Author: Sleepy.txt, Dongcha Beating

Editor: Kaori

In a sense, the previous generation of FinTech may have already died.

In early July, Peter Thiel's Valar Ventures, one of Silicon Valley's top angel investors, liquidated its holdings of 4.8 million shares of Wise at a transaction price of £10.30, totaling nearly £50 million. This venture capital firm was one of Wise's earliest and most core supporters, participating in early investments since 2013 and accompanying Wise through a complete entrepreneurial cycle until its listing on the London Stock Exchange in 2021.

Now, this relationship has ended with a quiet transaction.

This is certainly not an exit in a panic, nor merely a cashing out after book profits.

Many decisions in the financial world do not immediately reveal their significance. Whether it’s investing or exiting, the signs may not be apparent at the time, but looking back, a clear path can often be pieced together; those choices have long pointed to another future.

Peter Thiel and his fund Valar Ventures are among the most radical believers in FinTech. They believe that hidden efficiency dividends lie within the gaps of the banking system, betting on entrepreneurs who attempt to bypass regulation and reshape payment pathways with technology. These companies have risen in the crevices of the times, telling one story after another that challenges the traditional order.

But every technological revolution eventually ages. Paths are replicated, growth stabilizes, and the initial rebels begin to conform. And the investors are often the first to notice this change.

To truly understand the significance of this exit, we must go back twelve years to when Peter Thiel first decided to bet on Wise. At that time, the banking system was still slowly recovering from the 2008 financial crisis, while a group of self-proclaimed "hacker spirit" entrepreneurs was trying to penetrate the closed barriers of traditional finance with technology.

Peter Thiel was among the earliest believers in them.

I. From TransferWise to Wise: The Golden Decade of FinTech

In 2013, Wise was still called TransferWise, just an inconspicuous small project in a shared office building in East London. The team was small, with one founder from Skype and another who had worked at Deloitte.

The problem they aimed to solve was not new: cross-border transfers were too expensive and too slow, but their method was quite unconventional. TransferWise did not seek licenses or partner with banks; instead, it designed a currency exchange matching mechanism that allowed funds to circulate without needing to "cross borders."

The model was simple, the path clear, and it did not rely on financial institutions. For this reason, TransferWise caught Peter Thiel's attention.

What Peter Thiel has always liked is not the mainstream.

He has always been one of Silicon Valley's most well-known libertarians, remaining vigilant against government, regulation, and centralized organizations, and thus more willing to bet on systemic improvements that bypass the old order and emphasize individual efficiency. TransferWise happened to fit this logic, not relying on licenses, bypassing institutions, and achieving exchange rate pricing through direct matching between users, with a self-consistent product logic and a clear growth path.

In this company, Peter Thiel saw the "0 to 1" model he has long advocated, which is to occupy a small market through structural design, achieve a micro-monopoly through efficiency advantages, and then expand along logical boundaries. TransferWise's currency matching mechanism was precisely the systemic entry point he consistently focused on.

In 2013, Valar Ventures, under Peter Thiel, led a new round of financing for TransferWise. That was a year dominated by social media, cloud computing, and mobile internet, and he made a distinctly different choice.

