The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

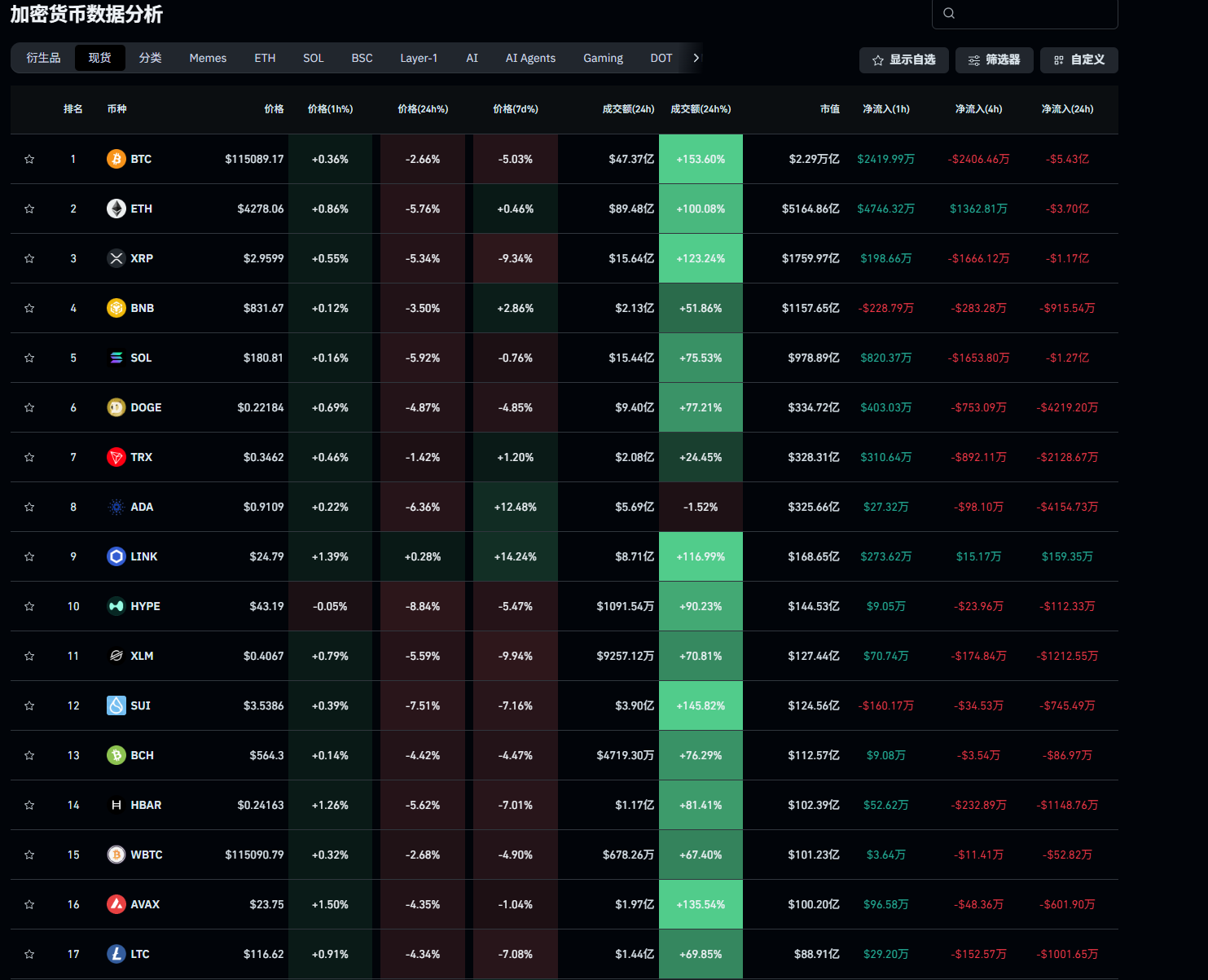

With a wave of decline, various smoke screens are once again spreading in the coin circle, which is also the last wave of washing before the bull market begins. Many coin friends hope that Lao Cui can provide an accurate retracement point, especially for Ethereum, as everyone seems to pay more attention to Ethereum's market. Today, Lao Cui will start from the outbreak of the bull market, questioning Ethereum is nothing more than differing recognition of its value. Everyone should be clear that the reason Ethereum can welcome the bull market this time is simply due to three key nodes. The first and foremost is security. Ethereum's public chain and system are considered the safest in the coin circle and are the only ones capable of accepting institutional-level investments without errors. This is something even Bitcoin cannot achieve. You may think that SOL's technology is superior to Ethereum. This preconceived notion is not correct. Although SOL has a latecomer advantage, it is not as secure as Ethereum.

