Written by: Wenser (@wenser 2010)

On August 13, OKX officially released an announcement that once again opened a new round of industry competition among exchanges.

On one hand, OKX decided to conduct a one-time destruction of the historical repurchase and the reserved 65,256,712.097 OKB, thereby fixing its total issuance at 21 million (Odaily Planet Daily note: consistent with Bitcoin's total supply); on the other hand, OKX decided to actively shrink its on-chain front, eliminating OKT Chain, with OKT tokens exchanged for OKB at a fixed price; fully developing the L2 network X Layer, upgrading network performance, and achieving ecological integration.

The news shook the market: within just 2 hours, the price of OKB surged from around $46 to about $142, an increase of approximately 208%; the OKB FDV market cap also surged to $7.45 billion (Coingecko data). On August 14, the 24-hour trading volume of OKB across the network was about $1.44 billion, with OKX alone accounting for a trading volume of up to $275 million. Affected by this news, platform tokens such as GT, BGB, and MX all saw varying degrees of increase, and the Hong Kong-listed company OK Blockchain (1499.HK) saw its intraday price surge by 26.09%, with the stock price reaching as high as HK$0.73 on August 14.

On August 15, the destruction of OKB tokens and the performance upgrade of X Layer were officially completed. Odaily Planet Daily will analyze the competitive landscape of CEX based on the existing information in this article.

Looking Back at the Development History of X Layer & OKB: Born for the Platform, Changing for Development

In 2023, influenced by the "Ethereum L2 wave," OKX, in collaboration with Polygon, launched an L2 public chain based on zkEVM, aiming to help users achieve lower transaction costs through ZK zero-knowledge proof technology; OKB, the platform token of OKX, serves as its native token. At that time, this L2 public chain was named OKX's L2.

In April 2024, OKX's L2 was officially renamed to X Layer, and with the subsequent addition of infrastructure projects such as The Graph, QuickSwap, Curve, and Wormhole, its ecosystem became increasingly rich.