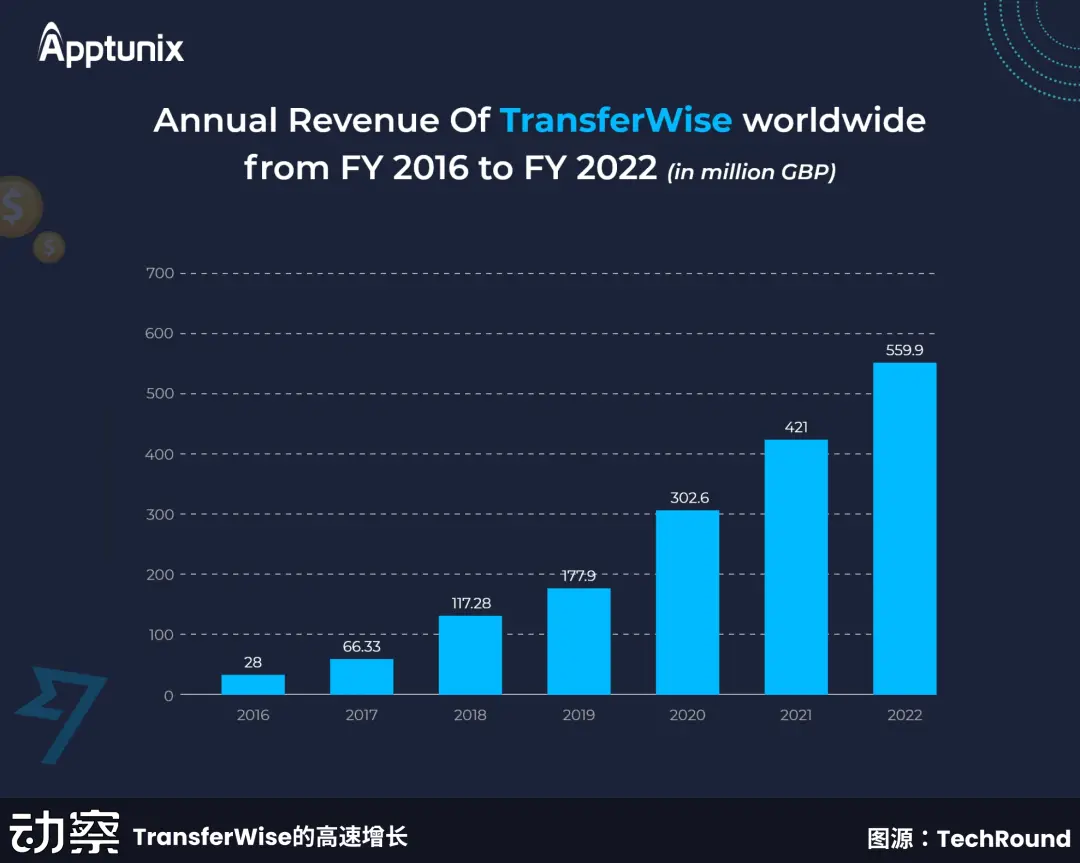

In the following years, the unusual growth curve exhibited by TransferWise proved Peter Thiel's vision.

By 2017, TransferWise's monthly settlement amount had exceeded £1 billion, and it achieved operational profitability for the first time, with revenue growth exceeding 150% year-on-year; by 2020, the annual transaction total rose to £67 billion, with approximately £42 billion in cross-border transactions, and its valuation reached $5 billion, making it one of the fastest-growing FinTech companies in Europe at the time.

In 2021, TransferWise officially rebranded as Wise and directly listed on the London Stock Exchange in July, with a valuation of £8.75 billion, approximately $11 billion. On its first day of trading, Wise's stock price rose by 10%, making it one of the most watched tech stocks in the London market that year. Valar Ventures, as an early investor in Wise, held over 10% of the shares at that time, becoming one of the biggest winners in this IPO.

The rise of Wise also became a model for the successful narrative of FinTech in the 2010s, breaking the banking monopoly, winning through efficiency, and leading with ideas. It did not rely on complex financial engineering, nor did it attempt to reconstruct the entire currency system, but instead focused on finding efficiency gaps within the existing system, using product advantages to penetrate and replace some functions of banks.

The decade of Valar Ventures and Wise indeed confirmed the high point of this model.

But every hero story has its curtain call. The golden age of FinTech has ended.

II. The Previous Generation of FinTech Narratives Can No Longer Be Told

Once, it was synonymous with "new finance," reducing intermediaries, being technology-driven, and prioritizing user experience, using a lighter model to nibble away at the heavy asset system of traditional finance. In the early decade, those FinTech companies repeatedly replicated that classic path, prying open a gap at the edge of the traditional system, breaking down the bank's profit model into APIs, fees, and UX combinations.

