-CLP is that it makes strategic choices for LPs, and the results are significant. We believe Gyroscope's products can make being a "passive LP" very easy, requiring less operation while delivering better performance, all packaged in a simple and user-friendly module.

BlockBeats: For ordinary users, what does "the actual profitability of LPs" really mean?

Ariah Klages-Mundt: We use a method called markout (spread backtesting) to more clearly measure the true profitability of LPs.

Intuitively, it measures how much valuable trading flow LPs earn beyond the "arbitrage flow" while providing liquidity.

"Markouts" have become a widely adopted core metric in the industry, used by experts including Dan Robinson and Alex Nezlobin to evaluate the yield performance of project LPs.

In an AMM mechanism, if your liquidity pool is frequently exploited by arbitrageurs, you can actually lose money; but if you receive "organic trading flow" (i.e., normal trades from non-arbitrageurs), then you have a chance to make a profit.

So, Markout assesses whether you, as an LP, are earning money from "quality trading flow" or being harvested by arbitrage flow.

Specifically, if Markout is positive, it means that when you sell ETH, the price is higher than the market price, or when you buy, it is lower than the market price, indicating that you, as an LP, are earning the price difference;

But if Markout is negative, it means you are completing trades at unfavorable prices, such as buying at a high price and selling at a low price, which naturally results in losses.

The benefit of this method is that it can strip away the true profitability of LPs from the complex asset price fluctuations in the AMM mechanism. Many traditional measurement methods struggle to distinguish whether earnings come from trade execution or the price fluctuations of the assets themselves.

This is also why we place particular importance on Markout.

From a more practical perspective, if your Markout is sufficiently positive, you can hedge against other asset risk exposures—meaning you can adjust to the asset portfolio you want to hold while still earning positive returns.

So, Markout is a very effective measurement metric. For example, at Gyroscope, we are market leaders in Markout performance, especially on our Dynamic E-CLP, which performs exceptionally well.

BlockBeats: Can you elaborate on how you achieve this effect? What is the essential difference between your module and Uniswap's approach?

Ariah Klages-Mundt: Our Dynamic CLP is special because we built a liquidity pool structure that is truly suitable for passive strategies from the design source. We finely calibrated the entire mechanism to ensure it is on a LP-friendly path from the very beginning.

Many "automated liquidity managers" built on Uniswap merely add a layer of shell without truly solving the core problem—choosing an excellent, robust passive strategy for LPs.

What we focus on is capturing sufficiently real trading flow while effectively avoiding excessive arbitrage losses. This is the design philosophy of Gyroscope: to enhance the long-term yield stability of LPs through a structural approach.

Ultimately, it boils down to two core questions: How do you design a good liquidity provision strategy? And how do you continuously update this strategy over time?

Another key aspect is—how to control risk in this process. Our solution is built around a "broad range liquidity strategy," which aims to reduce concentration risk.

More specifically, our design allows LPs to profit from what we call "Volatility Harvesting," which means making money by providing liquidity when prices fluctuate back and forth within a range.

A key point of this strategy is that it automatically adjusts the liquidity range in a very passive manner, thus avoiding the high costs associated with frequent rebalancing.

Why is rebalancing costly?

Because if you are constantly rebalancing trades, it essentially means you are trading against the market counterparties, which means you have to bear the spread costs.

For example, in Uniswap LP, the half of your assets in the pool may incur costs equivalent to several days' worth of earnings due to this spread every day.

If you can adjust your positions passively without frequent trading and without crossing the spread, you can save a significant amount of costs.

BlockBeats: In practice, what would the experience be like for an ordinary user?

Ariah Klages-Mundt: Our top-level design goal is to make being a "passive LP" extremely simple. You can achieve better returns than ordinary strategies while requiring less operation.

When we say "less operation," we mean it literally. Users only need to do one thing: come to the pool and choose to deposit funds.

After completing this step, they can completely forget about it.

This liquidity pool will automatically adapt to the market and operate efficiently.

You can also understand it from another perspective: Gyroscope helps LPs make optimal strategy choices, and it is built into the system, so you do not need to monitor the market, adjust positions, or change strategies yourself.

The original vision of the AMM mechanism was to allow more people to participate fairly in liquidity provision and earn related returns. We believe that Gyroscope's liquidity pool continues this vision.

In the early days of Uniswap V2, users only needed to use one type of liquidity pool, and the operation was relatively simple, allowing anyone to participate.

But when "Concentrated Liquidity" was introduced, the situation changed—being an LP became a task requiring high judgment and parameter settings. You had to correctly choose multiple parameters to have a chance to make money; otherwise, many LPs ended up losing money due to improper settings or not adjusting strategies in time.