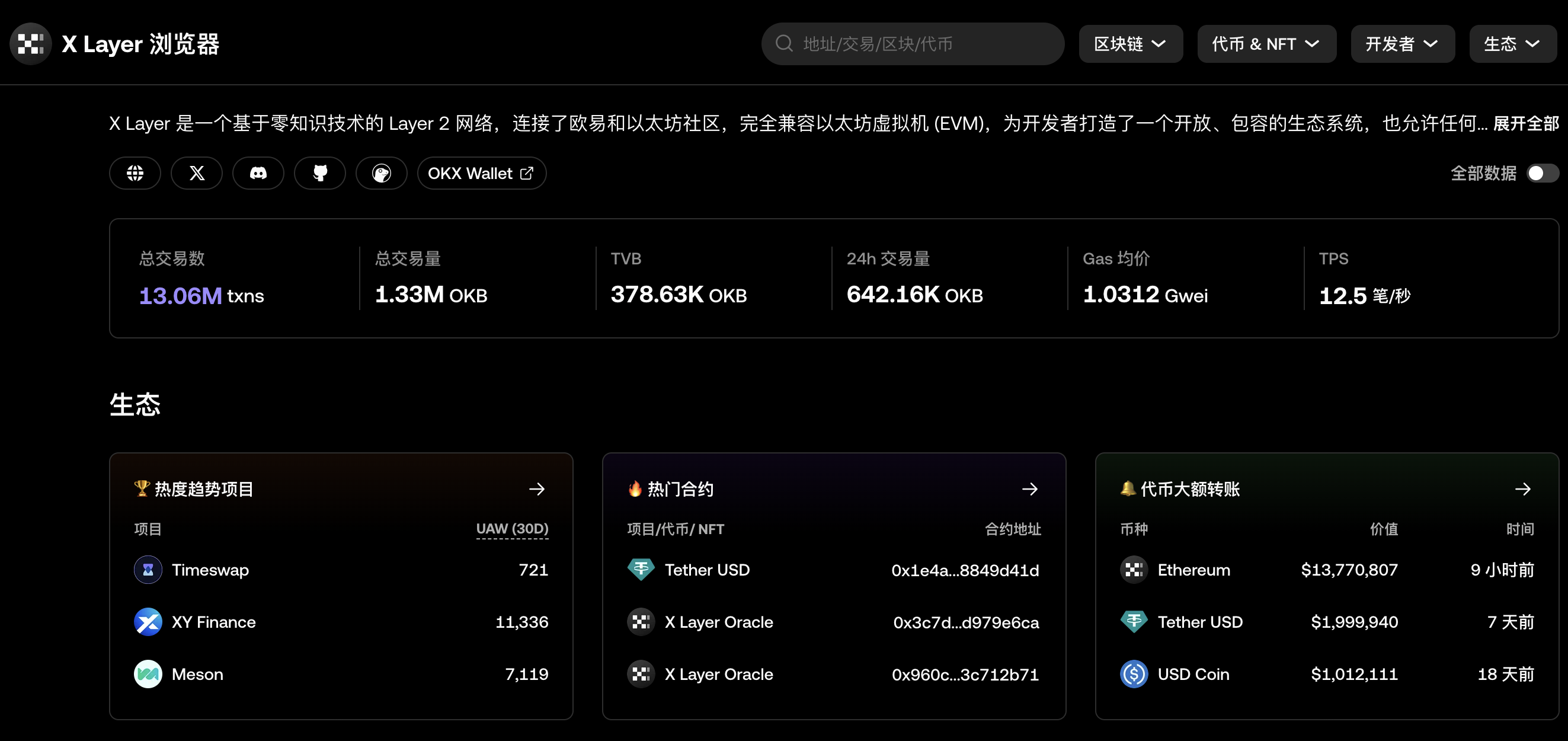

According to official blockchain explorer information, as of August 18, 2025, the total number of transactions on the network reached 13.06 million; the total transaction volume was 1.33 million OKB, valued at approximately $150 million; the TVB funds totaled 378,000 OKB, valued at around $43.09 million. As OKX CEO Star previously stated: "X Layer has completed its upgrade, with network performance improved to 5,000 transactions per second (TPS), transaction fees close to zero, and the supply of OKB fixed at 21 million. In the future, X Layer will support scenarios such as DeFi, global payments, and RWA with a 'one chain, one token' model, committed to building a fully integrated infrastructure."

It is evident that X Layer is highly anticipated within OKX, and its targeted direction aligns with currently popular sectors. A more focused strategic plan can better leverage OKX's scale advantage of over 60 million users, providing ample user volume and liquidity for on-chain ecological construction.

X Layer Ecosystem Related Data

In light of this, the OKB, with a fixed total supply of 21 million, will also welcome ecological support dividends.

When the OKChain testnet went live on February 10, 2020, the price of OKB surged from around $3 to about $5.5 due to the token destruction news, with a single-day increase of nearly 40%. At that time, its total circulation was approximately 286 million.

Now, after 28 rounds of token destruction, the price of OKB has risen to nearly $100, an increase of nearly 20 times. Subsequently, as the only Gas token and native token of the X Layer ecosystem, the market demand for OKB is expected to experience a new round of explosive growth, and its price will directly benefit from the development of the X Layer ecosystem, likely leading to another increase.

OKB Price Single-Day Increase of Nearly 40%

Nevertheless, the challenges facing X Layer should not be underestimated. Specifically, there are currently three main potential shortcomings regarding the positioning of X Layer:

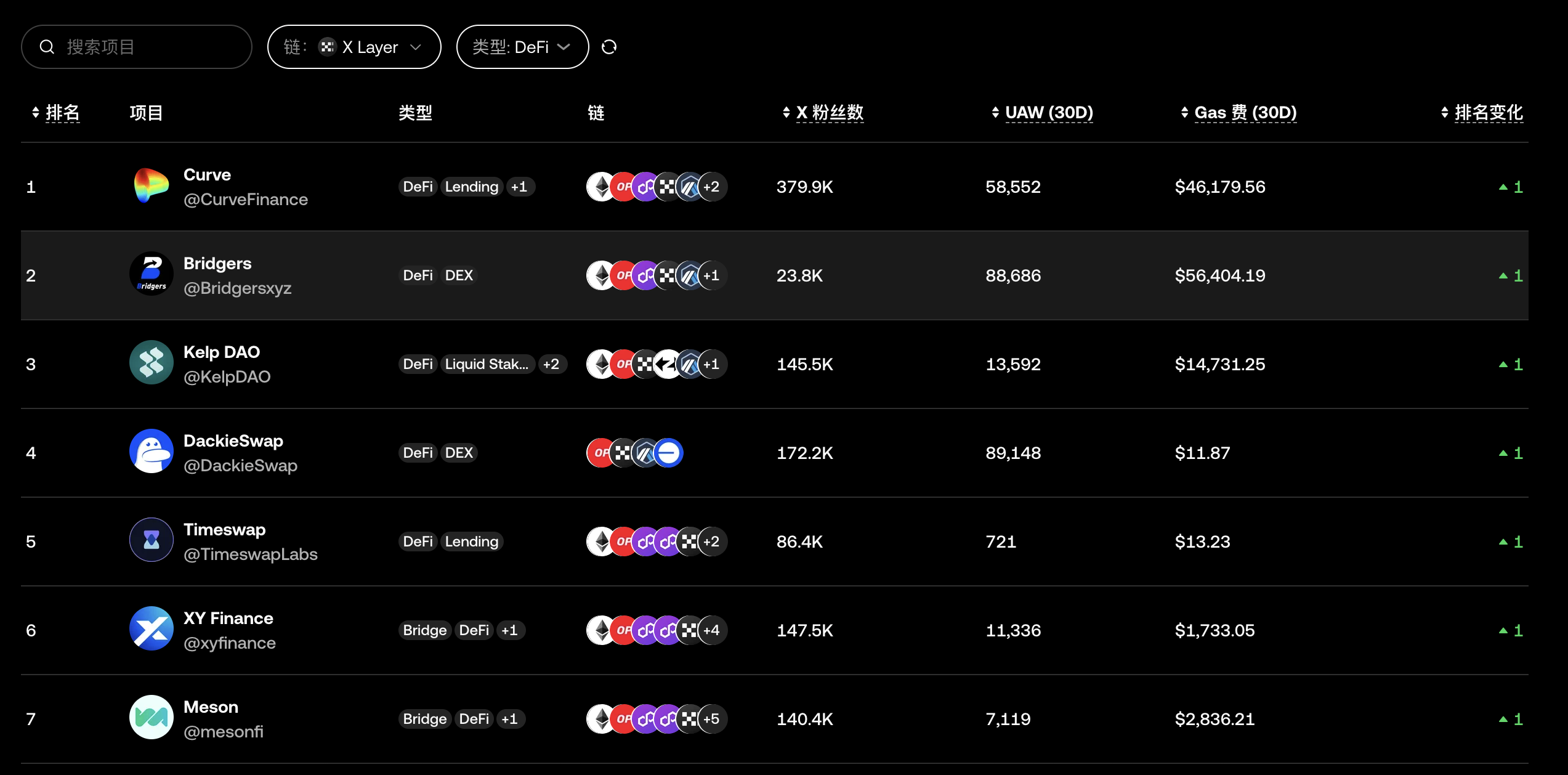

- Defi Protocol Quantity Gap. According to information from the X Layer official website, the number of DeFi protocols on this chain mainly includes seven major protocols such as Curve, KelpDAO, and Meson, which is significantly less compared to other L1 and L2 public chains that often have dozens of DeFi protocols.

Overview of X Layer Ecosystem DeFi Protocols

Payment User Gap. Although OKX has a large user base, how to convert platform users into active users of the X Layer ecosystem and payment is another pressing issue that X Layer needs to address. Compared to Ethereum L2 networks like Base, Arbitrum, and Optimism, which have already accumulated a large number of users and a certain level of active users, X Layer has a long way to go.

Stablecoin Issuance Gap. As one of the hottest sectors in the RWA track, the issuance volume of stablecoins is one of the important indicators for evaluating the development level of a chain. Unlike the TRON network with USDT issuance exceeding $80 billion and the Solana ecosystem with USDC issuance exceeding $5.5 billion in the past month, X Layer currently faces the dilemma of starting late, having a weak foundation, and limited resources. Additionally, other RWA assets also need further development and introduction.

These issues present both challenges and opportunities. It is precisely because the ecological development is relatively early that the future development of X Layer holds greater potential, and based on OKX's diversified resources, this "CEX on-chain ecological competition" is far from reaching a conclusion.

CEX Competitive Landscape in the New Cycle: On-Chain Becomes a Battleground

As mentioned above, in this cycle, major CEXs are shrinking their lines to focus on the on-chain ecology of the cryptocurrency industry's basic layer. In this regard, major CEXs have provided their own solutions and answers, including Binance, OKX, Bybit, and Coinbase, which can be described as "Eight Immortals Crossing the Sea, Each Showing Their Skills."

On the Binance side, after the initial failure of the Binance wallet development, Binance turned to attract market attention and capital liquidity through the dual-line development of "Alpha+ Wallet." On one hand, the TGE channel for Binance Alpha and Wallet ensures the active discovery of new coins, while on the other hand, the Alpha point threshold provides a continuous source of trading volume and fees for the Binance platform. Meanwhile, the BNB Chain ecosystem also guarantees Binance's development, with reports indicating that as of June this year, BNB Chain led in stablecoin usage with 11.8 million active addresses, and its daily active address count once exceeded 3 million.

Coinbase, on the other hand, chose to focus on the Ethereum L2 network Base: on one hand, it recently integrated applications such as the Coinbase wallet, launching a one-stop application BaseAPP to further promote the development of the Base ecosystem; additionally, it also introduced DEX trading features to facilitate users in trading Base ecosystem assets. According to L2 Beat data, as of August 15, the TVL of the Base network grew to around $16.1 billion; according to Dune data, the number of user addresses on Base reached 229 million, with the daily average number of active addresses consistently around 1.2 million.

