Bitcoin treasury firms such as Strategy and Metaplanet went on a buying spree as the cryptocurrency fell by more than 2% on Monday. Strategy Chairman Michael Saylor announced a 430 BTC purchase for more than $51 million, and Metaplanet President Simon Gerovich said his company bought 775 BTC for roughly $93 million. As the saying goes, a paper hands’ loss is a hodler’s gain.

(Despite bitcoin’s price tumbling, BTC treasury firm Strategy, rushed in and snapped up 430 bitcoins / Michael Saylor on X)

Bitcoin ( BTC) suddenly picked up steam last week, spurred by lower-than-expected consumer inflation. The flagship digital asset came within mere dollars of its all-time high, before a second inflation report tracking wholesale prices, showed a record jump, throwing cold water on the cryptocurrency’s momentum.

But while skittish traders triggered a sell-off, institutions recognized the opportunity and “bought the dip.” Regulatory records show that as of June 2025, the nearly $2 trillion Norwegian Government Pension Fund (GPFG) had increased its bitcoin exposure by approximately 83%, mostly by acquiring MSTR stock. And it’s clear to see why, Strategy now owns 629,376 BTC, and every time the digital asset goes lower, the Saylors and Gerovichs of the world dig in their heels even deeper.

“I hear the disappointment in the recent pullback. It’s natural to feel that way,” Gerovich explained in a post on X. “But what gives us conviction is the foundation we are building. Let’s review the milestones we’ve reached together, because over time fundamentals prevail.”

Bitcoin was priced at $116,028.63 at the time of reporting, down 1.69% since Sunday and 3.26% across seven days, based on Coinmarketcap data. The cryptocurrency hovered between $114,723.68 and $118,073.96 over the past 24 hours.

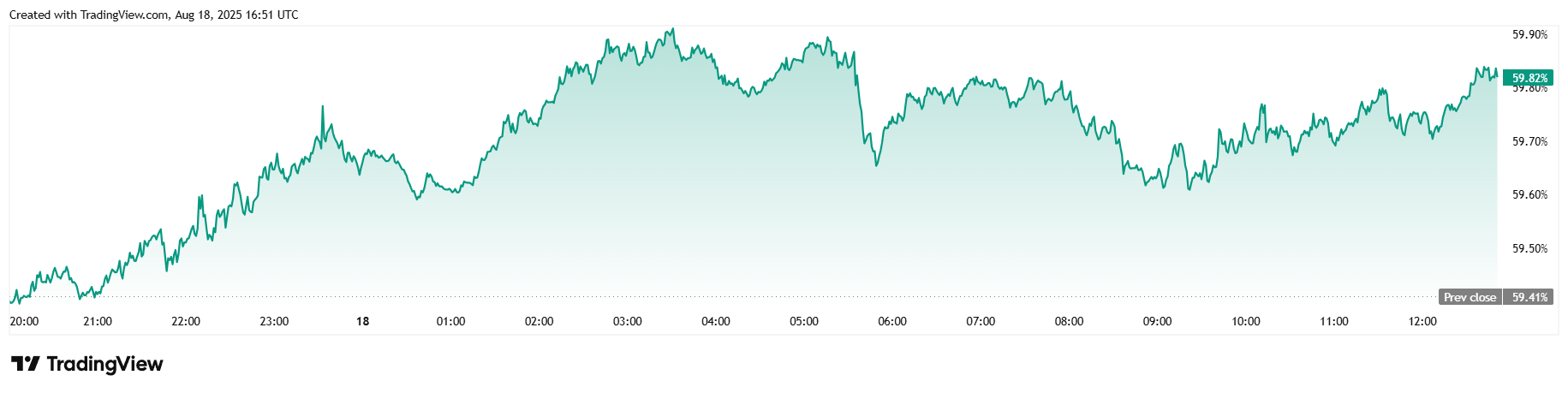

( BTC price / Trading View)

Trading volume rose 62.22%, an expected post-weekend surge, reaching $69.23 billion. Market capitalization, however, fell 1.64% to $2.31 trillion since yesterday. Bitcoin dominance was up 0.70% at 59.82%, as the digital asset continues to outperform the broader crypto market, which is currently down 2.61%.

( BTC dominance / Trading View)

Total bitcoin futures open interest was mostly flat over 24 hours at $82.94 billion, a slight 0.13% uptick. BTC liquidations were somewhat high, totaling $130.43 million according to Coinglass, most of which came from bullish traders having $123.01 million in long positions wiped out. Bears were relatively unscathed and made up only $7.42 million of the liquidation total.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。