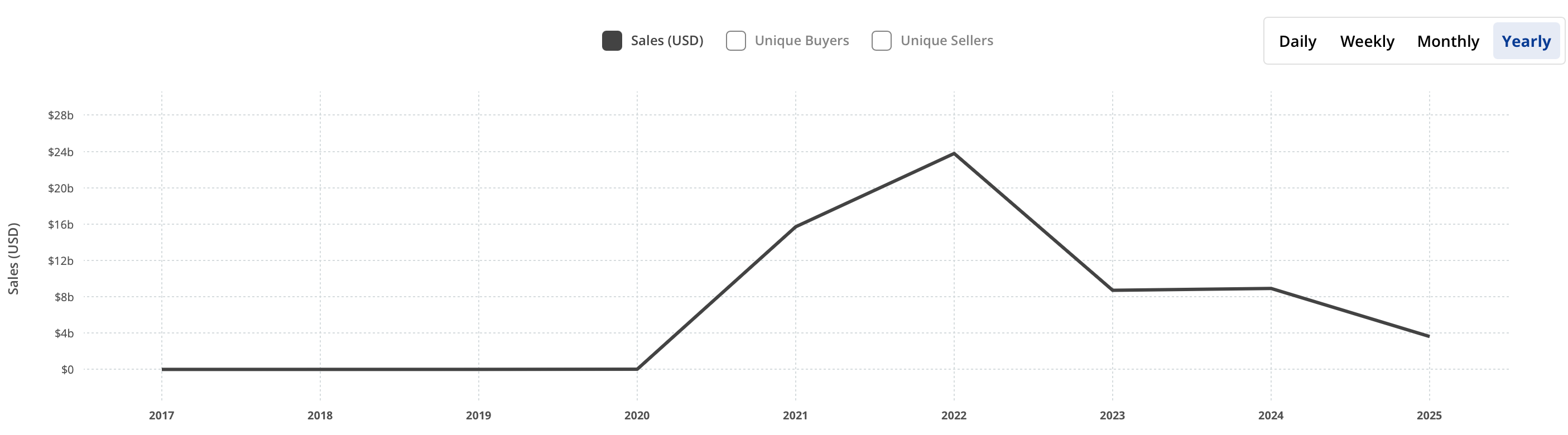

During the 2017 bull run, NFTs barely made a dent, with sales totaling just over $143,000, according to cryptoslam.io stats. The following year, 2018, brought $1.5 million. By 2019, sales doubled to $3.75 million, and in 2020 they climbed to a much higher $22.25 million. Then came 2021, when NFTs truly caught fire during the bull run, racking up $15.7 billion in sales volume. In 2022, the sector pushed even higher, reaching $23.77 billion.

