Author: Frank, PANews

In 2025, Grayscale has significantly accelerated the pace of launching new products, and the types of these products are no longer primarily focused on single cryptocurrency trusts. Instead, they have created a structural matrix of four types of products: ETFs, publicly traded funds, private funds, and active strategies. Among these, the single cryptocurrency trusts in the private fund category still represent a noteworthy area of exploration for Grayscale in the crypto market. PANews has conducted another review to see if the "Grayscale Effect" still exists or what new insights it might bring us. (Related reading: Review of 21 Grayscale Cryptocurrency Trust Funds: Some Up 10 Times, Some Bearish, Can They Be Market Contrarians at the End of a Bull Market?)

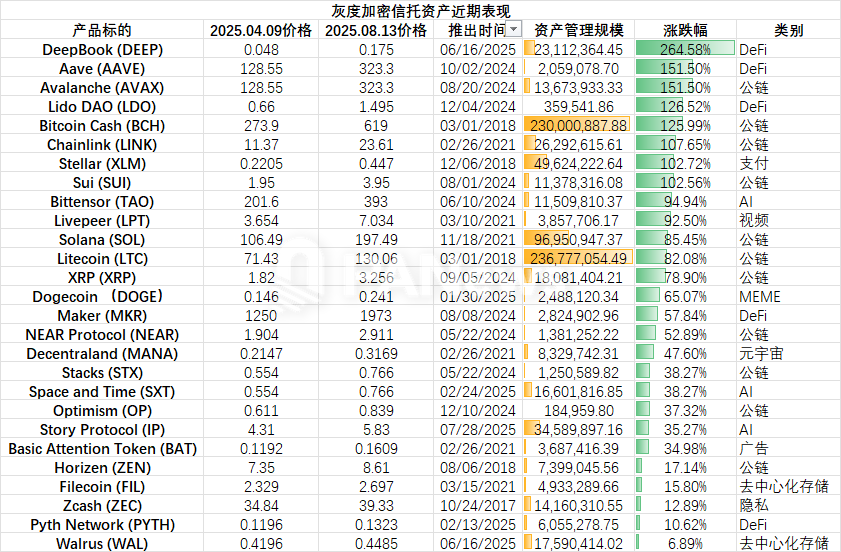

The price cycle for this survey is selected from the closing price on April 9, 2025 (market pullback low) to the closing price on August 13, 2025 (recent market high).

Grayscale's Vision for 2025: Deepening AI, Sui Ecosystem, and Meme Culture

As of August 2025, Grayscale has launched six new single cryptocurrency trust products, involving the following cryptocurrencies: Dogecoin (DOGE), Pyth Network (PYTH), Space and Time (SXT), Story Protocol (IP), DeepBook (DEEP), and Walrus (WAL).

From a narrative structure perspective, Grayscale's main market narratives this year are focused on AI, DeFi, and Sui. In the AI field, Space and Time (SXT) and Story Protocol (IP) are two infrastructure layer products related to AI. In terms of ecosystems, Grayscale's focus this year seems to be on the Sui ecosystem, having launched a private trust for the SUI token last August, and in August of this year, it also launched two major project trust products, DeepBook (DEEP) and Walrus (WAL). Additionally, it is worth mentioning that Dogecoin (DOGE), as Grayscale's first MEME-themed trust product, was also launched in 2025.

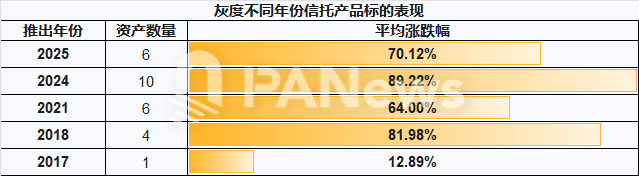

In terms of market performance, the projects launched in 2025 are not particularly impressive. The average price increase of these tokens during this period is about 70%. Although this outperforms BTC, it still falls short compared to Grayscale's products launched in other years. This may be because the products launched this year do not belong to market leaders or top-tier assets but rather represent Grayscale's layout in certain potential tracks.

Of course, this change in selection also indicates that Grayscale's trust products are no longer solely pursuing the hottest projects in the market as a "weather vane" but are also beginning to transform into a potential "reservoir" for discovery.

In terms of asset management scale, the average asset management scale of the several single asset trusts launched in 2025 is about $16.73 million, far below the overall average (average scale of about $32 million). This is partly because these products have been launched for a short time, and partly because the market's recognition of these emerging assets is still not high.

"Grayscale Select" Still Outperforms the Market

Recently, the overall market performance of Grayscale's trust products has shown polarization. The best and most mediocre performances both come from the Sui ecosystem, with DeepBook rising by 264.58% and Walrus by 6.89%. Among the 27 trust funds surveyed, 8 projects saw price increases exceeding 100%, and 16 projects had increases over 50%, with an average increase of 75.47% across all projects. In comparison, BTC's increase during the same period was about 56.5%, clearly indicating that Grayscale's selected targets are superior. Compared to the average increase of all tokens (in the same period, Binance spot trading pairs), which was about 59.8%, there is also a significant advantage.

