Author: Robert Osborne, Outlier, Ventures

Compiled by: AididiaoJP, Foresight News

Summary

- Web3 venture capital surged to $9.6 billion, marking the second highest quarterly total on record, despite the number of disclosed deals dropping to just 306 rounds.

- Capital concentration intensified. Fewer companies raised more funds, with the median size of financing rounds across all stages increasing. Series A funding reached $17.6 million, the highest level in over two years.

- Seed round amounts increased. The median size of seed round financing jumped to $6.6 million, reversing the decline seen in the first quarter, indicating increased confidence in early-stage capital.

- Private token sales remained stable, raising $410 million through just 15 transactions. Public token sales plummeted by 83%, with only 35 activities raising $134 million.

- Infrastructure continued to dominate, with cryptocurrency, mining and validation, and computing networks leading in capital and investor interest.

- The consumer category showed signs of life, particularly in financial services and marketplaces, but the scale of financing and share of deals remained relatively small.

- The financing trends this quarter indicate that this is no longer a broad net game, but rather a very thorough belief investment.

Market Overview: Capital Concentration

At first glance, the numbers seem contradictory: total Web3 venture capital skyrocketed, but the number of deals sharply declined. However, within the broader context of adjustments we have been tracking since 2024, the logic becomes clear: investors are shifting from broad coverage to deeper, more strategic bets, a transition solidified in the second quarter of 2025.

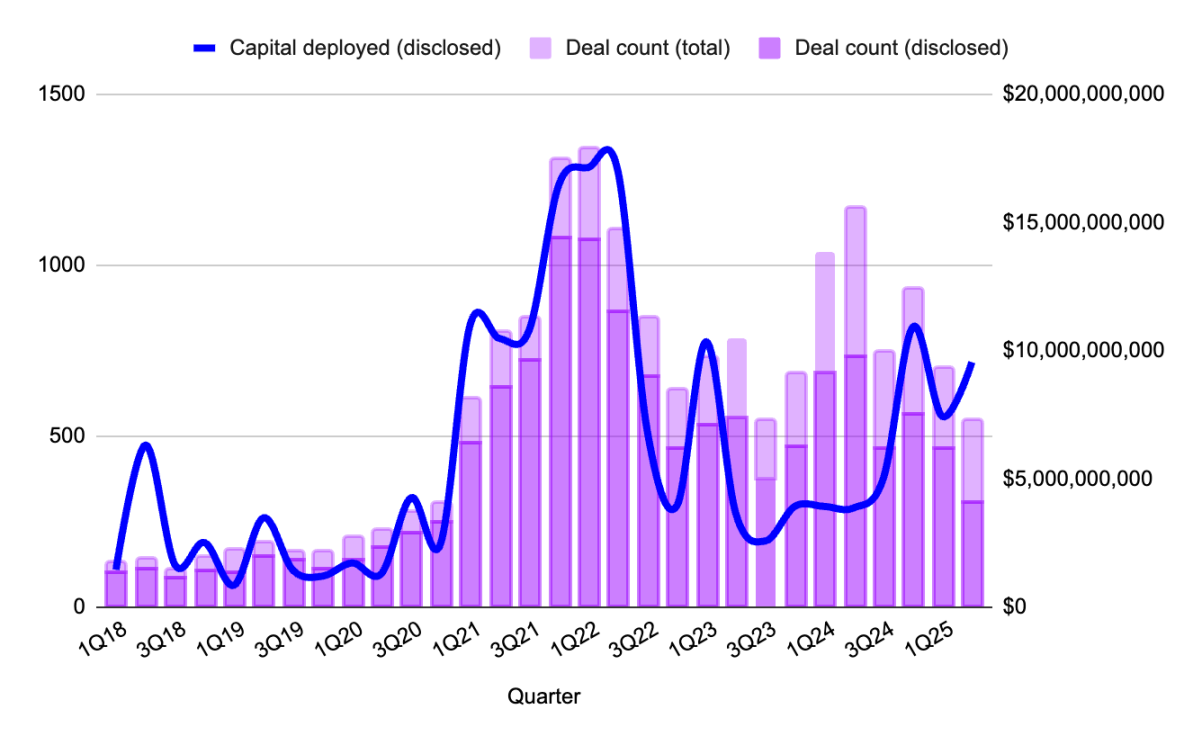

Figure 1: Quarterly statistics of Web3 deal numbers and financing amounts, Source: Outlier Ventures, Messari

This quarter recorded only 306 disclosed deals (transactions with published financing details): the lowest level since mid-2023. However, financing amounts soared to nearly $10 billion, nearly 30% higher than the previous quarter, without any outlier mega-deals. We did not see a single large transaction distorting the data, but rather a concentration of rounds between $50 million and $250 million, focused on strategic areas such as Rollup infrastructure and validator liquidity. The defining characteristic of financing this quarter was fewer bets, larger rounds, and higher thresholds.

