Bitcoin dipped below $117K on Friday, as markets floundered in the wake of Thursday’s higher-than-expected wholesale inflation data from the U.S. Bureau of Labor Statistics (BLS). But the cryptocurrency’s temporary price dip hasn’t deterred institutional investors like the nearly $2 trillion Norwegian Government Pension Fund Global (GPFG) from chasing bitcoin exposure.

The mammoth-sized sovereign wealth fund became interested in the digital asset no later than 2020, though it doesn’t purchase bitcoin directly, but rather, acquires shares of companies such as Strategy (Nasdaq: MSTR) for indirect exposure. By the end of 2024, GPFG held more than $500 million in MSTR and had stakes in other crypto firms such as Coinbase.

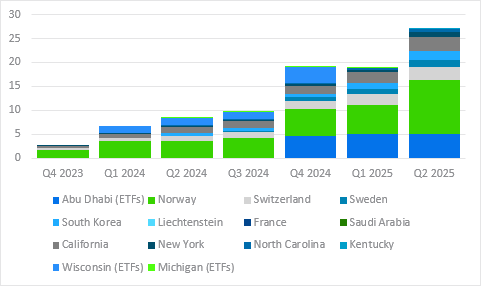

(MSTR positions in public pension plans, with the exception of Michigan and Wisconsin, which both use ETFs for bitcoin exposure / Standard Chartered Research)

And now London-based Standard Chartered Bank says 13F filings at the U.S. Securities and Exchange Commission (SEC) show GPFG, which is managed by Norges Bank Investment Management (NBIM), a division within the country’s central bank, reported holdings equivalent to 11,400 BTC.

“I just ran my usual 13F filing spreadsheet, for the BTC ETFs, MSTR and Metaplanet,” writes Geoffrey Kendrick, head of digital assets research at Standard Chartered. “The most interesting detail, by far, this time was Norges buying of MSTR and Metaplanet. In Q2 they increased their BTC equivalent exposure from 6,200 to 11,400 BTCs (an 83% increase).”

In his research note, Kendrick says Norges almost exclusively uses MSTR for bitcoin exposure, but the fund also has a position in Metaplanet, a Japanese hotel developer turned bitcoin treasury firm. “This position remains almost entirely in MSTR, although they did add a small (200 BTC equivalent) position in Metaplanet,” Kendrick explains.