From this perspective, while the "Grayscale Effect" may no longer exist, the selected targets in Grayscale's cryptocurrency trusts still seem to play a role as "Grayscale Select."

By year, the strongest performing group is the products launched in 2024, with an average increase of 89.22%. DeFi and L1 leaders like AAVE, AVAX, and LDO performed excellently during this period, representing the core driving force of the current cycle. The second-best performance comes from products launched in 2018, with an average increase of about 81.98%, mainly driven by the strong performance of established public chains like BCH, LTC, and XLM in this rebound. The worst performance was in 2017, where the only product launched (excluding BTC and ETH) was Zcash, with only a 12.89% increase.

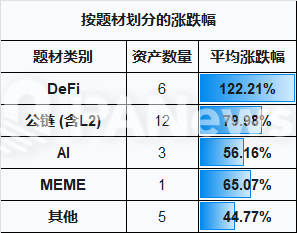

From the internal performance of themes, Grayscale's selected DeFi and public chain assets have outperformed the overall market level. Among them, DeFi assets performed the best, with an average increase of 122%, primarily due to the leading price increases of core DeFi infrastructures like AAVE, LINK, and LDO during the market recovery.

The performance of public chains is also relatively good, but there is significant differentiation within this category. High-growth ecosystems like AVAX, SUI, and SOL performed excellently, while others like ZEN and OP were relatively mild, indicating that the market's selection of public chains is becoming increasingly selective.

Additionally, AI, as one of Grayscale's current focus areas, has an average increase of about 56%. Although it does not reach the higher enthusiasm of DeFi and public chain projects, it still shows an overall increase of more than half.

From "Market Booster" to "Potential Discoverer"

In the face of fierce competition in the post-ETF era and an increasingly mature market environment, Grayscale's investment strategy seems to be undergoing a transformation. Its product thinking and market positioning are gradually shifting from "market booster" to "potential weather vane."

Before 2021, due to the extreme scarcity of compliant investment channels, the "Grayscale Effect" was a powerful "booster" for the market. Any asset included in Grayscale's trust was equivalent to obtaining a unique ticket to mainstream visibility, leading to almost certain price increases. At that time, Grayscale was a significant introducer of market liquidity.

By 2025, with the proliferation of various ETFs and compliant products, market channels have greatly diversified. Grayscale's role has shifted to that of a "potential weather vane." Its selection is no longer a sufficient condition for price increases, but its direction of choice is more inclined towards finding the next success story in a specific track or ecosystem.

The deep layout in the Sui ecosystem and Pyth may illustrate this transformation. Grayscale is no longer satisfied with merely providing exposure to the SUI token but is delving into its ecosystem, simultaneously launching trust products for core DeFi protocols DeepBook and decentralized storage project Walrus. This signals a "downward" shift, moving from a macro investment narrative in public chains to a micro investment approach that can directly benefit from ecosystem prosperity. Additionally, the investment in Pyth is also aimed at finding optimal potential on the hottest public chain, Solana, to become the next AAVE or Chainlink.

In addition to exploring single asset trust products, Grayscale is also simultaneously developing portfolio trusts and diversified ETF/ETP products. In 2025, in addition to launching several single cryptocurrency trust products, more product types include Bitcoin Miner ETF (MNRS), Bitcoin Adopter ETF (BCOR), and a series of options-based ETFs.

Notably, Grayscale has recently launched the Grayscale Dynamic Income Fund (GDIF), a product specifically investing in staking yields from proof-of-stake (PoS) networks. This indicates that as the market matures, speculative trading is gradually receding, and the "actual yield" from real protocol income (such as transaction fees and staking rewards) is actually a more stable and traditional institutional investor-preferred approach.

In summary, the performance of Grayscale's investment targets and the transformation of its investment strategy may bring us the following two reflections.

The "Grayscale Effect" may be gone, but "Grayscale Select" still holds value. The launch of a cryptocurrency asset trust by Grayscale no longer significantly stimulates the market, but in the long run, the overall selection of Grayscale's targets remains worthy of reference for research.

Infrastructure first: Grayscale's layout repeatedly confirms a simple investment principle— in any emerging gold rush, the business of selling "picks and shovels" has the highest certainty. Whether it is oracles, DeFi liquidity layers, or data warehouses, investing in core infrastructures that power the entire ecosystem is key to navigating cycles.

Traditional capital's enthusiasm for the crypto market is not just about pursuing high returns from a single asset but is more inclined towards laying out across the entire crypto upstream and downstream, as well as multi-asset mixed investments to balance risks.

These points may be the insights that Grayscale, this "crypto veteran," brings to us.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。