The result is a market that feels smaller but also more serious. In an environment following mega-funds, investors are not chasing every funding pitch; they are considering narratives, protocol dependencies, and distribution advantages comprehensively. You no longer receive funding for being promising; you receive funding for being indispensable.

Stages of Financing for Web3 Startups: Series A Returns

After being overlooked for a year, Series A financing has returned to the spotlight.

The median size of Series A financing climbed to $17.6 million, the highest level since early 2022, with 27 deals raising a total of $420 million. These are no longer "quasi-Series B" financings disguised as Series A; they are precise and prudent allocations of capital to companies with strong product-market fit (PMF), which typically have growing revenues and well-structured token mechanisms.

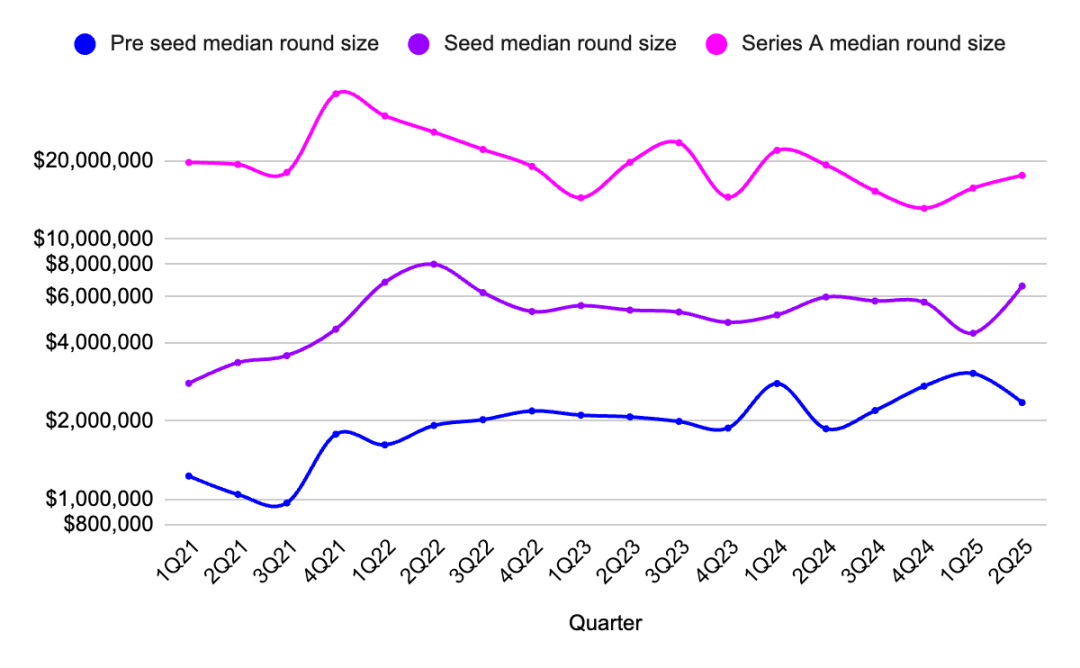

Figure 2: Quarterly changes in median financing sizes for pre-seed, seed, and Series A stages, Source: Outlier Ventures, Messari

Seed rounds also saw a rebound, with the median size of seed round financing rising to $6.6 million, while the total number of deals increased slightly. This indicates a return of investor interest in early-stage risk, at least in hot areas such as AI-native infrastructure or validator tools. Meanwhile, pre-seed rounds remained stable, with a median of $2.35 million, confirming what we have seen over the past year: early projects still exist.

In 2024, capital is concentrated at both ends, with optimism in pre-seed stages and maturity in Series B and beyond. Series A was once a place of belief decay, but the risk market will not remain stagnant forever. Infrastructure takes time to build, and scaling also takes time; that moment has now arrived.

Infrastructure Investment Dominates Web3 Capital Flows

This quarter's capital-weighted Web3 category map resembles a blueprint for post-consumer transformation.

