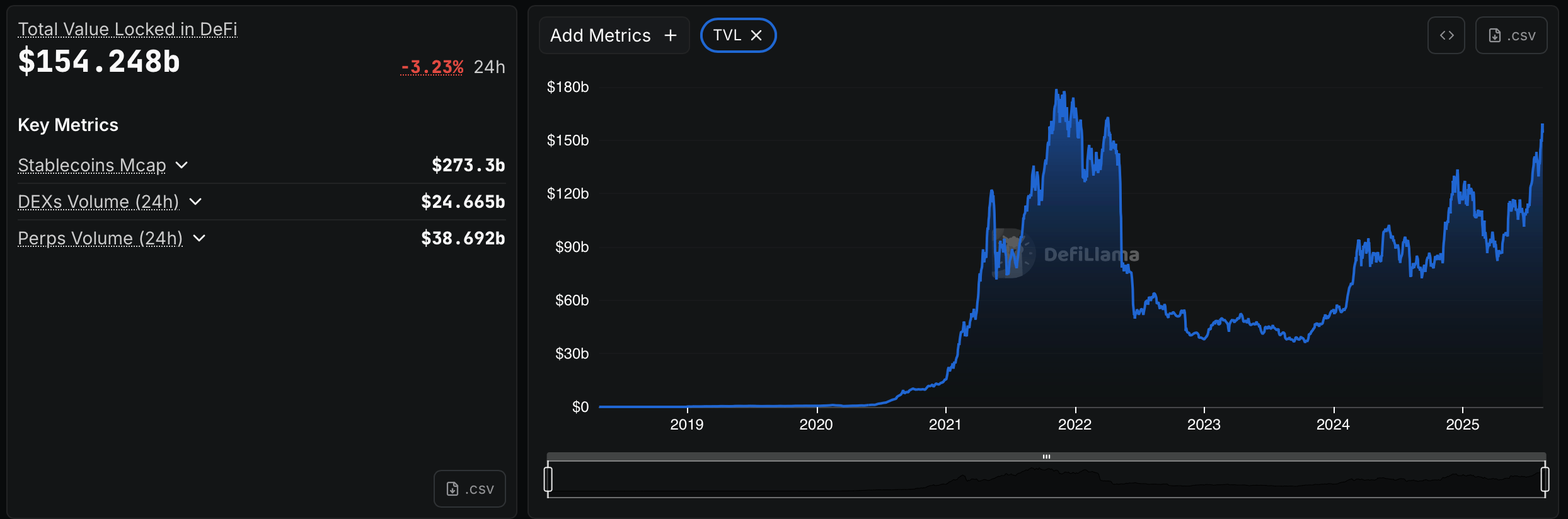

Data from defillama.com shows TVL declined 3.23% over the past 24 hours, yet the figure remains well above the $150 billion threshold, showcasing the sector’s scale. Stablecoins in circulation have a combined market capitalization of $273.3 billion, with decentralized exchange (DEX) platforms handling $24.665 billion in daily trading volume. Perpetuals markets processed $38.692 billion over the same period, while network participants paid $121.27 million in transaction fees.

Source: Defillama.com

Lido leads all protocols with $40.065 billion locked across five chains, primarily through its liquid staking services for Ethereum and other proof-of-stake assets. Aave follows closely with $38.018 billion in assets spread over 17 chains, cementing its role as a cornerstone of DeFi lending and borrowing markets. Eigenlayer, a restaking protocol, ranks third with $21.116 billion locked, highlighting the rising prominence of restaking mechanisms in the DeFi ecosystem.

Other major players include Binance’s staked ETH offering ($14.551 billion), Ether.fi ($12.109 billion), and Ethena ($11.147 billion). Yield protocol Pendle holds $8.681 billion across ten chains, while Spark, Sky, and Morpho each control between $6.3 billion and $8.3 billion in assets. Uniswap remains the top DEX protocol, with $6.234 billion locked across 38 chains.

The current TVL is near historical highs, as seen on long-term charts, which show a recovery from the sharp drawdowns of 2022 and early 2023. DeFi has since entered a renewed growth phase, with steady inflows pushing TVL levels close to their peak levels from late 2021.

Daily DEX trading volumes have been consistently elevated, with recent activity trending toward the higher end of the monthly range. Fee distribution data indicates a concentration of revenue among the largest DeFi protocols, with Lido, Uniswap, and several stablecoin issuers leading the fee generation charts.

The combination of high TVL, significant stablecoin liquidity, and consistent transaction fees highlights DeFi’s ongoing integration into the broader digital asset market and traditional finance (TradFi). With protocols like Lido and Aave anchoring the sector, the competition for liquidity and user activity remains intense across staking, lending, and yield generation platforms.

As DeFi approaches new TVL records, protocol innovation and cross-chain expansion appear to be key drivers of growth, even amid daily market fluctuations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。