Familiar friends in the market know that the overall trend is still moving upward. A healthy rise never runs wildly all the way; pullbacks are actually the norm — just like a long-distance runner needs to catch their breath to run further.

If you accidentally got caught in a position right now, don’t panic, let’s take a look together; if you’re already in profit, congratulations! Today, let’s talk about whether the entry point for this pullback has arrived.

This morning, the price dropped all the way down, isn’t this just “picking up passengers in reverse”? For friends who haven’t boarded yet, let’s see where we should queue at which “station”; those already on board can relax, as we haven’t seen any signs of large-scale selling yet.

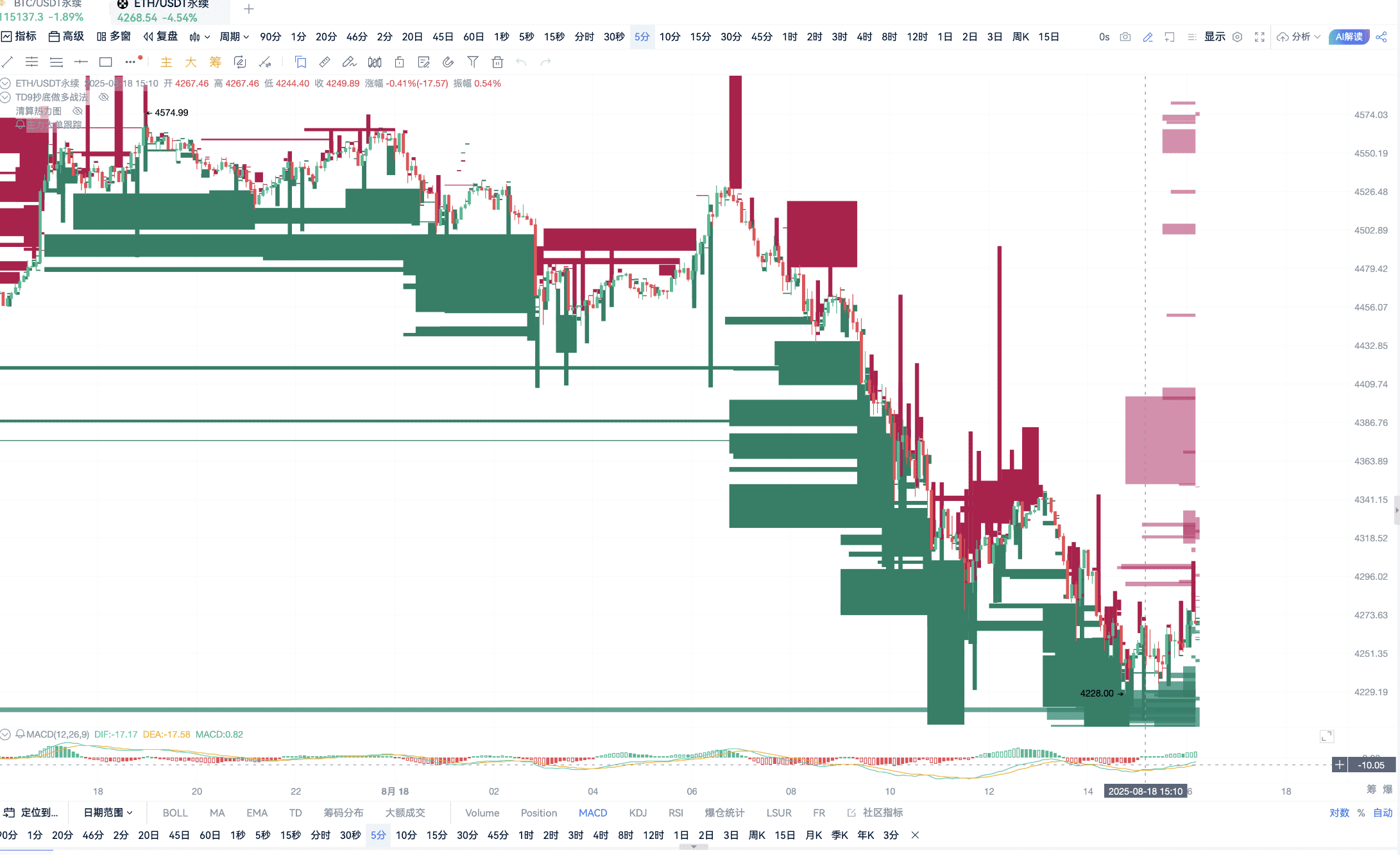

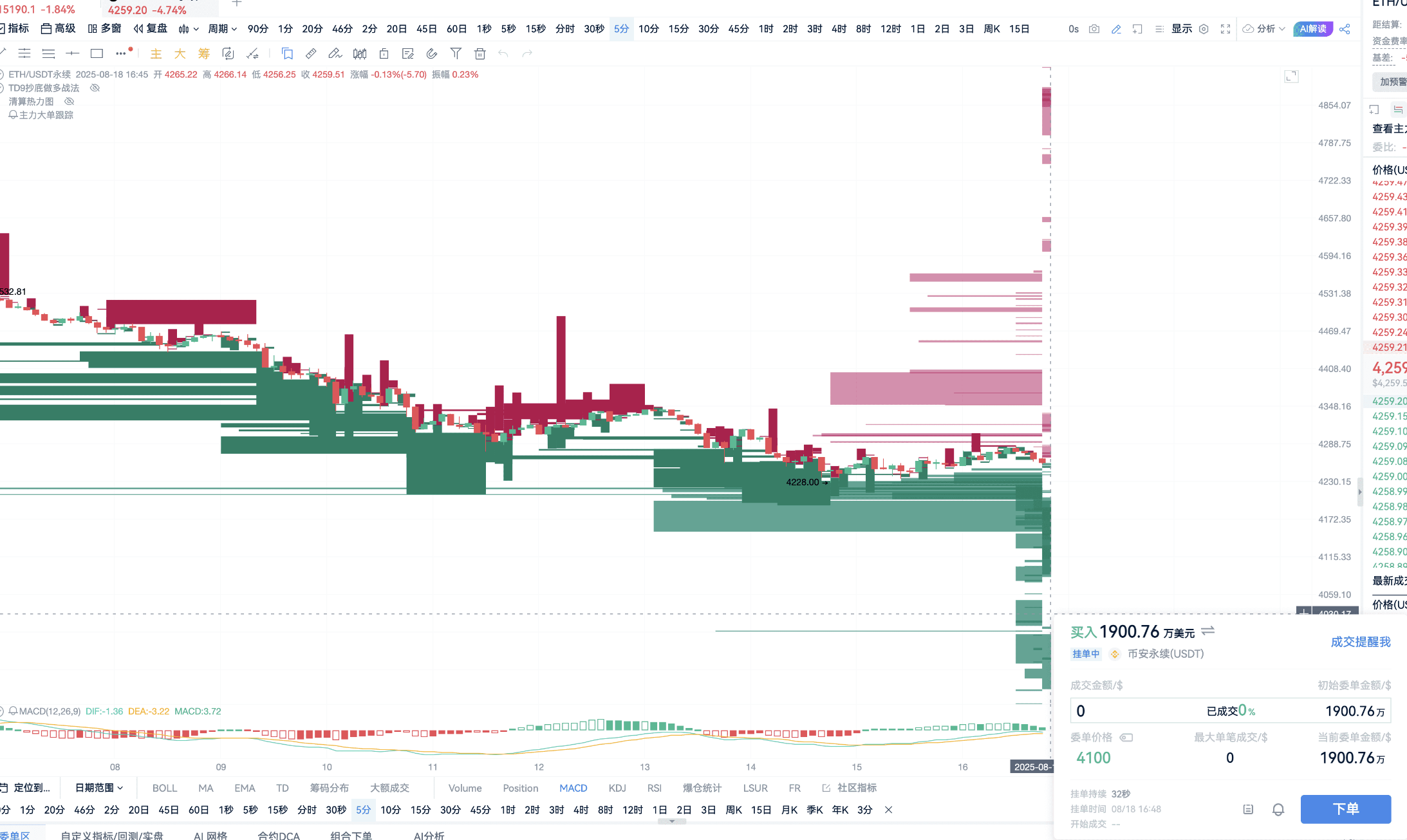

Let’s first take a look at ETH. Come on, follow me to open the ETHUSDT perpetual contract interface on OK — there seems to be a slight divergence on the chart, and there’s a large wall of pending orders below. At this price level, the bulls and bears are battling fiercely.

