To date, roughly five IPOs have come from companies tied to the digital currency space. Among them are Galaxy Digital (Nasdaq: GLXY), Etoro (Nasdaq: ETOR), Circle Financial (NYSE: CRCL), Coreweave (Nasdaq: CRWV), and Bullish (NYSE: BLSH). Bullish specializes in cryptocurrency, running a digital assets platform and owning the crypto news outlet Coindesk.

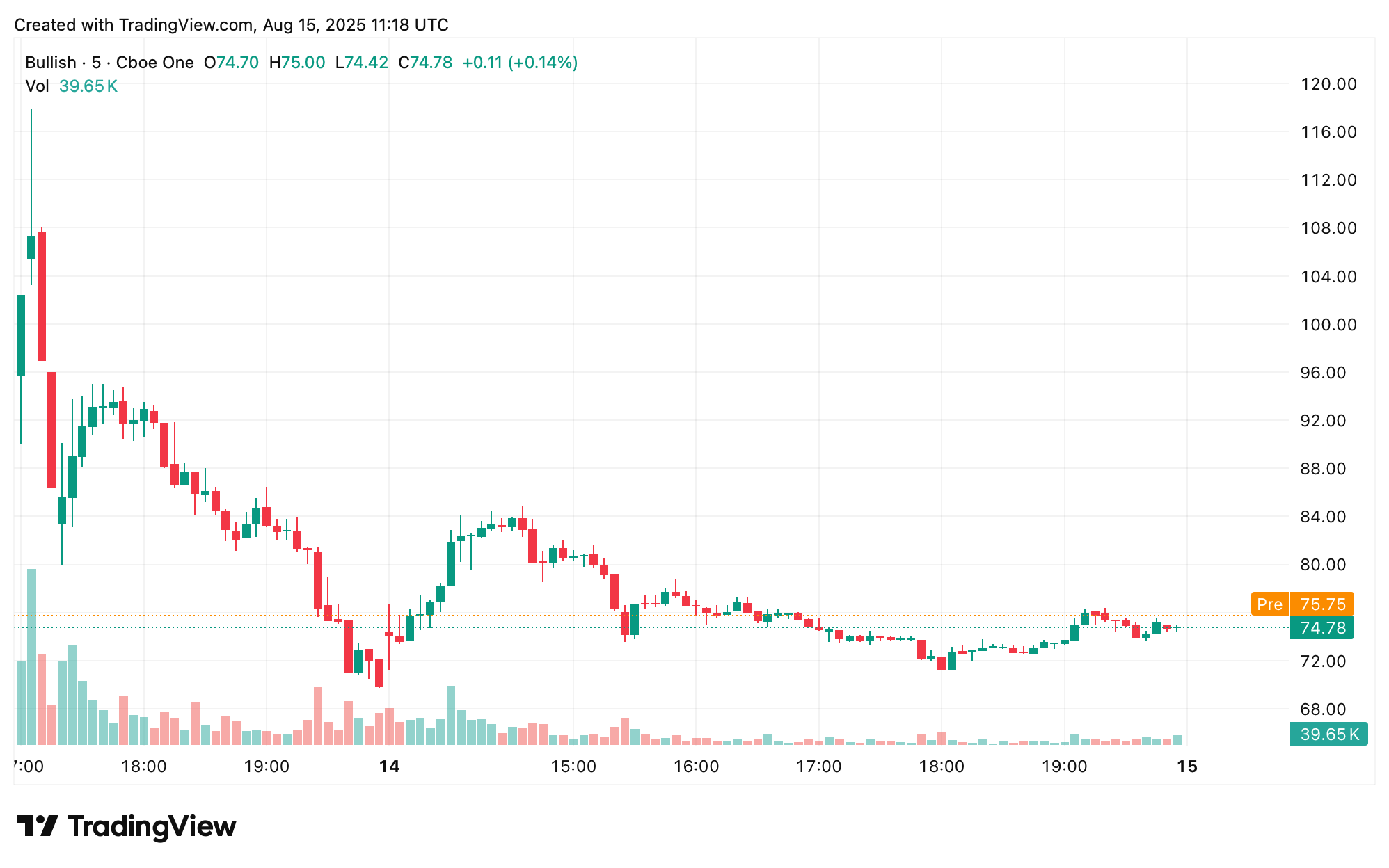

Bullish operates the Bullish Exchange, a digital assets spot and derivatives platform tailored for institutional investors. The company says it blends a central limit order book matching engine with automated market making, aiming to provide deep, consistent liquidity. So far, Bullish’s IPO has been a standout — debuting at $37 per share and soaring to $90+ within minutes of opening.

On Aug. 14, BLSH closed at $74.63, marking a 101.7% jump from its initial $37 per share. According to Kiplinger.com reporting, firms such as Ark Invest and Blackrock have been “accumulating a notable stake” in BLSH. The report also points out that Bullish’s underwriters—Citigroup, Jefferies, and JPMorgan—retain the right to sell “4.5 million shares over the next 30 days.”

So far in 2025, every other crypto-linked IPO except ETOR has posted gains since launch. Galaxy shares are up 25.31%, Circle has skyrocketed 349%, and Coreweave has climbed 148.75%. Etoro, however, debuted at $52 and now sits 8.54% lower at $47.56. The momentum in crypto-related IPOs suggests growing investor appetite for digital asset ventures. Yet, the sector’s next moves will test whether enthusiasm can sustain or begin to cool.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。