Original Source: Vectis Finance

Preface

On August 20, HyperliquidFR announced that Hyperliquid generated an average annual revenue of $102.4 million per employee, making it the highest revenue-generating company per capita in the world. The high profits behind this come from high-frequency trading with trillions of users. The key to attracting these users lies not only in the platform's extreme performance but also in its long-term maintenance of excellent funding rates.

As an amplifier of DeFi yields, Vectis Finance has seized this opportunity to launch the JLP HyperLoop vault: by establishing hedging positions on Hyperliquid, it can lock in price risks while steadily capturing high funding fees. Combined with Jupiter's newly launched JLP Loans (with borrowing rates as low as 5%), it achieves low-cost borrowing and cyclical leverage to acquire more JLP.

This combination truly achieves "low-cost leveraged returns + high funding fee returns," allowing JLP yields to be amplified on multiple levels, making it a typical case of "one fish, multiple meals."

Origin and Development of JLP

What is JLP? JLP is the core liquidity token of Jupiter (the largest liquidity and trading aggregation platform in the Solana ecosystem). As one of the most representative assets in the DeFi space this year, JLP has become the preferred entry point for large funds seeking on-chain yields. With a funding capacity of up to $1.85 billion, a value increase of over 3 times in one year, and an astonishing annualized return rate of 29.71%, it fully demonstrates the unique charm of stability and sustainability.

JLP provides opening and lending support for traders through liquidity pools, acting as a market counterparty. Its revenue comes from three main pillars:

· High proportion of fee dividends: 75% of the opening/closing fees, price impact fees, borrowing fees, and transaction fees are shared, forming a stable cash flow.

· Diverse asset appreciation: An index fund composed of SOL, ETH, WBTC, USDC, and USDT, combining volatility resistance and growth potential;

· Trader profit and loss capture: As a counterparty, it benefits from market fluctuations;

Compared to governance tokens or purely speculative assets that rely on market sentiment, the value of JLP is not a castle in the air but is steadily supported by real trading income and asset appreciation. Many arbitrageurs utilize cyclical borrowing to amplify their returns on JLP tokens.