As we all know, the current blockchain technology is a double-edged sword. If speed is prioritized, then security codes must be sacrificed. This is the extreme between SOL and Ethereum. Since SOL emphasizes speed and cost more, it is more suitable for small investments, which is also why Trump Coin chose SOL. Based on Ethereum's vast system, combined with its unique mechanism, it will generate more technical personnel to maintain the Ethereum public chain, which strengthens security and is a unique mechanism. Therefore, Ethereum was the first choice for institutions in this bull market. The second point is the funds from the interest rate cut cycle. Since the interest rate cut began last year, Lao Cui has always emphasized that the interest rate cut is a process, and the inflow of funds takes time. The first wave and the second wave of interest rate cuts saw Bitcoin as the biggest beneficiary. When the funds gathered in Bitcoin are insufficient to support institutions in driving the market again, the second choice can only be Ethereum.

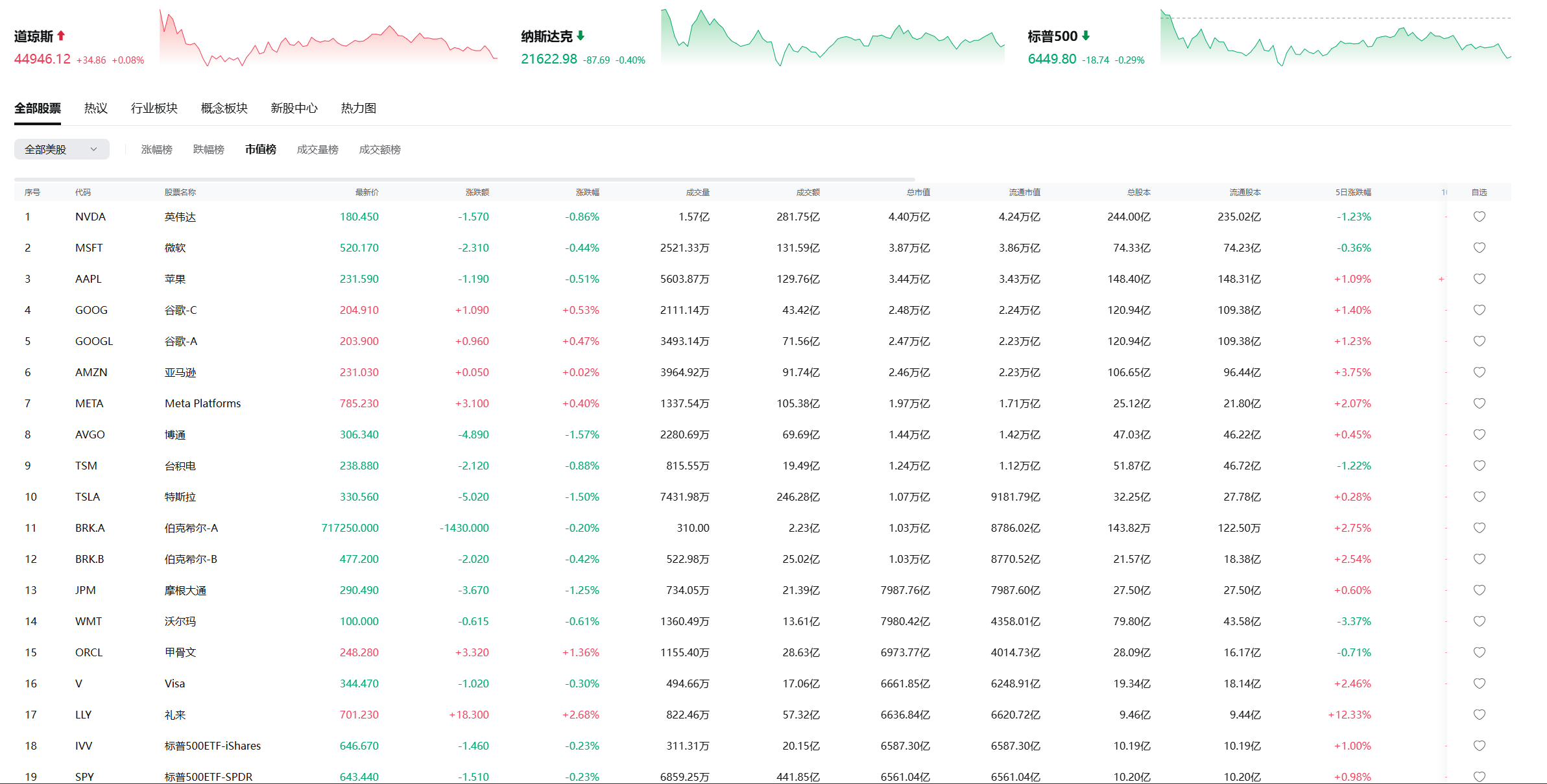

Although it has been delayed for half a year, coupled with the listing of ETFs and the inflow of traditional capital, only those coins with ETFs will dominate in the bull market phase. Especially under American regulations, some exchanges directly connect to the coin circle, and the so-called Internet of Everything allows stable coins to directly purchase US stocks, which has attracted a large number of transferring fund users. The recognition of institutions combined with sufficient capital will definitely lead to a wave of bull market. The third point is the innovation of the Vitalik Buterin team. By the end of 2024, it has been reported that Ethereum will have a significant upgrade this year, and there are often news leaks. Currently, the latest upgrade has reportedly been completed around November. Once the upgrade is successful, Ethereum's processing speed will be greatly improved. In fact, for institutions, a processing speed of one second versus 0.000 seconds is not important; only the technological aspect cares about those few decimal places. Institutions only recognize safety and reliability; 0 seconds is already sufficient for ordinary users and institutions.

Finally, this point is not included in the current growth category but is considered expected growth. Most traditional stable coins utilize Ethereum's public chain, which leads to prosperity on the chain, increased volume, and the generation of packaging fees, which will also drive Ethereum's market value. Even if only one percent of the market value buys Ethereum, it would be significant good news for Ethereum. If domestic stable coins confirm they will use Ethereum's public chain, then Ethereum will definitely continue to grow, and even surpassing 5K is not a big issue. Coupled with the interest rate cut, looking at the current market value, breaking through the 6-8K range is not a big problem. At this stage, it is merely the wave of interest rate cuts coming, along with the impact of US-China tariffs, which will definitely lead to a wave of decline. In this range, there is no need for everyone to worry too much; the current trend is still under control. Moreover, last week's ETF data is still mostly in an inflow state; the bull market has not yet changed.

