After days of a pervasive bearish sentiment, the cryptocurrency ecosystem showed signs of a potential reversal as a majority of altcoins posted modest gains. This collective upward movement was significant enough to propel the total crypto market capitalization back above the $3.9 trillion threshold.

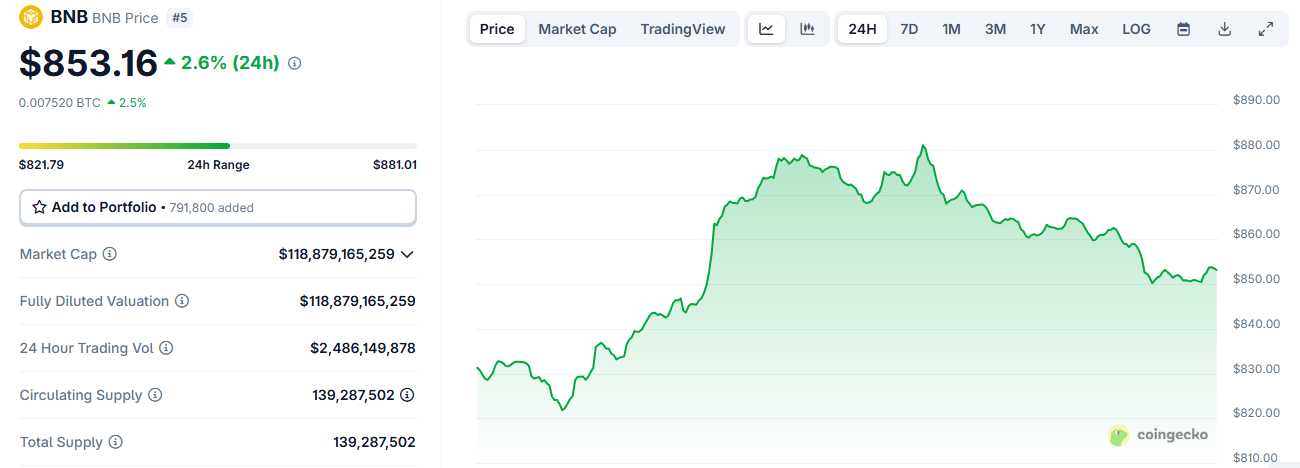

With bitcoin seemingly static, BNB was among the top picks as it rallied to a new all-time high of $882. Although it later retreated to $853, the digital asset’s 2.3% gain in 24 hours made it one of a handful of high-cap altcoins that helped the crypto ecosystem shrug off the impact of bitcoin’s ( BTC) marginal decline.

Meanwhile, LINK’s 4.5% increase was by far the highest of any digital asset among the top 20 assets tracked by Coingecko. In fact, LINK has been one of the few outliers in a week that has been dominated by bears. As shown by data, the latest gain brought its seven-day gains to 12.1%, making it one of the best performers in the period. Only OKB (44%) had a higher weekly gain of all the 100 digital assets.

While the majority of high-cap altcoins saw modest gains of 2% or less, this collective uptick was enough to trigger a slight decline in BTC market dominance, which fell from nearly 60% on Aug. 20 to approximately 58%. However, this minor shift has not been enough to convince some analysts that a full-fledged altcoin rally is imminent. The crypto community is now engaged in a heated debate over whether altcoins will finally “get into gear” and reach new milestones or if the current momentum is simply a temporary reprieve.

This uncertainty has prompted one crypto analyst, Miles Deutscher, to warn users to be wary of what he called a “massive trap.” In a post on X explaining what he thinks will happen next, Deutscher pointed to the BTC vs. ETH strength, which he said currently shows the latter to “have an upper hand on Bitcoin both in terms of price action and narrative.”

The crypto analyst asserts that this proves that BTC is “structurally weak,” while Strategy’s waning BTC purchases are stalling momentum. In contrast, the Ethereum treasury narrative is growing, an indication that ETH has room to move up and with it, altcoins too.

“And I believe this is why, despite the drawdown, altcoins are showing relative strength vs. BTC, as seen in the OTHERS/ BTC chart. The altcoin market upheld weekly support and turned bullish daily, indicating alts are stable against BTC, reflecting a risk-on sentiment return,” Deutscher added.

The crypto analyst claimed that while U.S. Federal Reserve Chairman Jerome Powell’s Jackson Hole speech and the Federal Open Market Committee (FOMC) meeting have the potential to trigger a “classic sell into the end of the month” pattern, he believes that sell-off is already in progress. He asserts, however, that once this period of uncertainty passes, the market will be in a much stronger position to attempt new, all-time highs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。