The company disclosed that it acquired 143,593 ETH last week, spending a net average of $4,648 per token. This aggressive purchasing was funded by substantial capital raises totaling $537 million in net proceeds.

A registered direct offering closed on Aug. 11, contributing $390 million, while the company’s at-the-market facility generated an additional $146.5 million between Aug. 10 and Aug. 15. Sharplink’s strategy, initiated on June 2, 2025, also includes staking its ether assets.

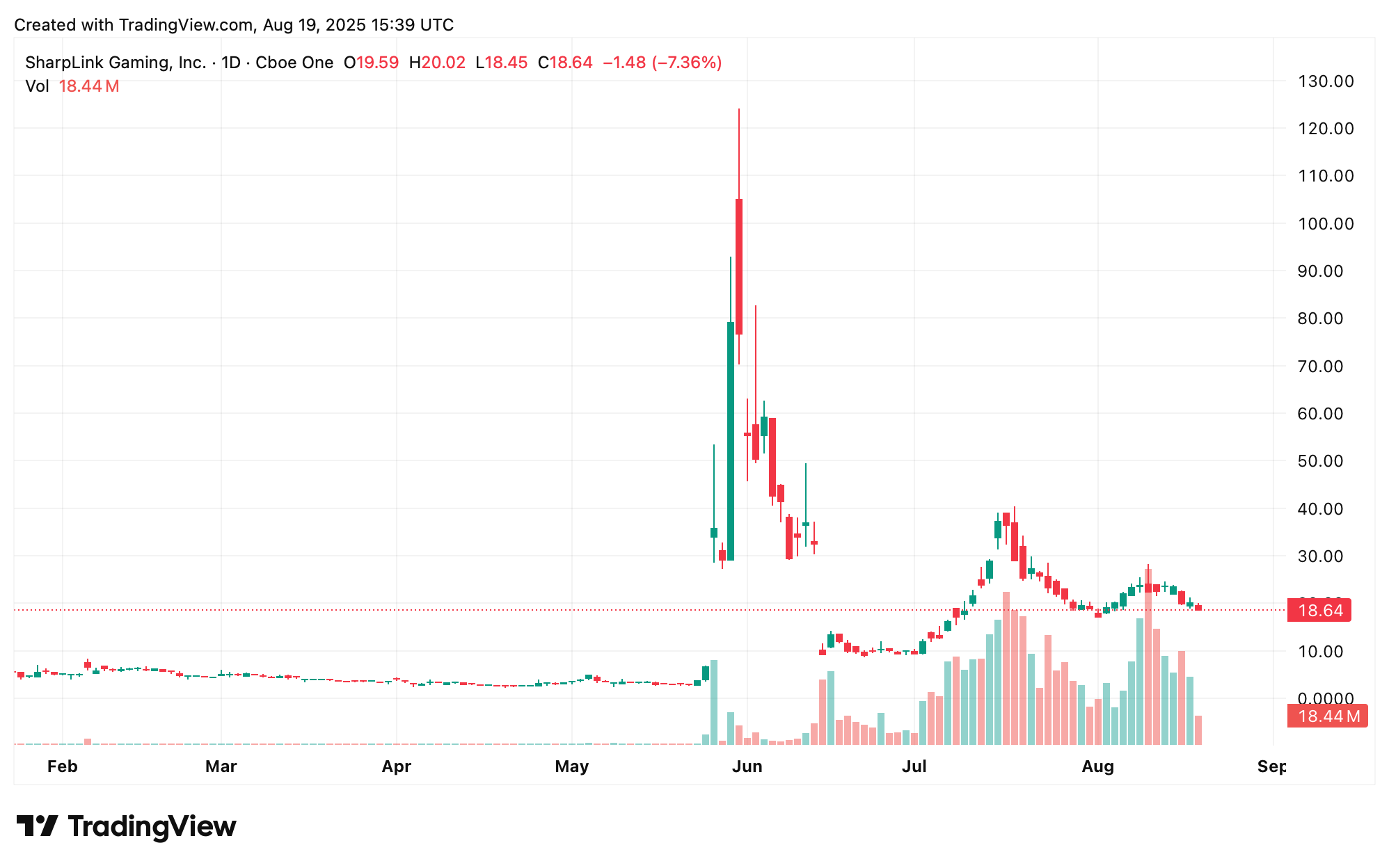

SBET shares on Aug. 19, 2025.

To date, this has yielded 1,388 ETH in staking rewards, which are included in the total holding figure. The company introduced a new metric, “ ETH Concentration,” which has increased 94% since the program’s start to a value of 3.87, indicating a growing allocation of ETH per share.

Despite these large purchases, the company reported that over $84 million in cash remains on hand and is designated for future acquisitions of ethereum. Sharplink has positioned itself as one of the largest corporate holders of Ether, adopting it as a primary treasury reserve asset.

On the other hand, the company’s shares, SBET, have fallen by over 7.5% in value on Tuesday during the day’s trading session. Moreover, over the five-day run, SBET is down more than 15% and since July 19, the stock has lost 49% of its value.

The company’s stated goal is to align its treasury with the future of digital capital, providing investors with direct exposure to ethereum ( ETH). Sharplink is also known for its work in developing online gaming solutions. The firm’s competitor Bitmine (BMNR) is the largest publicly-traded ETH treasury firm, and its shares have had a rough week too. However, unlike SBET, BMNR is up 6% over the 30-day run.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。