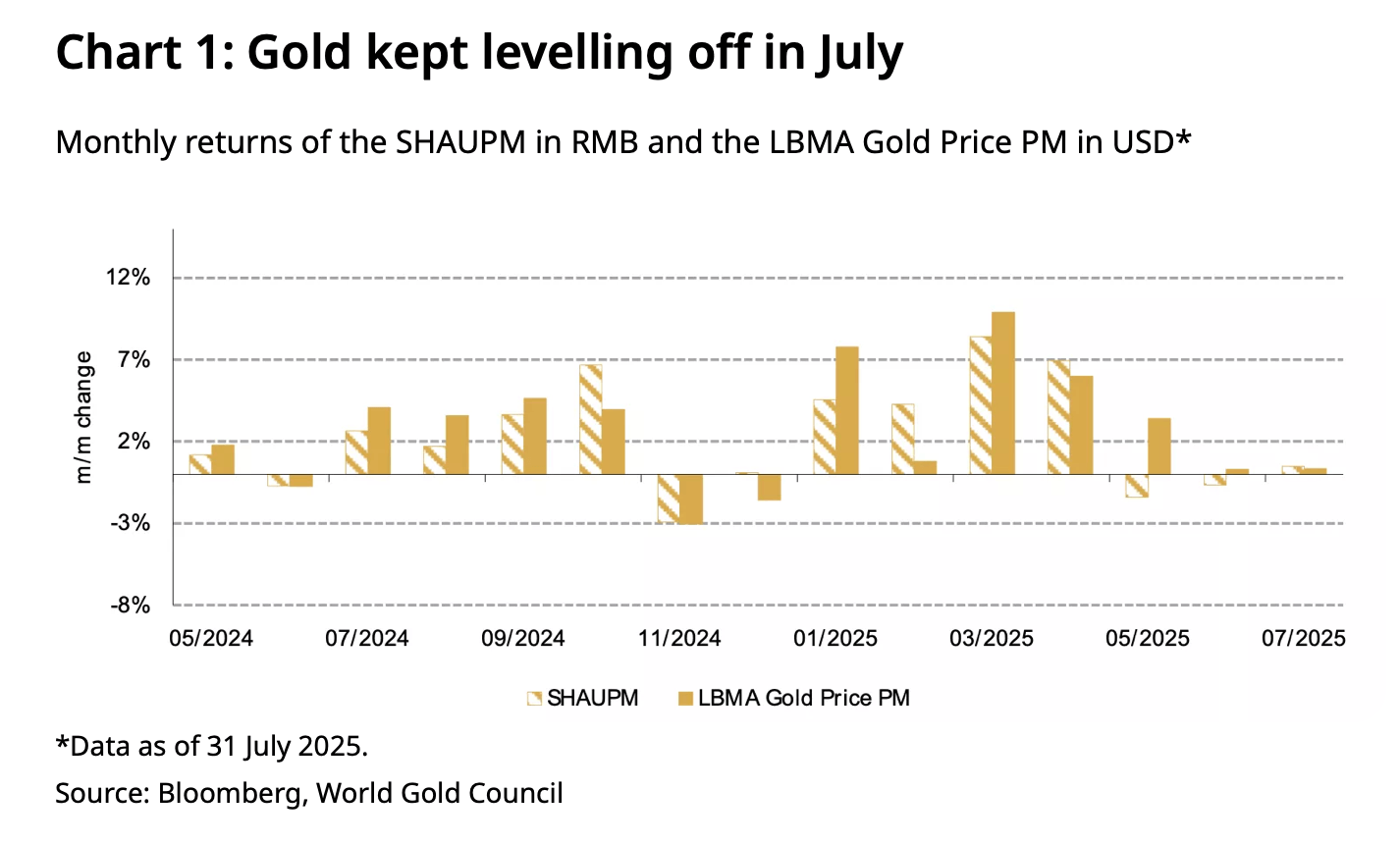

China’s gold market experienced relative price stability in July, with marginal monthly increases for key benchmarks, the World Gold Council reported. The LBMA Gold Price PM in U.S. dollars rose 0.3%, while China’s Shanghai Benchmark Gold Price PM (SHAUPM) in yuan climbed 0.5%, aided by yuan depreciation against the dollar. Year-to-date, yuan-denominated gold surged over 22%.

Physical gold withdrawals from the Shanghai Gold Exchange (SGE) saw a mild seasonal rebound to 93 tonnes, up 3 tonnes from June and 4 tonnes year-on-year. Despite this increase, demand remained significantly below the 10-year average, reflecting persistent weakness in the jewelry sector amid record-high local prices.

Chinese gold exchange-traded funds (ETFs) recorded outflows of RMB 2.4 billion ($325 million) in July. Total assets under management dipped 1% to RMB 151 billion ($21 billion), and collective holdings fell 3 tonnes to 197 tonnes. The WGC attributed the outflows to improved investor risk appetite following better-than-expected Q2 GDP and strong equity performance.

Gold futures trading volume on the Shanghai Futures Exchange (SHFE) averaged 242 tonnes per day, down 18% month-on-month. While cooling, activity stayed above the five-year average of 216 tonnes. Reduced price volatility contributed to lower trader interest.

The People’s Bank of China (PBOC) added 2 tonnes to its gold reserves in July, marking the ninth consecutive monthly purchase. Official reserves now stand at 2,300 tonnes, representing 6.8% of total foreign reserves. Year-to-date additions total 21 tonnes.

China’s gold imports concluded a weak first half of 2025. June imports halved to 50 tonnes, down 45% month-on-month. Total H1 imports plunged 62% year-on-year to 323 tonnes, the lowest since 2021, pressured by subdued wholesale demand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。