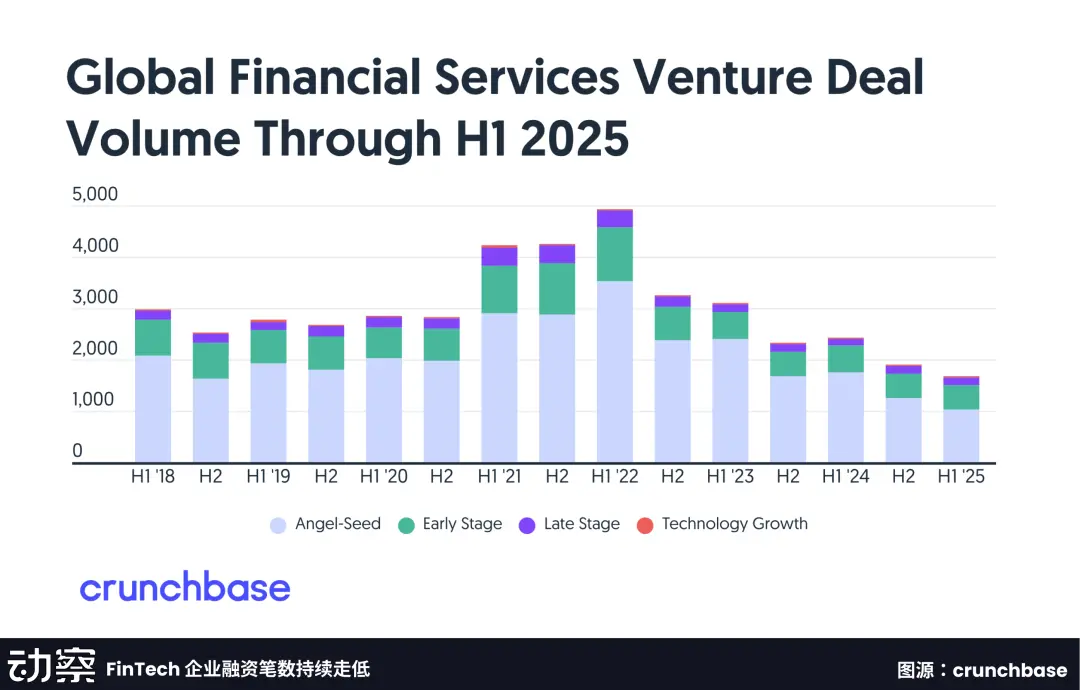

But by 2025, this path was clearly no longer viable, and venture capital interest in FinTech was cooling.

Statistics from Crunchbase show that global FinTech financing transactions totaled only 1,805, a year-on-year decrease of over 30%; a year earlier, this number was 2,633. The contraction in numbers was not unexpected, but the speed of decline was much faster than imagined.

The first to feel the chill were retail financial services close to the C-end. Data from PitchBook shows that in the first quarter of 2025, retail FinTech financing fell by 37.8% quarter-on-quarter. By the second quarter, even relatively counter-cyclical enterprise financial technology was not spared, with transaction volumes decreasing by about 13% year-on-year.

The past FinTech relied on working at the margins of the traditional financial system, using a lighter model to penetrate higher efficiency points. But once all easily optimized links have been transformed, what remains are increasingly heavy compliance obligations, increasingly high customer acquisition costs, and increasingly difficult growth spaces to break through.

Wise is one typical case.

In the past year, not only did its stock price fall over 20% from its 2024 peak, but it was also questioned multiple times by regulatory agencies. In June of this year, the U.S. Financial Crimes Enforcement Network (FinCEN) imposed a $9 million fine on it for serious non-compliance with anti-money laundering regulations. Meanwhile, UK regulators began to re-examine its risk control mechanisms, and Wise's once-proud light asset compliance model was being systematically dismantled by reality.

