The world is bustling, all for profit; the world is bustling, all for profit! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and I refuse any market smoke screens!

With interest rate cuts approaching, recent statements have become increasingly extreme. Whether it's Powell or Trump, their attitudes have always been sharply opposed. This has led many users to start doubting whether the cryptocurrency market's trend has ended. From Lao Cui's perspective, this series of measures further enhances the idea of interest rate cuts, and a rate cut in September has become a foregone conclusion. As for the choice of a bull market, everyone has limited holding space for Ethereum. Bitcoin, Ethereum, and SOL are all in a leading decline, and this pattern resembles a trap before the interest rate cut. However, the growth of ETH has been somewhat too rapid, and this time the correction space may be the most extreme among the three. Powell's remarks at 10 PM on August 22 are extremely important; he will address inflation caused by tariffs, which is also the first time the Federal Reserve has acknowledged the inflation issue. It is highly likely that during this speech, there will be a positive response regarding interest rate cuts. More analysts are speculating whether it will be a 25 basis point or 50 basis point cut, and Lao Cui leans towards the former.

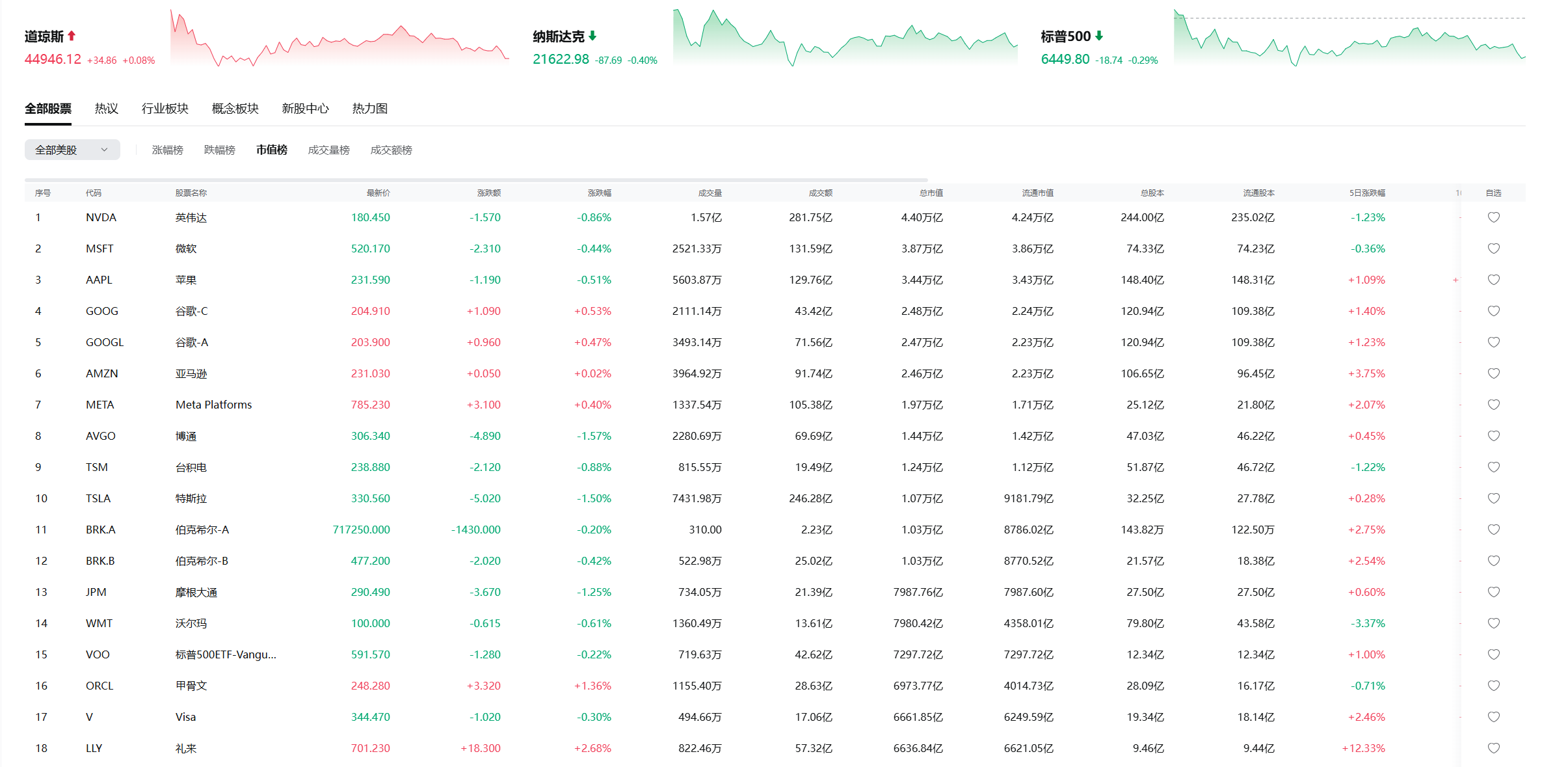

Regarding this interest rate cut, some friends will choose the market, and there will always be those hesitating between Lao A, the US stock market, and the cryptocurrency market. There is no correct answer to this, but there is a correct understanding. Many friends do not understand that the essence of a bull market is ultimately a game of chip swapping. Those with less capital are more likely to get trapped; for example, turning 100,000 into 200,000, they feel it is still not enough and are reluctant to exit. However, those with large positions, having turned 3 million into 6 million, are already satisfied and can calmly withdraw, waiting for the next bull market to start. This depends on the cyclical nature of the market economy. Currently, the cycle favors the cryptocurrency market, which almost experiences a wave of growth every 2-3 years. The US stock market has a cycle of about 5 years, while Lao A is nearly ten years. This does not mean that Lao A is not worth investing in; it is just that the cycle is longer and more stable. Although the cryptocurrency cycle is shorter, it poses a fatal threat to capital.

If you are thinking of crossing social classes, then the cryptocurrency market is definitely the first choice, while the US stock market is the stable upward choice. For the cryptocurrency market, the idea of crossing social classes can almost be solved by a single bull market. The US stock market needs two, and Lao A needs three, but life does not give you thirty years to lie in wait. Therefore, before the bull market arrives, the competition is not about who can read the K-line better or who has a more complete grasp of the news, but rather about accumulating enough capital beforehand. When opportunities arise, not having the capital to seize them is the most regrettable thing in the investment world. We are currently in a bull market phase, and you can even consider it as the early stage of a bull market; it has not ended. Do not be misled by various messages; the strength of Ethereum lies in being a stablecoin public chain. We cannot predict how large stablecoins can develop. However, the underlying significance is that it stands on the US dollar market, and it has enough capital to have the ability to improve later. Moreover, this year, Vitalik's upgrade for Ethereum has not yet truly arrived, and Ethereum still has room for growth.