However, particularly for some high-volatility trading pairs, the returns they offer are indeed very tempting. The problem is that ordinary people find it difficult to seize these profit opportunities. This is the core issue Gyroscope aims to solve—we provide a pool where you only need to "deposit once," and it operates fully automatically thereafter.

The strategy is designed and calibrated in advance by the liquidity pool deployer, and then it can automatically adjust and continuously evolve with the market. Users do not need to manually set anything or continuously intervene.

You just need to deposit funds to earn returns that were previously only accessible to "experts."

BlockBeats: It sounds like your design makes market-making much more accessible.

Ariah Klages-Mundt: Exactly, this is also one of our important goals. In the past, these market-making returns were difficult to obtain because they required complex strategies and tool support. Our newly launched solution significantly lowers the barrier, allowing ordinary users to participate in this type of profit acquisition.

BlockBeats: What are the core elements of designing a sustainable market-making module in DeFi?

Ariah Klages-Mundt: When we talk about "sustainability," it ultimately answers two questions: What constitutes true sustainability? What does sustainability really mean?

Many DEXs currently focus more on trading volume rather than profitability.

The result is that if you look at the real yield rates of these pools, they are generally very low.

But the problem is that someone has to fill the gap between LPs' "minimum return requirements" and actual yields.

For example, many DEXs are promoting stablecoin pools like USDC/USDT, but the "natural yield rates" these pools can generate are very low, possibly only 2-3%, even lower than short-term U.S. Treasury rates.

However, when LPs participate in these pools, their "return threshold" is often set around 12%.

So who fills the 9-10% gap in between? Typically, it is the project parties using subsidies or incentives to prop it up. This model is unsustainable in the long run.

So, the so-called "sustainability" is whether you can generate enough natural yield from the product itself, allowing LPs to profit without external incentives.

If you rely on subsidies in the long term, it will ultimately be difficult to sustain.

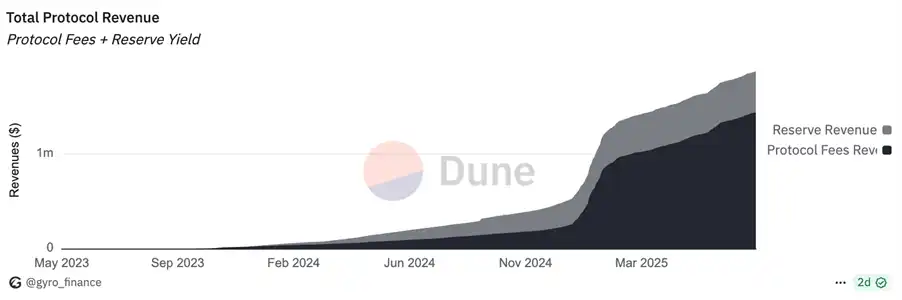

We believe that Gyroscope is a rare "positive case" in the current DeFi market—while most DEXs are still relying on token incentives to maintain LP yields, our dynamic E-CLP pools can already generate positive returns purely from trading itself, covering incentive costs.

This indicates that it is a product with profitability and scalability. We are currently in the expansion phase.

How to understand the upcoming structured market-making layer 3CLP?

BlockBeats: You are about to launch a three-asset concentrated liquidity pool, which will be the first to support three assets. Why choose three assets instead of two? What are the advantages of this approach? What is the logic behind your thinking?

Ariah Klages-Mundt: Yes, we are very excited about this three-asset pool. It is an important step for Gyroscope to showcase its technological advantages. We have already demonstrated a significant lead with our dynamic E-CLP (two-asset concentrated liquidity pool), and this three-asset pool will further solidify our leading position, something that no other DEX can currently achieve.

This product is called Gyroscope 3CLP, which stands for Three-Asset Concentrated Liquidity Pool. It is the first product to truly realize "three-way concentrated liquidity." Currently, most concentrated liquidity pools on the market are essentially two-asset pools—providing concentrated quote ranges between two assets; what we are doing now is placing three assets into the same pool and providing concentrated liquidity among them.

This way, a single pool can simultaneously support three trading pairs.

From a capital efficiency perspective, a three-asset pool theoretically has 100% higher efficiency than a two-asset pool. In other words, if the trading volumes of the three assets are similar, the three-asset pool can achieve double the trading volume with the same TVL.

For example, if you build a three-asset combination pool of BTC and stablecoins, and if Gyroscope's two-asset pool currently offers about 50% annualized yield (APY), then this three-asset pool could potentially reach double that, or 100% APY. This difference is very substantial, especially at a time when high-yield strategies are particularly in focus.

In the past, other projects have attempted "three-asset pools," but the results were mediocre, leading many to be skeptical, thinking "here's another three-pool product." However, those products failed mainly because their yields were not high enough—like squeezing out a marginal yield of 0.1% from a Curve pool, which people generally do not care much about.