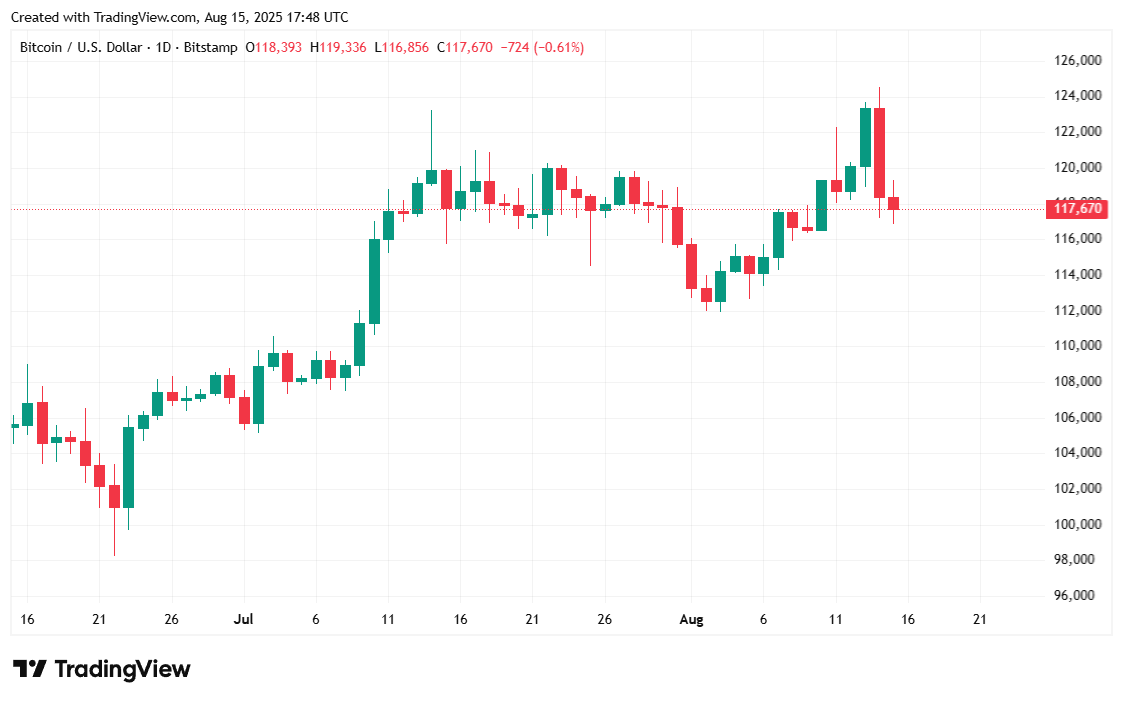

Bitcoin was trading at $117,251.98 at the time of writing, down ever so slightly by 0.46% since Thursday. However, on a weekly basis, the cryptocurrency is still up by a smidgen, 0.84% according to Coinmarketcap. BTC has been trading between $116,864.57 and $119,332.31 over the past 24 hours.

( BTC price / Trading View)

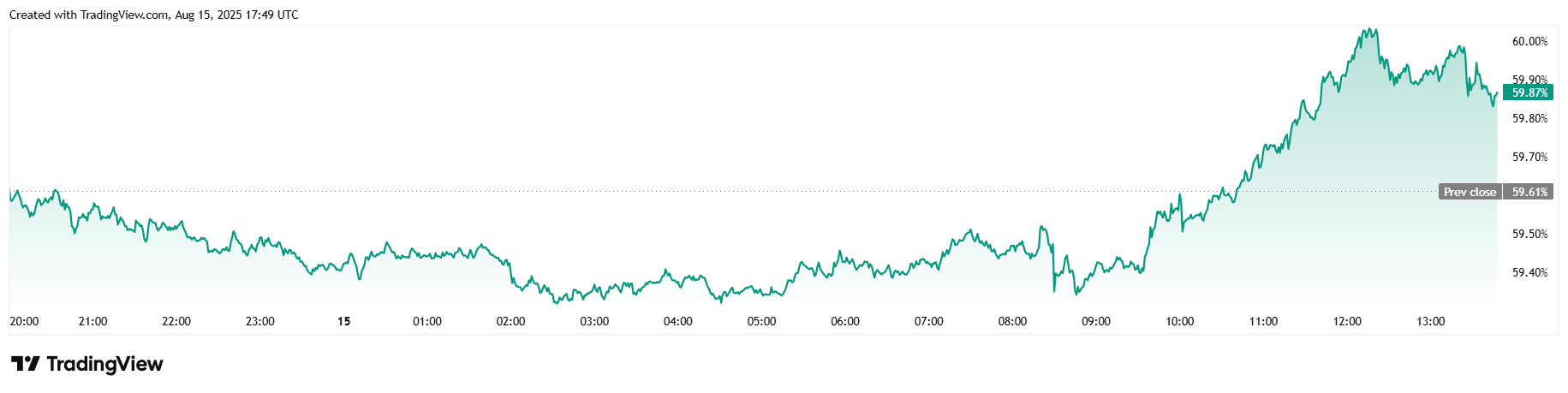

Trading volume fell significantly since yesterday, easing to $74.06 billion, a 31.39% decrease. Market capitalization, much like price, was also mostly flat, dipping 0.28% to $2.33 trillion in the last 24 hours. Interestingly, despite the flaccid price action, bitcoin dominance increased to 59.87%, a 0.43% improvement since Thursday. This indicates altcoins are faring worse than the dominant cryptocurrency in the current market.

( BTC dominance / Trading View)

Coinglass shows total bitcoin futures open interest at $81.72 billion at the time of reporting, a decrease of 1.67% over 24 hours. BTC liquidations on Friday were significantly lower than Thursday’s numbers. Long liquidations came in at $50.45 million, and short liquidations were $6.54 million, for a grand total of $56.99 million in leveraged bets wiped out.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。