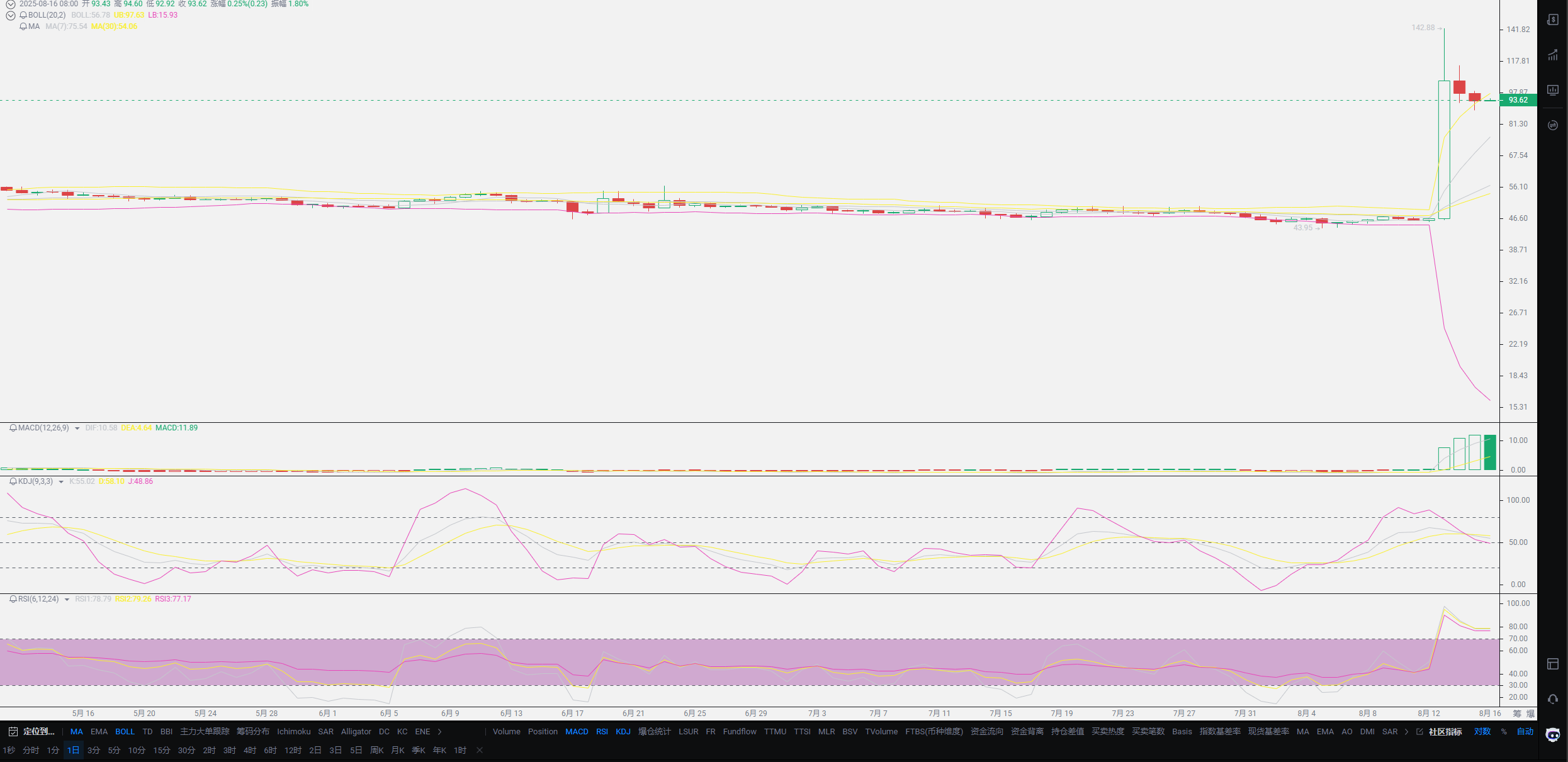

If your entry point is based on Lao Cui's thinking, most users' entry points for Ethereum are basically between 2000-2500. Currently, everyone has entered at a relatively low position; it is merely a choice of exit point. The idea of wanting to double your investment has already been achieved; this point is relatively safe, and you can have more imaginative space for profit-taking, with 5000 or even higher definitely appearing this year. If you consider short-term risk issues, you can also choose to exit, with the premise that you must maintain the courage to enter again later. At this stage, the speculation is indeed a bit excessive, but it does not mean that a bear market will start after the interest rate cut. The price after the interest rate cut will definitely be higher than it is now, and various favorable strategies have not been fully realized. The short-term downward space can only be regarded as a trap; this trend is to eliminate the threat of the previous surge.

With this surge, many friends hope Lao Cui can help look at the altcoins they hold. Everyone basically harbors dreams of getting rich, and Lao Cui will only say one thing: do not have a mentality of luck. It is not that Lao Cui does not have a positive outlook on altcoins, nor is it that what Lao Cui says is completely correct. Especially with the recent surge of OKB, it has completely slapped Lao Cui in the face. You can take this as a reference; this bull market is the strongest one in history, both in terms of capital and policy support. In any market, it would at least be explosive news. Under such extreme momentum, many coins still cannot reach their previous highs, and some are even jumping back and forth, remaining at their original points. It is basically advisable to consider giving up holding these coins; this kind of momentum will not give you another opportunity. The market is a survival of the fittest, and this is a law.

Under extreme capital momentum, if the corresponding upgrades do not arrive, these coins will definitely be eliminated in the future. OKB, after accumulating capital this time, has quickly made adjustments, including Ethereum and SOL, which will have certain upgrades and improvements this year. However, coins like DOGE are considered to be abandoned coins, arising from internet popularity and fueled by Musk's rhetoric, ultimately becoming worthless as time goes on. Unless it can