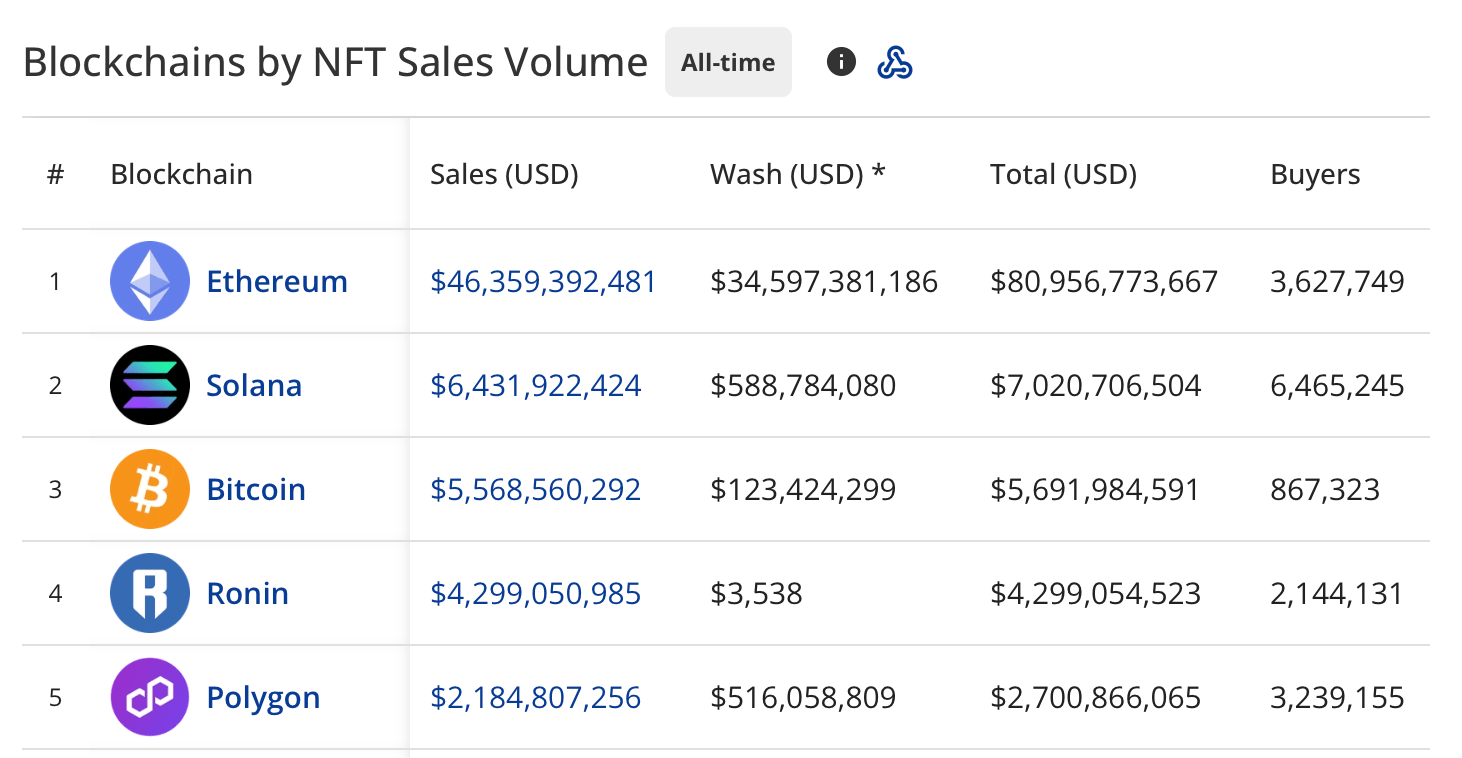

In 2023, the party came to an abrupt end as sales tumbled 63.4% to just $8.7 billion. The next year brought a slight bounce, with totals reaching $8.91 billion in 2024. So far in 2025, the tally stands at $3.62 billion in NFT sales. As of Aug. 19, 2025, total sales have reached $71.55 billion, with $46.35 billion of that tied to Ethereum-based NFTs. In fact, Ethereum recorded $80.95 billion overall, though $34.59 billion of that volume was wash trading NFTs.

A wash trade is when the same party simultaneously buys and sells an asset or NFT to artificially inflate trading volume or manipulate prices. Solana has logged $7.02 billion in total sales, with $588 million flagged as illegitimate wash trades. That leaves Solana, the second-place contender, with $6.43 billion in legit NFT sales volume. Bitcoin ranks third with $5.69 billion in total sales, $123 million of which were wash trades.

That brings its adjusted total to $5.56 billion—a notable figure given that the bulk of these Bitcoin-based NFT sales have occurred more recently, following the 2021 and 2022 digital collectible sales highs. Ronin holds the fourth spot in overall sales, with the Axie Infinity-linked chain recording $4.29 billion in lifetime NFT sales. Wash trading on Ronin is almost negligible, totaling just $3,538 since inception.

Axie Infinity’s marketplace and in-game NFTs come with design and economic limits that make wash trading and self-dealing strategies hard to pull off. Polygon, meanwhile, has seen $2.7 billion in total NFT sales, with $516 million tied to wash trades, leaving a genuine $2.18 billion. Just below Polygon, in sixth place, is Flow with roughly $1.53 billion in digital collectible sales.

Flow has logged an estimated $18.27 million in wash trades, giving it a final tally of $1.52 billion in legitimate NFT sales. Trailing Flow are Immutable, Mythos, Cardano, and BNB Chain, rounding out the top ten blockchains by NFT sales. While NFTs may not match their euphoric highs, their presence in digital culture still appears durable.

With 134 days left in 2025, the market would need another $5.29 billion in sales—an average of $39.48 million per day—to match 2024’s total of $8.91 billion. Hitting $10 billion this year would require $47.61 million daily, or 1.57× the current pace. To top 2022’s all-time high, however, daily sales would need to jump to more than four times today’s rate.

Sales distribution across multiple chains demonstrates a broader experiment in digital ownership, one that continues to attract interest despite setbacks. As speculative activity fades, the remaining ecosystem could evolve toward more practical applications, morphing and reshaping expectations for what NFTs ultimately represent in global markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。