On the Bybit side, it primarily explores the on-chain ecosystem through three aspects: 1. Focusing on on-chain DEX, it previously launched Byreal, which attracted 100,000 users in just 3 days, and the first phase of the Reset Launch project Fragmetric over-raised 49,587.8 bbSOL, valued at over $8.18 million, with the lowest price tier over-raising by 4,406.96%; 2. Providing direct minting and redemption services for USDtb launched by Ethena, enhancing the attractiveness of on-chain earning features; 3. Bybit's U Card has received widespread market acclaim, with its cashback incentives once triggering "cashback attacks" from opportunistic users.

Exchanges like Bitget, Gate, and MEXC have also launched Alpha sections, accelerating the frequency of new coin listings on one hand, while attracting users through wallet entry points to capture market share on the other.

OKX's strategy is more steady and aims to deeply integrate its three major businesses with X Layer to create synergies.

In terms of DeFi, the OKX Wallet, as a "one-stop on-chain entry," is favored by market users for its rapidly iterating products and convenient DEX trading experience. Combined with OKX's global user base of over 60 million, it will undoubtedly provide a solid user foundation for the explosive growth of the X Layer ecosystem and facilitate efficient liquidity circulation.

In terms of payments, OKX Pay, based on the operation of X Layer, is expected to bring revolutionary changes to the ecosystem. According to OKX CEO Star's previous statement, OKX Pay is the world's first crypto payment wallet with a complete built-in compliance system, allowing users to send and receive USDT and USDC instantly and securely worldwide; it also achieves zero transaction fees on X Layer and offers users an annual yield of up to 5% on USDT. It is evident that OKX Pay will attract a large number of incremental users with a yield that is more attractive compared to traditional financial channels; on the other hand, it will further consolidate the brand recognition of OKX and OKX Pay through everyday payment scenarios. With its convenient application features and low-cost transaction fees, OKX Pay is expected to become another "killer application" following OKX Wallet, facilitating OKX's overall business landscape.

In the RWA sector, whether it is stablecoins or other RWA assets, it naturally relies on user volume and market support. After the suspension of OKT Chain, X Layer has experienced explosive growth with an average increase of over 50,000 addresses per day, and currently, its network address count has exceeded 1.85 million. According to L2 Beat data, after the large-scale destruction of OKB, the on-chain assets of the X Layer network grew by 103% in the past 7 days to reach $84.89 million, setting a new historical high; on August 16, the number of transactions on X Layer reached 2.05 million, surpassing Ethereum for the first time in history; in the past day, the network's user operations per second (UOPS) reached 19.23, an increase of over 1000%.

This may be attributed to the sudden surge of the Meme coin craze in the X Layer ecosystem following the OKB destruction and network upgrade. Although the official has repeatedly emphasized that X Layer is an open decentralized blockchain network and will not endorse or guarantee on-chain projects, protocols, or tokens, the community still shows great enthusiasm for related Meme coins, and the future Meme coin sector of the X Layer ecosystem is also worth looking forward to.

As an established exchange with 8 years of experience, OKX's market expansion experience is a rare resource that is expected to combine with community development to bring more liquidity to the OKX platform and X Layer ecosystem, thereby achieving a leapfrog in the RWA sector.

In the future, the X Layer ecosystem built on DeFi ecology, payment applications, and RWA assets is expected to create a new business growth flywheel through the integration with OKX Wallet, OKX Pay, and the OKX exchange platform: existing users and new users will invest more liquidity funds, which will support the development of the platform and applications, and the development of the platform and applications will attract more quality on-chain assets and RWA assets, ultimately drawing in more user participation. At that time, the OKX platform ecosystem will welcome a new round of explosive growth.

Thus, the narrative logic of "whoever controls the on-chain ecosystem controls the world" emerges, and it can be said that OKX is poised and ready.

Conclusion: New Moves of OKB & X Layer Ignite the Next Round of Industry Under-the-Radar Battles

As we mark the 16th year since Bitcoin's inception and the 10th anniversary of Ethereum's launch, with traditional financial institutions entering the on-chain ecosystem through ETFs and coin hoarding strategies, the crypto exchange industry has also entered the "second half moment." Whether leading crypto exchanges represented by Binance, OKX, and Coinbase can gain an advantage in the next round of industry under-the-radar battles depends not only on converting exchange resources into on-chain ecosystem construction but also on their understanding and practice of user needs, industry trends, and product innovation.

As for which ecosystems under major exchanges like BNBChain, XLayer, and Base will ultimately prevail, it remains to be seen through time and market validation. It is foreseeable that this "war" will be more prolonged and intense than most people imagine.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。