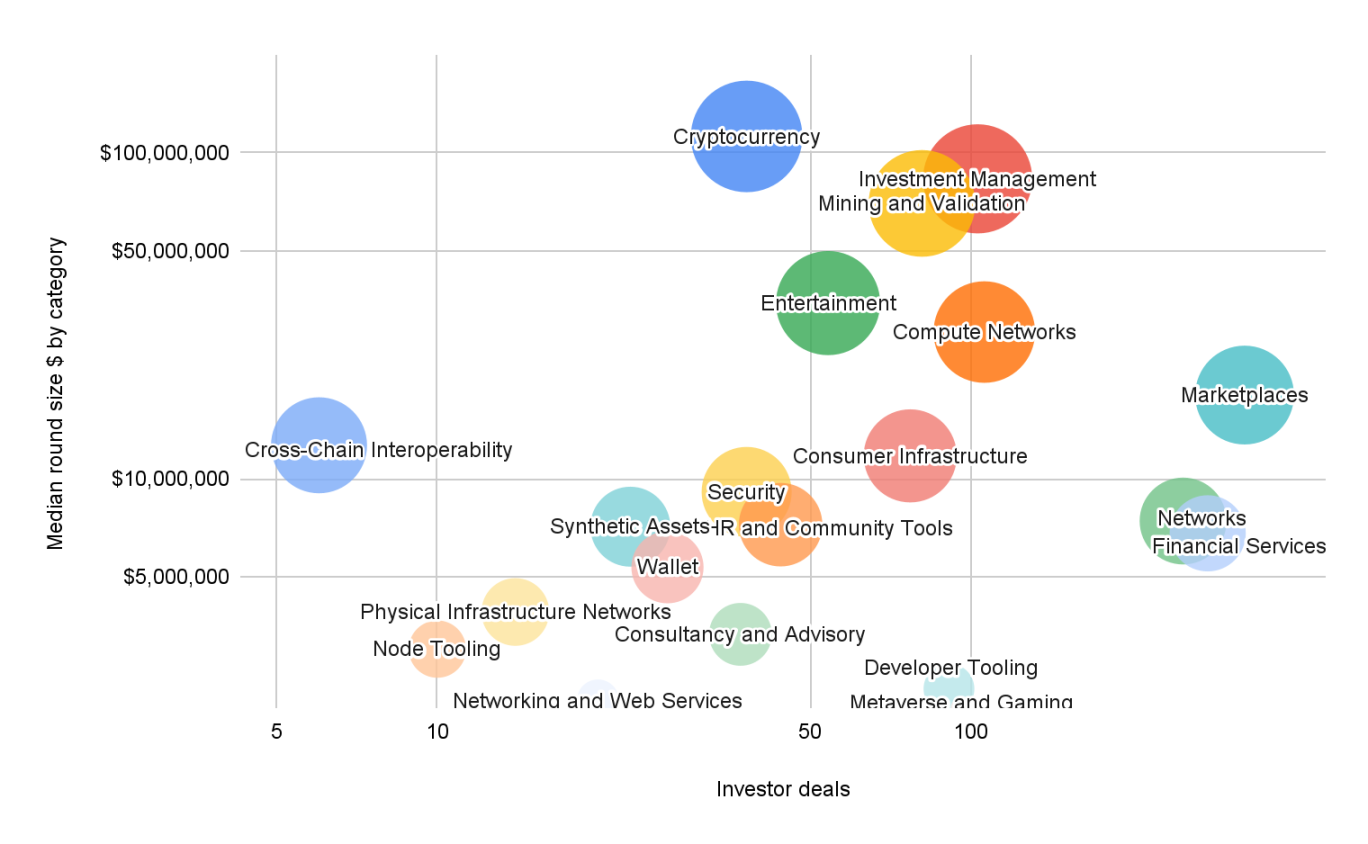

Figure 3: Average size of financing stages and rounds by category in Q1 2025. Source: Outlier Ventures, Messari

Note: "Investor transactions" refer to the total number of times investors participated in a given category, not the number of independent investors. If an investor participated in three financings, it counts as three investor transactions.

The largest financing sizes occurred in infrastructure (median $112 million), mining and validation (median $83 million), and computing networks (median $70 million). These are not speculative tokens but infrastructure that supports validator networks, modular block space, and AI alignment consensus systems, which define long-term blockchain investment strategies. The logic for investors is clear: support the underlying infrastructure, then rapidly develop the application layer.

Other prominent infrastructure areas include consumer infrastructure (median $11.7 million) and asset management (median $8.3 million). These categories sit at the intersection of infrastructure and user experience (UX), representing high-functionality products with technical depth and long-term composability.

On the other hand, developer tools once again attracted strong capital interest (91 investor transactions), but the financing amounts were smaller. This is a familiar narrative for this long-tail, low-capital expenditure industry. However, it remains a playground for early teams and those willing to engage in grant and token option games.

Financial services, entertainment, and marketplaces achieved healthy deal numbers and moderate median financing sizes (ranging from $6 million to $18 million), indicating that investors maintain stable and cautious attention. However, their transaction volumes are far from the levels seen in 2021-2022. Investors have not lost interest in consumer applications; they are simply waiting for new products to emerge.

Q2 2025 Token Financing: Private vs. Public

Following a booming first quarter, token financing entered a calmer phase in the second quarter, but this shift feels more like a redistribution than a retreat.