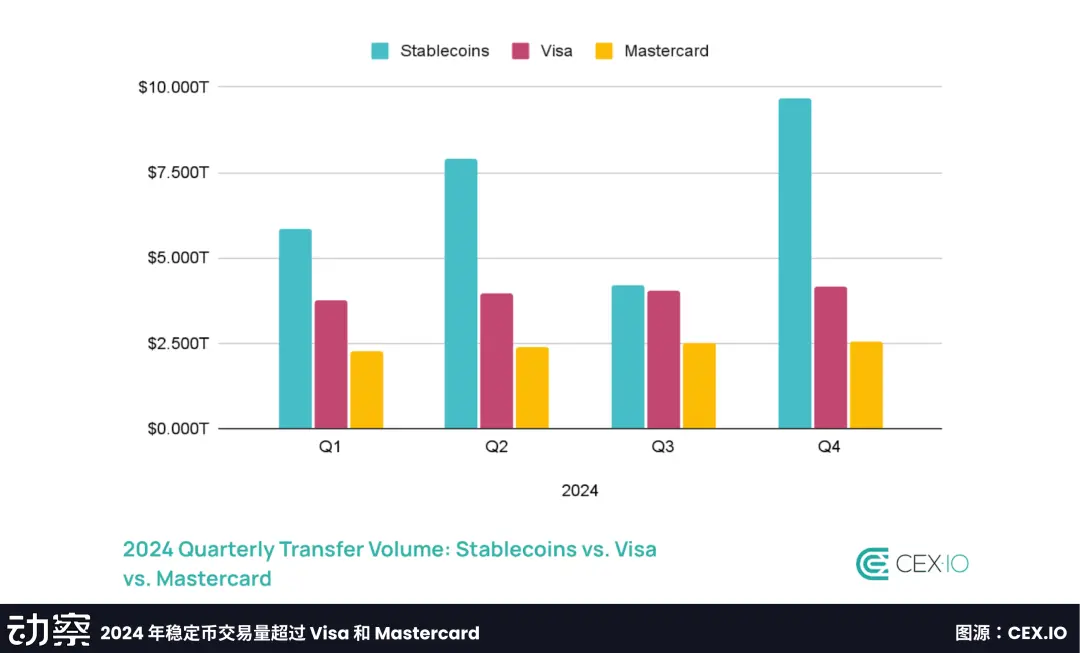

At the same time, new pressures were also spreading from the Crypto sector.

The on-chain payments, real-time clearing, and settlement pathways brought by stablecoins have begun to erode the profit margins of traditional cross-border transfers. Compared to transfer solutions like Wise, more and more companies are considering directly deploying on-chain settlement channels, no longer relying on the complex scheduling systems between banks and payment platforms.

Under the increasing pressure, Wise also began preparing for a U.S. listing, considering listing in the U.S. in the form of ADR, which means it does not need to change its corporate structure while seeking higher liquidity and valuation expectations in the U.S. capital market.

This re-listing attempt, officially described as a "valuation optimization action," is actually a search for rescue, a deep-seated unease about liquidity, valuation, and whether the previous generation of FinTech narratives can still withstand a new round of capital cycles.

The previous FinTech model indeed gave birth to a number of outstanding companies. But as Crypto begins to rewrite the clearing and account systems, the path of "optimization" itself is gradually losing its footing.

This revolution has ultimately reached its ceiling.

Looking back, Valar Ventures' bet in 2013 was a direct response to the high costs and low efficiency of the banking system; while the liquidation in 2025 was a clear farewell to the old financial innovation model.

III. New Protocols Are Devouring Old Systems

Today's Crypto is becoming FinTech 2.0.

If the previous generation of FinTech was an efficiency patch built on the banking system, the new generation of Crypto protocols is attempting to bypass banks and rewrite that system itself.

This is not just an idealistic narrative; it has already become a visible reality.

The daily on-chain settlement amount of stablecoins has long surpassed billions of dollars, becoming the new default pathway for many companies' cross-border capital flows. It does not rely on Swift, nor does it require traditional bank accounts; it only needs an address to complete global settlements within minutes.

A deeper transformation is occurring in the backend. The clearing pathways are being reconstructed on-chain, identity verification no longer relies on financial institutions, and interest rates and asset pricing logic are detached from the settings of central banks and banks. Those modules that once drifted outside the mainstream view are becoming core components of a parallel financial system.

This is also forcing a fundamental shift in the value capture logic of FinTech.

The innovations of the previous generation of FinTech mostly focused on the performance layer, such as account systems, payment channels, and UX design. They were more like a friendlier shell wrapped around the original financial system, essentially enhancing the usability of banks rather than replacing the banks themselves.