But Gyroscope's three-asset pool is different; we have validated that our dynamic liquidity pool has actual yield capabilities. If we can double the APY, for example, from 50% to 100%, that tells a completely different story. Such yield levels can genuinely attract market interest, which is why we believe that the launch of 3CLP will not go unnoticed like previous "three-asset pools," but will truly gain attention.

BlockBeats: For ordinary users, this mechanism might still seem a bit complex. We want to understand how you maintain the simplicity of user experience?

Ariah Klages-Mundt: Gyroscope's philosophy has always been to make user choices simple and intuitive—users should be able to see at a glance that the yield performance here is better, and the operational threshold is low; the three-asset pool is no different in this regard.

The LP experience is actually as simple as what we discussed earlier: users only need to enter the pool, decide whether to deposit assets, and everything else is handled automatically by the pool. It will manage the operation of the assets, yield strategies, etc.; the entire process is automated, and users do not need to intervene excessively.

This is also one of Gyroscope's design principles—whether it's ECLP or now the 3CLP, users do not need to manually set various parameters or make complex configurations. These tasks are completed by the deployer when the pool is set up, and once the pool is established and running well, LPs only need to understand the pool's strategy and performance, confirm that they can accept it, and then deposit their assets. Overall, it provides an "plug-and-play" experience for LPs.

DeFi Market-Making Trends and the Future of Stablecoins

BlockBeats: In the context of the rise of modular AMMs, Layer 2, and Uniswap V4, how do you view the evolution trend of DeFi? What role will Gyroscope play in this?

Ariah Klages-Mundt: Gyroscope's current products can be deployed on any chain and have already been validated in multiple scenarios for their attractiveness to LPs.

We observe that the market for liquidity solutions is diverging in two directions: one focuses on serving passive LPs, enabling them to easily achieve high performance; the other provides highly customizable tools for professional market makers, which are often not suitable for ordinary LPs.

Gyroscope is focusing on the first direction, aiming to create products that are high-performing yet easy enough for passive LPs to use.

It is worth mentioning that Gyroscope itself is designed to be modular. Many AMM solutions are evolving towards modularity, and Gyroscope's pools also possess high modularity. You can embed Gyroscope's liquidity pools into various parallel development functional modules, which may come from us or other development teams in the ecosystem.

For example, you can connect Gyroscope's pools with asset rehypothecation modules, lending yield modules, or integrate various Hook plugins or dynamic trading mechanisms. This means that any new innovation in the DeFi space can be seamlessly layered on top of Gyroscope's foundational pools.

We have already seen some exciting directions, such as dynamic trading fee optimization, which still has a lot of potential to explore. Gyroscope's pools already have strong foundational performance, and further enhancements can be made, indicating that this architecture has significant scalability.

At the same time, we welcome more teams in the ecosystem to collaboratively develop these modular components; it does not have to be led by us. Any excellent product developed by any team can be directly integrated into Gyroscope's liquidity pools, thereby sharing the advantages of the entire system.

Of course, our flagship product remains the two-asset pool (2Pool), but what we truly want to solidify our leading advantage with is the three-asset pool (3CLP) we just mentioned. We believe that 3CLP will be key for Gyroscope to consolidate its technological leadership, as currently, no other DEX can achieve the capability of "three-asset concentrated liquidity."

We see 3CLP as a crucial piece in the future solution puzzle for DeFi liquidity, as it can provide a highly attractive performance baseline for passive LPs while serving as a robust underlying architecture to support more innovations, continuously enhancing performance as the ecosystem evolves.

BlockBeats: What are the main goals for Gyroscope's next stage of development? I would like you to discuss this from a more macro perspective—what role do you hope Gyroscope will play in the entire DeFi ecosystem?

Ariah Klages-Mundt: Gyroscope is currently in a very advantageous position because our products have proven to have real yield capabilities, achieving "net profitability." This actually puts us ahead of most current DeFi protocols—many protocols are still struggling to find profitable paths, while we have already taken a key step on this issue.

Our current top priority is to have these yield-generating products carry more AUM, starting with mainstream crypto asset trading pairs, such as combinations of BTC and stablecoins, which are the most traded on-chain pairs and represent the most profitable areas on-chain today.

Our dynamic liquidity pools have already achieved good results in this regard, and we are particularly optimistic about the future development of the three-asset pool. We believe it will become the primary source of income for passive LPs, and this type of user actually occupies a large portion of the market. In other words, in the future, if you are a passive LP in the mainstream crypto asset market, 3CLP should be your preferred liquidity tool.

From a longer-term perspective, our grand vision is to further expand the market space for on-chain trading. Currently, the most profitable on-chain trading pairs are still mainstream ones like ETH, BTC, and stablecoins, but we hope to drive more asset trading volumes on-chain, making Gyroscope a key infrastructure for supporting these trades.