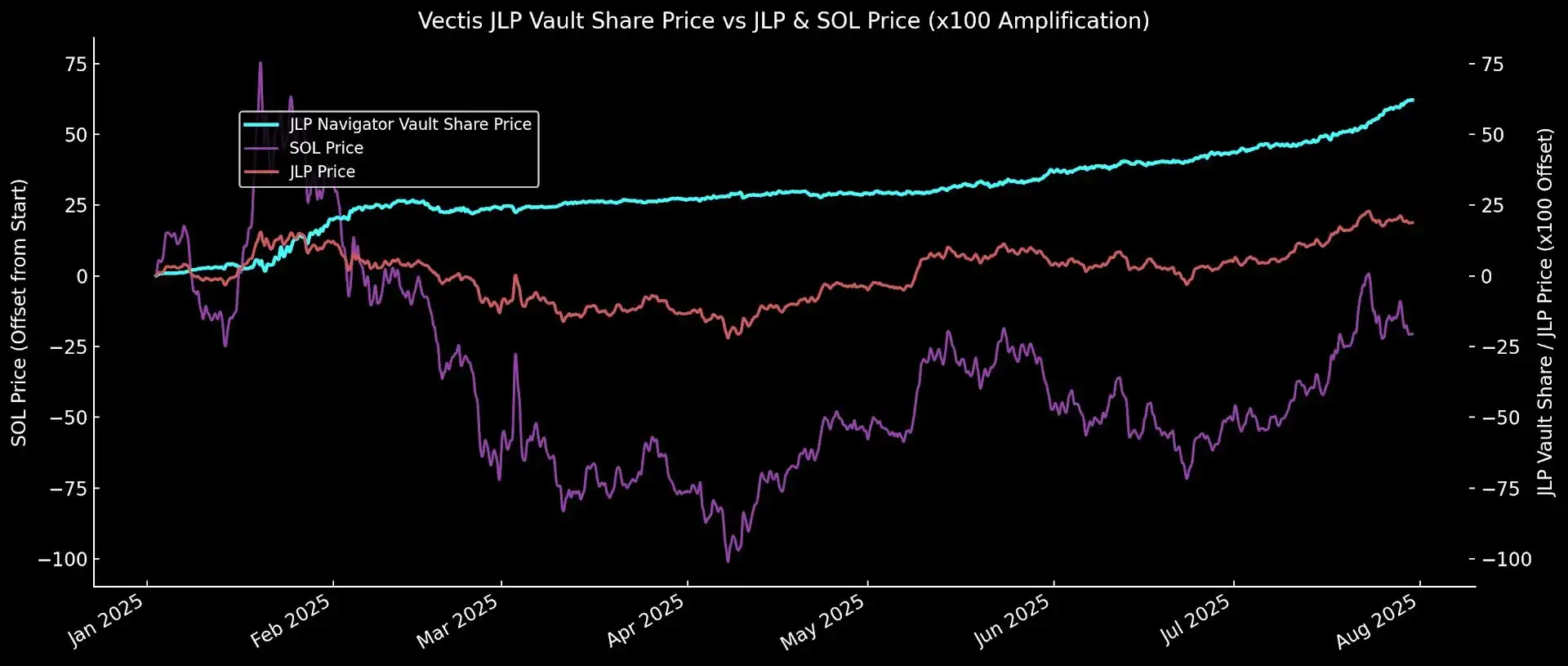

Nevertheless, JLP experienced a maximum drawdown of up to 30% in March-April 2025, which inevitably raised market concerns, primarily due to the weakening market conditions of SOL. If effective hedging mechanisms can alleviate price fluctuations, JLP is expected to truly become a high-quality, low-risk yield strategy.

Vectis's Innovative Strategy: One Fish, Multiple Meals, Amplifying JLP Yields

Vectis Finance launched the innovative JLP Navigator vault strategy in November 2024, deploying it on Drift, a perpetual contract exchange on Solana. This strategy focuses on hedging price volatility risks while efficiently amplifying JLP's yield performance. Its core consists of two main pillars:

· Precise volatility hedging: Effectively avoiding the price drawdown risk of the asset pool through hedging operations, while further enhancing returns in a positive funding rate environment;

· Low leverage yield amplification: Utilizing 2-3 times low leverage cyclical borrowing to increase JLP position size, thereby amplifying dividend and fee income.

With 2-3 times the JLP value amplification and 2-3 times the funding fee enhancement, the Navigator strategy has built a robust yield moat. According to official data from Vectis, the strategy performs excellently: the 30-day annualized return rate (APR) remains stable at around 30%, with a Sharpe ratio as high as 5.86.

Vectis Finance is an independent DeFi protocol built on Solana, transforming market volatility into investment opportunities. The team launched the innovative JLP yield amplification strategy vault, boosting TVL to $30 million during peak periods. On this basis, the protocol further expanded into funding rate arbitrage and AI-driven trading strategies, demonstrating high adaptability in different market environments, thus being recognized as a representative of "on-chain asset management."

HyperLoop Vault: A Further Upgrade in Amplifying JLP Yields

In August 2025, Vectis Finance announced the launch of the JLP HyperLoop vault strategy. This strategy iteratively upgrades the JLP Navigator and switches the original hedging trading platform from Drift to Hyperliquid, providing users with a more efficient yield amplification solution. The specific strategy is:

1. Low-cost leveraged returns

Users deposit USDC into the Vectis vault, and the funds are first used to purchase JLP on Jupiter. Subsequently, the vault borrows more USDC using JLP Loans and reinvests in JLP, thereby forming cyclical leverage. This method establishes a low-leverage position on a yield-generating LP token, effectively amplifying returns from trading fees and Jupiter ecosystem incentives.

JLP Loans is a new lending product recently launched by Jupiter, allowing JLP holders to borrow USDC at rates as low as 5%, with borrowing costs less than half of those on other platforms.

According to the JLP Loans official website, the current borrowing rate is approximately 5.31%, less than half of the average rate of about 10.39% on Drift from March 12 to July 25.