And Crypto, or FinTech 2.0, bets on the protocol layer and settlement layer, which are those self-operating system components that detach from banks. It constructs a complete set of clearing pathways and identity systems independent of the banking system, fundamentally bypassing the dependencies of the original financial architecture.

When value is no longer concentrated on the front-end interface but begins to sink into the back-end structure, investors naturally turn their attention to the bottom of the system, the place that truly has the potential to leverage order. Peter Thiel is a keen hunter; he focuses on projects that can reconstruct the foundational financial order because they have the potential to shake existing rules at the structural level.

Under this betting logic, Wise's withdrawal gains its true significance.

From serving the front end to building the back end; from connecting banks to bypassing banks; from optimizing reality to rewriting reality.

IV. Turning Towards a New World

Peter Thiel has never left the financial technology table.

In addition to Valar Ventures, which bet on Wise, Peter Thiel also has another fund with more strategic intent, Founders Fund. This institution was one of the earliest Silicon Valley VCs to invest in SpaceX and Meta, managing over $12 billion in assets by 2023.

Compared to Valar, which often focuses on early-stage growth companies, Founders Fund is more inclined to directly participate in system-level and infrastructure-level construction. In recent years, this fund has gradually shifted away from traditional tech tracks and begun to concentrate on Crypto infrastructure, building future financial frameworks around stablecoins, on-chain clearing, and on-chain banking systems.

From late summer to early autumn 2023, Founders Fund purchased a total of $200 million in Bitcoin and Ethereum, each accounting for half. Thiel's fund had already invested in Bitcoin back in 2014 and liquidated before the market peaked in 2022, making a profit of about $1.8 billion. This time, they are back at the table, but the posture and context are entirely different from those of the past.

Peter Thiel's renewed bet on crypto is aimed at gaining the authority to shape future financial order, building his financial empire from assets to protocols.

In his investment portfolio, Bullish serves as the front end of trading scenarios, connecting users with liquidity; Paxos provides compliant issuance capabilities for stablecoins; Ubyx builds clearing protocols responsible for the on-chain flow of funds and assets; Erebor attempts to establish an on-chain banking system, acting as the Visa + Swift of on-chain finance; and CoinDesk, as one of the largest media platforms in the crypto space, was acquired by Bullish in 2023, becoming the voice of the entire system.

These invested companies collectively form a hidden but complete financial underlying structure, controlling asset anchoring, controlling clearing pathways, and controlling information dissemination, akin to a "shadow central bank" of the crypto era.

From the very beginning, Peter Thiel did not intend to bet on just one platform company; he aims to create a new financial machine that does not rely on traditional financial institutions but can independently maintain credit, liquidity, and regulatory order.

This main line ultimately reflects Peter Thiel's betting philosophy. He often bets on those futures that have not yet been accepted by the market, or even those that do not yet have names. He has funded autonomous city experiments at sea, invested in cryogenic human research, and has also invested in defense technology; many of his investments seem fanciful and far ahead of their time.

For him, waiting is a waste. Betting on investments is a way to drive the realization of the future.

Peter Thiel once said a famous quote: "We wanted flying cars, instead we got 140 characters."

This is a satire of the so-called "technological innovation" over the years, which ultimately only optimized advertising placements, extended user engagement time, and created more information silos. People used all their intelligence to create tweets with higher click rates, yet did not move any closer to the future.

Peter Thiel is not satisfied with optimizing within the existing system; he seeks to find starting points that can rewrite the underlying logic of the system, from energy, healthcare, and space exploration to now, Crypto.

The projects he invests in can be obsessive, the pace can be slow, but every step must be aimed at that "flying car" world.

Over a decade ago, he bet on Wise because it could enhance efficiency in the gaps of the traditional financial system; now, he bets on Crypto because he wants to reconstruct a financial system from the ground up.

From optimization in the gaps to reconstruction at the base. Peter Thiel is shifting his chips from the end of an old consensus to the starting point of a new consensus.

Thus, he exits Wise and turns towards a farther world.

Click to learn about job openings at ChainCatcher

Recommended reading:

Backroom: Information tokenization, a solution to data redundancy in the AI era? | CryptoSeed

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。