Risk is Entertainment.

Written by: Lauris

Translated by: AididiaoJP, Foresight News

The Trend of Hyper-Gambling is Inevitable

The core of gaming has always been about risk, speculation, and dopamine.

Casinos are the most direct form: blackjack, poker, slot machines—these are purely probability-driven stimuli. Without the gambling market, sports events struggle to scale. The explosion of trading cards is due to the lottery-like mechanism of unpacking and drawing cards, which drives the pursuit of rare cards. Even decorative skins in video games have spawned an underground economy, where rarity and speculation outweigh practicality.

This is not a flaw; speculation is a characteristic. It makes games sticky, viral, and community-oriented. When risk is involved in the cycle, attention compounds.

We call this "hyper-gambling": merging speculative game mechanics with financial speculation into a shareable entertainment foundation. With the support of on-chain infrastructure, this becomes inevitable: liquidity, verifiability, composability, and globalization.

A Cautionary Tale: Why the "Play-to-Earn" Model Collapsed

The last wave of "crypto games," Play-to-Earn, essentially miscalculated the cycle. It once seemed unstoppable: Axie Infinity's explosive growth, guilds rapidly expanding in Southeast Asia, billions of dollars pouring in, but then everything collapsed.

Why? Because P2E mistakenly treated gaming as work.

Players were not playing; they were extracting value. The cycle itself was not fun; it was labor. Once speculative funds dried up, there was no support left. Games never scaled through labor; they scaled through play. And the core of play has always been speculative.

This is why, unless speculation is integrated into the core functionality, most attempts at "crypto games" are doomed to fail. Ponzi schemes and inflationary tokens are no longer effective. What people consistently want is the combination of risk stimulation and the breadth of entertainment.

This is also why every on-chain game is quietly reintroducing betting mechanisms.

They have realized the obvious fact: without speculation in the cycle, survival is impossible.

A Macro Perspective: Hyper-Gambling as Market Design

Speculation has always been the most common form of play. From ancient Roman dice games to modern casinos, from sports betting to unpacking Pokémon cards, the common thread remains: risk is entertainment.

The internet has financialized it, crypto technology has provided liquidity, and on-chain has made it programmable.

This has fundamentally changed the rules of the game:

Liquidity has become instant and global.

Every bet or interaction is verifiable.

Market movements themselves become distribution engines.

This is why most people's imagined "crypto games" are destined to fail. Without a speculative cycle, it is just a worse user experience of Web2 games. Ponzi schemes and inflationary tokens cannot survive in the current environment. The only games that can expand on-chain are those that directly connect to the market.

This is the inevitability of hyper-gambling. It is not a side bet, but a new market design where play and speculation are inseparable, and attention itself becomes the distribution track.

The Correctness of Prediction Markets

Prediction markets are a form of game. The market is an entertainment cycle; the return is the truth at settlement. Prediction markets, whether superficial or as the underlying support for consumer experience, will become the next huge long-tail, high-variance game on-chain.

They are effective because:

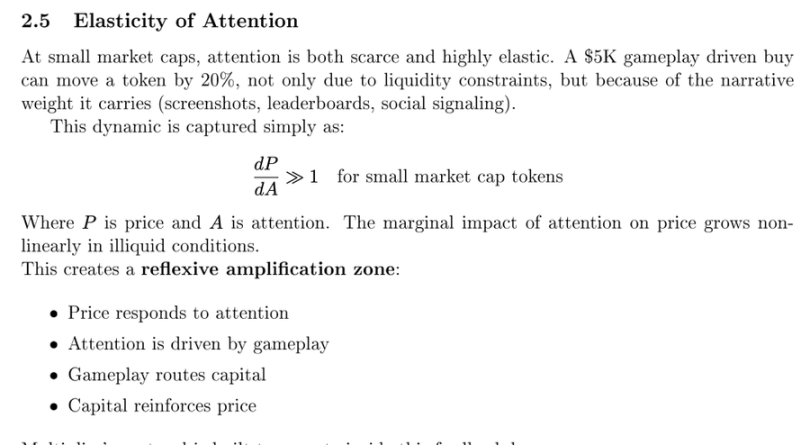

Small pools of capital yield returns. Retail investors can drive market movements; price impacts are clear and addictive.

Settlement creates stakes. Outcomes are resolved, proofs exist, and consequences are content.

Odds become memes. Implied probabilities turn into charts, screenshots, and shareable narratives.

Reflexivity is inherent; betting drives prices → prices spark discussions → discussions drive more betting.

Their durability lies in the fusion of speculation with consequences and distribution.

Potential Long-Term Shortcomings of Prediction Markets

Classic prediction markets are narrow in scope: binary, slow, fragmented. They excel at handling outcomes but struggle to sustain. This technology is amazing at aggregating opinions to seek truth, but most trading volume still comes from large players and major market participants rather than retail investors.

The next wave will improve their microstructure, not just the shell:

Treat each game as a micro-market with clear profit curves (like lottery-style betting, AMM, or order books).

Design around visible market fluctuations to give users a sense of agency.

Adopt faster settlement rhythms to maintain cycle vitality.

Allow games, tasks, and creator challenges to access shared liquidity.

The standard cycle is: attention → pricing risk → proof. Everything else is just auxiliary tools.

Durable on-chain games will resemble less of a labor cycle and more of a prediction market with better skins, micro liquidity pools, shareable odds, ongoing consequences, and reflexive distribution.

Why On-Chain Makes This Inevitable

Crypto technology provides the perfect foundation for speculative play:

Instant liquidity—bets and outcomes settle without intermediaries.

Composable markets—each game connects to shared infrastructure.

Transparent odds—verifiable fairness is built into the chain.

Meme amplification—tokens turn every outcome into a narrative.

The next wave will not resemble labor cycles like Axie. It will be like an arcade connected to the financial system, where each machine is a micro-market, every action is priced, and every new player adds liquidity to the cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。