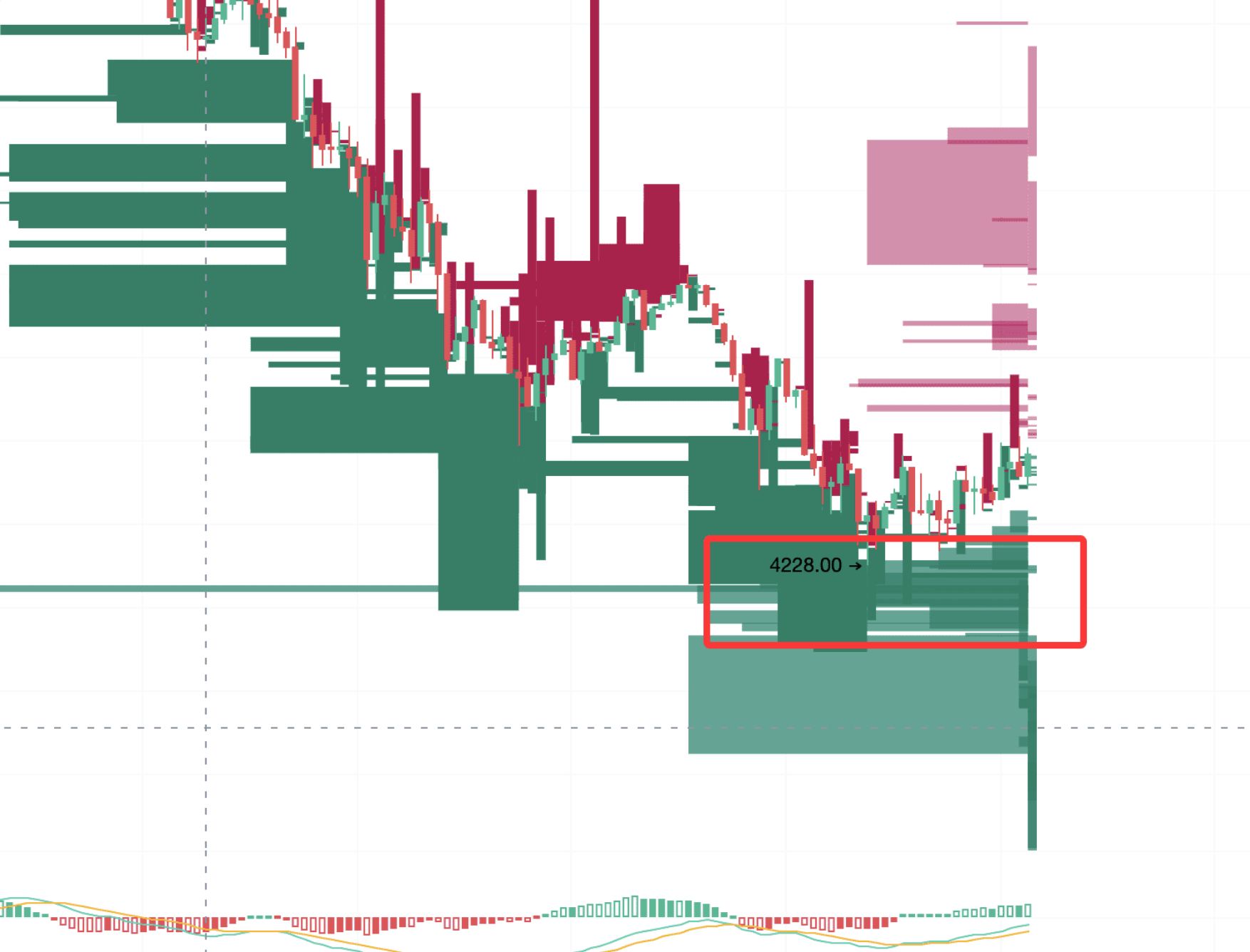

Just opened a long position here, actually, the 4200 level is particularly critical, and then it dropped. But don’t worry, there are still “experts” supporting below.

