Cryptocurrency exchange Gemini filed documentation with the U.S. Securities and Exchange Commission (SEC) on Friday proposing to go public, but there’s one small problem, the firm is hemorrhaging money.

(Cryptocurrency exchange Gemini has filed for an IPO despite mounting losses / sec.gov)

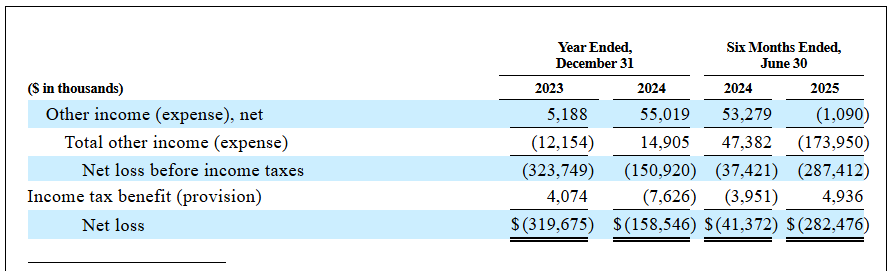

Controversial billionaire twins Camron and Tyler Winklevoss of Facebook infamy founded Gemini in 2014, and since then, the exchange has grown to more than $18 billion in assets under custody, 1.5 million users, and more than 600 employees, according to the filing. But a quick glance at the company’s financials reveals a troubling trend, nearly $160 million in losses at the end of 2024, and roughly $282 million already lost as of June 30, 2025.

But despite the bleeding, the Winklevoss twins are betting on the favorable regulatory environment cultivated by a crypto-friendly Trump administration, to help Gemini garner the same success seen with the recent initial public offerings by stablecoin issuer Circle and fellow cryptocurrency exchange Bullish. Both firms raised more than $1 billion each.

“We discovered Bitcoin in the Summer of 2012,” the Winklevoss twins wrote in a letter that can be found in the IPO filing. “In 2014, we put together an all-star team of engineers and technologists with a ‘security first’ mindset, to build a safe, reliable, and easy-to-use exchange.”

That exchange will now trade on the Nasdaq under the ticker “GEMI,” and Goldman Sachs and Citigroup will lead the IPO. The proceeds, as per the S-1 filing, will be used in part, to pay off “third-party indebtedness.”

“As we stand here today, ready to introduce Gemini to the public markets,” the brothers wrote. “We are as excited as we were when we first started Gemini in 2014.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。