As for whether it will touch 4100 or even below 4000, a spike is very likely to occur, but it will not give everyone an opportunity to enter. This kind of gradual decline will not last long. What everyone should think about now is how to hold their chips at the lowest cost. For contract users, Lao Cui also does not recommend going short. Although Lao Cui also noticed the bearish trend the other day, I still disagree with everyone entering short positions. A large part of the reason is that the current state is not suitable for heavy short positions, and most users still cannot control their mindset. It is recommended that everyone focus on spot trading. At the same time, Ethereum, as mentioned above, is the foundation of this bull market. As long as these few factors do not change in terms of policy in the short term, the depth below will not be too deep. However, if you need Lao Cui to provide space or specific points, I really cannot provide them, mainly depending on everyone's needs. Spot users can hold without selling, while contract users must not gamble if the liquidation point is close.

After discussing Ethereum, combining the theory of Ethereum, everyone can understand why Lao Cui has been vigorously recommending SOL recently. Because SOL and Ethereum have similarities, each has expanded its advantages in its field, representing two extreme choices. It is highly likely that at the end of this Ethereum market, the market makers will target SOL again, especially since SOL's essence requires little capital to drive the entire market. This attribute is extremely valuable for market makers. Moreover, the biggest vision this year is the listing. Once the listing space opens up, it will naturally attract traditional financial giants, and SOL can further utilize funds to enhance its ecosystem. Although ETFs belong to the fund type, the funds raised for SOL's ETF listing may not be fully invested; only about 30% of the funds are needed to elevate SOL to historically high levels. Currently, SOL's market value is only around 100 billion, while Ethereum is nearly 600 billion. The two are not comparable, but reaching a market value of 200-300 billion is still considerable, and everyone should focus their investments on SOL.

Lao Cui summarizes: Reviewing Ethereum is only to hope that everyone has a correct understanding of Ethereum. Only by understanding its actual value can one comprehend its bottom space. Just one proof of Ethereum's irreplaceability is that the circulation security of stable coins can only be borne by Ethereum. This is why most channels requiring international turnover will choose Ethereum as the main option, which is unique in the coin circle. Regarding the space below, Lao Cui suggests not to speculate too much; it will definitely continue to decline. The current trend is something everyone can guess. Basically, there will be a downward range of 100-200 points every day, encountering a large amount of capital holding. Only when there is no capital intervention and a spike occurs will the next bull market start. Recently, it has been reported that Japan's stable coin has also been put on the agenda, including a series of stable coin issuances in Europe. Everyone should pay more attention to the public chains they use. As long as they are involved in the coin circle public chain, the likely choice will be the duel between Ethereum and SOL. Once there is a system for its use, it will inevitably generate value for the coin itself. Lao Cui indeed does not have the ability to predict the low point, but this year's high point is worth holding. Everything will wait until the end of the year to look back at this article. Lao Cui will continue to hold both. For contract users, it is best to stop for now and wait for stabilization before making further arrangements!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess. A master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the final victory. The novice, however, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。