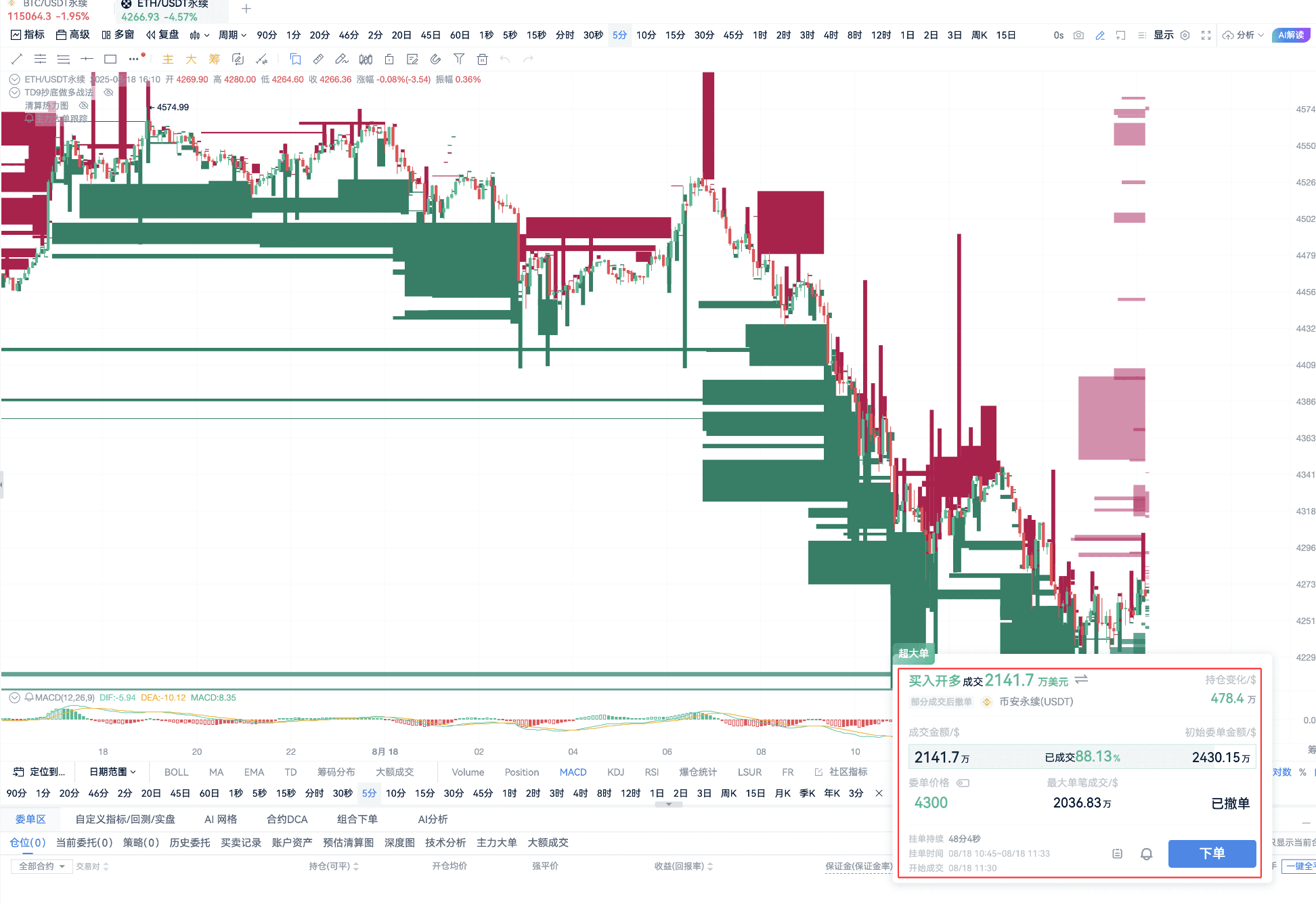

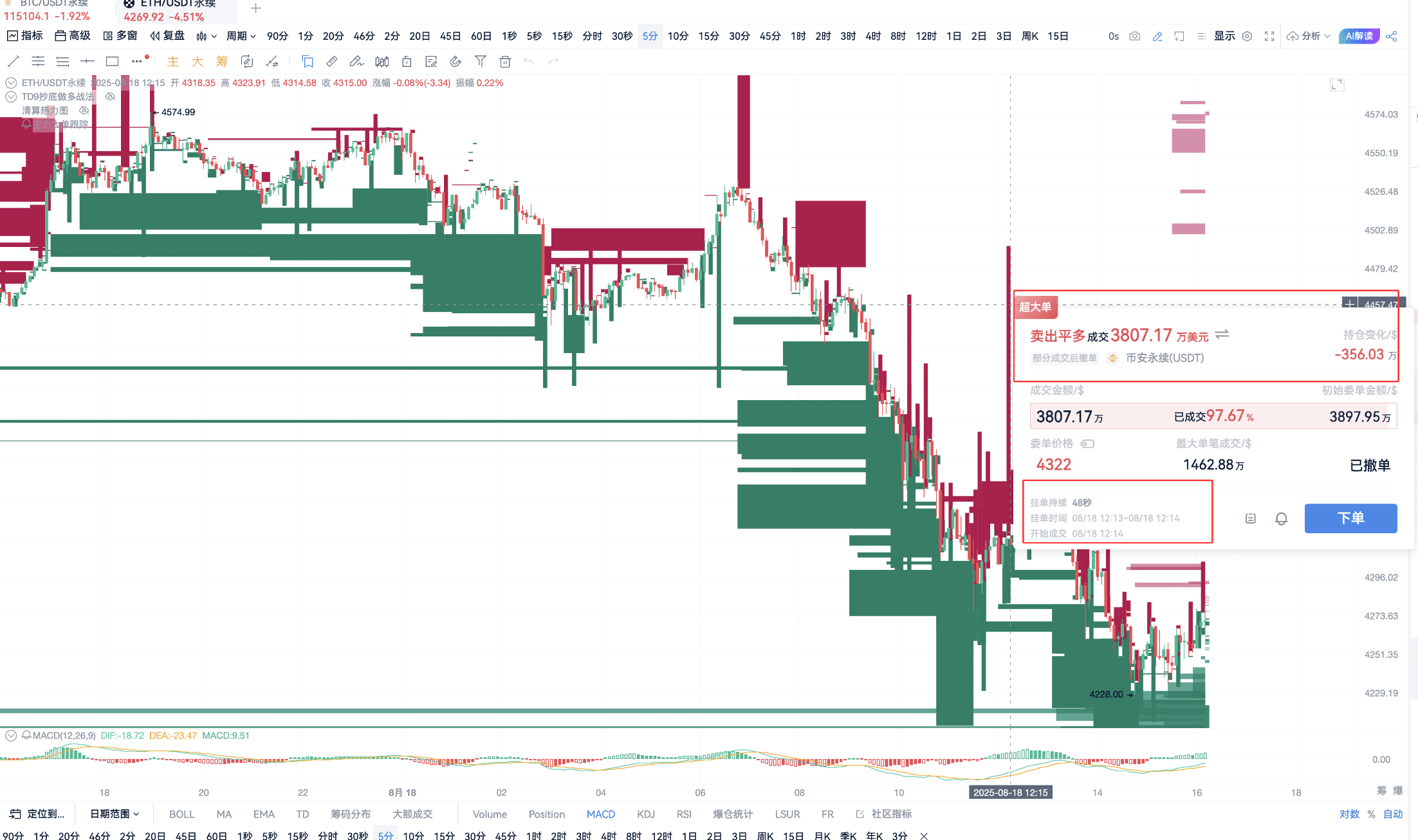

Based on my experience tracking the main forces for so long, given their “nature,” they probably need to eat a bit more chips downwards. Why do I say this? There are two super large orders hanging below! As per the usual practice, let’s analyze using the “tricks” of the main large orders — prices always like to gravitate towards nearby large pending orders, whether they are bullish or bearish, the main force won’t miss the opportunity that comes to them; it would be foolish not to make money.

