The native token of the OKX platform, OKB, briefly broke through the $250 mark today, currently reported at $242, with a 24-hour increase of up to 32.21%, setting a new historical high. This sudden surge stands out particularly as mainstream assets like Bitcoin and Ethereum are experiencing a pullback, with trading volume skyrocketing to the billions, highlighting the unique resilience of platform tokens during market fluctuations.

As the core utility token of the OKX exchange, OKB has served as a bridge connecting users and the platform since its launch in 2018. Its total supply was originally set at 300 million tokens, but through a continuous buyback and burn mechanism, it has gradually been reduced to a cap of 21 million tokens, aligning closely with Bitcoin's scarcity design. The core of this mechanism is that 30% of transaction fees are allocated each quarter for token destruction, thereby enhancing the long-term value for holders. This breakthrough is a continuation of the effect following OKX's announcement on August 13 to destroy 65.26 million OKB tokens (valued at approximately $7.6 billion). This "supply shock" directly halved the circulating supply, igniting market FOMO and driving the price from around $100 in mid-August to its current level.

An Independent Market Rally from Low to Peak

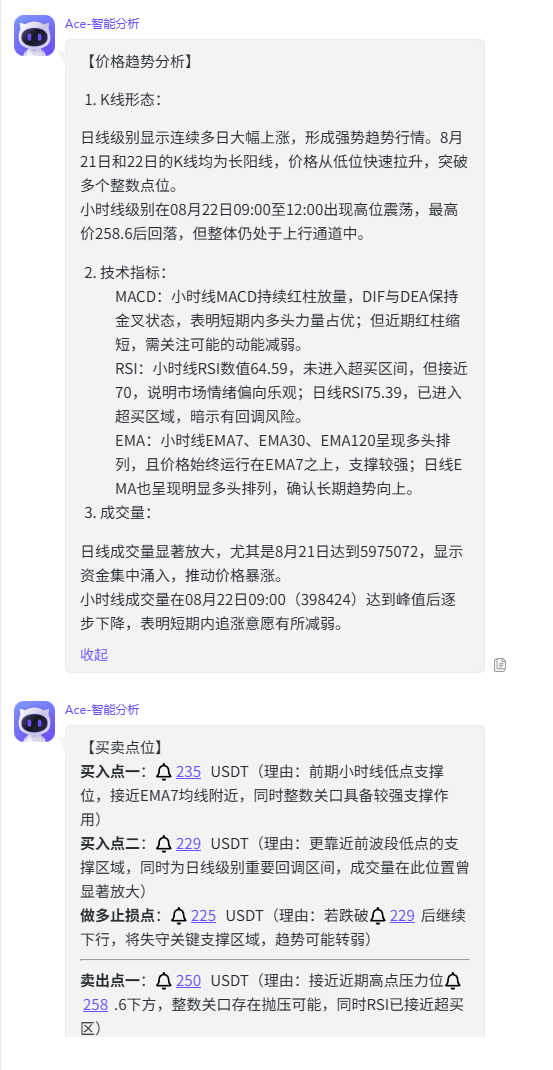

Looking back over the past week, the price trajectory of OKB can be described as a textbook example of a counter-trend rally. On August 21, OKB was priced at around $167, with a cumulative increase of 35.34% within 24 hours. According to market data, OKB peaked at $258.60, with hourly trading volume surging to 398,424 at 09:00, before gradually shrinking, indicating a cooling of market sentiment. The daily trading volume yesterday was 5,975,072, significantly higher than in previous days, while today's volume has notably decreased, suggesting a slowdown in capital inflow. This performance sharply contrasts with the broader market: Bitcoin fell about 8% during the same period, Ethereum dropped 3%, while OKB stood out with a market cap nearing $5 billion, ranking 31st among crypto assets.

From a technical perspective, OKB's candlestick chart shows a strong V-shaped reversal. In the short term, it broke through the resistance level of $235, with increased trading volume supporting bullish momentum. Although implied volatility has risen, the overall trend line remains upward, with short-term targets pointing towards $300. On-chain data indicates that OKB's turnover rate surged from 0.03 before the announcement to 0.093, reflecting active participation from speculators and strategic investors. Notably, OKB's trading depth on the OKX platform has significantly improved, with liquidity indicators showing an average transaction amount of $2,280, far exceeding the industry average.

The halving of supply has directly created a scarcity effect. After the burn, OKB's total supply is fixed at 21 million tokens, which not only mimics Bitcoin's 21 million cap but also enhances the intrinsic value of each token by reducing circulation. Historical data shows that similar burn events often trigger short-term price surges; for instance, after a small-scale burn in 2024, OKB rose by 50%.

The upgrade of OKX's X Layer public chain has played a significant role. The X Layer, based on the Polygon zkEVM network, completed its upgrade on August 5, increasing its processing capacity to 5,000 TPS, with transaction fees approaching zero. OKB serves as the gas fee on this chain, and the demand for DeFi and RWA applications directly boosts its utility value. On-chain withdrawal volume reached $888 million, indicating that long-term holders are accumulating.

Ecological integration further strengthens OKB's position. OKX has initiated the migration of OKTChain to X Layer, with OKT tokens gradually converting to OKB, a process expected to be completed by January 2026. This means that all of OKX's resources will be concentrated on OKB, enhancing its centrality within the ecosystem. Users holding OKB can enjoy transaction fee discounts (up to 40%), staking rewards, and participation rights in Jumpstart projects, attracting a large influx of retail and institutional investors.

Market Sentiment: Optimism Mixed with Caution

On social media, discussions related to OKB have surged, with many users viewing this price increase as a prime example of a "supply shock." One analyst noted, "The momentum of OKB is unstoppable, similar to the early explosion of BNB." Another viewpoint suggests that the post-burn scarcity will drive the price to $300-$600, potentially challenging BNB's market cap of $100 billion.

At the institutional level, Hong Kong's Ming Shing Group has locked in 4,250 Bitcoin as reserves, with similar actions extending to OKB, indicating a renewed confidence in platform tokens. Although the ETF holdings of OKB have not been directly disclosed, the derivatives market shows that futures open interest has risen from $2.8 billion in April to $10 billion, with annual trading volume exceeding $4 trillion.

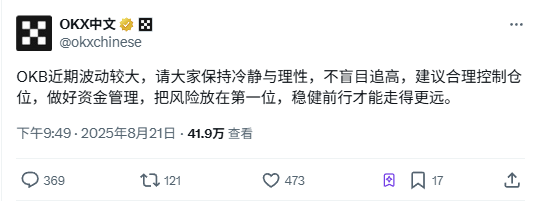

On August 21, OKX officially warned on the X platform: "OKB has been experiencing significant volatility recently; please remain calm and rational, avoid blindly chasing highs, and manage your positions wisely." This statement is seen as a short-term bearish signal but, in the long run, reinforces the platform's sense of responsibility, preventing a FOMO-driven bubble.

This article is for informational sharing only and does not constitute investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。