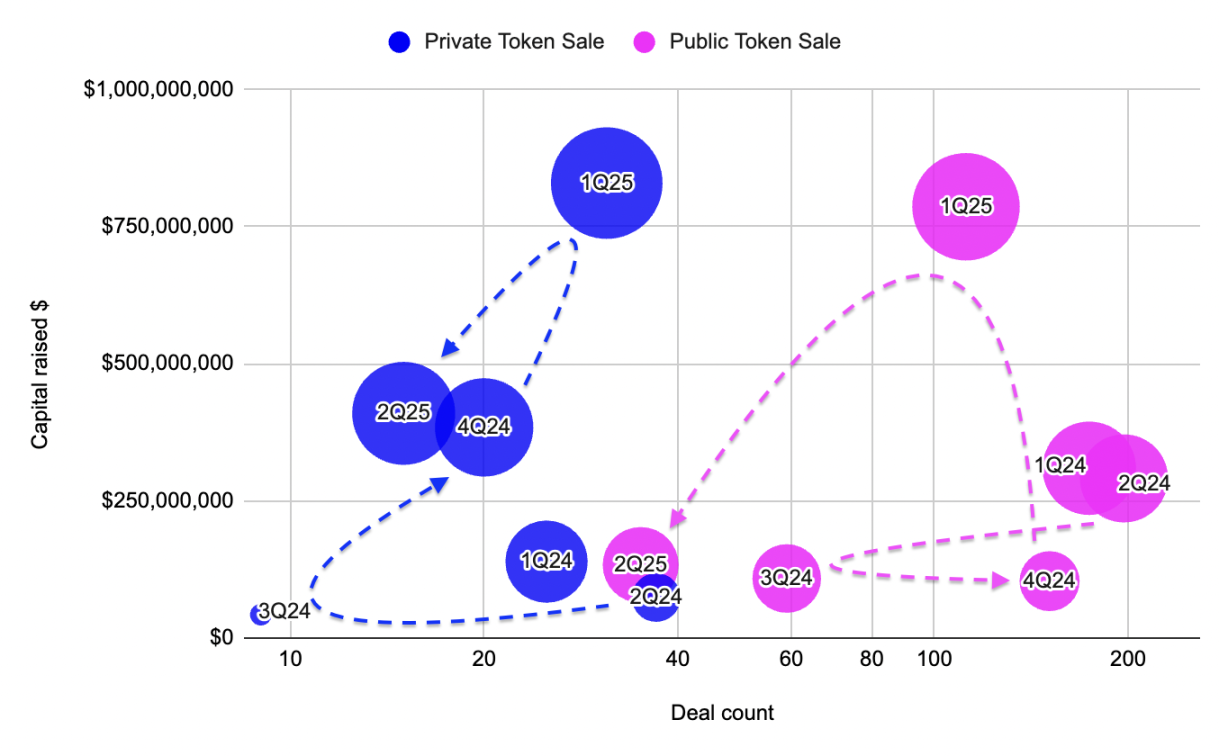

Figure 4: Comparison of private and public token sales in terms of financing amounts and transaction numbers from 2022 to 2024, Source: Outlier Ventures, Messari

Private token sales raised $410 million through just 15 transactions, with a median financing size of $29.3 million, the highest level since 2021. The growth of these high-value private allocations highlights the current financing environment in Web3: consistency and strategic partnerships are more important than hype. These are not meme coins driven by speculation or utility tokens disguised as protocols; rather, they are validator alliances, L2 treasuries, and modular Rollup ecosystems quietly consolidating liquidity.

In contrast, public token sales collapsed. Only 35 financings were completed, down from 112 in the first quarter, totaling just $134 million, with the median financing size halving. Even retail-favored issuances struggled to attract attention, with most transaction volumes concentrated in a few high-profile projects. Beyond that, market sentiment feels more like a wait-and-see stance rather than bearish, a posture of waiting and observing rather than a full retreat.

The divergence between private and public sales continues a trend tracked since the end of 2023. Public token issuances surged during market heat, but private rounds reflect consistency rather than hype.

Conclusion

Investors are looking for clearer narratives, more solid infrastructure, and builders who understand how to navigate this new financing environment.

If 2024 was a year of recovery and restructuring, then Q2 2025 feels like a year of silent execution.

Capital is flowing, but only to a few. Deal flows are decreasing, but financing sizes are increasing. Infrastructure continues to win, but not out of bias; no significant ideological shifts have occurred.

For founders, the path has narrowed, but it is not unfeasible; early deals are still happening, and Series A financing has returned. As long as they align with strategic, scalable, and protocol-dependent goals, private tokens once again have a real seat at the negotiating table.

In short: we have moved away from a broad market hype cycle. This is a slow, pressurized climb, aimed at those critical infrastructures and enduring applications.

The conclusion is simple: this market does not need more hype cycles; it needs inevitability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。