So where can we consider the first buying point? The main force has placed orders at 4200.

There are also a bunch of small pending orders above, like little mounds of dirt. Experienced old fans understand these details, so I won’t go through them one by one; pro members can check them out themselves. Therefore, from the perspective of the main large orders, it’s highly likely that we can touch 4200 today.

That’s the shortest buying point for ETH! So many friends liked it today, I have to bring out all my skills to serve everyone well. Are the friends who just asked questions still here? If not, I won’t repeat it; the live stream is currently very hot, and I’m “burning” all over~ I see there are pro members here!

Next up is BTC, let’s strip down the main force’s “underwear” and take a look. How to say, since ETH’s strong rise, there have indeed been fewer large orders on BTC, but it’s still watchable. However, the main force of BTC seems to be “playing dead,” with only a few large transaction orders; let’s take a look at what these orders are about.

First, let’s talk about the super large order on August 14 — PROs in the discussion area, did you notice it at the time? If you had seen the $210 million short order then, you probably wouldn’t have been so eager to chase the long, right? At least we should wait for the main force of this short to exit before considering long positions for safety.

So, did this main force close the short position? Let’s trace back along the K-line. The first closing made quite a profit; I must say, the main force is indeed the main force~ By this point, the main force has actually almost exited, with the second closing at this position. That’s the situation for the short positions; what about the long positions?

Looking up, there are also some small closing orders, but overall, the $210 million short order above has been mostly digested. As for the long positions, currently, there are no signs on the K-line indicating their stop-loss or take-profit exits — which means there is still strong main force supporting BTC.

On the 17th, a main force opened a $61 million large order; although a lot of funds have gone to ETH, it’s expected that after the price drops, this main force will likely add to their position, so there’s actually a bottom support below.

However, currently, there aren’t many real-time large orders for BTC, so everyone needs to pay more attention; pro members should focus on the large orders for ETH — look, there are already orders at 4100 for ETH, pro members remember to keep a close watch!

I’m not exaggerating; the main force’s attention is basically on ETH’s long positions. As for BTC, the best state right now is to consolidate, giving us time to wait for a wave of altcoin season — we old holders who have endured an entire cycle are looking forward to this wave of recovery!

Let’s look at the data from a different perspective and check the situation with ETFs to see what Wall Street is busy with. Overall, in the past half month, the net inflow scale has been enormous, over $10 billion! A short-term outflow over one or two days is normal, but if it continues for several days, everyone needs to be alert.

Currently, ETH hasn’t shown such risks, and the narrative is slowly unfolding. After the US stock market opens tonight, we’ll be able to see the latest data tomorrow; besides large orders, the net inflow of ETFs also needs to be closely monitored.

By the way, friends who want to open a membership, click here for live stream benefits — you can get in for 10% off, which is about enough to exchange for a pack of Lihua or an eyebrow pencil! I don’t need to say where to check ETF data, right? Bookmark this website: https://www.aicoin.com/zh-Hans/web3-etf/us-eth?lang=cn, and you can also check the inflow situation for BTC here. Currently, there aren’t any densely packed risk areas, so everyone can relax!

The liquidation heat map hasn’t shown particularly good opportunities yet; making money requires waiting for the right position. Currently, there are large pending orders below ETH, and it’s expected to drop further, possibly below 4200, even down to 4100; it hasn’t reached the best buying point yet.

However, large orders will change dynamically; those who can should open a pro membership to keep an eye on it themselves; if conditions don’t allow, pay attention to our research institute’s live streams, dynamic square, and news every week; we will share important information~ Moreover, free memberships are drawn every Monday, Wednesday, and Thursday, and 10% off memberships are waiting for you to grab!

This article only represents the author's personal views and does not represent the platform's stance or views. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。