We believe that the most effective way to expand the overall trading volume of the DEX market is to bring foreign exchange trading pairs on-chain. The foreign exchange market is one of the largest off-chain financial markets, and structurally, on-chain systems may outperform traditional off-chain systems in certain aspects, especially in terms of efficiency and transparency. Therefore, "on-chaining" these foreign exchange trading flows has significant potential.

However, this area is currently almost blank on-chain. For example, the global foreign exchange market has a daily trading volume of about $2 trillion, which far exceeds the current total DEX market—where the daily trading volume is around $8 billion. The gap between the two is several orders of magnitude. At the same time, the penetration rate of on-chain foreign exchange trading is extremely low, around only 0.0005%.

So even if we only bring 1% of the foreign exchange trading volume on-chain, the total scale of the DEX market could potentially expand by 2.5 times. This means that not only does Gyroscope have enormous growth potential, but the entire DEX sector also has the potential for a qualitative leap.

Of course, mainstream trading pairs like Ethereum, Bitcoin, and stablecoins remain the most active and profitable markets, but their growth will eventually hit a ceiling. At that point, there must be a broader range of financial assets that can operate efficiently on-chain, and we believe that foreign exchange is a particularly suitable breakthrough point.

This is also why, when designing liquidity pools, we did not only consider serving crypto assets. For example, while CLP and 3CLP are currently built around mainstream crypto pairs, their underlying mechanisms can fully support FX foreign exchange trading pairs. We are very excited about this direction, believing it will not only drive further growth for Gyroscope but also help the entire DEX ecosystem move towards a broader financial market.

BlockBeats: In your view, what changes are happening in the stablecoin sector? What do you think future stablecoins will look like?

Ariah Klages-Mundt: I will break this question into two parts: one part is "which types of stablecoins have advantages in different application scenarios"; the other part is "how the business models of stablecoins themselves are evolving, and which types of business models are more likely to support the long-term survival of stablecoins."

First, regarding application scenarios, stablecoins can roughly be divided into two categories—centralized stablecoins and decentralized stablecoins. In the past, many believed that decentralized stablecoins could achieve widespread adoption in some mainstream scenarios, such as on-chain payments and daily settlements.

However, the reality is that this assumption has not been realized. Moreover, with the increasing number of centralized stablecoins being launched, gaining compliance support and deeply integrating with the entire payment ecosystem (not just crypto payments, but even Web2 payment infrastructures like Stripe), decentralized stablecoins are increasingly at a disadvantage in competition for mainstream application scenarios.

In the current trend, it is difficult for decentralized stablecoins to break through the advantages that centralized stablecoins have already established.

So we see that some decentralized stablecoin projects originally focused on "payment use" are also beginning to shift towards yield-oriented strategies, such as Sky and Athena. Sky used to emphasize on-chain payment use cases, but now it is clearly starting to focus more on how to create on-chain yields for users.

I believe that from now on, the core direction of decentralized stablecoins will shift towards "yield tools," rather than competing in the main battlefield of "payment experience."

They may still leverage the advantages of centralized stablecoins' widespread circulation, embedding their use in various scenarios, but their positioning will be more like financial products that "help users earn better yields on-chain," rather than "universal payment currencies."

Of course, if the market changes in the future, we would also be happy to see decentralized stablecoins challenge the payment field again, but based on the current development trend, their focus has indeed shifted towards "yield-generating financial tools."

On the other hand, there is the issue of the business models adopted by these stablecoins. If you look at the current stablecoin projects, there are not many that can truly achieve "net profitability," mainly just USDT, and to some extent, USDC.

Most other stablecoins are still struggling to gain sufficient natural adoption, meaning their growth often relies on external incentives rather than spontaneous market demand. This makes it difficult for them to build a truly sustainable business model.

A key issue currently is that market yields are primarily driven by token incentives. If you are a new stablecoin project, you must bet—can you outlast your competitors, meaning can you continue to invest before their incentive budgets run out?

But clearly, token incentives cannot last forever; essentially, it is the project team subsidizing yields. When a certain point in time arrives, stablecoins must be able to cover these costs through their own "natural yields" to achieve a long-term, sustainable business model.

Which stablecoins will ultimately be able to do this in the future is still uncertain, but it is certain that not all stablecoins will survive.

This is also where we believe Gyroscope has its unique advantages. Most stablecoins are isolated, lacking a complementary DEX product; and most DEX projects do not have a stablecoin that can sustain profitability on its own.

Gyroscope's approach is to combine the profitability of DEX with the demand for stablecoins, creating a synergistic effect. We believe that this integrated model may be a better solution for the future sustainability of stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。