be linked to other values, using the internet as a carrier, this path is basically no longer viable. The current trend in the cryptocurrency market is shifting from a niche track to a compliant framework; it will no longer cater to niche groups. Just like FIL, as the hype of the game fades, it is now a matter of cutting 90% first and then cutting another 90%, going from three digits to single digits; how can such coins have hopes of revival? Even the founding team has abandoned this track.

Lao Cui summarizes: With the vigorous development of the market, if you want to invest in some small coins, you can only choose emerging valuable coins. In the future, there will definitely be valuable coins emerging, like SOL, which we may not be able to imagine now. However, with the development of digitalization, the cost of issuing a coin is also increasing, the TPS value is also increasing, and with the improvement of technology and the gathering of capital, there will definitely be innovations in new technologies. In the cryptocurrency market, security is the top priority. As long as there is no perfect hacking technology, the development of this market will become broader and broader. Investing in the cryptocurrency market emphasizes investing in new rather than old. Previous altcoins without listing plans should be discarded as much as possible. We are still in a bull market cycle, and it is still possible to recover losses if you turn back in time. During the short-term correction cycle, Lao Cui will not advise everyone to exit, especially for spot users; rather, Lao Cui feels that it provides an opportunity for everyone to enter. The bull market for SOL has not truly arrived; those who still have ideas can buy some to hold. The same goes for Ethereum; the correction cycle will not be too long, and growth will still occur in about one to two weeks. For contract users, it is best to choose to operate at low positions; chasing shorts, Lao Cui fears that when the reversal occurs, you will not be able to grasp it. If you have specific questions, you can directly ask Lao Cui. The fluctuations in the past few days have been large, and responses may be slow; I hope everyone can understand! In my spare time, I will reply to everyone!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on individual pieces or territories, aiming for the final victory. The novice, on the other hand, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。