2. High funding fee returns

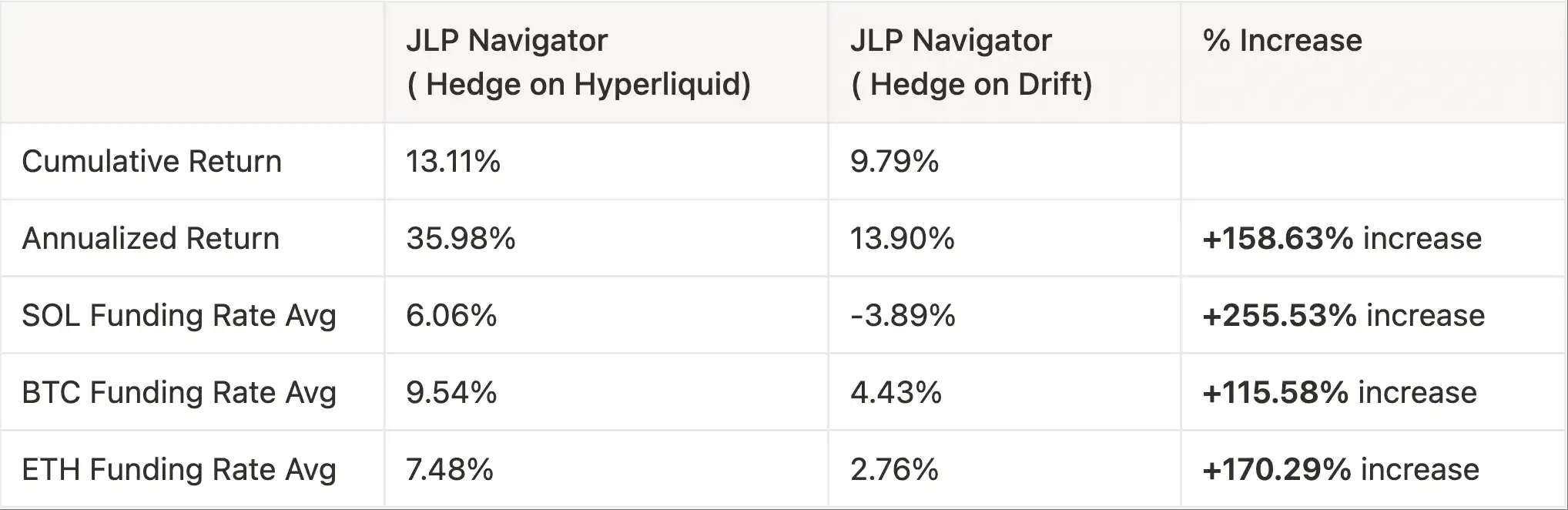

To resist price volatility, the vault strategy maintains Delta neutrality: Vectis will simultaneously open short positions in SOL, ETH, and BTC on Hyperliquid to match the underlying asset composition of JLP. These positions are monitored and dynamically adjusted in real-time by an automated trading system.

When the funding rate on Hyperliquid is positive, these short positions can generate additional income, further enhancing the overall yield performance of the vault. Compared to the previous hedging performance on Drift, the annualized return rate brought by the funding rate has increased by as much as +158.63% after migrating to Hyperliquid.

Additionally, when executing hedging on Hyperliquid, limit orders will be prioritized when conditions allow. This approach minimizes slippage and reduces rebalancing costs, especially during periods of high market volatility.

3. Security and Infrastructure

User funds in the JLP HyperLoop vault are custodied by Cobo. Cobo is an industry-leading institutional custodian, providing a secure operational environment for all asset transfers and wallet interactions. Unlike many DeFi vaults that rely on multi-signature wallets or internal custody systems, HyperLoop reduces key management risks by integrating with Cobo and ensures fund security through industry-leading security practices.

On the execution level, all smart contract interactions are completed through verified and mature platforms such as Jupiter and Hyperliquid. Meanwhile, Vectis's self-developed automated infrastructure is responsible for rebalancing, hedging management, and position monitoring, thereby reducing the potential risks of human error and significantly improving execution speed.

Furthermore, during the launch period of the new strategy vault, Vectis also introduced the Boost Station event, incentivizing users to earn JLP yields while also receiving additional USDC rewards.

Conclusion

Vectis has seized the high-speed train of JLP, rapidly amplifying profits with the dual-engine combination of low-cost leverage + high funding rates, achieving an acceleration that surpasses the market. These are just the tip of the iceberg among successful cases.

In the world of DeFi, Vectis deeply understands the philosophy of DeFi trading: based on real profits, secured by safety, driven by high-frequency iterations, transforming complex strategies into simple and stable growth paths.

In the future, as a new generation leader in on-chain asset management, Vectis will continue to explore the most promising Alpha opportunities, allowing large funds to enjoy a robust, sustainable, and explosive DeFi growth curve.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。